High-intensity Sweeteners Market Research, 2031

The global high-intensity sweeteners market was valued at $1,897.30 million in 2020, and is projected to reach $2,920.10 million by 2031, growing at a CAGR of 3.7% from 2022 to 2031.

High-intensity sweeteners are sugar substitutes that are used in lower concentration than other sweetening agents, such as sucrose, and comprise lesser calorie content. For instance, the compound aspartame, is about 160–220 times sweeter than sucrose and is considered a high-intensity sweetener. Moreover, these sweeteners are widely used in food to prevent dental caries and prevent the rise in blood sugar levels. Furthermore, these sweeteners are extensively used by diabetic patients to control their blood sugar levels and low-calorie value. Moreover, the use of these sweeteners is regulated by Food and Drug Administration (FDA) for use as a food additive, and are commercially used after receiving an approval from Generally Recognized as Safe (GRAS), especially in Europe and North America.

The high-intensity sweeteners market is characterized by the presence of local and overseas raw material suppliers. Manufacturers can opt for different suppliers due to variation in products. The procurement of raw material depends on the special quoted prices and convenience of manufacturers. Buyers tend to switch to other suppliers due to presence of large number of suppliers, thus leading to lower bargaining power of suppliers. Sweeteners producers can manufacture food and beverage items themselves, which results in moderate threat of forward integration. Therefore, the bargaining power of suppliers is projected to remain low to moderate in the global high-intensity sweeteners market.

The market is also characterized by the presence of multiple buyers who are involved in bulk purchases, and represent a large sale portion of artificial sweeteners manufacturers, which indicates high bargaining power of buyers. Moreover, they are less expected to integrate backward, as sweeteners are differentiated products, thus indicating lower bargaining power of buyers. In addition, buyers govern low bargaining power due to lack of effective substitutes in the market. However, they are price sensitive toward procuring sweeteners, which leads to high bargaining power of buyers. Thus, the bargaining power of buyers ranges from low to moderate in the global market.

The high-intensity sweeteners market witness’s high level of competition, which results in industry consolidation. Various sweetener manufacturers have launched new products for specific end-use industries, such as Aspartame, Acesulfame K2, Saccharin, and Sucralose, which are widely used in the food and beverage industry. Frequent product launches demonstrate the extent to which firms limit their competitors’ profit potential. In addition, competitors are strategically diverse in nature, which further leads to intense competition. All these factors demonstrate that there is moderate competition in the global market.

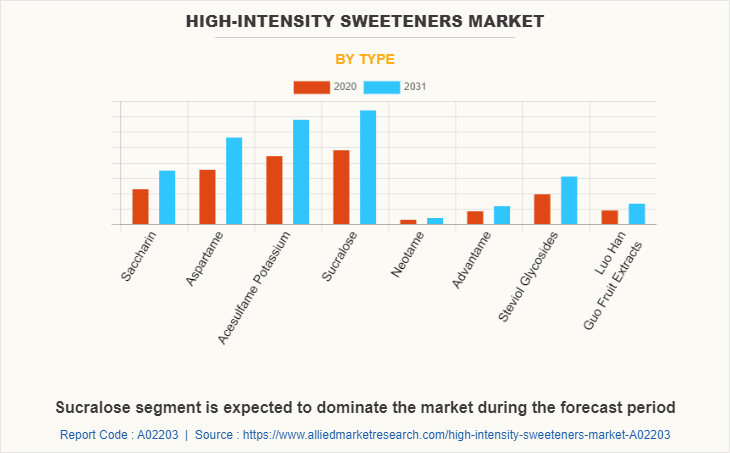

The sucralose segment dominated the global market in 2020, and is anticipated to maintain this trend during the forecast period. The sucralose segment is also expected to grow at a CAGR of 3.7%.

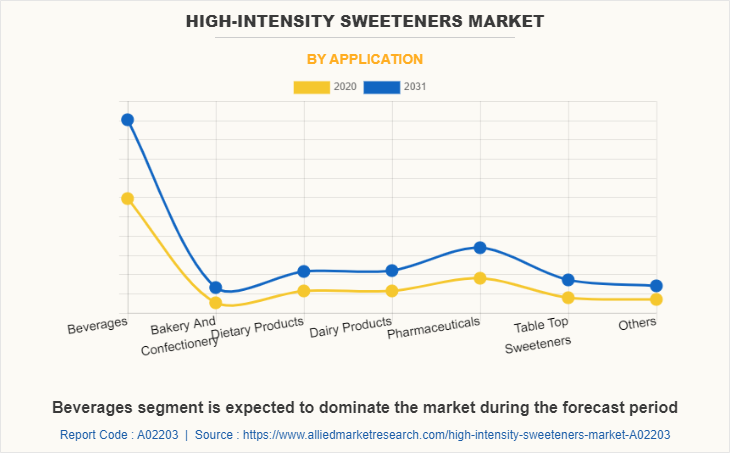

The beverages segment dominated the global market in 2020, and is anticipated to maintain this trend during the forecast period. The pharmaceuticals segment is also expected to grow at a CAGR of 3.9%.

