Hazmat Plastic Packaging Market Overview

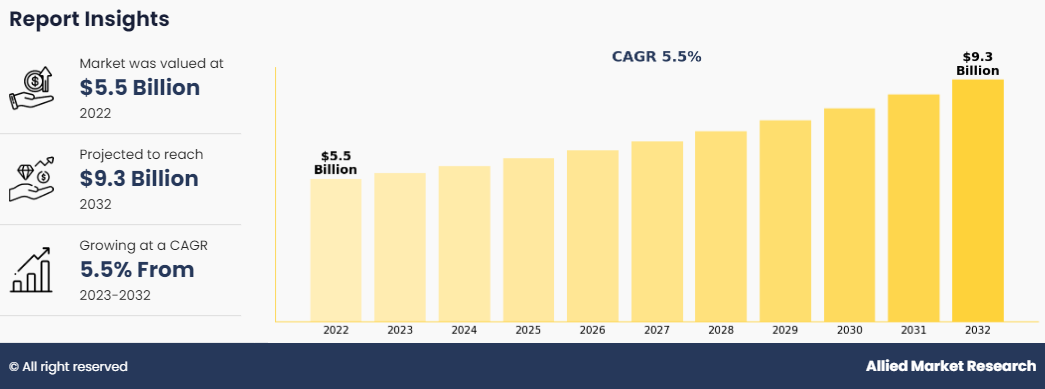

The global hazmat plastic packaging market size was valued at $5.5 billion in 2022, and is projected to reach $9.3 billion by 2032, growing at a CAGR of 5.5% from 2023 to 2032.

Market Introduction and Definition

Hazmat plastic packaging refers to packaging materials specifically designed and certified for the transport and containment of hazardous materials. The hazmat plastic packaging is meant for the storage of hazardous substances and material, which need to be transported across borders. Shipping of hazardous material is not only considered dangerous but also requires a lot of regulations and guidelines to be transported.

Hazmat Plastic Packaging Market Report Key Highlighters

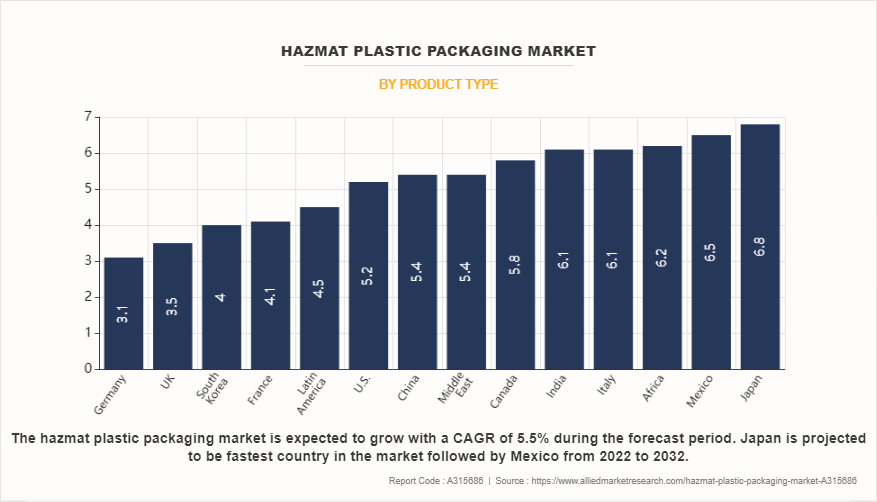

- The hazmat plastic packaging market studies more than 16 countries. The analysis includes a country-by-country breakdown analysis in terms of value ($million) available from 2022 to 2032.

- The research combined high-quality data, professional opinion and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global hazmat plastic packaging market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

- The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the hazmat plastic packaging market.

- The hazmat plastic packaging market share is marginally fragmented, with players such as Berlin Packaging, Berry Global Inc., C.L. Smith, Cjk, Crateco, Fibrestar Drums Limited, Greif, Mauser Group, Peninsula Drums, and Sabu. Major strategies such as product Launch, partnerships, expansion, and other strategies of players operating in the hazmat plastic packaging market are tracked and monitored.

