High-Speed Camera Market Summary, 2032

The global high-speed camera market was valued at $0.6 billion in 2022, and is projected to reach $1.6 billion by 2032, growing at a CAGR of 10.5% from 2023 to 2032. A high-speed camera is a specialized imaging device designed to capture and record events that occur at extremely fast speeds. Unlike conventional cameras, high-speed cameras are capable of capturing motion with exceptional detail and clarity by capturing a significantly higher number of frames per second (FPS). These cameras typically have adjustable frame rates that can range from a few hundred to several thousand frames per second, allowing for the precise analysis of fast-moving objects or processes.

High-speed cameras are used in various industries, including scientific research, engineering, sports analysis, manufacturing, and entertainment, to capture and analyze rapid events in using a slow motion that are imperceptible to the human eye.

High-speed cameras employ advanced technologies to capture fast motion with high temporal resolution. They utilize high-performance image sensors, often with a complementary metal-oxide-semiconductor (CMOS) or charge-coupled device (CCD) technology, capable of capturing images at incredibly fast frame rates. These sensors convert the incoming light into digital signals, which are then processed and stored in the camera's memory. The high-speed camera is capable of capturing stunning slow-motion camera footage with its high-frame-rate camera capabilities, making it ideal for high-speed imaging applications.

The captured images or videos from high-speed cameras can be played back in slow motion, allowing for detailed analysis and precise measurements of motion, deformation, or other dynamic properties. The slow-motion camera, integrated into the high-speed camera, enables the capture of mesmerizing slow-motion camera footage for a wide range of applications. Additionally, high-speed cameras may offer features such as adjustable exposure times, high-resolution imaging, synchronization with external triggers, and various lens options to cater to specific application requirements.

The versatility and high-performance capabilities of high-speed cameras make them invaluable tools in a wide range of fields where capturing and analyzing fast-motion phenomena is crucial. The increase in demand for high-speed cameras within the sports sector is also on the rise owing to its enhanced capabilities such as high resolution, frame rate, and image processing.

In addition, growth in demand for small, lightweight high-speed cameras in automotive and transportation and an increase in usage of high-speed cameras in thermal imaging applications act as a major driver for the high-speed camera market growth.

However, the high cost of high-speed cameras is expected to hinder the high-speed camera industry globally. Furthermore, emerging applications of high-speed cameras in intelligent transportation systems (ITS), and the growing adoption of high-speed cameras in the aerospace & defense industry vertical among others offer lucrative opportunities for the high-speed camera market size globally.

Segment Review:

