The global heat exchanger market size was valued at $19.7 billion in 2023, and is projected to reach $33.2 billion by 2033, growing at a CAGR of 5.4% from 2024 to 2033.

Market Introduction and Definition

A heat exchanger is a device designed to efficiently transfer heat between two or more fluids, which can be liquids, gases, or vapors, without mixing them. The fluids involved in the heat exchange process can either be in direct contact or separated by a solid wall to prevent mixing. Heat exchangers are essential in various industrial processes where heating or cooling of fluids is required. Heat exchanger market analysis play a crucial role in numerous domains, including industrial processes, energy production, heating, ventilation, and air conditioning (HVAC) systems, automotive engineering, and environmental technology. Their applications are diverse, reflecting the need for efficient thermal management across different fields.

In industrial applications, heat exchangers are used in chemical plants, petroleum refineries, natural gas processing, and wastewater treatment facilities. For instance, in chemical plants, they help maintain optimal temperatures for chemical reactions, ensuring efficiency and safety. In petroleum refineries, heat exchangers recover heat from hot fluids and gases to preheat other streams, enhancing energy efficiency and reducing operational costs. In wastewater treatment, they are used to extract heat from sewage, which can then be used to heat buildings or other processes, contributing to energy conservation and sustainability.

The energy sector heavily relies on heat exchangers for both conventional and renewable energy production. In thermal power plants, heat exchangers, often in the form of boilers and condensers, are essential for converting heat from fuel combustion into electricity. They ensure the effective transfer of heat from burning fossil fuels to steam, which then drives turbines to generate power. In nuclear power plants, heat exchangers transfer heat from the nuclear reactor core to a secondary coolant loop, which then produces steam for power generation.

Key Takeaways

- The heat exchanger industry covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global heat exchanger market report overview and to assist stakeholders in making educated decisions to achieve their growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the heat exchanger market trends.

- The heat exchanger market shares is highly fragmented, with several players including Accessen Group, Alfa Laval, API Heat Transfer, Chart Industries, Danfoss A/S, Hisaka Works. Ltd, Exchanger Industries Limited, Koch Industries, Inc, Thermofin GmbH, and Xylem. Also tracked key strategies such as acquisitions, product launches, mergers, and expansion of the players operating in the heat exchanger market growth.

Market Segmentation

The heat exchanger market is segmented into type, material, end-use industry, and region. On the basis of type, the market is classified into shell and tube, plate and frame, air-cooled, micro channel heat exchanger, and others. On the basis of material, the market is categorized into carbon steel, stainless steel, nickel, and others. On the basis of the end-use industry, the market is fragmented into chemical, petrochemical, oil and gas, food and beverage, power generation, HVAC, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Key Market Dynamics

