Instant Coffee Market Summary

The global instant coffee market size was valued at $32.9 billion in 2022, and is projected to reach $60.7 billion by 2032, growing at a CAGR of 6.4% from 2023 to 2032.

Key Market Trends and Insights

Region wise, North America generated the highest revenue in 2022.

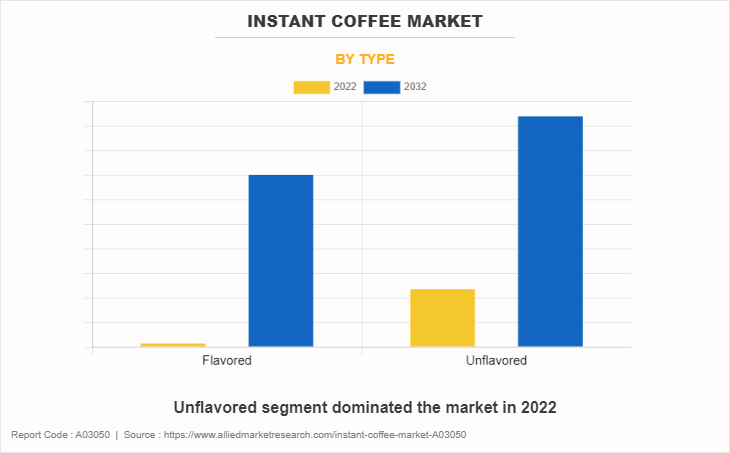

The global instant coffee market share was dominated by the unflavored segment in 2022 and is expected to maintain its dominance in the upcoming years

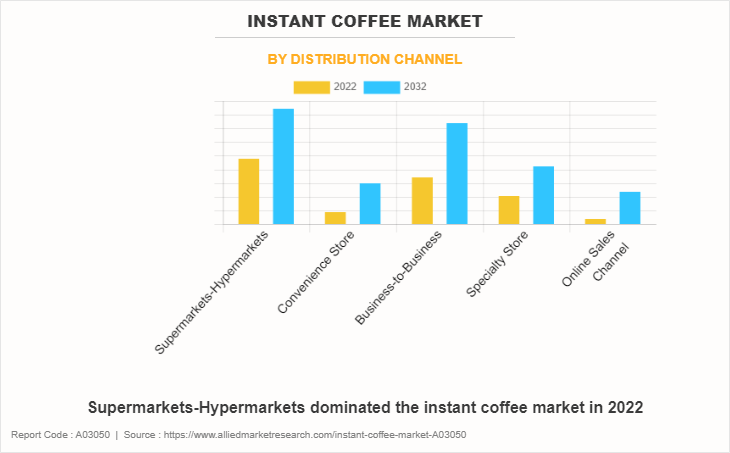

The supermarkets-hypermarkets segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2022 Market Size: USD 32.9 Billion

- 2032 Projected Market Size: USD 60.7 Billion

- Compound Annual Growth Rate (CAGR) (2023-2032): 6.4%

- North America: Generated the highest revenue in 2022

Instant coffee, also known as soluble coffee, is a dehydrated coffee extract derived through brewing regular coffee at an increased concentration. It is produced by spray drying or freeze-drying regular coffee to create a fine coffee powder or granules. Post-brewing, the removal of water content results in a convenient dry form that can be easily rehydrated prior to consumption. The name itself appropriately signifies its swift preparation, making it a time-efficient beverage option. In terms of cost, instant coffee proves to be more economical than ground coffee, although it generally contains lower caffeine levels. Most brands in the market utilize Robusta coffee beans, imparting a strong and bold flavor to the instant coffee product.

Market Dynamics

The instant coffee market experiences substantial growth, primarily fueled by the convenience offered through single-serve packaging. Single-serve instant coffee is a convenient option for individuals with busy schedules and time limitations. The compact and portable nature of individual-sized packaging makes it perfect for on-the-go consumption, which leads to a high demand for single-serving instant coffee packages. Customers can effortlessly carry and use the product without requiring any additional requirements and equipment, thus making it popular among consumers. This, in turn, has helped to drive the instant coffee market demand in the past few years. Moreover, single-served packaging offers pre-measured portion control, which ensures that consumers receive the appropriate amount of coffee with each serving. This attribute is especially attractive for those who are conscious of their coffee intake or are seeking to manage their caffeine consumption more effectively.

