Industrial Internet of Things Market Outlook - 2023

The IIoT market size was valued at $115 billion in 2016 and is projected to reach $197 billion by 2023, growing at a CAGR of 7.5% from 2017 to 2023.

Advancements in technologies have helped key players to offer enhanced Industrial Internet of Things offerings to their end users. Integration of smart sensors into industrial machines encouraged the manufacturers to reduce the operational cost by 50% and is expected to decrease further during the forecast period.

An increase in technological investments in developing regions coupled with the emergence of big data analytics has widely driven the global industrial Internet of Things market growth of the Industrial Internet of Things. Further, the rise in demand from the healthcare industry and the initiation of industry-specific platforms in the developed region is expected to fuel the growth of the IIoT market.

The industrial Internet of Things market size witnesses a continuous rise in the adoption of the Internet of Things (IoT) due to the presence of factors such as high penetration of Wi-Fi connectivity, technological enhancements in wireless network technologies, and a rise in the adoption of cloud platforms. Furthermore, growth in the development of smart transportation and smart cities leads to increased adoption of IoT. This in turn propels the growth of the Industrial Internet of Things industry.

Various communication technologies are well known among people due to smartphones tablets, TVs, and other electronic appliances because these are highly adopted by people daily. Such technologies are WIFI, Bluetooth, ZigBee, 2G/3G/4G, and cellular technology. But few new technologies have emerged and integrated with the Industrial Internet of Things like Thread for home automation appliances, and Whitespace TV technologies for wider areas in major cities. For instance, in smartphones, IoT chips work like it allows phones to connect with all other devices and sensors through any technology. It is an internetworking of physical and virtual objects that relate to each other with the help of cloud technology. IoT technology demands in various areas such as electronics, automotive, thermostats, vending machines, speakers systems, and security systems because it follows real-time monitoring process and made easy to access information and communication.

The market for IIoT chips is expected to grow in subsequent years from 2019-2026 due to high growth, and demand in the healthcare and automotive industry. Expansion of investments have been made by the IoT industry to develop new IoT-based products because IoT is used in numerous devices and applications of various industries such as Wearable devices, healthcare, consumer electronics, and others as these enable devices to improve efficiency, safety and helps in decision- making which increases productivity. Hence these factors contribute positively to the industrial internet of things market across the globe. Moreover, a new domain in the transportation and automotive sector driving the IIoT market i.e. Intelligent Transportation System (ITS) integrated with the advancement of IOT technology. Retail a leading industry vertical in IoT usage can also drive IIoT market growth.

Some of the significant players that operate in the industrial Internet of Things market and are profiled in the report include Cisco Systems, Inc., General Electric, Intel Corporation, Rockwell Automation, Inc., ABB, Texas Instruments Inc., Dassault Systèmes, Honeywell International Inc., Huawei Technology Co., Ltd., and International Business Machines Corporation (IBM).

The industrial Internet of Things market is segmented based on component, application, and region. The components covered in this report include hardware, software, services, and connectivity. The applications discussed in this study are manufacturing, energy & power, oil & gas, healthcare, transportation & logistics, and others.

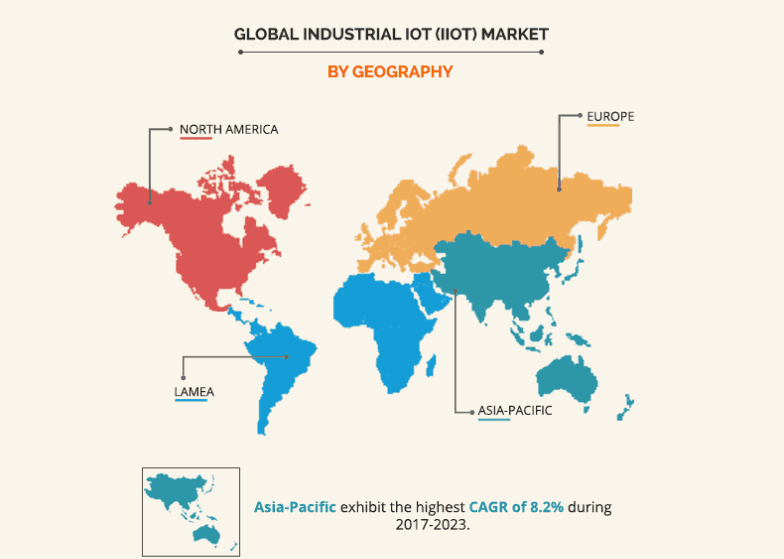

Furthermore, the IIoT market share is analyzed across North America, Europe, Asia–Pacific, and LAMEA.

