High Fat Powder Market Research, 2032

The global High Fat Powder Market Size was valued at $86.9 billion in 2022, and is projected to reach $190.3 billion by 2032, growing at a CAGR of 8.5% from 2023 to 2032. North America was the highest revenue contributor, accounting for $34.3 billion in 2022, and is estimated to reach $66.6 billion by 2032, with a CAGR of 7.2%.

The high fat powder market is a specialized segment of the food and beverage industry that deals with the production, distribution, and utilization of powdered ingredients containing a high fat content. These powders are typically derived from sources such as dairy products (for example, whole milk, cream, or butter), vegetable oils, or animal fats. High fat powders serve as crucial ingredients in various food applications, including confectionery, bakery products, ready-to-eat meals, and dairy products. They are favored for their ability to enhance flavor, texture, and creaminess in a wide range of food and beverage items. The high fat powder market caters to the demand for versatile, shelf-stable fat sources, enabling food manufacturers to incorporate rich, fatty characteristics into their products while also extending shelf life and convenience for consumers.

The high fat powder market has experienced a notable surge in demand, driven in large part by the increase in need for sports nutrition of athletes. Athletes and fitness enthusiasts have turned to high fat powders as a valuable dietary supplement as they seek to optimize their performance and recovery. These powders are rich in essential fatty acids, particularly omega-3s and omega-6s, which provide a concentrated source of energy. High fat powders can be easily incorporated into various sports nutrition products, such as protein shakes and energy bars, to enhance endurance and muscle recovery. Athletes have recognized the benefits of fat as a sustainable energy source, especially during prolonged exercise or endurance events.

Moreover, high fat powders contribute to improved cognitive function and overall well-being, making them an attractive choice for athletes aiming to maintain peak performance levels. The rise in demand for sports nutrition for athletes has propelled the high fat powder market forward, with growth opportunities driven by the ever-increasing focus on enhancing physical and mental performance through optimal nutrition.

However, rise in health concerns among individuals has restrained the market growth. There is a growth in awareness of the potential adverse effects of excessive fat consumption on health, such as obesity, cardiovascular diseases, and diabetes as consumers become more health conscious. This heightened awareness has led to a shift in dietary preferences toward lower-fat and healthier options. Therefore, there is a demand for food products that are lower in saturated fats and trans fats. High fat powders, which are often associated with calorie-dense and less nutritious foods, may face challenge in the market as consumers seek healthier alternatives. In addition, stringent regulations on labeling and health claims related to high fat products may further impact market growth.

The high fat powder market presents a promising opportunity for growth and innovation in the food and beverage industry. High-fat powders offer a versatile solution as consumers increasingly seek both indulgence and health-conscious options. The rise in popularity of low-carb and ketogenic diets has created a niche for high fat products, as they can serve as convenient sources of healthy fats. In addition, high fat powders enhance the sensory experience of various food items, making them attractive to consumers seeking rich, creamy textures and flavors. The market can cater to a broad range of applications, from baked goods to coffee beverages and sports nutrition products. This sector is poised for growth and diversification, meeting the demands of a health-conscious yet taste-driven market as R&D continues to improve the nutritional profiles and ingredient sources of high fat powders. Collaborations between ingredient suppliers and food manufacturers can lead to exciting product innovations in this space, capitalizing on the expanding consumer interest in high fat, low-carb options.

Segmental Overview

The high fat market is segmented on the basis of type, application, distribution channel and region. On the basis of type, the market is categorized into coconut milk powder, butter powder, cream powder, avocado powder, olive oil powder, powdered cheese, whole milk powder, nut powder and others. On the basis of application, it is further divided into ice cream mixes, Bakery mixes, confectionery mixes, and others. On the basis of distribution channel, the market is divided into hypermarkets/supermarkets, specialty stores, online sales channel and business to business. On the basis of region, the market is subdivided into North America, Europe, Asia-Pacific and LAMEA.