Furthermore, manufacturers have started investing in research and development activities to create innovative packaging solutions that enhance the convenience of instant coffee products. This includes specialty blends and even 3-in-1 options that include coffee, creamer, and sweetener in a single serving. For instance, Nescafe 3-in-1 strong intense & rich instant coffee, Jacobs Milka 3in1 instant coffee sachets, G7 3-in-1 gourmet instant coffee, NY salted caramel instant white coffee with sugar 3 in 1 sachet, Narusa’s 3 in 1 Coffee Premix Stick Pack, are few examples of different packages and categories available in the market, which is expected to drive the instant coffee market size.

Although the instant coffee market share has increased, it still falls behind due to the fluctuation in raw material prices. Instant coffee is made from processed coffee beans, and any fluctuations in the prices of raw coffee beans directly affect the production cost of instant coffee. Extreme weather changes such as drought, frosts, and pests significantly damage coffee crops, which reduces production and disrupts timely supply of coffee beans to the market. For instance, in November 2021, global coffee prices surged due to challenging conditions in Brazil, including drought, frost, and unusual weather patterns. This trend continued into 2022, with a 14.8% increase in coffee product prices observed in grocery stores. Moreover, the return of El Nino weather condition has been officially confirmed by the US Climate Prediction Center, and forecasters anticipate it to be possibly even a strong weather event. This weather phenomenon is expected to bring about hotter and drier conditions, particularly in key Robusta coffee-growing regions such as Vietnam and Indonesia. The increased risk of adverse weather conditions poses a threat to crucial coffee supplies from these areas, thus contributing to supply shortages and fluctuations in prices of coffee beans used in instant coffee production.

As per the data provided by the International Monetary Fund (IMF), the global price of coffee exhibited fluctuations throughout the year 2022, ranging from a high of 279.83 US cents per pound in February to a low of 210.38 US cents per pound in December. The manufacturers of instant coffee often operate with tight profit margins. Rapid or unpredictable increases in raw material prices can erode these margins, affecting the overall profitability of the business operating in the instant coffee industry. The competitive landscape of the instant coffee market further increases this challenge, with manufacturers hesitant to raise prices for fear of losing market share to competitors. Furthermore, the global supply chain's exposure to factors such as weather conditions and geopolitical events, which are expected to disrupt Robusta bean supply, adds a risk factor to the market. These uncertainties may affect the quality of instant coffee and hinder potential investments and expansion efforts in the industry, thereby impeding overall instant coffee market growth.

The demand for premium instant coffee has increased in developing regions, which has led to an increase in premium product innovation and differentiation in the instant coffee industry. With increased globalization, consumers in developing regions are exposed to global trends, including the popularity of premium coffee options. This exposure can create a demand for premium instant coffee as consumers seek to align their choices with international preferences and lifestyle trends. As a result, many companies have started introducing premium and innovative instant coffee products to gain instant coffee market share and maintain competition in this region. For instance, in February 2020 Nestle launched its first ultra-premium instant coffee as part of the Starbucks lineup in China. This offering comes in popular mini-can packaging and utilizes freeze-drying technologies to rapidly freeze the liquid into ice and sublimate some of it into gas to retain the coffee aroma. Despite the high production costs associated with this method, a set of 18 capsules is priced at $24.55, reflecting its premium nature. Similarly, in January 2022, Sleepy Owl launched premium instant coffee in three variants namely original, French vanilla, and hazelnut which was made of 100% Arabica coffee, to expand its product portfolio and widen accessibility as a coffee brand in India. In January 2023, Tata Consumer Products also launched a high-end instant coffee under brand name Tata Coffee Grand Premium in North India, to expand its product portfolio of instant coffee in premium segment. Thus, there are many upcoming opportunities for instant coffee manufacturers in these developing regions during the anticipated period.

