HVAC Equipment Market Overview

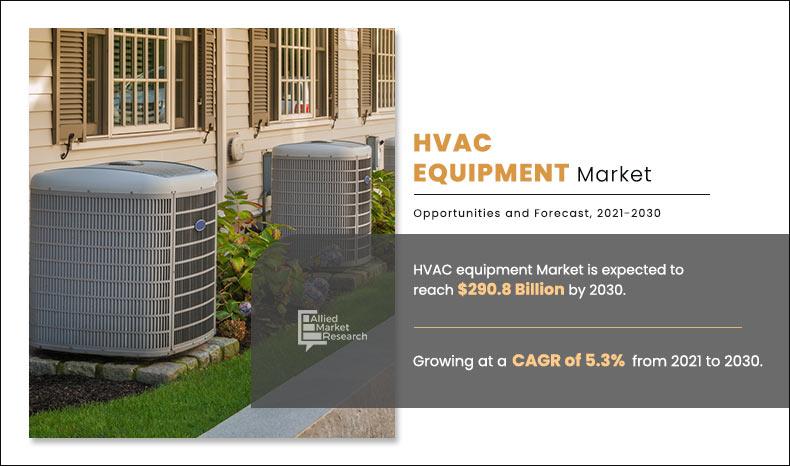

The global HVAC equipment market size was valued at $171.8 billion in 2020, and is projected to reach $290.8 billion by 2030, registering a CAGR of 5.3% from 2021 to 2030. This is fueled by rapid urbanization and rising demand for residential and commercial infrastructure. Growth is further supported by the construction industry's focus on creating safe and healthy work environments. Additionally, shifting weather patterns, technological advancements, and the need to replace outdated systems are key drivers of market expansion.

Market Dynamics & Insights

- The HVAC equipment industry in Asia-Pacific held a significant share of over 50.1% in 2020.

- The HVAC equipment industry in China is expected to grow significantly at a CAGR of 6.0% from 2021 to 2030

- By system type, central segment is one of the dominating segments in the market and accounted for the revenue share of over 57.3% in 2020.

- By end-user, commercial segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2020 Market Size: $171.8 Billion

- 2030 Projected Market Size: $290.8 Billion

- CAGR (2021-2030): 5.3%

- Asia-Pacific: Largest market in 2020

- LAMEA: Fastest growing market

What is Meant by HVAC Equipment

HVAC system stands for heating, ventilation and air-conditioning and this system provides heating and cooling to residential building, commercial and industrial buildings. The replenishing or exchanging of air inside a room is done by ventilation. this improves indoor air quality by removing moisture, smoke, heat, dust, bacteria, carbon dioxide, and other unwanted pollutants as well as controlling temperature and replenishing oxygen.

HVAC Equipment Market Overview

The HVAC equipment market is being propelled by changes in urbanization, industrialization, and migration are some of the key drivers driving HVAC equipment market expansion; as a result, the number of companies, manufacturing units, and residential complexes that utilize HVAC equipment has increased. Furthermore, climate change has resulted in an increase in demand for electrical cooling systems in the summer and natural gas, heating oil, wood, and electrical heating systems in the winter. Climate change has an impact on building energy consumption and air conditioning loads, which vary depending on the ambient temperature and humidity. The energy efficiency of HVAC systems is projected to improve as a result of new regulatory requirements. This has paved the way for smart HVAC control systems to be included in buildings' most modern heating and air conditioning units.

By System Type

DeCentralized segment is projected to grow at a significant CAGR

The novel coronavirus has rapidly spread across various countries and regions, causing enormous impact on lives of people and overall community. Originating as a crisis to human health, it now poses significant threat to worldwide trade, economy, and finance. Due to the continuous lockdown in key global countries, the COVID-19 pandemic has halted production of many items in the HVAC equipment business. The players in HVAC equipment market can afford a complete lockdown only for a limited period, after which they would have to alter their investment plans. Furthermore, number of COVID-19 cases are expected to reduce in the near term as vaccine for COVID-19 has been introduced in the market. This is further expected to lead to re-initiation of HVAC equipment companies at their full-scale capacities, which would aid the HVAC equipment market to recover by the start of 2022. After COVID-19 infection instances start to decline, equipment and machinery producers must focus on protecting their staff, operations, and supply networks in order to respond to urgent emergencies and establish new methods of working.

