Healthcare Third-party Logistics Market Overview

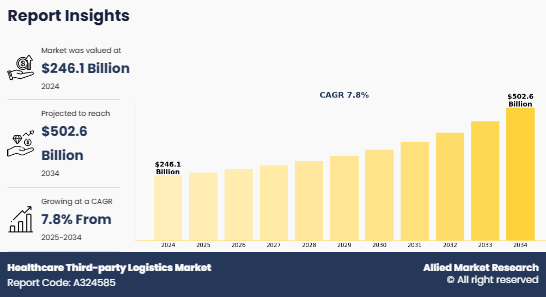

The global Healthcare Third-party Logistics Market Size was valued at USD 246.1 billion in 2024, and is projected to reach USD 502.6 billion by 2034, growing at a CAGR of 7.8% from 2025 to 2034. Technological advancements are a key driver of the healthcare third-party logistics market, with AI, real-time analytics, IoT tracking, and blockchain enhancing delivery monitoring, product safety, and counterfeit prevention.

Key Market Trends and Insights

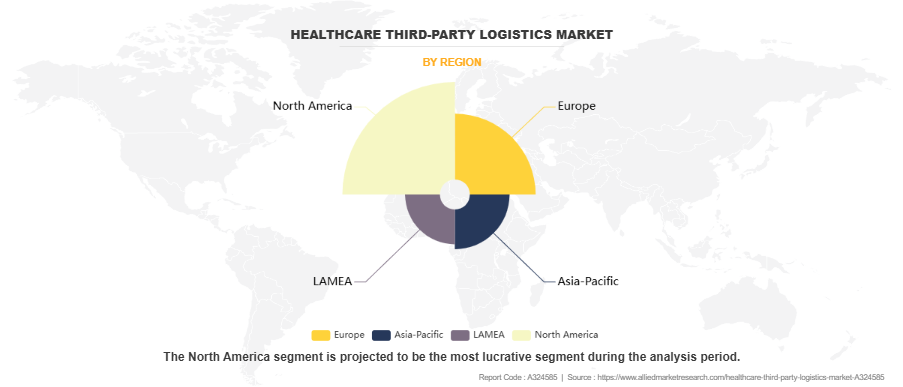

Regional Insights: North America held the largest market share in 2024 and is projected to retain its dominance during the forecast period.

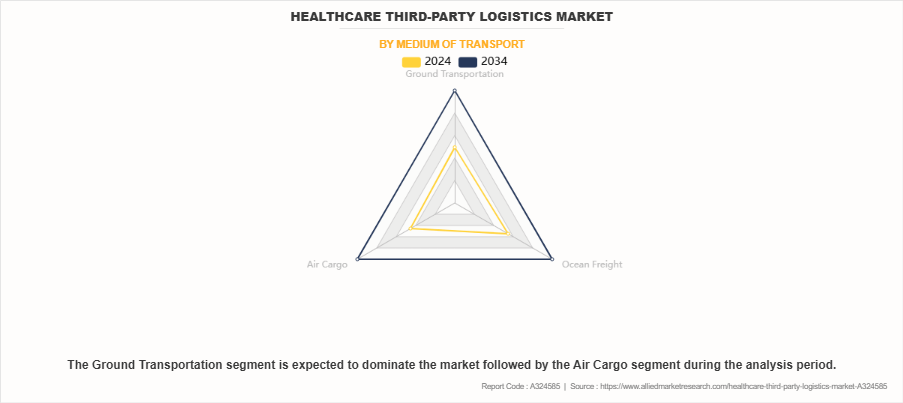

Transportation Mode: Ground transportation emerged as the top contributor in 2024 and is anticipated to retain its dominance in the years ahead.

