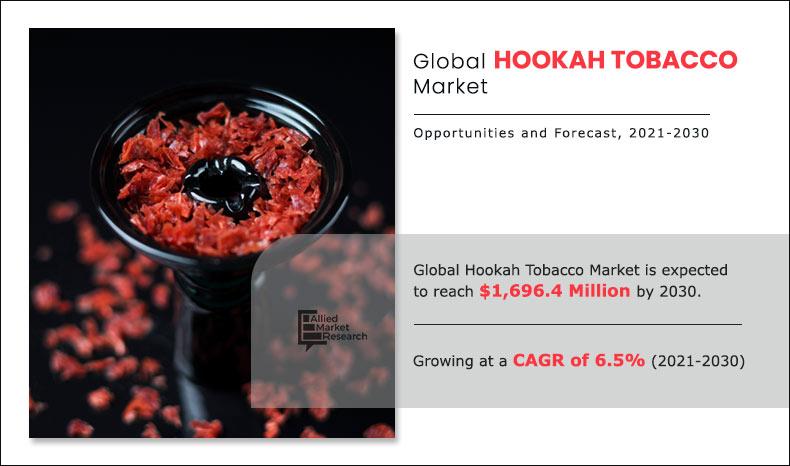

The hookah tobacco market size was valued at $824.8 million in 2020 and is estimated to reach $1,696.4million by 2030, registering a CAGR of 6.5% from 2021 to 2030.

Hookah tobacco is a type of combustible tobacco that is smoked with a hookah. It is also known as waterpipe tobacco, maassel and shisha.

Several factors are driving the growth hookah tobacco market such as rapid rise in health consciousness, tobacco product manufacturers have invested in R&D of several low-risk tobacco products. As a result, these businesses have been able to maintain profits while also expanding their existing customer base. In addition, rising per capita income has given market participants more ways to raise product prices and shift toward premium products. It is consumed for its benefits that calm and energize the mind. Furthermore, Growing hectic and stressful lifestyles have resulted in an increase in the number of both male and female smokers. In addition, tobacco product manufacturers have been releasing feminine-labeled products to increase the number of female consumers. Flavor-infused hookah tobacco has been gaining significant popularity among millennial population.

Innovative marketing techniques that industry players use to attract and target potential consumers particularly the young population. Automated technologies are predicted to lead the global hookah tobacco market by 2030 in combination with the growth of online sales.

The crisis of COVID-19 threatens the hookah tobacco industry. Sales in the first quarter were disappointing and some establishments had to shut their businesses. Although many businesses saw a decline in consumer demand as a result of the COVID19 crisis, the tobacco market is likely to emerge undaunted and develop significantly.

According to the hookah tobacco market analysis, the market segmented into flavor, distribution channel, age group and region. On the basis of flavor, the market is categorized into fruits, mint, chocolate and others. On the basis of distribution channel, the market is segmented into, bars and cafes, specialty stores, online and others. By age group, market is categorized into, below 18 years, 18 to 30 years, 30 to 50 years and above 50 years. Region wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, Switzerland and Rest of Europe), Asia-Pacific (China, Japan, India, Australia and Rest of Asia-Pacific), and LAMEA (Brazil, Argentina, Saudi Arabia, South Africa and Rest of LAMEA).

By Flavor

Mint segment helds the major share of 32.7% in 2020

According to the hookah tobacco market forecast, based on flavor, the mint segment has gained a major share in the global market in 2020 and is expected to sustain its market share during the forecast period 2021-2030. Mint flavors are majorly preferred over other flavors as they provide a refreshing taste and a sense of cooling effect after consumption. Menthol, a substance present in mint interacts with receptors inside of the mouths to produce the sensation of cold. Due to the increasing global warming and deterioration of the weather, the coolness from the mint provides comfort to the consumers. Due to this reason, the demand for mint flavor hookah tobacco is rising.

According to the hookah tobacco market trends, on the basis of age group, the 18 to 30 years segment was the highest contributor to the market, with $400.0 million in 2020, and is estimated to reach $757.0 million by 2030, at a CAGR of 5.6% during the forecast period. People who are between the ages of 18 and 30 are included in this age group. They are commonly referred to as young adults. This is the age category in which smoking and drinking are permitted in practically every country. This age group's population is very active and on the point of trying new things. They are also of legal age to test different hookah flavors and try out new items. This age group's users may have a significant impact on the global market.

By Distribution Channel

Specialty Stores segment helds the major share of 33.7% in 2020

According to the hookah tobacco market analysis, based on distribution channel, the bars and cafes segment has gained a significant share in the global hookah tobacco market in 2020 and is expected to sustain its market share during the forecast period 2021-2030. bar and cafe, sometimes known as a saloon, tavern, pub, or club, is a retail business that provides alcoholic beverages such as beer, wine, liquor, cocktails and hookah. Growing disposable income, increased spending on entertainment and rise in consumer indulgence in leisure activities are majorly attributed for the hookah tobacco market growth through bar and café segment.