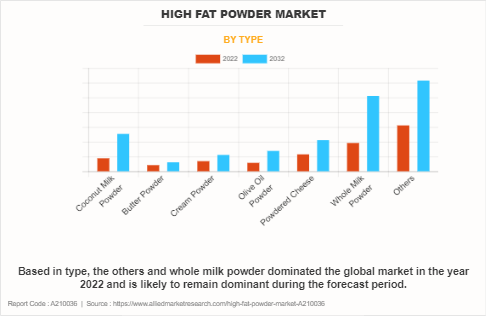

By Type

Based in type, the others and whole milk powder dominated the global market in the year 2022 and is likely to remain dominant during the forecast period. High fat powder trends have evolved to meet changing consumer preferences and dietary needs. Beyond traditional dairy-based options, there is a High Fat Powder Market Growth in interest in plant-based high fat powders, catering to vegan and lactose-intolerant consumers. These alternatives, like coconut and almond-based powders, offer creaminess without animal products. In addition, functional high fat powders enriched with nutrients such as Omega-3 fatty acids or probiotics have gained popularity, appealing to health-conscious consumers.

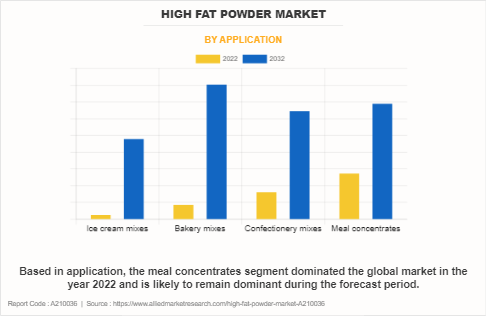

By Application

Based in application, the meal concentrates segment had the dominating High Fat Powder Market Share in the year 2022 and is likely to remain dominant during the forecast period. In the market for high fat powder, a notable trend is the increase in High Fat Powder Market Demand in meal concentrates. Meal concentrates have gained popularity as convenient, on-the-go meal solutions. High fat powders are being incorporated to enhance the creaminess, flavor, and nutritional content of these products, catering to consumers seeking indulgent and satisfying meal options.

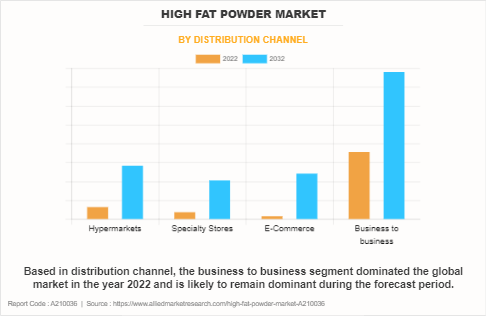

By Distribution Channel

Based on distribution channel, the business-to-business segment dominated the global market in the year 2022 and is likely to remain dominant during the High Fat Powder Market Forecast period. The major factor driving the growth of the business-to-business high fat powder sales is the rise in outdoor dining trend among consumers. There is a rise in the consumption of food outside the house as the disposable income is on the rise, owing to which the demand for high fat powder is also on rise QSR such as McDonalds, Dominos, Pizza Hut, and Taco Bell have utilized refrigerated or frozen products in order to provide quick services to its customers.

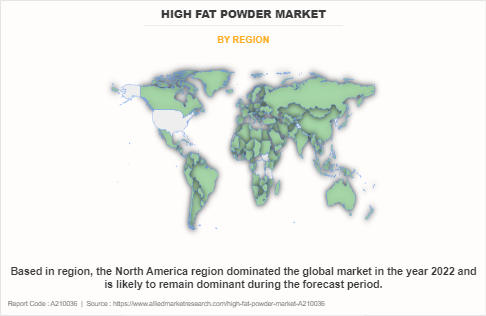

By Region

Based in region, the North America region dominated the global market in the year 2022 and is likely to remain dominant during the forecast period. The demand for high fat powder products is being driven by an increase in the number of gym-going and fitness conscious people who want to stay healthy and fit. The increase in popularity of “clean label” and “free-from” products has led the way in North America, particularly in the U.S., and is expected to play a significant role in the growth of the sports nutrition market in the future which is expected to foster the overall High Fat Powder Industry growth.

