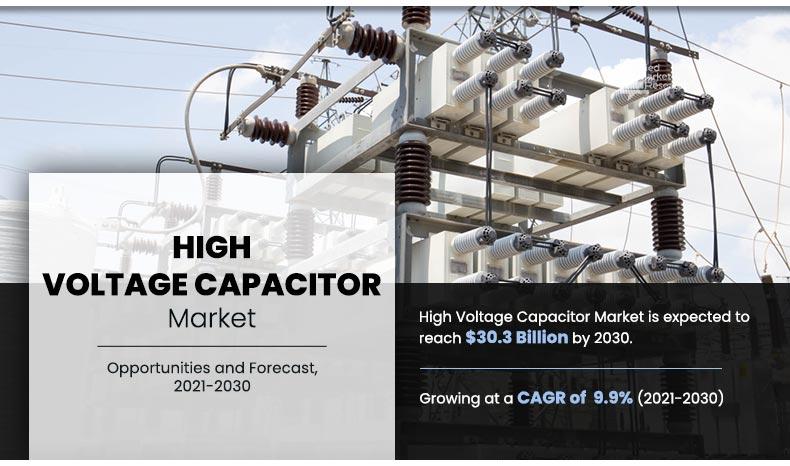

High Voltage Capacitor Market Overview - 2030

The high voltage capacitor market was valued at $11.8 billion in 2020, and is projected to reach $30.3 billion by 2030, growing at a CAGR of 9.9% from 2021 to 2030. High voltage capacitors offer simple and reliable reactive power to enhance system efficiency, performance, and quality. It is utilized under oil for peaking in large pulse power systems or pulse shaping. The capacitors are produced utilizing foil electrode windings and dielectric. The capacitors are enclosed in plastic cases with pivotal terminals, and are exhaustively vacuum-dried and infused with an insulating liquid.

The high voltage capacitor market is driven by factors such as increased demand to boost grid infrastructure for increasing the electricity accessibility, increased demand for multilayer ceramic capacitors, and others. However, the high voltage capacitor market is hindered by the high voltage hazards related to high voltage capacitor. There are many factors related to high voltage capacitors that can cause hazards such as, retaining energy even after the equipment has been de-energized, which may further build up a hazardous residual charge without an external energy source. On the contrary, development of the renewable energy market is anticipated to offer lucrative opportunity during the forecast period.

The high voltage capacitor market is segmented on the basis of dielectric, capacity, application, and region. On the basis of dielectric, the market is segregated into plastic film capacitor, ceramic capacitor, aluminum electrolytic capacitor, others. By capacity, the global market is classified into 500-1000V, 1001-7000V, 7001-14000V, and Above 14000V. On the basis of application, the market is divided into power generation, transmission, distribution, and others Region-wise, the high voltage capacitor market share is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The high voltage capacitor market analysis covers in-depth information of the major industry participants. Some of the major players in the market of high voltage capacitor include ABB Ltd, AVX Corporation (AVX), General Electric, Lifasa, Maxwell Technologies, Presco AG, Siemens AG, TDK Corporation (TDK), Vishay Intertechnology, Inc., Eaton (COOPER), General Atomics, Inc. (General Atomics), Murata Manufacturing, Hitachi Ltd. (Hitachi), Samwha Capacitor Co Ltd (Samwha Capacitor), and UCAP Power, Inc. (UCAP Power)

Other players in the value chain of the high voltage capacitor market include Jiande Haihua Electric Co., Ltd, Zhejiang Yide Technology Co., Ltd., RTDS Technologies, Sieyuan Electric, and others.

The key players adopt numerous strategies, such as product launch, business expansion, acquisition, partnership, collaboration, joint venture, and agreement, to stay competitive in the high voltage capacitor market.

For instance, Murata launched new product named KCM series of metal terminal type multilayer ceramic capacitors. It has temperature compensating U2J characteristics for automotive applications and the KRM series of metal terminal type multilayer ceramic capacitors for general-purpose applications. These products are basically for IGBT snubber circuits used in industrial and automotive equipment. This product launch has reinforced its product launch.

In addition, TDK Corporation launched new product named EPCOS aluminum electrolytic capacitor series B43548* with snap-in terminals. This new product has an excellent maximum ripple current capability. This product is used in power electronics. This capacitor is developed for a maximum operating temperature of 105 °C, and has a rated voltage range of 400V to 500V. This product launch has reinforced its product portfolio.

High Voltage Capacitor Market, by Dielectric

By dielectric, the ceramic segment garnered market share of 16.7% in 2020, in terms of revenue and expected to grow at a CAGR of 11.9% during the forecast period. Multilayer ceramic capacitor (MLCC) manufacturers are boosting production capacity to serve the demand for large format high quality ceramic capacitors for military, medical, and industrial applications. These applications demand for high-voltage MLCCs, which has been halted by some of the major MLCC participants. This is attributed to shift in focus toward insatiable demand for lower voltage, and smaller, i.e., lower performance MLCCs.