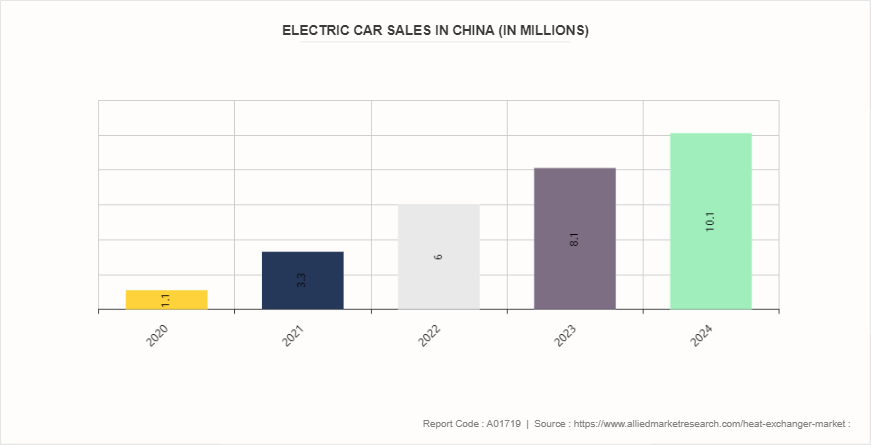

Advancements in automotive technologies are expected to drive the growth of the heat exchangers market. Electric vehicles rely on advanced battery systems that require efficient thermal management to ensure optimal performance, longevity, and safety. Heat exchanger market play a crucial role in cooling these batteries during operation and charging, helping to maintain optimal operating temperatures and extend battery life. Electric vehicles, in particular, rely heavily on efficient thermal management to optimize battery performance and ensure longevity. Heat exchangers play a crucial role in electric vehicle cooling systems by dissipating heat generated from the battery pack, electric motor, and power electronics. As EV manufacturers strive to increase driving range and battery life while maintaining performance and safety, the demand for advanced heat exchangers capable of managing thermal loads effectively continues to grow. As per the International Energy Agency, Electric car markets are seeing robust growth as sales neared 14 million in 2023. The share of electric cars in total sales has increased from around 4% in 2020 to 18% in 2022. Electric vehicles are the key technology to decarbonize road transport, a sector that accounts for over 15% of global energy-related emissions.

Hybrid vehicles combine internal combustion engines with electric propulsion systems, presenting unique thermal management challenges. Heat exchangers are essential components in hybrid vehicles for cooling internal combustion engines, managing transmission heat, and optimizing the efficiency of regenerative braking systems. The integration of heat exchangers in hybrid vehicles contributes to improving overall fuel efficiency and reducing emissions, aligning with global efforts towards sustainability.

However, high initial costs for high-performance heat exchangers are expected to restrain the growth of the heat exchanger market. These high-performance heat exchangers are engineered to deliver superior efficiency, durability, and reliability, making them essential for applications in sectors such as manufacturing, energy production, and HVAC systems. However, the initial cost outlay for these specialized equipment pieces can deter SMEs from investing in upgrades or replacements, despite the potential long-term benefits in terms of energy savings and operational efficiency. Moreover, SMEs may face challenges in securing financing or justifying the return on investment (ROI) for high-performance heat exchangers within their budget constraints. The perceived risk of committing significant financial resources upfront without guaranteed immediate returns can further delay or discourage adoption, particularly when SMEs prioritize short-term financial stability over long-term operational enhancements.

Moreover, the surge in investments in renewable energy projects is expected to offer lucrative opportunities in the heat exchanger market forecast period. In solar energy applications, heat exchangers play a crucial role in converting sunlight into usable energy through solar thermal collectors. These collectors absorb solar radiation and transfer heat to a working fluid, which is then circulated through a heat exchanger to generate electricity or provide heating for residential and commercial buildings. Efficient heat exchangers help maximize energy conversion efficiency and ensure optimal performance of solar thermal systems. Similarly, heat exchangers are essential components in geothermal energy projects to transfer heat between the underground geothermal reservoir and the fluid circulating through the system. Geothermal heat exchangers enable the extraction of heat from the Earth's crust for electricity generation or direct heating applications, contributing to the sustainability and reliability of geothermal energy systems. In January 2023, AP Renewable Inc. announced a groundbreaking ceremony to indicate the beginning of the 17-MW binary geothermal project's construction in the Tiwi geothermal site in the Philippines. The project will extract recoverable heat from geothermal brine to produce 17 MW of electricity, and this facility is expected to be completed by the end of 2023.

Regional Market Outlook

Based on region, the market is divided into North America, Europe, Asia-Pacific, and LAMEA. In North America, heat exchangers are extensively used in sectors such as oil and gas, chemical processing, Heating, Ventilation, and Air Conditioning (HVAC) , and food processing. The region's industrialized economy demands efficient heat transfer solutions to optimize energy consumption and reduce environmental impact. Heat exchangers are vital in improving process efficiency, maintaining product quality, and complying with stringent environmental regulations.

In the Asia-Pacific region, rapid industrialization and urbanization drive the demand for heat exchangers across diverse applications. Countries such as China, India, Japan, and South Korea are major consumers, leveraging heat exchangers in power generation, chemical manufacturing, electronics, and agriculture. The region's growing infrastructure development and expanding manufacturing base underscore the critical role of heat exchangers in enhancing operational efficiency and sustainability. According to EIA, China was the world’s third-largest natural gas consumer and the largest importer in 2021. In 2050, the EIA expects China to consume nearly three times as much natural gas as it did in 2018, which was 280.30 b/cm. China’s natural gas consumption accounted for 9% of its total energy mix in 2021.