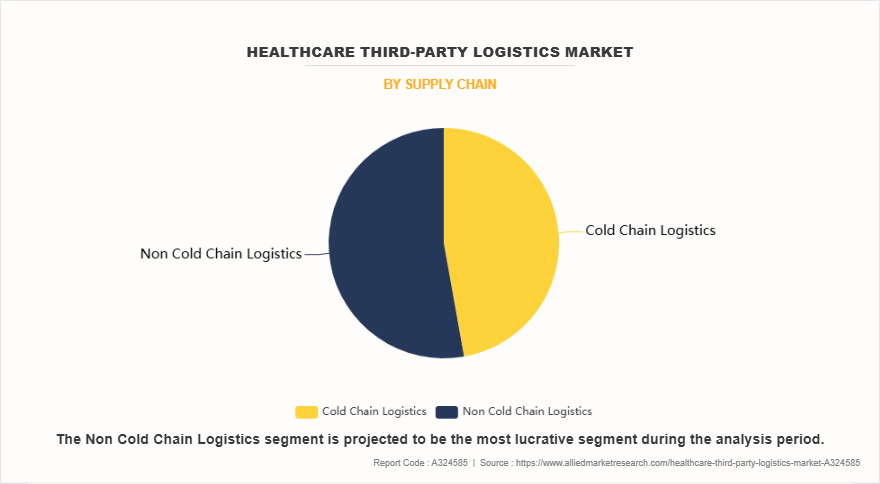

Logistics Type: The non-cold chain segment led the market in 2024 and is expected to maintain its lead throughout the forecast period.

Market Size & Forecast

2034 Projected Market Size: USD 502.6 billion

2024 Market Size: USD 246.1 billion

Compound Annual Growth Rate (CAGR) (2025-2034): 7.8%

Key Takeaways

- The Healthcare Third-party Logistics Market Size covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major decorative coatings industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

What is meant by healthcare third-party logistics (3PL)

The healthcare third-party logistics market refers to the segment of the logistics industry that specializes in providing contracted logistics services to companies in the healthcare sector. These services include transportation, warehousing, distribution, and supply chain management of healthcare products such as pharmaceuticals, medical devices, and other related goods.

The healthcare third-party logistics (3PL) market refers to the outsourcing of logistics and supply chain operations related to pharmaceuticals, medical devices, and healthcare products to specialized third-party service providers. These services include transportation, warehousing, inventory management, packaging, order fulfillment, and distribution. Healthcare 3PL providers help pharmaceutical and medical companies ensure timely and secure delivery of temperature-sensitive and high-value products while meeting strict regulatory and quality standards.

Transportation services, warehousing services, distribution services, inventory management, regulatory compliance and technology integration are important components of the healthcare third-party logistics market. The management of the transportation of medical supplies from producers to distribution hubs, hospitals, pharmacies, and other healthcare institutions is aided by healthcare third-party logistics. This covers transportation by land, air, and water. Healthcare third-party logistics provide storage solutions that comply to the stringent legal norms for healthcare products, including temperature-controlled spaces for fragile products such as vaccines and biologics. Distribution centers store healthcare products under regulated and often temperature-controlled conditions to ensure quality and safety. They also ensure that healthcare products are delivered to end users such as hospitals, clinics, and pharmacies in a timely and efficient manner.

Moreover, healthcare third-party logistics services maintain compliance with industry standards and laws by managing sensitive and strictly controlled healthcare products using expertise and knowledge. By applying the benefit of the size and effectiveness of healthcare third-party logistics providers, outsourcing logistics permits medical centers to preserve expenditures related to distribution, warehousing, and transportation.

What are the Top Impacting Factors

Key Market Driver

The healthcare third-party logistics market plays a critical role in streamlining supply chains, improving efficiency, and reducing operational costs for healthcare manufacturers and distributors. With the growing complexity of global healthcare supply chains, especially for biologics and specialty drugs, 3PL providers offer advanced technologies, cold chain logistics, and real-time tracking solutions. The market continues to expand due to rise in global pharmaceutical trade, growth in demand for cost-effective logistics services, and increase in need for regulatory compliance and risk management across the healthcare supply network.

For instance, in April 2025, Morris & Dickson Inc., a prominent pharmaceutical wholesale and specialty distributor, acquired Presa Solutions, a leading virtual third-party logistics (3PL) provider for pharmaceutical manufacturers. This acquisition move enhances Morris & Dickson‐™s service capabilities by integrating Presa Solutions‐™ innovative order-to-cash platform with its own established fulfilment and logistics operations. Moreover, in October 2024, Karo Healthcare, a leading provider of over the counter and prescription medicines, partnered with Yusen Logistics (UK) to enhance its supply chain and support its growth strategy across European markets. This collaboration reflects the increasing reliance on third-party logistics (3PL) providers within the pharmaceutical industry, as Karo Healthcare leverages Yusen's expertise in transportation, warehousing, and value-added services.