By Dielectric

Ceramic Capacitor is projected as the most lucrative segment.

High Voltage Capacitor Market, by Capacity

By capacity, the 500-1000V segment garnered market share of 14.4%% in 2020, in terms of revenue and expected to grow at a CAGR of 10.9% during the forecast period. In recent years, the electronics industry has seen large growth owing to technological advancement and population growth across the globe. Capacitors ranging from 500 to 1000 volts are commonly employed in electrical circuits to block direct current while allowing alternating current to pass. They smooth the output of power supply in analogue filter networks.

By Capacity

500-1000V is projected as the most lucrative segment.

High Voltage Capacitor Market, by Application

By application, the power generation segment garnered market share of 37.0% in 2020, in terms of revenue and expected to grow at a CAGR of 10.9% during the forecast period. Power generation equipment has witnessed a strong demand owing to the increase in population followed by rise in number of consumers and rapid urbanization. The increase in consumption leads to a rise in demand for electricity, thereby increasing the demand for high voltage capacitors in the power generation equipment.

By Application

Power Generation is projected as the most lucrative segment.

High Voltage Capacitor Market, by Region

Region-wise, Asia-Pacific is expected to grow at a CAGR of 11.6%, in terms of revenue during the forecast period. This is attributed to presence of key high voltage capacitor industrial participants and rising consumer base in China, Japan, and India.

By Region

Asia-Pacific holds a dominant position in 2020 and would continue to maintain the lead over the forecast period.

Key benefits for stakeholders

- The report outlines the current market trends and future scenario of the market from 2021 to 2030 to understand the prevailing opportunities and potential investment pockets.

- The high voltage capacitor market size is provided in terms of revenue and volume.

- The report provides an in-depth analysis of the market along with the current and future high voltage capacitor market trends.

- This report highlights the key drivers, opportunities, and restraints of the high voltage capacitor market along with impact analysis during the forecast period.

- Porter’s five forces analysis helps analyze the potential of buyers & suppliers and the competitive scenario of the high voltage capacitor industry for strategy building.

- The study provides a comprehensive analysis of the factors that drive and restrain the high voltage capacitor market growth.

Impact of COVID-19 on the High Voltage Capacitor Market

- The outbreak of COVID-19 in China and it’s spread across numerous countries around the world halted the manufacturing activities of industrial sectors which correspondingly hampered high voltage capacitor manufacturing as well.

- The raw material procurement was also challenged owing to outbreak of COVID-19.

- The revenue streams of government of numerous countries were halted which correspondingly hindered the government funded transmission and distribution projects. This consequently decreased the demand for high voltage capacitors.

- It is expected that as economies of numerous countries are recovering the government funded transmission and distribution projects might resume as soon as possible. Which might increase the demand for high voltage capacitor.

High Voltage Capacitor Market Report Highlights

| Aspects | Details |

| By Dielectric |

|

| By Capacity |

|

| By Application |

|

| By Region |

|

| Key Market Players | LIFASA, VISHAY INTERTECHNOLOGY, INC., ARTECHE GROUP, SIEMENS AG, ABB LTD., GENERAL ELECTRIC, MAXWELL TECHNOLOGIES, TDK CORPORATION, PRESCO AG, AVX CORPORATION |

Analyst Review

According to the CXOs of leading companies, the spread of COVID-19 led to temporary problems such as restrictions on purchase of materials & components and shipment of products. This was attributed to an impact on the logistic networks. In addition, global companies having presence in various countries witnessed problems with respect to production activities owing to different policies in different countries against COVID-19. However, the industrial activities are expected to increase in coming time which is projected to surge the energy demand and consequently the demand for passive components such as high voltage capacitors.

Product Launch, Business Expansion, Acquisition is some of the key growth strategies adopted by high voltage capacitors market players

The potential customers of high voltage capacitor are power equipment manufacturers such as power electronics manufacturers.

To get latest version of high voltage capacitor market report can be obtained on demand from the website.

On the basis of dielectric, the ceramic segment holds the maximum share of the high voltage capacitor market.

Power electronics and power generation applications are expected to drive adoption of high voltage capacitors.

The top ten market players are selected based on two key attributes - competitive strength and market positioning

The market is driven by factors such as increased demand to boost grid infrastructure for increasing the electricity accessibility, increased demand for multilayer ceramic capacitors, and others

Asia-Pacific region is expected to offer more business opportunities for high voltage capacitor in future. This is attributed to presence of key players in Japan, China, India etc., and rising consumer bases such as renewable energy sector, automotive, and others.

Vishay Intertechnology, Inc, TDK Corporation, AVX Corporation and Murata Manufacturing are some of the leading players in the global high voltage capacitor market.

The rising energy demand from emerging economies is expected to influence to the high voltage capacitor market in next few years.

Loading Table Of Content...