Various companies are expanding their product portfolio by launching HVAC equipment with advance technology to strengthen their presence in the HVAC equipment market. For instance, in June 2021, Johnson Controls, launched the Quantech QWC4 Water-Cooled System to the brand’s expanded chiller portfolio. When compared to standard systems, the QuantechTM QWC4 System employs variable speed drive technology to save up to 30% on energy expenditures and carbon emissions. By directly controlling refrigerant charges and potential leak sites, the QuantechTM QWC4 system also lowers environmental consequences. Hence, rising air pollution are forcing key players to come up with advance technology HVAC equipment and therefore, it will boost the HVAC equipment market during the forecast period.

By End User

Commercial segment holds dominant position in 2020

HVAC Equipment Market Segment Overview

The HVAC equipment market is segmented on the basis of system type, business type, end-user, and region. By system type, the market is divided into central, and decentralized. By business type, it is divided into new construction, and retrofits. By end user, it is divided into residential, commercial, and industrial. Region wise, the HVAC equipment market analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Germany, Italy, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea and Rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

Competition Analysis

Key companies profiled in the HVAC equipment market report include Daikin Industries, Ltd., Johnson Controls, Hitachi Air Conditioning Company, LG Electronics Inc., Raytheon Technologies Corporation (United Technologies), Emerson Electric Co., Honeywell International, Inc., Mitsubishi Electric Trane HVAC U.S. LLC, Nortek Global HVAC, and Danfoss AS.

By Region

Asia-Pacific holds a dominant position in 2020 and LAMEA is expected to grow at a significant rate during the forecast period.

What are the Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging HVAC equipment market trends and dynamics.

- In-depth emerging HVAC equipment market analysis is conducted by constructing market estimations for key market segments between 2021 and 2030.

- Extensive analysis of the emerging HVAC equipment market is conducted by following key product positioning and monitoring of top competitors within the HVAC equipment market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The global emerging HVAC equipment market forecast analysis from 2021 to 2030 is included in the report.

- The key players within emerging HVAC equipment market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the emerging HVAC equipment industry.

HVAC Equipment Market Report Highlights

| Aspects | Details |

| By SYSTEM TYPE |

|

| By BUSINESS TYPE |

|

| By END USER |

|

| By Region |

|

| Key Market Players | MITUBISHI ELECTRIC TRANE HVAC US LLC, NORTEK, INC., RAYTHEON TECHNOLOGIES CORPORATION, HONEYWELL INTERNATIONAL, INC., EMERSON ELECTRIC CO., JOHNSON CONTROLS INTERNATIONAL PLC, DAIKIN INDUSTRIES, LTD., DANFOSS AS, LG ELECTRONICS INC., HITACHI AIR CONDITIONING COMPANY |

Analyst Review

An HVAC system is utilized for heating or cooling industrial or commercial facility. It also improves indoor air quality and provides comfort for everyone inside a building. The HVAC equipment market has observed significant growth in the past few years, due to increase in demand for processed food and beverages and metal manufacturing. Individuals working in such sectors are exposed to the artificial environment of a confined industrial area on a daily basis. As a result, industrial HVAC equipment are required to maintain an interior industrial environment and to ensure employee safety. Hence, these factors anticipate growth in the HVAC equipment market during the forecast period.

Furthermore, a growing number of companies have begun to provide HVAC systems with improved energy efficiency and green technologies that are compatible with a variety of smart devices. For instance, Honeywell announced one of the first self-driving building sustainability solutions in February 2020, which assesses if a building's HVAC system is operating at optimal efficiency. Honeywell Forge Energy Optimization is a cloud-based machine learning system that analyses trends such as a building's energy usage on a regular basis and changes them to the most energy-efficient settings without sacrificing occupant comfort.

The HVAC Equipment market size was valued at $1,71,800.0 million in 2020.

Based on system type, the central segment holds the maximum market share of the HVAC Equipment market in 2020.

The HVAC Equipment market is projected to reach $2,90,750.2million by 2030.

Increasing demand for the residential and commercial infrastructure and rise in the population in various regions are the key trends in the HVAC Equipment market.

The product launch is key growth strategy of HVAC Equipment market players.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Increase in the raw material prices is the effecting factor for HVAC Equipment market.

The end user of HVAC Equipment include residential, commercial and industrial.

Loading Table Of Content...