Hazmat Plastic Packaging Market Dynamics

Stringent regulations govern the handling, transportation, and storage of hazardous materials to ensure safety and environmental protection. Compliance with regulations such as those set by the Occupational Safety and Health Administration (OSHA), the Environmental Protection Agency (EPA), and the Department of Transportation (DOT) drives demand for hazmat plastic packaging solutions that meet regulatory requirements. Each country has its own set of regulations governing the handling, storage, transportation, and disposal of hazardous materials. These regulations may be established by government agencies, responsible for occupational health and safety, environmental protection, transportation, or other relevant areas. For example, in Australia, hazardous materials are regulated under various laws and regulations, including the Work Health and Safety Act and the Australian Dangerous Goods Code. Many Asia-Pacific countries align their hazmat regulations with international standards and guidelines to facilitate trade and ensure consistency with global best practices. International standards such as those developed by the United Nations Economic Commission for Europe (UNECE) and the International Maritime Organization (IMO) are often referenced or adopted by Asia-Pacific nations in their regulatory frameworks.

The main framework for hazmat plastic packaging market regulation in Europe is established by the European Union. The primary regulation governing the classification, packaging, labeling, and transportation of hazardous materials is the Regulation (EC) No 1272/2008 on Classification, Labelling and Packaging of Substances and Mixtures, commonly known as the CLP Regulation. This regulation aligns with the United Nations Globally Harmonized System of Classification and Labelling of Chemicals (GHS) and establishes harmonized criteria for the classification and communication of hazards associated with chemicals. In the U.S., Pipeline and Hazardous Materials Safety Administration (PHMSA) regulates the transportation of hazardous materials. The Hazardous Materials Regulations (HMR), found in Title 49 of the Code of Federal Regulations (49 CFR), establish requirements for the classification, packaging, labeling, marking, placarding, and transportation of hazardous materials by air, highway, rail, and water.

However, the release of harmful materials and fumes during the production of hazmat plastic packaging is expected to restrain the hazmat plastic packaging market growth. Sulfur dioxide, nitrogen dioxide, and other air-polluting substances are emitted during the annealing process used to make containers. High amounts of these hazardous substances can cause lung cancer, chronic bronchitis, asthma, and mucus discharge. Furthermore, Volatile organic compounds (VOCs) are organic chemicals that can evaporate into the air and lead to air pollution. They are often emitted during the manufacturing process of plastics, especially during the production of resins and coatings used in packaging materials. Residual chemicals from the manufacturing process, such as monomers, solvents, plasticizers, and additives, can remain in the plastic packaging materials. If not properly controlled, these residues can leach out of the packaging over time, contaminating the contents and the environment. Some plastic manufacturing processes involve the use of heat or chemical reactions that produce hazardous fumes, such as hydrogen chloride, chlorine gas, or other toxic compounds. Exposure to these fumes can cause respiratory irritation, chemical burns, and other health effects.

Moreover, growing demand for innovative packaging technology is expected to provide lucrative growth opportunities for growth. Due to the convenience of storage, transportation, and customer preference for safe and secure packaging, packaging is becoming an essential part of modern life. To safeguard and transport chemical items, there is rise in demand for intelligent packaging solutions such as hazardous chemicals packaging. Chemical packaging producers offer a range of options for storing dangerous chemicals, including IBCs, drums, and bins. Organizations are also investing in clever and cutting-edge packaging solutions to achieve prospective results. For instance, in April 2021, Mauser Packaging Solutions acquired the Global Tank Srl through Joint Venture NCG-Maider in Italy. Via this acquisition, Mauser Packaging Solutions further plans to extend the offering of industrial packaging products and services in the Italian market while strengthening the company position as the global hazmat plastic packaging market player in reconditioning. Hence, such acquisition and business plan can propel the growth of hazmat plastic packaging market.

The hazmat plastic packaging market is witnessing various obstructions in its regular operations due to the COVID-19 pandemic and inflation. Earlier, the global lockdowns resulted in reduced industrial activities, eventually leading to reduced demand for hazmat plastic. However, COVID-19 has subsided, and the major manufacturers in 2023 are performing well. However, the rise in global inflation is a new major obstructing factor for the entire industry. The inflation, which is an immediate result of the Ukraine-Russia war, and a few long-term effects of the COVID-19 pandemic, have led to volatility in the expenses incurred on raw materials used for the production of hazmat plastic packaging. In addition, the price of oil and gas has also increased extensively, and many countries, mainly, the nations in Europe, Latin America, and developing economies in Asia-Pacific are experiencing intense negative effects on industrial production, consisting of the production of hazmat plastic packaging. However, India and China are performing relatively well. In addition, inflation is anticipated to worsen within the coming years, as the possibility of the ending of the conflict between Ukraine and Russia is much less. However, a peace agreement between Ukraine and Russia may be devised, with continued talks among the nations.

