HVAC Filters Market Overview

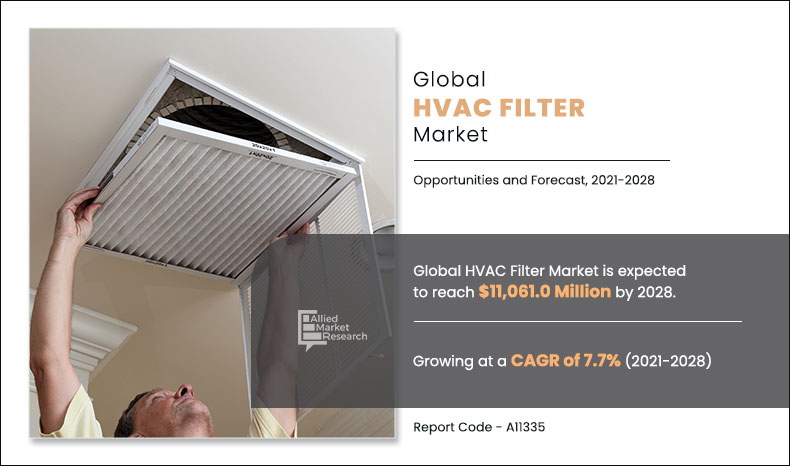

The HVAC Filters Market size is expected to reach $11,061.0 million in 2028, from $6,066.1 million in 2020, growing at a CAGR of 7.7% from 2021 to 2028. This is fueled by rising awareness of indoor air quality concerns. As people spend more time indoors, the focus on reducing air pollutants and allergens grows. Strict regulations in industrial, healthcare, and commercial sectors drive demand. Advancements in technologies like HEPA and electrostatic filters further enhance filtration efficiency and market growth.

Market Dynamics & Insights

- The HVAC filters industry in Asia-Pacific held a significant share of over 34.2% in 2020.

- The HVAC filters industry in France is expected to grow significantly at a CAGR of 7.0% from 2021 to 2028

- By material, fiberglass segment is one of the dominating segments in the market and accounted for the revenue share of over 44.8% in 2020.

- By application, residential segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2020 Market Size: $6.1 Billion

- 2030 Projected Market Size: $11.1 Billion

- CAGR (2021-2028): 7.7%

- North America: Largest market in 2020

- LAMEA: Fastest growing market

What is Meant by HVAC Filters

HVAC filters are important part of any heating, ventilation, and air conditioning system to filter the foreign particles through the air. These filters are utilized for maintaining indoor air quality (IAQ) by filtration of impurities such as pollen, dust, and chemical pollutants in enclosed spaces. Few HVAC filters are highly efficient in trapping around 99.97% particles up to size of 0.3 microns. In addition, HVAC filters also avoid entrance of pollutants in HVAC equipment, which reduces potential damage to equipment due to large foreign particles.

HVAC Filters Market Dynamics

HVAC filters are critical for the performance and air quality of HVAC device. They enhance indoor air high-quality trapping dust, allergens, and airborne debris, benefits individuals with breathing situations. These filters additionally stop risky contaminants like bacteria, viruses, and volatile compounds (VOCs), growing a more stable indoor surroundings. By preventing clogs, filters preserve right airflow, reducing the gadget's workload, decreasing electricity intakes. Effective filters stop dirt and dust buildup inside the tool, enhancing cleanliness and saves from expenses. Regular maintenance and filter replacement ensures efficient use of HVAC performance and toughness.

The HVAC filters market is driven by growing recognition of indoor air quality (IAQ) issues. With increased indoor time, there is a heightened emphasis on preserving healthier environments to combat air pollutants and allergens. Stringent rules mandate efficient filtration in industrial, healthcare, and commercial sectors, fostering market increase. Technological improvements, together with HEPA and electrostatic filters, upgrade filtration efficiency, propelling the HVAC filters market. In addition, the giant adoption of HVAC systems in residential and commercial projects globally amplifies the demand for HVAC filters.

