Indonesia OTT Market Overview

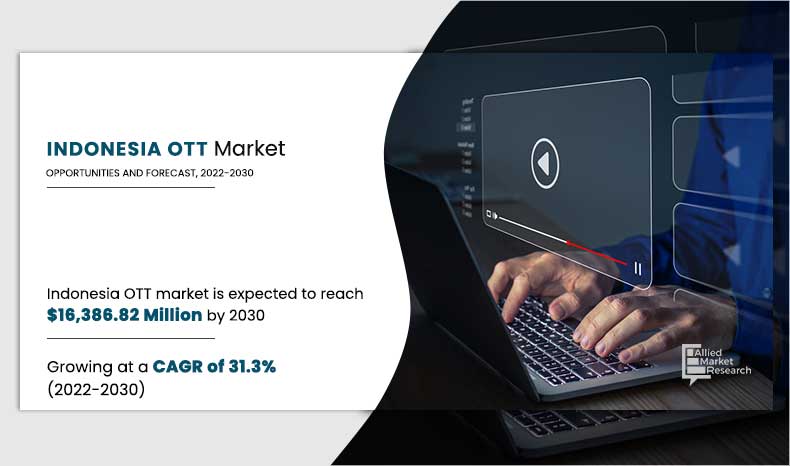

The Indonesia over-the-top market size was valued at USD 870.35 million in 2020, and is projected to reach USD 16,386.82 million by 2030, registering a CAGR of 31.3% from 2022 to 2031. Rise in popularity of direct carrier billing in over-the-top market, rise in subscription of over-the-top video (SVoD) in Indonesia, and surge in adoption of smartphones & their compatibility with OTT applications are the key factors that impact growth of the market.

Key Market Insights

- By component, the services segment is expected to witness highest growth during the forecast period.

- By user type, the personal segment is expected to witness highest growth rate in the forecasted period.

Market Size & Forecast

- 2030 Projected Market Size: USD 16,386.82 Million

- 2020 Market Size: USD 870.35 Million

- Compound Annual Growth Rate (CAGR) (2022-2031): 31.3%

What is Over-the-top (OTT)

OTT stands for over the top, initially named in reference to devices that go “over” a cable box to give users access to TV content. On OTT platforms, content is delivered via an internet connection rather than through a traditional cable/broadcast provider. OTT content such as movies and TV services are delivered directly over the internet to connected devices such as PC, tablet, smartphone, and gaming console and do not require cable or satellite television subscription. OTT content can be directly downloaded and viewed on user’s demand. Presently, over-the-top services are at a relatively nascent stage, and are trending across the Indonesia OTT Industry.

OTT Market Segment Review

On the basis of device type, it is classified into smart devices, laptops, desktops & tablets, gaming consoles, set-top box, and others. The content type segment includes video, audio/VoIP, games, communication, and others. By revenue model, the Indonesia over the top market is categorized into subscription, advertisement, transactional, and hybrid. The industry vertical segment is segregated into media & entertainment, education & training, health & fitness, sports & live events, IT & telecom, E-commerce, BFSI, government, and others.

By Device Type

Smartphone segment is projected as one of the most lucrative segments.

On the basis of component, the solution segment dominated the Indonesia over the top market in 2020, and is expected to continue this trend during the forecast period. This is attributed to rise in demand for innovative over-the-top solutions for media sharing by consumers. Over-the-top streaming service providers allow users to directly transmit media anywhere at any time which will boost the Indonesia OTT market growth. However, the services segment is expected to witness highest growth as there has been an increase in adoption of services among end users, as they ensure effective functioning of software and platforms throughout the process. Moreover, increase in adoption of OTT software and platforms is expected to boost demand for these services and also impact on the Indonesia OTT market size.

By Component

Service segment is projected as one of the most lucrative segments.

Based on Indonesia OTT market trends Depending on device type, the smartphones segment dominated the Indonesia over the top market share in 2020, and is expected to continue this trend during the forecast period. The growth of the segment is attributed to increase in use of smartphones to stream OTT services. There is a potential market for larger screen smartphones in Indonesia. In addition, advent of affordable android-based smartphones has democratized online gaming and brought gameplay to millions of smartphone users across the country.

The report focuses on the growth prospects, restraints, and opportunities. Indonesia OTT market forecast. The study uses Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, the threat of substitutes, and bargaining power of buyers on the Southeast Asia 5G private network market.

By Country

Media and Entertainment is projected as one of the most lucrative Country.

What are the Top Impacting Factors in OTT Market

Economical charges of OTT services, high internet speed, shift in focus toward generation of local content, and integration of numerous technologies, such as machine learning and artificial intelligence in OTT services, positively influence the market growth. Furthermore, challenges in consumer engagement and rise in piracy of digital streaming ecosystem are expected to affect growth of the Indonesia OTT market during the forecast period. However, each of this factor has a definite impact on the Indonesia over-the-top market.

Increase in Popularity of Direct Carrier Billing in Over-the-Top Market

Direct carrier billing (DCB) is an online mobile payment method that allows users to make purchases directly charged to their mobile phone bill or prepaid SIM card. DCB works across all mobile devices and it is accessible to any user having a subscription or prepaid plan with a telecom operator. Direct carrier billing is secure.