Top Impacting Factors

Low operational cost

Smart and connected products are critical components in the connected supply chain and smart manufacturing processes. Further, the advent of low-cost connected devices has enabled manufacturers to adopt IoT technologies to lower resource consumption and increase overall productivity. Moreover, due to low operational costs, several manufacturers prefer to implement IoT applications in machines to maximize efficiency with reduced cost.

Growth in the adoption of a cloud-based deployment model

Demand for low-cost data storage, backup, and data protection are major opportunities for small & medium enterprises (SMEs). Implementation of the cloud helps enterprises to provide better IoT services to various industry verticals.

Growth in the adoption of the Industrial Internet of Things

Advancements in technologies have helped key players to offer enhanced IIoT offerings to their end users. Integration of smart sensors into industrial machines has encouraged manufacturers to reduce operational cost by 50%, and this is expected to decrease further during the forecast period. Further, virtual and augmented reality offers end users a 360-degree of an object before manufacturing it in real.

Increase in technological advancements

Advancements in technologies have helped key players to offer enhanced IIoT offerings to their end users. Integration of smart sensors into industrial machines has encouraged manufacturers to reduce operational cost by 50%, and this is expected to decrease further during the forecast period. Further, virtual and augmented reality offers end users a 360-degree of an object before manufacturing it in real.

Inadequate IT infrastructure

Poor internet architecture and lack of skilled laborers majorly limit the growth of the IoT in the manufacturing market. Many of the developing countries lack basic IT infrastructure, which is a prerequisite for reliable connectivity. Further, power supply systems have to be stable and reliable to ensure high-quality exchange of data between sensors and control systems. Therefore, poor internet connectivity in countries such as Africa, Malaysia, Chile, and Brazil is expected to hinder the industrial Internet of Things market growth in the coming years.

Surge in predictive maintenance

Predictive maintenance techniques are designed to determine the condition of in-service equipment to predict when maintenance is required. The application of predictive maintenance is based on the actual condition of the equipment rather than time or age factors. The rise in the adoption of predictive maintenance has encouraged key players to install such techniques into their existing machines.

Key Benefits For Stakeholders

- The overall market potential is determined by understanding the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current industrial Internet of Things market size is quantitatively analyzed from 2017 to 2023 to highlight the financial competency of the market.

- Porter’s Five Forces analysis illustrates the potency of the buyers and suppliers in the IIoT industry.

Industrial Internet of Things (IIoT) Market Report Highlights

| Aspects | Details |

| By Component Type |

|

| By Application |

|

| By Geography |

|

| Key Market Players | INTEL CORPORATION, HONEYWELL INTERNATIONAL, INC., ABB GROUP, TEXAS INSTRUMENTS, INC., CISCO SYSTEMS, INC., ROCKWELL AUTOMATION, INC., HUAWEI TECHNOLOGY CO., LTD.,, DASSAULT SYSTEMES, GENERAL ELECTRIC, IBM CORPORATION |

Analyst Review

The IIoT market holds high potential for the semiconductor industry. The current business scenario is witnessing an increase in the demand for IIoT, particularly in the developing regions. Companies in this industry adopt various innovative techniques to provide customers with advanced and innovative offerings.

Among the analyzed geographical regions, North America is expected to account for the highest revenue in the global market throughout the forecast period (2017-2023) due to innovation in advanced manufacturing technologies such as predictive maintenance, asset performance management, and real time asset monitoring. However, Asia-Pacific is expected to grow at a higher growth rate, due to lucrative opportunities offered by countries such as China, India, Singapore, South Korea, and Japan. Further, government initiatives such as Make in India and Smart Cities Mission enable manufacturers to adopt IoT technologies to improve shop floor operational efficiency, improve quality, and reduce asset downtime in Asia-Pacific.

Some of the significant players that operate in the market and are profiled in the report include Cisco Systems, Inc., General Electric, Intel Corporation, Rockwell Automation, Inc., ABB, Texas Instruments Inc., Dassault Systèmes, Honeywell International Inc., Huawei Technology Co., Ltd., and International Business Machines Corporation (IBM).

Loading Table Of Content...