For instance,in March 2024, American Air Filter Co., Inc. d/b/a AAF International, a global leader of air filtration solutions acquired Northeast Air Solutions, Inc., one of the leaders in providing clean air solutions to New England. The acquisition was expected to yield important benefits for its customers and vendors in air filter solution. These factors collectively fuel market expansion, aiming to deliver cleaner, safer, and more comfortable indoor spaces.

Moreover, rise in concerns regarding degradation of air quality, especially in urban areas drives sales of HVAC filtration systems. Increase in pollution levels, owing to elements such as vehicular traffic and industries has affected the overall air quality, which is affecting health of people on a large scale. High pollution levels generally cause short term effects such as nausea and dizziness, however, long term exposure to pollutants can cause fatal effects on respiratory, nervous, and reproductive systems.

Thus, maintenance of indoor air quality (IAQ) plays a vital role in preserving health and safety of occupants in residential areas and workspaces, where people spend majority of their time. This is expected to drive growth of the HVAC filters market. Furthermore, stringent government policies for maintaining indoor air quality (IAQ) in industrial spaces is expected to drive demand for HVAC filters. For instance, the U.S. Center for Disease Control and Prevention (CDC) recommended use of portable industrial grade HEPA filter units to propel removal of pollutant particles in construction zones, manufacturing & engineering facilities, rooms with inefficient ventilations, and patient care rooms. This is expected to drive the HVAC filters market growth.

However, HVAC filters require constant cleaning and replacement in spaces with high pollution levels. Highly productive HEPA filters often utilize pleated and thick media for efficient filtration, which gets blocked and prevents free flow of air through HVAC system and reduces productivity of these systems. This is expected to restrain growth of the HVAC filters market.

Furthermore, the HVAC filters industry experienced a significant decline during the outbreak of COVID-19 pandemic in 2020. Major players in the industry faced severe reduction in revenues during the first quarter of 2020. For instance, leading company in the HVAC filters market, Carrier Global Corporation, based in the U.S., witnessed 22% decline in growth in the first quarter of 2020 as compared 2019.

By Material

Self Erecting segment is projected to grow at a significant CAGR

HVAC Filters Market Segmental Overview

The HVAC filters market is segmented on the basis of material, technology, end user industry, and region.

By material, it is classified into fiberglass, synthetic polymer, carbon, and metal. By technology, it is categorized into electrostatic precipitator, activated carbon, UV filtration, HEPA filtration, and ionic filtration. By application, it is divided into residential, commercial, and industrial. By region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Italy, and rest of Europe), Asia-Pacific (China, India, Japan, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). Asia-Pacific is expected to hold the largest HVAC filters market share throughout the study period and LAMEA is expected to grow at the fastest rate. On the contrary, rise in awareness regarding various diseases caused by polluted air and presence of bacteria and pollen is expected to create opportunities for growth of the HVAC filters market in the future.

By Technology

HEPA segment holds dominant position in 2020

Competition Analysis

The key of HVAC filters market players profiled in the report include 3M Company, Parker-Hannifin Corporation, Camfil AB, Mann+Hummel, American Air Filter Company, Inc., Donaldson Company, Inc., Ahlstrom-Munksjö, Filtration Group Corporation, Freudenberg Group, and Sogefi Group.

By Application

Building Construction segment holds dominant position in 2020

Many competitors in the HVAC filters market adopted product launch as their key developmental strategy to expand their production capacities and upgrade their product technologies. For instance, in February 2020, Camfil Group based in Sweden launched two major filtration products, namely, Absolute V and Megalam EnerGuard HEPA filters for cleanroom applications. Megalam EnerGuard filter includes unique filtration media, which reduces chances of filter leaks and resultant room contamination for operations in cleanrooms. Such leakages often cause product failure due to mishandling, which are avoided in Megalam EnerGuard filters.

By Region

Asia-Pacific holds a dominant position in 2020 and LAMEA is expected to grow at a highest rate during the forecast period.

What are the Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging global HVAC filters market trends and dynamics.