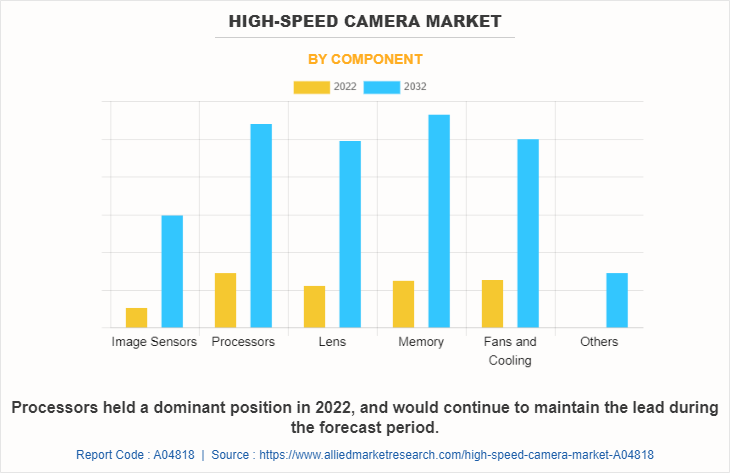

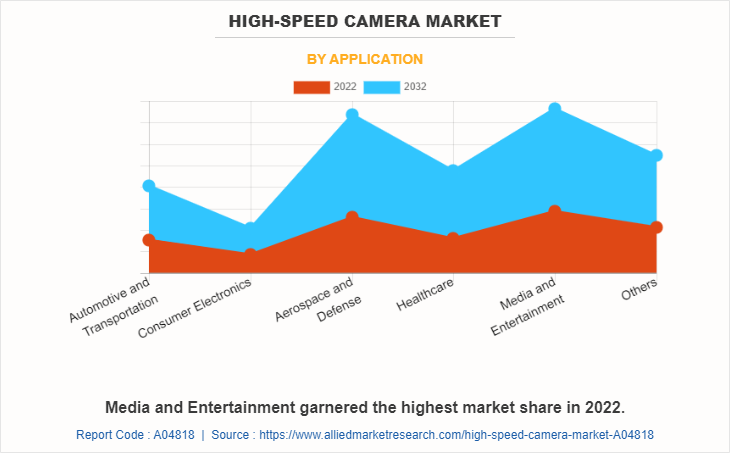

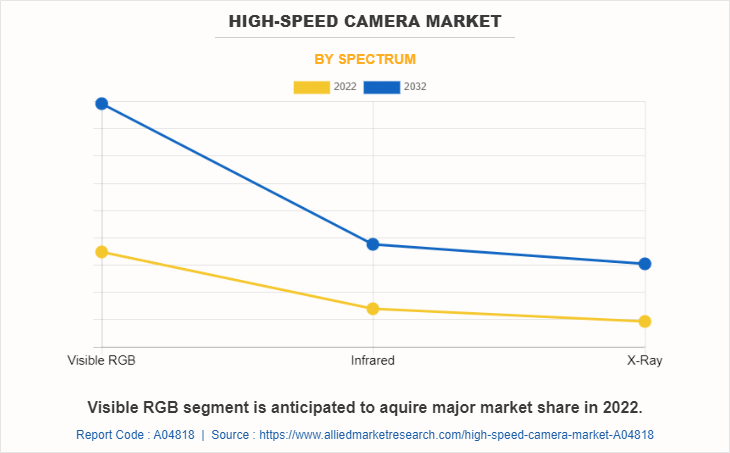

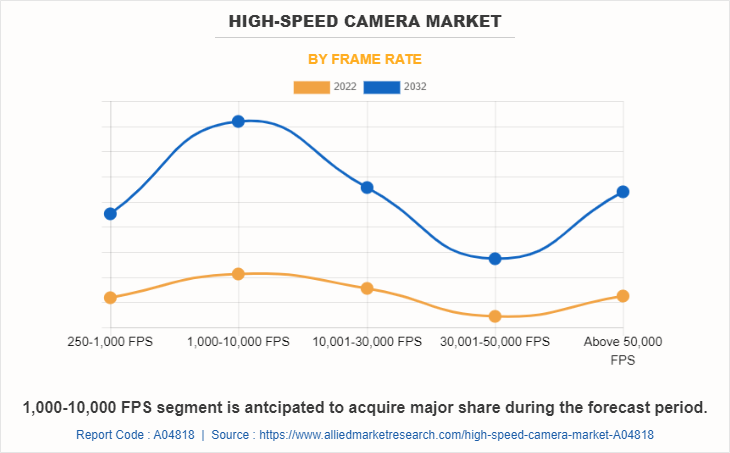

The market is segmented into component, application, spectrum and frame rate.

As per component, the market is classified into image sensors, processors, lens, memory, fan & cooling, and others. The processors segment acquired the largest share in 2022 and memory segment is expected to grow at a significant CAGR from 2023 to 2032.

Depending on application, the market is categorized into automotive and transportation, consumer electronics, aerospace and defense, healthcare, media and entertainment, and others. The media and entertainment segment acquired the largest share in 2022 and healthcare segment is expected to grow at a significant CAGR from 2023 to 2032.

On the basis of spectrum type, the market is segmented into visible RGB, infrared, and x-ray. In 2022, the visible RGB segment dominated the market, and x-ray is expected to acquire major market share till 2032.

By frame rate, the market is divided into 250 to 1,000 FPS, 1,001-10,000 FPS, 10,001-30,000 FPS, 30,001-50,000 FPS, and above 50,000 FPS. The 1,000-10,000 FPS segment acquired the largest share in 2022 and is expected to grow at a significant CAGR from 2023 to 2032.

Region-wise, the market are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

Competitive Analysis

Competitive analysis and profiles of the major global High-speed camera market players that have been provided in the report include DEL Imaging, iX Cameras, Olympus Corporation, Fastec Imaging, Mikrotron GmbH, nac Image Technology, Photron, Vision Research Inc. (AMETEK Inc.), WEISSCAM GmbH, and Motion Capture Technologies. The key strategies adopted by the major players of the high-speed camera market are product launch, agreement and others.

Country Analysis

Country-wise, the U.S. acquired a prime share in the high-speed camera market in the North American region and Canada is expected to grow at a significant CAGR during the forecast period of 2023-2032.

In Europe, Rest of Europe, dominated the high-speed camera market share, in terms of revenue, in 2022 and is expected to follow the same trend during the forecast period. However, the Rest of Europe is expected to emerge as the fastest-growing country in Europe's high-speed camera market with a CAGR of 10.9%.

In Asia-Pacific, China, is expected to emerge as a significant market for the high-speed camera, owing to a significant rise in investment by prime players due to an increase in growth of manufacturing and packaging industries in rural and urban regions.

By LAMEA region, the Latin America garner significant market share in 2022. The LAMEA high-speed camera market has been witnessing improvement, owing to the growing inclination of prime vendors towards utilizing the high-speed camera across this region in various applications such as healthcare, media and entertainment and others. Moreover, the Africa region is expected to grow at a high CAGR of 11.9% from 2023 to 2032.