- Factors such as rising trend of outsourcing logistics and increasing use of advanced technology by integrating information between manufacturers, suppliers, retailers, and wholesalers have led to the growth of the healthcare third party logistics industry. In addition, pharmaceutical logistics companies are increasingly adopting retrieval systems and automated storage solutions, which are garnering substantial attention. Furthermore, expansion of global pharmaceutical and medical device supply chains has boosted the demand for specialized third-party logistics (3PL) providers.

Regulatory requirements vary significantly across regions, requiring logistics partners with deep expertise in compliance, temperature-controlled transport, and supply chain visibility. Many pharmaceutical companies prefer outsourcing logistics to ensure compliance with good distribution practice (GDP) and other regional regulations.

The growing prevalence of complex biologics, cell and gene therapies, and personalized medicine has intensified the need for sophisticated cold-chain logistics. Specialized 3PL providers offer proper shipping solutions, real-time monitoring, and end-to-end tracking to minimize risks in transit.

Restraints

High capital requirements for cold chain infrastructure pose a significant challenge and may hamper the growth of the healthcare third-party logistics (3PL) market. Cold chain logistics involve specialized equipment, temperature-controlled storage facilities, and advanced monitoring systems to ensure the safe transportation of temperature-sensitive products such as vaccines, biologics, and certain pharmaceuticals. Establishing and maintaining these facilities demands substantial upfront investment and ongoing operational costs, which can be prohibitive for many 3PL providers, especially smaller players. This financial barrier limits the expansion of cold chain services and restricts market access for companies lacking sufficient resources.

In addition, stringent regulatory standards for temperature control and product safety increase compliance costs, further adding to the capital burden. As a result, the high cost of building and managing cold chain infrastructure slows down the adoption of healthcare 3PL services in emerging markets and thus restricts the overall market growth, despite increasing demand for temperature-sensitive healthcare logistics.

Opportunity

Technological advancements present a lucrative opportunity for the healthcare third-party logistics (3PL) market by transforming how supply chains are managed and optimized. Innovations such as Internet of Things (IoT) sensors, blockchain, artificial intelligence (AI), and advanced data analytics enable real-time tracking, improved inventory management, and enhanced temperature control for sensitive healthcare products. These technologies increase transparency, reduce errors, and ensure regulatory compliance, which is critical in handling pharmaceuticals, biologics, and medical devices. Automation and robotics in warehousing and transportation further boost efficiency, reduce costs, and speed up delivery times.

In addition, digital platforms facilitate seamless communication between stakeholders, thus improving coordination across the supply chain. The integration of IoT enables real-time tracking of pharmaceutical products, ensuring temperature compliance and location transparency, while AI enhances predictive analytics for inventory management, route optimization, and demand forecasting. By adopting these cutting-edge technologies, 3PL providers can offer more reliable, secure, and cost-effective logistics services. This technological evolution not only meets growing industry demands but also opens new avenues for market expansion, thus positioning healthcare 3PL providers as essential partners in delivering high-quality patient care.