Competition Analysis

Key players included into the high fat powder market analysis are Barry Callebaut AG, Corman SA Kanegrade Limited, Glanbia PLC, Kerry Group plc, Arla Foods amba, Lactalis Group, Danone S.A., Darigold, Inc., and Fonterra Co-Operative Group Limited.

Recent Developments in the Market

Expansion

- July 2023, Fonterra Co-operative Group Limited announced to expand its business in China in the premium dairy category in order to serve its health-conscious consumers.

- March 2022, Kerry Group plc opened new manufacturing facility in Rome, Georgia, to expand its product capabilities and business presence.

Collaboration

February 2021, Barry Callebaut AG collaborated with Deloitte to accelerate support for cocoa farming communities in Indonesia and expand its product offering.

Agreement

June 2023, Barry Callebaut AG extended its agreement with Unilever PLC, in order to supply cocoa and chocolate products.

Partnership

- May 2023, Barry Callebaut AG partnered with Maersk, in order to build and operate a new Built-To-Suit cocoa bean warehousing and dispatching facility in Malaysia.

- February 2021, Barry Callebaut AG partnered with PT Sinarniaga Sejahtera, which is a subsidiary of Garudafood in order to bring the compound chocolate range of the Van Houten Professional brand to bakeries, chocolatiers and home bakers in Indonesia.

- October 2022, Barry Callebaut AG partnered with Attelli SARL, in order to acquire its manufacturing assets and establish its local production foot-print in North Africa.

Product Launch

- May 2021, Lactalis Group launched new organic whole milk powder in order to expand its product offering.

Acquisition

- August 2020, Glanbia PLC through its subsidiary Glanbia Nutritionals, announced that it has agreed to acquire Foodarom, which is a Canadian-based custom flavor designing company in order to expand its product offering.

- May 2022, Glanbia PLC acquired Sterling Technology, which is an U.S. based manufacturer of dairy bio-active solutions in order to expand its portfolio.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the high fat powder market analysis from 2022 to 2032 to identify the prevailing high fat powder market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the high fat powder market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global high fat powder market trends, key players, market segments, application areas, and market growth strategies.

High Fat Powder Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 190.3 billion |

| Growth Rate | CAGR of 8.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Type |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Kanegrade Limited, Danone S.A., Kerry Group plc, Glanbia PLC, FONTERRA CO-OPERATIVE GROUP LIMITED, Darigold, Inc., Lactalis Group, Barry Callebaut AG, Arla Foods amba, Corman SA |

Analyst Review

In the view of CXO, the high fat powder market is currently a dynamic and promising segment within the food industry. Leading market players in this sector have witnessed several trends and opportunities that have shaped their strategic decisions.

One key driver fostering the high fat powder market growth is the rise in consumer demand for convenience and indulgence. CXOs are aware that modern lifestyles have led to a surge in the consumption of ready-to-eat and convenience products. High fat powders, derived from sources such as dairy or vegetable oils, play a pivotal role in enhancing the flavor and texture of these products. This consumer preference for rich and creamy tastes has created a substantial market opportunity for CXOs, prompting them to innovate and expand product portfolios to meet evolving customer expectations.

However, one of the significant restraints in this market is the growth in awareness of health and wellness. Health-conscious consumers have increasingly scrutinized the nutritional aspects of their food choices, including the fat content. CXOs are facing the challenge of balancing the demand for high fat powders with the need to address health concerns. They must navigate this restraint by investing in R&D to create healthier alternatives or by providing transparent nutritional information to inform consumer choices.

The global High Fat Powder Market Size was valued at $86.9 billion in 2022, and is projected to reach $190.3 billion by 2032

The global High Fat Powder market is projected to grow at a compound annual growth rate of 8.5% from 2023 to 2032 $190.3 billion by 2032

Key players included into the high fat powder market analysis are Barry Callebaut AG, Corman SA Kanegrade Limited, Glanbia PLC, Kerry Group plc, Arla Foods amba, Lactalis Group, Danone S.A., Darigold, Inc., and Fonterra Co-Operative Group Limited.

Based in region, the North America region dominated the global market in the year 2022 and is likely to remain dominant during the forecast period.

Significant benefits of high fat powder, Increase in demand for bakery and beverage products

Loading Table Of Content...

Loading Research Methodology...