Segments Overview

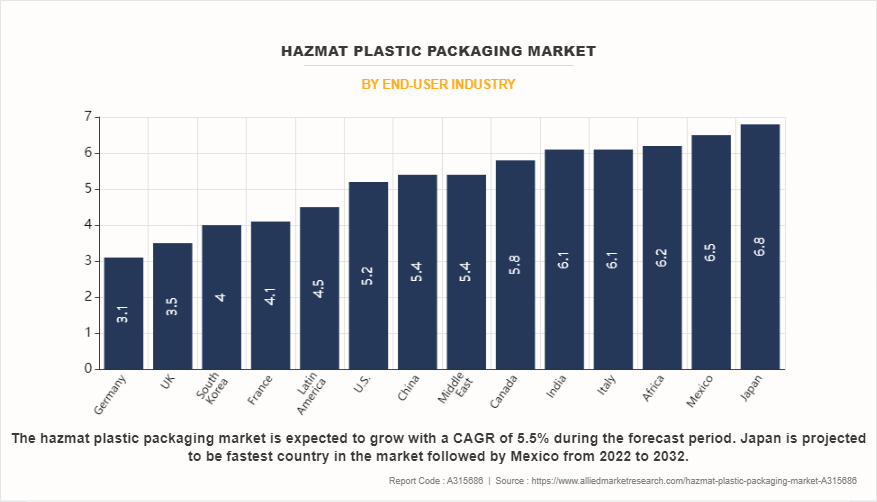

The hazmat plastic packaging market is categorized into product type, end-user, and region. On the basis of product type, the market is categorized into drums, intermediate bulk containers (IBCs), pails, bottles, and Jerrycan. On the basis of end-user, the hazmat plastic packaging market is analyzed across chemical, pharmaceutical, oil & gas, and others. Furthermore, the hazmat plastic packaging market is also analyzed across different regions across the globe such as North America, Europe, Asia-Pacific, and LAMEA.

By Product type, the hazmat plastic packaging market is divided into, drums, intermediate bulk containers (IBCs), pails, bottles, and Jerrycan. Among these segments, the drums segment accounted for the highest market share in terms of revenue, and the jerry can segment is expected to grow with a higher CAGR during the forecast period. Plastic drums are robust and durable, capable of withstanding rough handling, stacking, and transportation without compromising the integrity of the container or its contents. They are less prone to denting, rusting, or corrosion as compared to metal drums, thus, making them suitable for long-term storage and repeated use.

On the basis of end-user, the hazmat plastic packaging market is analyzed across chemical, pharmaceutical, oil & gas, and others. Out of these segments, the chemicals segment accounted for the highest market share in terms of revenue generated in 2022. Chemical packaging is a way of enclosing chemical items to store, distribute, sell, and use them. Packaging safeguards, maintains, and identifies the chemical being stored and transported. Rise in demand for chemicals from the chemicals and petroleum industries is a major growth driver of the hazmat plastic packaging market.

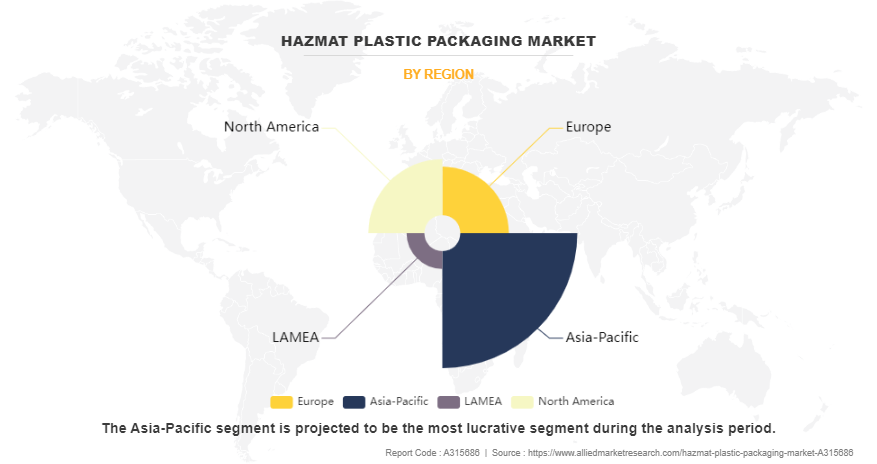

Region wise, the hazmat plastic packaging market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, Italy, France, and rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). On the basis of region, Asia-Pacific is expected to be the largest market shareholder and is expected to grow with the CAGR of 5.8% due to the constantly increasing expenditure to develop domestic industrial sector in their respective countries.