According to the hookah tobacco market opportunities. Region wise, Asia-Pacific was the highest revenue contributor, accounting for $306.7 million in 2020, and is estimated to reach $656.3 million by 2030, with a CAGR of 6.9%. There has been increase in the number of hookah users in Asia Pacific region owing to increased spending power, desire to experience the luxurious lifestyle and increased millennial population.

By Age Group

18 to 30 Years segment helds the major share of 48.5% in 2020

Furthermore, the launch of new hookah products including mint, menthol, and fruit flavors, increased this trend of hookah smoking. Thus, these above mentioned factors are predicted to influence the Asia Pacific hookah tobacco market. In addition, the introduction of innovative tobacco products into various flavor possibilities has been crucial as customers steadily migrate from traditional smoking to hookah smoking.

The players operating in the global hookah tobacco market have adopted various developmental strategies to expand their market share, increase profitability, and remain competitive in the market. The key players profiled in this report include Japan Tobacco, Inc., Alzawrae Industrial Company, Metco Ltd, Al Fakher Tobacco Trading LLC, Cloud Tobacco, Inc., Mujeebsons, Fumari, Inc., Haze Tobacco, LLC, Al Andalus Flavoured Tobacco & Molasses Co. LLC and Social Smoke, Inc.

By Region

Asia Pacific region helds the major share of 37.2% in 2020

Key Benefits For Stakeholders

- The report provides a quantitative analysis of the current trends, estimations, and dynamics of the market size from 2020-2030to identify the prevailing opportunities.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

- In-depth analysis and the market size and segmentation assist to determine the prevailing market opportunities.

- The major countries in each region are mapped according to their revenue contribution to the hookah tobacco market share.

- The market player positioning segment facilitates benchmarking and provides a clear understanding of the present position of the market players in the Hookah tobaccoindustry.

Key Market Segments

By Product Type

- Flavor

- Fruits

- Mint

- Chocolate

- Others

By Distribution Channel

- Bars and Cafes

- Specialty Stores

- Online

- Others

By Age Group

- Below 18 Years

- 18 to 30 Years

- 30 to 50 years

- Above 50 years

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Switzerland

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Argentina

- Saudi Arabia

- South Africa

- Rest of LAMEA

Hookah Tobacco Market Report Highlights

| Aspects | Details |

| By FLAVOR |

|

| By DISTRIBUTION CHANNEL |

|

| By AGE GROUP |

|

| By Region |

|

| Key Market Players | AL FAKHER TOBACCO TRADING LLC, .ALZAWRAE INDUSTRIAL COMPANY, .SOCIAL SMOKE, INC., JAPAN TOBACCO, INC., METCO LTD, .HAZE TOBACCO, LLC, AL ANDALUS FLAVOURED TOBACCO & MOLASSES CO. LLC (AL RAYAN), FUMARI, INC., CLOUD TOBACCO, INC., MUJEEBSONS |

Analyst Review

According to the insights of CXOs of leading companies, tobacco is extracted from its dried and fermented leaves, which are utilized in the preparation of tobacco products. Hookah tobacco comprises washed or unwashed tobacco leaves It is loaded into a water pipe apparatus with water, glycerin, sugar molasses, and flavored solution.

Increasing smoking rates and consistent demand for aromatic tobacco products are the primary factors driving the growth of the global hookah tobacco industry. Despite strict rules and constraints to reduce the use of tobacco in several nations, throughout the predicted period, hookah tobacco will increase because of the increase in prices. Hookah tobacco is a significant source of tax revenue for governments across the world. Attributed to tax regulatory environments, developing economies are now supporting market growth.

The market for hookah tobacco is concentrated, with a few major players representing a significant portion of the world market. In addition, regulatory restrictions discourage new participants on the hookah tobacco market for hookah in China and India. Jordan is one of the biggest tobacco producers and users in the world. The region is home to some of the biggest hookah tobacco businesses in the world, including Al Andalus Flavored Tobacco, Molasses Co, LLC, Metco Limited, and the Alzawrae Industrial Company. The region's biggest market in Asia-Pacific and the tobacco product is used by a significant share of its population.

The inclusion of tobacco taxes in regulations in countries, such as India, a ban on the consumption of tobacco products in public places, and a rise in the availability of hookah tobacco products in modern retail outlets in the region are factors that are actively affecting the growth of the hookah tobacco market.

The hookah tobacco market size was valued at $824.8 million in 2020 and is estimated to reach $1,696.4million by 2030

The global Hookah Tobacco market is projected to grow at a compound annual growth rate of 6.5% from 2021 to 2030 $1,696.4million by 2030

JAPAN TOBACCO, INC., .HAZE TOBACCO, LLC, .ALZAWRAE INDUSTRIAL COMPANY, AL ANDALUS FLAVOURED TOBACCO & MOLASSES CO. LLC (AL RAYAN), MUJEEBSONS, FUMARI, INC., .SOCIAL SMOKE, INC., METCO LTD, CLOUD TOBACCO, INC., AL FAKHER TOBACCO TRADING LLC

Asia Pacific region helds the major share

Increase in consumption of hookah, adoption of innovative product marketing and promotion techniques, and availability of wide range of products drive the growth of the global hookah tobacco market.

Loading Table Of Content...