India Olive Oil Market Overview:

The India olive oil market size was valued at $58.6 million in 2017, and is projected to reach $127.5 million by 2025, growing at a CAGR of 9.9% from 2018 to 2025.

Olive oil is a viscous liquid that is extracted from the fruit of the olive tree by pressing whole olives. Olive oil has a low smoke point of 240C and hence can be consumed raw. Olive oil consumption is often considered healthy as it is associated with a lower risk of heart disease and certain cancers including colorectal and breast cancer. Olive oil is also a good source of monounsaturated fatty acid and antioxidants such as polyphenols, vitamins E & K, chlorophyll, and carotenoids. The olive oil industry in India has witnessed considerable growth in the recent years due to rise in health-conscious consumers. The olive oil market has become more competitive and price sensitive due to the high potential and steady growth of the olive oil market.

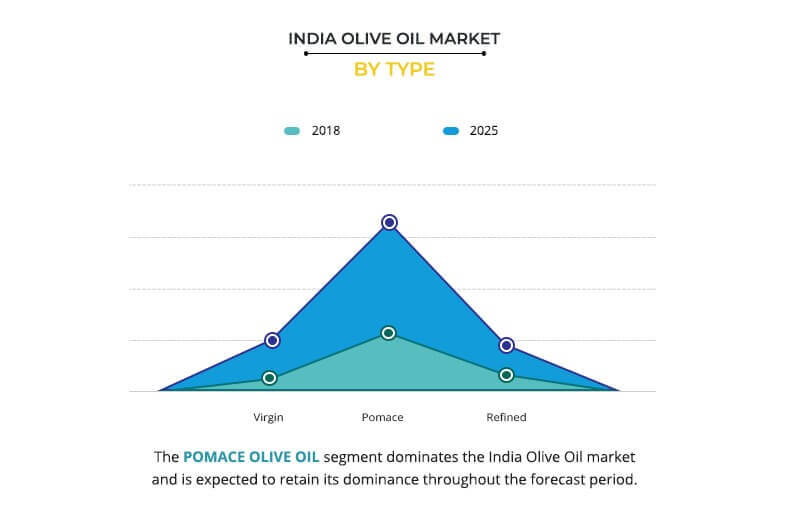

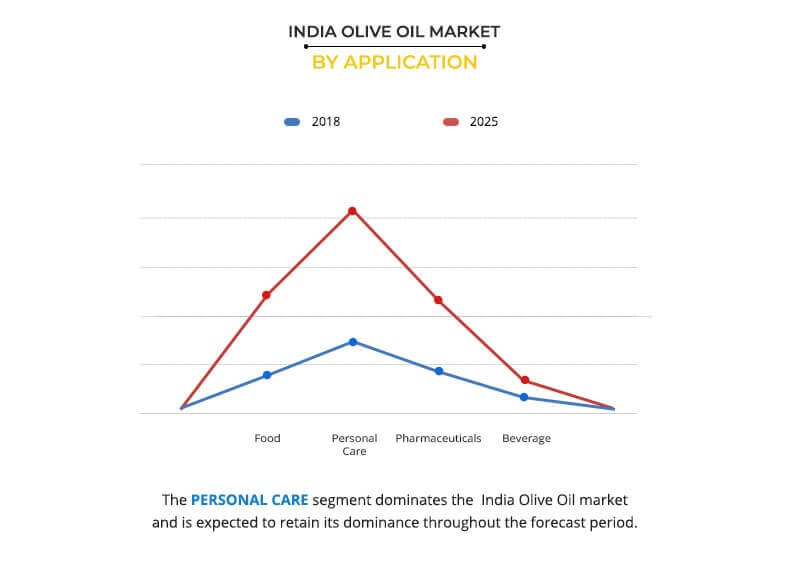

The report on the India olive oil market is segmented based on type which includes virgin, pomace, and refined olive oil. On the basis of application, the market is segmented into food, beverage, personal care, and pharmaceuticals segments. The personal care segment is expected to have the largest share in the application segment. The factors such as increasing demand from end-user industries such as food, personal care, pharmaceuticals, etc. and rising awareness about health benefits is expected to drive the India olive oil market growth.