Segmental Overview

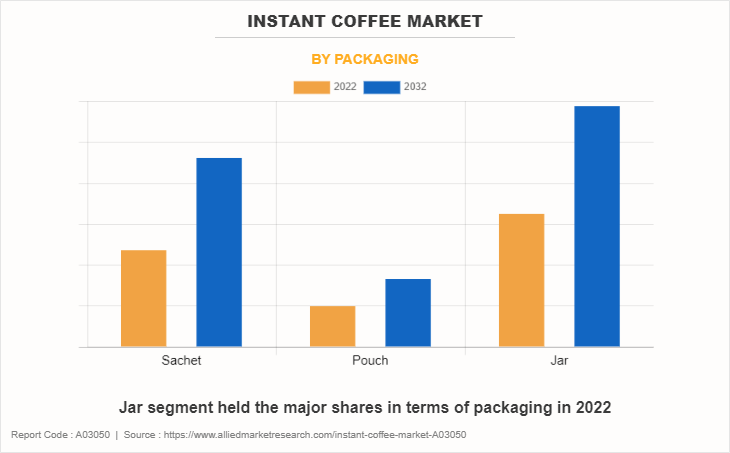

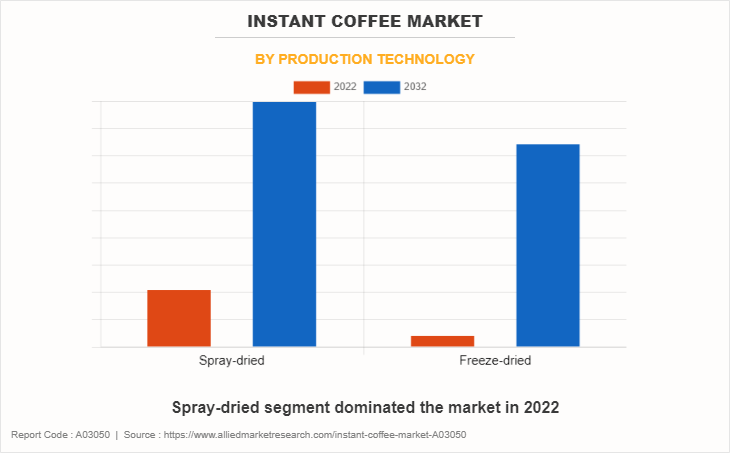

The instant coffee market is analyzed on the basis of type, packaging, production technology, distribution channel, and region. By type, it is divided into flavored and unflavored. As per packaging, it is categorized into sachet, pouch, and jar. By production technology, it is bifurcated into spray-dried and freeze-dried. Depending on distribution channel, it is fragmented into supermarkets-hypermarkets, convenience store, business-to-business, specialty store, and online sales channel. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Type

As per type, the unflavored segment dominated the instant coffee market in 2022 and is anticipated to maintain its dominance throughout the forecast period. Unflavored instant coffee is known for its simplicity, convenience, and ability to provide a quick and easy cup of coffee without the need for brewing equipment. Some people appreciate the straightforward taste of plain coffee and enjoy the purity of the coffee bean flavor without any added enhancements or alterations. In addition, unflavored instant coffee allows individuals to customize their coffee experience by adding their preferred sweeteners, milk, or other flavorings if desired, which increases the overall market share of this segment during the instant coffee market forecast.

By Packaging

By packaging, the jar segment dominated the instant coffee market in 2022 and is anticipated to maintain its dominance throughout the forecast period. Jars are associated with a premium and high-quality packaging format. The use of jars increases the perceived value of the beverage, which makes it more appealing to consumers seeking a sophisticated experience. The air-tight nature of jars helps extend the shelf life of instant coffee by preventing oxidation and moisture absorption. This is particularly important for ensuring that the product maintains its quality and flavor for an extended period. Moreover, the transparent nature of glass jars allows consumers to see the product inside, emphasizing its color and texture. This visual appeal can be particularly important for beverages with vibrant colors or unique visual characteristics, enhancing the overall presentation.

By Production Technology

By production technology, the spray-dried segment dominated the instant coffee market in 2022 and is anticipated to maintain its dominance throughout the forecast period. This process is known for its efficiency in preserving the quality of aroma and flavor, attributed to the exceptionally swift drying rates. Spray drying stands as the most widely utilized method in the coffee industry for transforming liquid coffee concentrate into a convenient and easily soluble powder. The equipment and energy requirements for spray drying are generally lower, making it a more economical choice for large-scale production. As a result, spray drying is a more cost-effective method compared to freeze drying. Thus, the spray dried instant coffee is anticipated to grow in the coming years.

By Distribution Channel

Depending on distribution channel, the supermarkets-hypermarkets segment dominated the instant coffee market in 2022 and is anticipated to maintain its dominance throughout the forecast period. Supermarkets/hypermarkets are the primary retail channel for instant coffee as they offer a range of instant coffee products. The products offered are from different brands and contain different formulations or flavors. Instant coffee is present in the cooking and baking section along with the dietary and grocery products. Moreover, in supermarkets instant coffee is present in different flavors such as vanilla, hazelnut, chocolate, along with others. The availability of different brands of instant coffee products along with different packaging of products, is driving the growth of the segment significantly.

In addition, the increase in popularity of supermarkets due to the convenience provided by them for offering a wide range of products under one roof along with arranging ample parking space with timeless operations is making them a favored option for shopping. In addition, the product arrangement is done by placing the products near each other, so the consumer can compare them easily and make a smooth buying decision. Furthermore, they offer products at hugely competitive prices and are usually located in accessible areas. The staff present at supermarkets also provide relevant information regarding the products which boost sales through this distribution channel. Thus, consumers find this segment very attractive as it provides a platform to meet their all-shopping needs at one destination, which saves them time.