Consumers do not need to provide any sensitive personal data such as credit card or banking information. Direct carrier billing allows users to pay OTT subscription fees as part of their monthly data bills or telephone bills as many OTT subscribers with low or average disposable income cannot make payment through credit cards. OTT providers are leveraging telecom billing systems to reach new customers, which would otherwise make it unable to sign up due to payment difficulties.

These type of partnerships between OTT service providers and telecom operators are witnessing increased popularity in the Indonesia market. Moreover, direct carrier billing allows customers to pay for streaming subscriptions through their mobile services, which propels growth of the Indonesia over the top market.

In addition, certain subscription promotions apply specifically to mobile broadband plans, owing to which OTT platforms are adopting different partnership strategies to best approach these mobile-first markets. For instance, in October 2019, a mobile technology company, Fortumo and Vidio, which is Indonesia’s biggest streaming platform, launched a direct carrier billing partnership. Under this partnership, more than 140 million subscribers of XL Axiata, Indosat Ooredoo, and Smartfren can subscribe to Vidio Premier and charge payments for the service to their mobile operator invoice.

Furthermore, competition between OTT companies across the country is on the rise and the need for OTT companies to differentiate themselves through these partnerships is growing, owing to presence of a number of OTT providers in Indonesia, which increases popularity of direct carrier billing. For instance, in June 2021 smartphone penetration increased leading to rise in demand for over-the-top (OTT) content.

Which are the Key Companies in Indonesia OTT

Amazon Prime Video

CatchPlay

Iflix

Mola TV

PT. Media Nusantara Citra Tbk. (MNC Media)

Netflix Indonesia

PT Telekomunikasi Selular (Telkomsel)

PT. Telekomunikasi Indonesia

Tbk (Telkom Indonesia)

Vidio.com

Viu.

What are the Key Benefits for Stakeholders

The study provides an in-depth analysis of the Indonesia OTT market share along with the current trends and future estimations to elucidate the imminent investment pockets.

Information about key drivers, restraints, and opportunities and their impact analysis on the Indonesia OTT market size is provided.

Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the Indonesia OTT market.

The quantitative analysis of the share from 2020 to 2031 is provided to determine the market potential.

Indonesia OTT Market Report Highlights

| Aspects | Details |

| By component |

|

| By Device Type |

|

| By Content Type |

|

| Key Market Players | PT. Media Nusantara Citra Tbk. (MNC Media), CatchPlay, Vidio.com,, PT. Telekomunikasi Indonesia, Tbk, PT Telekomunikasi Selular (Telkomsel),, Viu, Mola TV, Netflix Indonesia, Iflix, Key Market Players, Amazon Prime Video |

Analyst Review

According to top CXOs of leading companies, rise in adoption of smartphones and internet has drastically changed the way content is delivered in Indonesia. Growth of ad-supported OTT media presents a tremendous opportunity for advertisers as even premium broadcasters are forced to bring their programming to smaller screen to protect revenue.

This is creating new ad placements that combine attention-grabbing quality of television content with highly targeted impressions of digital channels. In addition, it is important to consider the buying methods that are supported by a particular partner. In the realm of OTT, direct buys from publishers or platforms still account for the major share of inventory sold. Moreover, video and audio content are currently being streamed on smartphones and tablets, owing to ease of accessibility. In Indonesia, adoption of 4G network has increased with less challenges.

Telecommunication operators of the country have deployed 4G networks in major cities, which further fuels demand for OTT services and augments growth of the market. Availability of strong 4G network, along with emerging 5G technology and high speed and low latency network is anticipated to enable superior video experience with availability of large content libraries to users, which is projected to fuel adoption of over-the-top services in Indonesia. The over-the-top service market in Indonesia is fragmented and competitive, owing to presence of well-diversified international and regional vendors. However, continuous increase in presence of international vendors in the country makes the market highly competitive. However, current laws of Indonesia do not allow foreign OTT service providers to operate in Indonesia independently.

They can only be resent in the market through collaboration or partnership with Indonesian companies. Conversely, as per CXOs, licensing policy is expected to change in Indonesia in the upcoming years, and the market is expected to witness increased presence of foreign OTT service providers.

Furthermore, payment system of the country is not well-developed and banking population of the country is still low. Thus, popular payment models used are cash-on-delivery (COD) or ATM bank transfer for goods and through voucher & carrier billing for digital goods. Thus, OTT platform serves as a popular approach, which is used by several OTT service providers.

Currently, key players in the Indonesia OTT market focus on user-generated content (UGC) model with advertising support such as YouTube, vidio.com, or movie sites such as nonton.com. Though the market is currently dominated by advertisement-based revenue models, subscription-based revenue models are expected to witness increase in adoption in the upcoming years.

The Indonesia over the top market size was valued at USD 870.35 million in 2020, and is projected to reach USD 16,386.82 million by 2030

The global Indonesia OTT market is projected to grow at a compound annual growth rate of 31.3% from 2021-2030 to reach USD 16,386.82 million by 2030

Key players operating in this market such as Amazon Prime Video, PT Telekomunikasi Selular (Telkomsel),, Mola TV, Netflix Indonesia, CatchPlay, Vidio.com,, Viu, Iflix, PT. Media Nusantara Citra Tbk. (MNC Media), Key Market Players, PT. Telekomunikasi Indonesia, Tbk

Rise in popularity of direct carrier billing in over-the-top market, rise in subscription of over-the-top video (SVoD) in Indonesia, and surge in adoption of smartphones & their compatibility with OTT applications are the key factors that impact growth of the market.

Loading Table Of Content...