Historical Data & Information

The global high-speed camera market opportunity is highly competitive, owing to the strong presence of existing vendors. Vendors of the market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to worsen as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

DEL Imaging, iX Cameras, Olympus Corporation, Fastec Imaging, Mikrotron GmbH, nac Image Technology, Photron, Vision Research Inc. (AMETEK Inc.), WEISSCAM GmbH, and Motion Capture Technologies are the top companies holding a prime share in the high-speed camera market forecast. Top market players have adopted various strategies, such as product launch, product development, partnership, investment, acquisition, contract, branding, and expansion to expand their foothold in the market.

In March 2023, Mikrotron announced the launch of its 10MP EoSens 10CCX12-FM CXP-12 camera with global shutter, which provides performance of the Gsprint 4510 CMOS sensor, allowing color images to be captured at up to 478fps.

In February 2020, Fastec Imaging announced the launch of the HS7, a full HD high-speed camera with unique high-speed image transfer capabilities. It was designed primarily for laboratory and industrial use. TheHS7 systemcombines a high-speed camera with a dedicated controller, thus simplifying setup, streamlining integration, and optimizing workflow. It is also capable of recording FHD (1080p) at 2500 frames per second.

In March 2022, Photron launched three high-speed camera systems, including the Fastcam Nova R5-4K, which is a very fast 4K UHD camera system. The Fastcam Nova R5-4K uses the latest CMOS image sensor technologies and provides an ultra-high-resolution high-speed camera with excellent light sensitivity and large internal memory, enabling it to be used in a variety of applications.

In October 2022, Photron announced the launch of PhotoCam Detector, a high-speed surveillance system that integrates computer vision and data logger with a high-speed camera.

In January 2021, iX Cameras announced the launch of three i-SPEED 7 high-speed camera models. All these models 717, 721, and 727, feature a custom Advanced Sensor Technology (AST) CMOS 3.2-megapixel sensor designed by the engineers to provide a unique combination of high frame rates and high resolution as required in exacting motion analysis applications.

In June 2023, iX Cameras launched the 3 models of i-SPEED 5 Series high-speed cameras. These models in the series offer class-leading features that elevate their performance and expand their capabilities across various industries and applications, making them invaluable for professionals in scientific research and engineering.

Key Benefits For Stakeholders

This high-speed camera market outlook provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the high-speed camera market analysis from 2022 to 2032 to identify the prevailing high-speed camera market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the high-speed camera market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global high-speed camera market trends, key players, market segments, application areas, and market growth strategies.

High-Speed Camera Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.6 billion |

| Growth Rate | CAGR of 10.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 295 |

| By Component |

|

| By Application |

|

| By Spectrum |

|

| By Frame Rate |

|

| By Region |

|

| Key Market Players | Olympus Corporation, Motion Capture Technologies, iX Cameras, WEISSCAM GmbH, DEL Imaging, nac Image Technology, Vision Research Inc. (AMETEK Inc.), Fastec Imaging, Photron, Mikrotron GmbH |

Analyst Review

According to the perspectives of CXOs (Chief Executive Officers) of a leading high-speed camera market company, there is a strong expectation for significant growth in the market in the coming years. Technological advancements and innovations in high-speed camera technology are expected to drive market growth. The continuous development of high-performance image sensors, faster frame rates, higher resolutions, and improved connectivity options are projected to attract more customers and expand the applications of high-speed cameras.

The increasing demand for high-speed cameras in various industries such as automotive, manufacturing, aerospace, and healthcare is seen as a key driver of market growth. These industries require high-speed cameras for quality control, research and development, process optimization, and safety applications. As these sectors continue to grow and invest in advanced technologies, the demand for high-speed cameras is expected to rise correspondingly. The rising adoption of high-speed cameras in emerging sectors and applications is viewed as an opportunity for market expansion. Industries such as robotics, artificial intelligence, virtual reality, and augmented reality are increasingly utilizing high-speed cameras for precise motion analysis, object tracking, and immersive experiences. The integration of high-speed cameras with these emerging technologies opens up new avenues for growth.

The expanding use of high-speed cameras in entertainment and media, including sports analysis, film production, and broadcasting, is considered a significant market driver. The demand for slow-motion shots, detailed visuals, and enhanced viewer experiences in these industries fuels the adoption of high-speed cameras. Technological advancements, industry demand, emerging applications, and the entertainment sector are expected to be the key factors driving this growth.

The high-speed camera market was valued at $0.6 billion in 2022 and is estimated to reach $1.6 billion by 2032.

North America was the highest revenue contributor, accounting for $200.22 million in 2022.

DEL Imaging, iX Cameras, Olympus Corporation, Fastec Imaging, Mikrotron GmbH, nac Image Technology, Photron, Vision Research Inc. (AMETEK Inc.), WEISSCAM GmbH, and Motion Capture Technologies are the top companies to hold the market share in High-Speed Camera.

The high-speed camera market to grow at a CAGR of 10.5% from 2023 to 2032.

Growth in demand for small, lightweight high-speed cameras in automotive and transportation and an increase in usage of high-speed cameras in thermal imaging applications act as a major driver for the high-speed camera market growth.

Loading Table Of Content...

Loading Research Methodology...