Segment Analysis

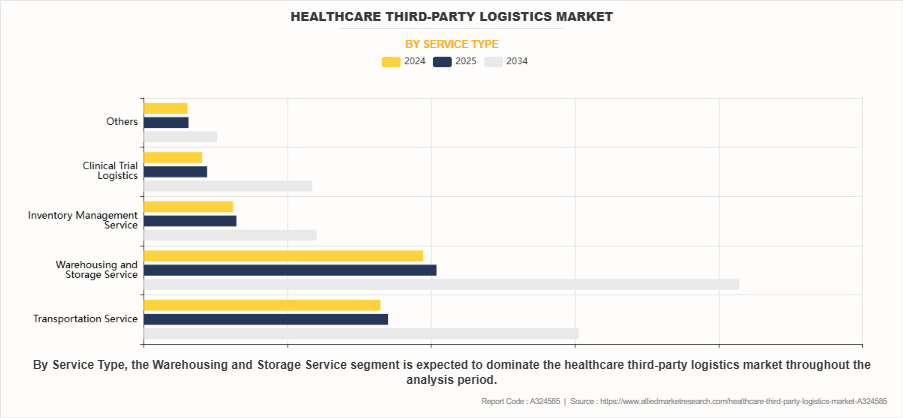

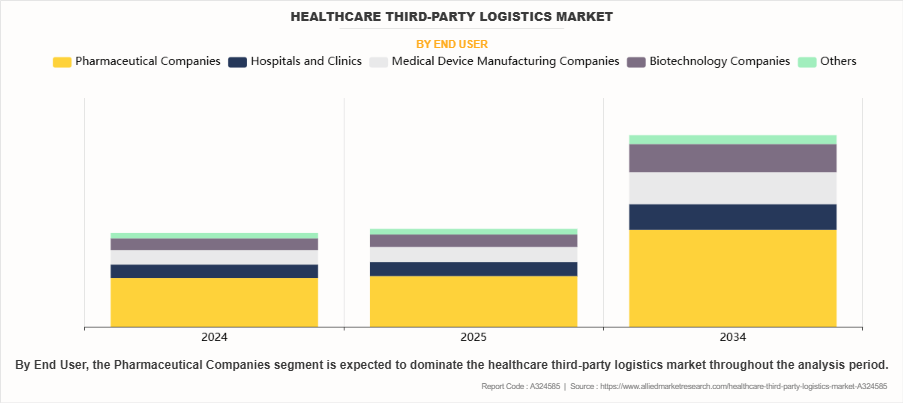

The healthcare third-party logistics market is segmented on the basis of service type, end-user, medium of transport, and region. On the basis of service type, the market is segmented into transport service, warehouse and storage service, inventory management, clinical trial logistics, and others. By end-user, the Healthcare Third-party Logistics Industryis divided into pharmaceutical companies, hospitals and clinics, medical device manufacturing companies, biotechnology companies, and others. On the basis of medium of transport, the market is classified into ground transportation, air cargo, and ocean freight. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Service Type

Based on service type, the warehousing and storage service segment dominated the global market in 2024 and is likely to remain dominant during the forecast period. This is attributed to the growing need for temperature-controlled, secure, and compliant storage facilities for pharmaceuticals, vaccines, and biologics. Increasing regulatory requirements and inventory management complexities further drive demand for specialized warehousing services.

By End User

Based on end user, the pharmaceutical companies segment dominated the global market in 2024 and is likely to remain dominant during the forecast period. This is attributed to their rising dependence on third-party logistics providers for efficient distribution, regulatory compliance, and temperature-sensitive handling. Outsourcing logistics enables pharma companies to focus on R&D and core operations while ensuring streamlined supply chain performance.

By Medium of Transport

Based on medium of transport, the ground transportation segment dominated the global market in 2024 and is likely to remain dominant during the forecast period. This is attributed to its cost-effectiveness, wide geographic reach, and suitability for short- to medium-distance deliveries. Ground transport is critical for maintaining cold chain integrity in last-mile delivery, especially for vaccines and critical pharmaceutical products.

By Supply Chain

Based on supply chain, the non-cold chain logistics segment dominated the global Healthcare Third-party Logistics Market in 2024 and is likely to remain dominant during the Healthcare Third-party Logistics Market Forecast period. This is attributed to the higher volume of generic drugs, over-the-counter medications, and medical devices that do not require temperature control. The growing demand for these products in both developed and emerging markets supports segment Healthcare Third-party Logistics Market Growth.

By Region

Based on region, the North America region hasd the dominating Healthcare Third-party Logistics Market Share in the year 2024 and is likely to remain dominant during the forecast period. This is attributed to the region‐™s advanced healthcare infrastructure, stringent regulatory environment, and high concentration of pharmaceutical and biotech firms. Established 3PL networks, technology adoption, and rising demand for efficient cold chain logistics further support market dominance in North America.

Which are the leading healthcare 3PL companies

The report examines the profiles of leading companies active in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the healthcare 3PL industry.

United Parcel Service of America, Inc.

Cardinal Health

Kinesis Medical B.V.