Competitive Analysis

Competitive analysis and profiles of the major global hazmat plastic packaging market players that have been provided in the report include Berlin Packaging, Berry Global Inc., C.L. Smith, Cjk, Crateco, Fibrestar Drums Limited, Greif, Mauser Group, Peninsula Drums, and Sabu The key strategies adopted by the major players of the global hazmat plastic packaging market are product launch and mergers and acquisitions.

Key Developments/ Strategies in Hazmat plastic packaging

- In January 2024, DGCA Labelmaster expanded its portfolio of dangerous goods packaging portfolio including plastic containers, drums, and pails from packaging producer Curtec.

- In August 2023, CurTec, a manufacturer of high-performance plastic packaging launched Fold Pack. Fold Pack is a stackable plastic container for bulk packaging of specialty chemicals, food ingredients, and pharmaceuticals.

- In November 2022, Novvia Group, a worldwide distributor of rigid containers and life sciences packaging, acquired Auberst Inc., a California-based distributor specializing in plastic and metal rigid packaging solutions. This purchase facilitated the expansion of Novvia Group's presence on the West Coast.

Key Benefits For Stakeholders

- This study comprises analytical depiction of the global hazmat plastic packaging market overview along with the current trends and future estimations to depict the imminent investment pockets.

- The overall global hazmat plastic packaging market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current global hazmat plastic packaging market forecast is quantitatively analyzed from 2022 to 2032 to benchmark the financial competency.

- Porters five forces analysis illustrates the potency of the buyers and suppliers in the hazmat plastic packaging industry.

- The report includes the market share of key vendors and the global hazmat plastic packaging market.

Hazmat Plastic Packaging Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 9.3 billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 189 |

| By Product Type |

|

| By End-user Industry |

|

| By Region |

|

| Key Market Players | MAUSER Corporate GmbH, Sohner Kunststofftechnik GmbH, Peninsula Drums LLC, Berry Global Inc., C.L. Smith Company, Greif, Inc., CJK Packaging Limited, Crateco Pack LLC, Fibrestar Drums Limited, Berlin Packaging LLC |

Analyst Review

The hazmat plastic packaging market has observed huge demand in North America, Asia-Pacific, and Europe. Asia-pacific is expected to grow at the highest rate during the forecast period, owing to the increasing industrialization. Furthermore, advances in plastics technology have led to the development of innovative hazmat plastic packaging solutions with enhanced features such as improved durability, chemical resistance, and safety mechanisms. These advancements make plastic packaging increasingly attractive for businesses seeking reliable and cost-effective solutions for packaging hazardous materials.

Various market players have adopted strategies such as business expansion and acquisition to expand their business and strengthen their market position. For instance, in September 2021, Mauser Group invested a significant amount on cutting-edge machinery to expand the production capacity of IBCs and plastic drums at its factory in Gebze, Turkey. The site expansion will also support the customer growth strategies and provide additional support for the expanding export markets in the Middle East and Eastern Europe.

HAZMAT plastic packaging companies are focusing on sustainability initiatives, including the development of eco-friendly materials, recycling programs, and the reduction of plastic waste. Companies are investing in R&D to create packaging solutions that are recyclable, reusable, or made from renewable materials. There has been a continued emphasis on the development of advanced plastic materials with improved properties such as increased durability, chemical resistance, and barrier performance. These materials are designed to meet the evolving needs of industries that handle hazardous materials, including stricter regulatory requirements and changing market demands.

Companies are increasingly offering customizable packaging solutions tailored to the specific needs of their customers. This includes providing packaging designs that optimize storage space, minimize material waste, and enhance operational efficiency. Innovation in packaging design and functionality is driving competitiveness in the industry.

As a result, such strategic moves are expected to provide lucrative growth opportunities in the global hazmat plastic packaging market.

Growth in chemical industry, increasing in urbanization are the upcoming trends of Hazmat Plastic Packaging Market in the world

Chemical is the leading application of Hazmat Plastic Packaging Market

Asia-Pacific region is the largest regional market for Hazmat Plastic Packaging

The global hazmat plastic packaging market was valued at $5,484.1 million in 2022

Berlin Packaging, Berry Global Inc., C.L. Smith, Cjk, Crateco, Fibrestar Drums Limited, Greif, Mauser Group, Peninsula Drums, and Säbu.

The global hazmat plastic packaging market is projected to reach $9,290.3 million by 2032

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

The product launch is key growth strategy of Hazmat Plastic Packaging industry players.

Loading Table Of Content...

Loading Research Methodology...