In 2017, the pomace olive oil accounted for the highest share in terms of value in the India olive oil market and is projected to grow at a steady growth rate during the forecasted period. This is attributed to the pomace olive oil being a more conveniently priced and readily available olive oil variant. Though the pomace olive oil is processed, it is still considered a better alternative to other oils in the market and hence is in high demand as compared to the other varieties of olive oils.

In 2017, the personal care segment was the highest contributor to the India olive oil market due to growing awareness about the various health benefits offered by the oil and increasing usage in the manufacturing of products in the beauty care and cosmetics industry. Moreover, improved purchasing power and rising aspiration among the lower- and middle-class society in the nation and industry players coming out with products and pricing to suit consumes across different levels of purchasing power drive the growth of the olive oil for personal care. According to The Associated Chambers of Commerce and Industry of India (ASSOCHAM), the market size of India's beauty, cosmetic, and grooming product was $6.5 billion in 2016 and is expected to reach $20 billion by 2025. This rise in consumption of cosmetic and beauty products is expected to provide lucrative opportunities for the growth of the India market in the future.

The leading players in the olive oil market have focused on product launch, partnership, and business expansion as their key strategies to gain a significant share in the market. The key players profiled in the report include Colavita S.p.A, FieldFresh Foods Pvt Ltd., Deoleo, S.A., Modi Naturals Limited, Cargill Inc., R R Oomerbhoy Pvt Ltd., Ybarra, Rafael Salgado, Borges International Group, S.L., and Hashmitha Enterprise.

Key Benefits for India Olive Oil Market:

The report presents an in-depth analysis of the current trends, drivers, and dynamics of the India olive oil market to elucidate the prevailing opportunities and tap the investment pockets.

It offers qualitative trends and quantitative analysis of the global market for the period of 20182025 to assist stakeholders to understand the market scenario.

In-depth analysis of the key segments demonstrates the types of olive oil available.

Competitive intelligence of the industry highlights the business practices followed by key players across geographies and the prevailing market opportunities.

Key players and their strategies and developments are profiled to understand the competitive outlook of the market.

India Olive Oil Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| Key Market Players | BORGES INTERNATIONAL GROUP, S.L., RAFAEL SALGADO, DEOLEO, S.A., COLAVITA S.P.A., FIELDFRESH FOODS PVT. LTD., R OOMERBHOY PVT LTD,, MODI NATURALS LIMITED, HASHMITHA ENTERPRISE, CARGILL INC., YBARRA |

Analyst Review

The consistent demand for olive oil from end-use industries is expected to propel the India olive oil market throughout the forecast period.

In India, olive oil is majorly imported from countries such as Spain, Italy, and Turkey. Almost 90% of the total olive oil consumed is imported from these countries. Olive oil is majorly used in the food and beverages industry, the beauty care and cosmetics industry, and the pharmaceutical industry. The steady growth of these industries is likely to boost the demand for olive oil. Olive oil has the highest content of monounsaturated fats and contains antioxidants such as vitamins A, D, E, K, and Beta-carotene that helps in reducing bad cholesterol and prevents heart diseases. Owing to these health benefits it is becoming one of the preferred cooking medium for Indian cuisines. The Indian market for olive oil is experiencing considerable growth due to the rise in consumer awareness regarding the benefits of consuming olive oil and strong economic growth. In addition, the Western lifestyle is being increasingly adopted by the Indian consumer. This is credited to be one of the biggest factors driving the India olive oil market. Other than this, initiatives taken by government to promote domestic olive oil production and introduction of effective farming techniques are expected to provide lucrative opportunities for the growth of the India olive oil market. For instance, Rajasthan Olive Cultivation Ltd (ROCL) was incorporated in 2007 by the Government of Rajasthan to promote olive cultivation under public-private partnership in the state.

The India olive oil market size was valued at $58.6 million in 2017, and is projected to reach $127.5 million by 2025

The global Southeast Asia Food Processing Equipment market is projected to grow at a compound annual growth rate of 9.9% from 2018 to 2025 $127.5 million by 2025

YBARRA, HASHMITHA ENTERPRISE, COLAVITA S.P.A., FIELDFRESH FOODS PVT. LTD., BORGES INTERNATIONAL GROUP, S.L., DEOLEO, S.A., MODI NATURALS LIMITED, RAFAEL SALGADO, CARGILL INC., R OOMERBHOY PVT LTD,

Health benefits associated with olive oil consumption coupled with its profound demand from end use industries drives the growth of the market.

Loading Table Of Content...