By Region

Region wise, North America is predicted to dominate the market with the largest share during the forecast period (2023-2032). Companies operating in the North America instant coffee market are innovating new products to sustain in the competitive market. They are launching new products to expand their business operations across different countries in this region and increase their customer base. High spending capabilities of individuals due to increased disposable incomes and economic stability are some of the major driving factors for the North American market. In addition, the changing lifestyle of individuals is contributing to the increased sales of instant coffee in North America.

Competitive Landscape

The major players analyzed for the instant coffee industry include Nestle SA, The Kraft Heinz Company, Starbucks Corporation, Tata Consumer Products Limited, Strauss Group Inc., The J. M. Smucker Company, Sleepy Owl Coffee Private Limited, illycaffe S.p.A., Unilever PLC, and Koninklijke Douwe Egberts B.V.

Manufacturers of instant coffee are creating new products and formulae to meet the change in requirements of their customers. They make investments in R&D to create novel combinations of instant coffee with enhanced functionality, stability, and selectivity and create new applications for existing instant coffee. While developing new products, enhancing production methods, and navigating regulatory requirements, manufacturers of instant coffee frequently work with farmers, regulatory organizations, and other industry players. Manufacturers can increase their capacities, pool their knowledge, and create novel solutions through these collaborations. Manufacturers are improving their production capacity and cutting costs, which can involve both investing in new production facilities and renovating current ones to keep up with the rising demand for instant coffee. In addition, factors such as innovation, collaboration, product launch, and expansion are opportunistic for instant coffee market growth.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the instant coffee market analysis from 2022 to 2032 to identify the prevailing instant coffee market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the instant coffee market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global instant coffee market trends, key players, market segments, application areas, and market growth strategies.

Instant Coffee Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 60.7 billion |

| Growth Rate | CAGR of 6.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 290 |

| By Type |

|

| By Packaging |

|

| By Production Technology |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Tata Consumer Products Limited, Illycaffe S.p.A., The Kraft Heinz Company, Starbucks Corporation, Koninklijke Douwe Egberts B.V., The J. M. Smucker Company, Strauss Group inc., Nestle SA, Unilever PLC, Sleepy Owl Coffee Private Limited |

Analyst Review

On the basis of insights from top CXOs, the instant coffee market is expected to grow rapidly in the future, owing to the growing demand for instant and quicker beverages options among the global population. Consumers are increasingly busy, and they are seeking convenient ways to get their caffeine fix. Instant coffee is a quick and easy way to prepare a cup of coffee, and it is also portable in nature that can be consumed while on the go. According to CXOs instant coffee has come a long way in recent years, and now it tastes much better than it used to earlier. This is owing to the advancements in coffee processing and packaging technologies. There is a growth in popularity cold brew coffee, which is made by steeping coffee grounds for 12-24 hours. Instant cold brew coffee is a convenient way to enjoy this popular beverage. Moreover, millennials and Gen Z are more likely to drink instant coffee than older generations. This is because these age groups are more brand-conscious and they seek affordable and convenient ways when it comes to coffee products. Thus, the key players are bullish on the future of instant coffee market.

Furthermore, they believe innovation has been a key driver of the instant coffee market growth, as it allows manufacturers to develop new and unique flavors that are expected to attract new consumers and keep existing consumers engaged. This includes developing instant coffee with unique flavor profiles and creating new packaging designs that enhance the consumer experience. In addition, innovation can help manufacturers to address emerging trends, such as sustainability and health and wellness, which can help to create a competitive advantage and meet the evolving needs of consumers.

The global instant coffee market size was valued at $32.9 billion in 2022, and is projected to reach $60.7 billion by 2032

The global Instant Coffee market is projected to grow at a compound annual growth rate of 6.4% from 2023 to 2032 $60.7 billion by 2032

The major players analyzed for the instant coffee industry include Nestle SA, The Kraft Heinz Company, Starbucks Corporation, Tata Consumer Products Limited, Strauss Group Inc., The J. M. Smucker Company, Sleepy Owl Coffee Private Limited, illycaffe S.p.A., Unilever PLC, and Koninklijke Douwe Egberts B.V.

Region wise, North America is predicted to dominate the market with the largest share during the forecast period (2023-2032).

Increase in demand for single-serve and convenient packaging, Growing demand for flavored instant coffee, Expanding retail market

Loading Table Of Content...

Loading Research Methodology...