- In-depth analysis of the HVAC filters market is conducted by constructing market estimations for the key market segments between 2020 and 2028.

- Extensive HVAC filters market analysis is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive HVAC filters market opportunity analysis of all the countries is also provided in the report.

- The global HVAC filters market forecast analysis from 2021 to 2028 is included in the report.

- The key players within the HVAC filters market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the industry.

HVAC Filters Market Report Highlights

| Aspects | Details |

| By MATERIAL |

|

| By TECHNOLOGY |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | Camfil AB, American Air Filter Company, Inc.\, 3M Company, Ahlstrom-Munksjö, Parker-Hannifin Corporation, Donaldson Company, Inc., Freudenberg Group, Filtration Group Corporation, Mann+Hummel, Sogefi Group |

Analyst Review

The degrading air quality in urban areas is expected to boost demand for heating, ventilation, and air conditioning (HVAC) systems, which, in turn, would drive growth of the HVAC filters market. Rise in pollution caused by vehicular traffic and development of industries, especially in countries such as China and India is affecting health of people. This has created awareness for maintenance of air quality in indoor spaces. This is expected to influence growth of the HVAC filters market.

With the spread of coronavirus, people are now realizing importance of indoor air quality (IAQ) in houses and other closed spaces, owing to government-imposed lockdowns. Concerns related to COVID-19 virus and similar bacteria and viruses that spread through air are highlighting the role of HVAC systems in residential as well as commercial spaces. Particular set of guidelines and regulations toward HVAC products and general ventilation rules in the post-pandemic world can curb the risk of spread of the virus through air conditioning systems and air ducts. In addition, organizations such as the American Society of Heating, Refrigerating and Air-Conditioning Engineers (ASHRAE) have developed strategies and resources including differential room pressurization, dilution variation, source capture variation, and ultraviolet germicidal irradiation (UVGI) to assist in maximizing the role of HVAC filtration systems in creating a positive impact on the coronavirus spread.

Demand for operation and maintenance of pre-installed systems is expected to rise significantly post-COVID. Most commercial establishments have remained closed since implication of lockdowns. These spaces require maintenance and upgradation of HVAC systems complying to new health and safety regulations. Growth of mold and fungus in closed air conditioning systems are expected to pose health hazards for employees. Thus, the service industry is anticipated to surge back in the future. Further, developments in HVAC filter technologies such as disinfection of filters and use of UV light in filter system can promote growth of the HVAC market even after the pandemic ends. Such technologies can provide preparedness among healthcare facilities and people to overcome viral outbreaks such as COVID-19 in the future. Installation of new filtration in commercial spaces in the preinstalled HVAC systems can also offer long term benefits from bacterial and viral infections, which also promotes safety for employees during the COVID-19 crisis.

The global HVAC filters market size was $6,066.0 million in 2020 and is projected to reach $11,060.9 million in 2028, growing at a CAGR of 7.7% from 2021 to 2028.

The forecast period considered for the global HVAC filters market is 2021 to 2028, wherein, 2020 is the base year, 2021 is the estimated year, and 2028 is the forecast year.

The base year considered in the global HVAC filters market is 2020.

No, the report does not provide Value Chain Analysis for the global HVAC filters market. However, it provides market share analysis for the top players in the HVAC filters market.

On the basis of material, the synthetic fiber segment is expected to be the most influencing segment growing in the global HVAC filters market report.

Based on the application, in 2020, the commercial segment generated the highest revenue, accounting for 66% of the market and is projected to grow at a CAGR of 7.2% from 2020 to 2027.

The report contains an exclusive company profile section, where leading 10 companies in the market are profiled. These profiles typically covers company overview, geographical presence, and market dominance (in terms of revenue and volume sales).

The market value of global HVAC filters market is $6,599.9 million in 2021.COVID Banner Statement: The COVID-19 pandemic is expected to drive the demand for HVAC filters in the near future owing to the increasing awareness for maintenance of indoor air quality (IAQ).

Loading Table Of Content...