FedEx Supply Chain

Kuehne and Nagel

Expeditors International

CH Robinson Worldwide

Kerry Logistics Network Limited

SF Express

UPS Healthcare Logistics

Amerisource Bergen

Sinotrans

DHL Supply Chain

Freight Logistics Solutions

DB Schenker

AGILITY

Barett Distribution

Nippon Express

XPO Logistics

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the Healthcare Third-party Logistics Industry segments, current trends, estimations, and dynamics of the healthcare third-party logistics market analysis from 2024 to 2034 to identify the prevailing healthcare third-party logistics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the healthcare third-party logistics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global healthcare third-party logistics market trends, key players, market segments, application areas, and market growth strategies.

Healthcare Third-party Logistics Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 502.6 billion |

| Growth Rate | CAGR of 7.8% |

| Forecast period | 2024 - 2034 |

| Report Pages | 300 |

| By Service Type |

|

| By End User |

|

| By Medium of Transport |

|

| By Supply Chain |

|

| By Region |

|

| Key Market Players | Sinotrans, FedEx, XPO Logistics, Inc., United Parcel Service of America, Inc., SF Express, AmerisourceBergen Corporation, Nippon Express Co., Ltd., Barett Distribution, BDP international, Kuehne Nagel, GEODIS, Cardinal Health, Kinesis Medical B.V., Freight logistics Solutions, Deutsche Post AG, KERRY LOGISTICS NETWORK LIMITED, Expeditors International of Washington, Inc., C.H. Robinson Worldwide, Inc., DSV A/S |

Analyst Review

As per CXO perspective the growing demand for the healthcare third-party logistics (3PL) market is experiencing robust growth, fueled by increase in complexity of pharmaceutical supply chains, rise in demand for temperature-sensitive biologics, and heightened focus on operational efficiency. A surge in healthcare spending has led pharmaceutical and biotech companies to increasingly outsource logistics to specialized 3PL providers to streamline operations, ensure regulatory compliance, and reduce costs.

The demand for specialized logistics solutions such as cold chain management, clinical trial logistics, and reverse logistics has grown significantly. These services are significant for maintaining the efficacy of high-value biologics and cell and gene therapies. For instance, in January 2025, AmerisourceBergen expanded its global specialty logistics network by adding new GDP-compliant cold storage facilities in Asia, thus supporting the safe distribution of temperature-sensitive pharmaceutical products across emerging healthcare markets. Technological advancements are also a major driving factor in the healthcare third party logistics market. The integration of artificial intelligence, real-time data analytics, IoT-enabled tracking devices, and blockchain help better monitor healthcare deliveries, keep products safe, and prevent fake or spoiled items. For example, in March 2024, Cardinal Health launched a blockchain-based traceability platform for pharmaceutical logistics, thereby enabling secure, end-to-end monitoring of drug shipments, and compliance with global regulatory mandates.

Some of the key players profiled in the report include United Parcel Service of America, Inc., Cardinal Health, Kinesis Medical B.V., FedEx Supply Chain, Kuehne and Nagel, Expeditors International, CH Robinson Worldwide, Kerry Logistics Network Limited, SF Express, UPS Healthcare Logistics, Amerisource Burgen, Sinotrans, DHL Supply Chain, Freight logistics Solutions, DB Schenker, AGILITY, Barett Distribution, Nippon Express, XPO logistics. These players have adopted various strategies to increase their market penetration and strengthen their position in the healthcare third-party logistics (3PL) market.

The healthcare third-party logistics market was valued at $246,060.6 million in 2024 and is estimated to reach $502,545.6 million by 2034, exhibiting a CAGR of 7.8% from 2025 to 2034.

From 2025-2034 would be forecast period in the market report.

$246,060.6 million is the market value of Healthcare Third-party Logistics market in 2022. The market is studied across North America, Europe, Asia-Pacific, and LAMEA.

2024 is base year calculated in the Healthcare Third-party Logistics market report. The leading companies adopt strategies such as product launch, partnership, acquisition, expansion, and collaboration to strengthen their market position.

United Parcel Service of America, Inc., Cardinal Health, Kinesis Medical B.V., FedEx Supply Chain, Kuehne and Nagel, Expeditors International, CH Robinson Worldwide are the top companies hold the market share in Automotive Tire Market.

Loading Table Of Content...

Loading Research Methodology...