Competitive Analysis

Key market players in the heat exchanger market overview include Accessen Group, Alfa Laval, API Heat Transfer, Chart Industries, Danfoss A/S, Hisaka Works. Ltd, Exchanger Industries Limited, Koch Industries, Inc, Thermofin Gmbh, and Xylem.

Industry Trends

- According to the Energy Information Administration, the United States generated a total of 4, 178 terawatt-hours (TWh) of electricity in 2023. This represents a decrease of 50 TWh compared to 2022. However, electricity demand is projected to rise in the coming years, with increasing urbanization.

- In September 2023, APV, a member of SPX FLOW's portfolio of process solutions, launched the new Plate Heat Exchanger FastFrame. This product boasts enhanced usability and durability, anticipated to save time and money for food and beverage operators.

- In March 2023, Alfa Laval introduced the AlfaNova GL50, the first heat exchanger specifically designed for fuel cell systems. This innovation aims to harness the energy from hydrogen and its derivatives—ammonia, methanol, and methane—helping to decarbonize challenging sectors such as shipping and heavy industry. The AlfaNova GL50 enhances system efficiency and minimizes energy losses, supporting fuel cell manufacturers in achieving optimal performance and contributing to the broader goal of accelerating decarbonization.

- In February 2024, the Biden-Harris Administration unveiled a $63 million initiative aimed at boosting American manufacturing in electric heat pumps. The U.S. Department of Energy (DOE) has announced funding to expedite the production of residential heat pumps, heat pump water heaters, and related systems and components within the country. This initiative forms part of the broader Investing in America Agenda. Thus, the increase in demand for heat pumps is expected to boost the growth of the heat exchanger market during the forecast period.

Key Sources Referred

- The International Trade Administration

- U.S. Department of Commerce,

- U.S. Department of Energy

- HRS Heat Exchangers

- Empire State Development (ESD)

- National Renewable Energy Laboratory (NREL)

Key Benefits For Stakeholders

- The report provides an in-depth analysis of the global heat exchanger market trends along with the current and future market forecast.

- This report highlights the key drivers, opportunities, and restraints of the market along with the impact analysis during the forecast period.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the global heat exchanger market for strategy building.

- A comprehensive global heat exchanger market forecast report covers factors that drive and restrain the market growth.

- The qualitative data in this report aims on market dynamics, trends, and developments.

Heat Exchanger Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 33.2 Billion |

| Growth Rate | CAGR of 5.4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Type |

|

| By Material |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Xylem, Exchanger Industries Limited, Chart Industries, ALFA LAVAL, Hisaka Works. Ltd, Thermofin Gmbh, Koch Industries, Inc, API Heat Transfer, Danfoss A/S, Accessen Group |

Analyst Review

Heat Exchangers especially, shell & tube, plate & frame, and micro-channel are widely used across several end-user industries. Shell & tube type is anticipated to register a significant growth during the forecast period, owing to its erosion protection, price advantage, and low pressure drop characteristics.

Heat exchangers composed of stainless steel and nickel are expected to witness significant growth as they are particularly useful in prevention of heat exchanger pipes and walls from corrosion caused by pollution and from the chemicals used to counter it. These heat exchangers are also utilized to overcome the corrosive nature of synthetic oils & refrigerants. These factors have further led to demand of heat exchangers in oil & gas industries.

The Asia-Pacific heat exchangers market offers lucrative opportunities for key manufacturers, owing to growth in the industrial activities and rise in trend of setting up refineries & petrochemical plants in Middle East regions. In addition, technological development in heat exchangers by manufacturers in emerging economies such as China, India, and Japan fuels the market growth. Asia-Pacific is anticipated to account for one-fourth in the global market by 2022, followed by North America.

Key market players in the heat exchanger market include Accessen Group, Alfa Laval, API Heat Transfer, Chart Industries, Danfoss A/S, Hisaka Works. Ltd, Exchanger Industries Limited, Koch Industries, Inc, Thermofin Gmbh, and Xylem.

The global heat exchanger market size was valued at $19.7 billion in 2023, and is projected to reach $33.2 billion by 2033, growing at a CAGR of 5.4% from 2024 to 2033.

Asia-pacific is the largest regional market for heat exchanger.

Chemical is the leading end-use industry of heat exchanger market.

the surge in investments in renewable energy projects are the upcoming trends of heat exchanger market in the globe.

Loading Table Of Content...