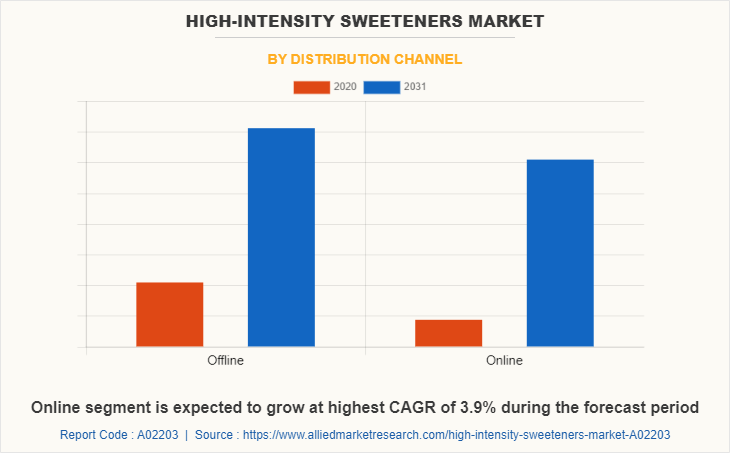

The offline segment dominated the global market in 2020, and is anticipated to maintain this trend during the forecast period. The online segment is also expected to grow at a CAGR of 3.9%.

Asia-Pacific accounted for a significant high-intensity sweeteners market share of the global revenue in 2020, followed by LAMEA and Europe. Furthermore, rise in living standards, change in lifestyle, and extensive branding by food manufacturers are expected to increase the demand for high-intensity sweeteners. These are estimated to grow at the highest CAGR, owing to spread of obesity in the emerging Asian economies.

The key players of high-intensity sweeteners industry such as Hyet Sweet, Tate and Lyle, Plc., Celanese Corporation, Cumberland Packing Corporation, Merisant, Ajinomoto Co., Inc., Hermes Sweeteners Ltd., JK Sucralose, Inc., Heartland Food Products Group, and Stevia First Corporation, have invested in R&D activities to develop advanced products to cater to the requirements of the market.

The other players in the value chain (profiles not included in the report) include Cargill, Inc., The NaturaSweet Company, A & Z Food Additives Co., Ltd., DuPont, PureCircle, Archer Daniels Midland Company, and Associated British Foods.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the high-intensity sweeteners market analysis from 2020 to 2031 to identify the prevailing high-intensity sweeteners market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the high-intensity sweeteners market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global high-intensity sweeteners market size.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global high-intensity sweeteners market trends, key players, market segments, application areas, and market growth strategies.

High-intensity Sweeteners Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By DISTRIBUTION CHANNEL |

|

| By Region |

|

| Key Market Players | JK Sucralose, Inc., Stevia First Corporation, Hyet Sweet, Merisant, Hermes Sweeteners Ltd., Celanese Corporation, Tate and Lyle, Ajinomoto Co., Inc., Cumberland Packing Corporation, Heartland Food Products Group |

Analyst Review

High intensity sweeteners (HIS) comprise structurally diverse set of compounds that are sweeter than sucrose (table sugar), and can be used as a substitute to sugar. A sugar substitute is a food additive compound that imparts a sweet taste to food but releases lesser food energy. Unlike sugar, HIS are noncaloric and noncariogenic compounds; and hence its consumption does not lead to dental caries. These sweeteners, such as acesulfame K, aspartame, cyclamate, saccharin, and sucralose, are artificial sweeteners produced by chemical synthesis; while stevia extract is natural products.

High intensity sweeteners have gained popularity in the recent years in dairy products, snack foods, and others, owing to their growing demand for low-sugar beverages, dairy products, and snack foods. The initiatives taken by top food & beverage industry players to introduce natural sweeteners in soft drinks and other food items in the U.S. proliferated the market growth.

Asia-Pacific dominated the global market in 2020. This region offers lucrative opportunities for key manufacturers, owing to presence of a wide range of suppliers and manufacturers. In addition, high economic growth rate, increase in purchasing power, and development in new food habits, such as consumption of low calorie diet drinks and sodas, are other supplementary factors that fuel the market.

The global high-intensity sweeteners market was valued at $1,897.30 million in 2020, and is projected to reach $2,920.10 million by 2031

The global High-intensity Sweeteners market is projected to grow at a compound annual growth rate of 3.7% from 2022 to 2031 $2,920.10 million by 2031

The key players of high-intensity sweeteners industry such as Hyet Sweet, Tate and Lyle, Plc., Celanese Corporation, Cumberland Packing Corporation, Merisant, Ajinomoto Co., Inc., Hermes Sweeteners Ltd., JK Sucralose, Inc., Heartland Food Products Group, and Stevia First Corporation, have invested in R&D activities to develop advanced products to cater to the requirements of the market.

Asia-Pacific accounted for a significant high-intensity sweeteners market share of the global revenue in 2020

Ongoing developments and new applications in the food industry including dairy products & baked goods, rise in incidences of diabetes and obesity, and concerns about health and nutrition among the population drive the growth of the global high-intensity sweeteners market

Loading Table Of Content...