Insurance BPO Market Research, 2032

The global insurance bpo market was valued at $7.9 billion in 2022, and is projected to reach $24.6 billion by 2032, growing at a CAGR of 12.3% from 2023 to 2032.

Insurance BPO services refer to outsourcing certain business processes of an insurance company to a third-party provider who specializes in providing such services. This can include tasks such as claims processing, policy administration, customer service, underwriting, and other back-office operations. By outsourcing these processes, insurance companies can reduce costs, improve efficiency, and focus on their core competencies.

The ability to scale operations up or down quickly is critical for insurance companies, particularly in a market where demand can fluctuate rapidly. Therefore, by outsourcing to BPO service providers, insurance companies can benefit from the provider's ability to scale their operations up or down quickly, depending on the level of demand. Furthermore, insurance companies outsource their non-core functions such as back-office operations, administrative tasks, and customer service to BPO service providers. Thus, by doing so, they can concentrate on their core business activities such as underwriting, risk management, and product development. However, data security concern is one of the significant restraints for the insurance BPO market.

The insurance BPO companies handle a large volume of sensitive customer information, including personal and financial data, which in turn makes them a prime target for cyber-attacks and data breaches. In addition, during economic downturns, insurance companies experience a decline in business, which leads to a decrease in demand for BPO services. As a result, BPO providers may face lower revenues and reduced profitability. On the contrary, BPO service providers offer insurance companies access to specialized expertise and knowledge in a particular area, which can be particularly beneficial for non-core business processes. Therefore, access to specialized expertise is expected to provide significant opportunities for the insurance BPO industry.

The report focuses on growth prospects, restraints, and trends of the insurance BPO market outlook. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the insurance BPO industry.

Segment Review

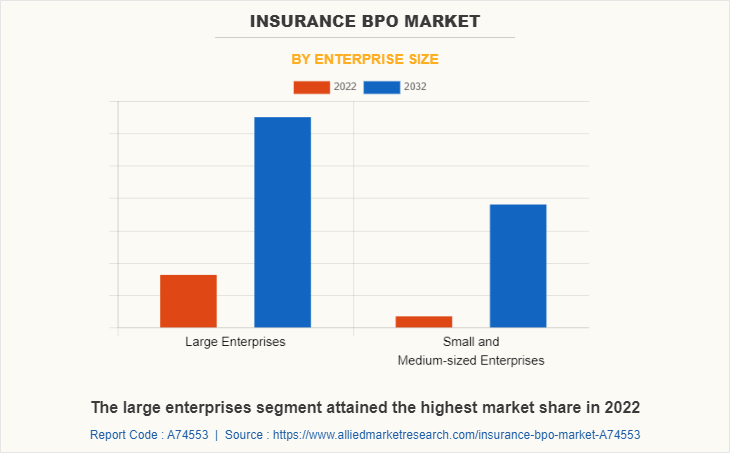

The insurance BPO market is segmented on the basis of type, enterprise size, application and region. Based on type, it is segmented into policy administration, asset management, finance and accounting services, customer care services, marketing, and others. By enterprise size, it is segmented into large enterprises and small and medium-sized enterprises. By application, it is segmented into life insurance and non-life insurance. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By enterprise size, the large enterprises segment attained the highest growth in 2022. This is due to increase in demand for customized insurance BPO services that cater to specific needs of enterprises. And these large enterprises are leveraging data analytics to gain insights into customer behavior, market trends, and risk management. Therefore, large enterprises look for BPO partners who can provide end-to-end solutions, from policy administration to claims management.

However, the small and medium-sized segment is considered to be the fastest growing segment during the forecast period. This is due to the fact that by outsourcing non-core insurance operations to third-party service providers, SMEs can streamline their business processes, reduce costs, and enhance their operational efficiency. Moreover, outsourcing allows SMEs to focus on their core competencies and strategic initiatives, while the outsourcing partner takes care of mundane and repetitive tasks such as claims processing, policy servicing, and underwriting support. Hence, this drives the growth and competitiveness in the insurance BPO services industry.

By region, North America attained the highest growth in 2022. This is due to an increase in adoption of digital technologies, such as automation and AI, to streamline insurance processes and enhance customer experiences. Moreover, in North America, the market is driven by factors such as cost savings, the need for increased efficiency, and the rise of digital technologies. Thus, such trends are expected to continue shaping the insurance BPO market in North America.

However, Asia-Pacific is expected to be the fastest growing region during the forecast period. This is due to rise in adoption of digital technologies, surge in number of insurance companies, and the availability of a skilled workforce. In addition, the rise of insurtech startups and the emergence of new business models such as pay-per-mile insurance drive the growth of the insurance BPO market in this region.

The report analyzes the profiles of key players operating in insurance BPO market such as Accenture, Acquire BPO Pty Ltd., Canon Business Process Services., Cogneesol, Flatworld Solutions Pvt. Ltd., Infosys Limited, Invensis Technologies Pvt Ltd., Patra, Solartis, and WNS (Holdings) Ltd. These players have adopted various strategies to increase their market penetration and strengthen their position in the insurance BPO market.

Market Landscape and Trends

The insurance BPO (Business Process Outsourcing) market has seen significant growth in recent years and is expected to continue its upward trend. Furthermore, Insurers are increasingly outsourcing non-core activities such as claims processing, policy administration, and underwriting to specialized BPO providers to reduce costs and improve efficiency. In addition, the market is also seeing the adoption of emerging technologies such as AI and machine learning, which are being used to automate and streamline processes.

Moreover, technological advancements such as artificial intelligence and robotic process automation are expected to further enhance the capabilities of insurance BPO services, leading to increased adoption of these services by insurance companies. Thus, in the future the insurance BPO market is expected to see a shift towards a more customer-centric approach, with providers offering personalized services to meet the unique needs of individual customers. Therefore, these are the major market trends of insurance BPO market.

Top Impacting Factors

Offers to Focus on Core Business Activities

Insurance companies outsource their non-core functions such as back-office operations, administrative tasks, and customer service to BPO service providers. Thus, by doing so, they can concentrate on their core business activities such as underwriting, risk management, and product development. Furthermore, outsourcing non-core functions allows insurance companies to free up their internal resources and focus on their strengths, which can improve their overall performance and profitability. This is particularly important in a highly competitive industry such as insurance, where companies need to continuously innovate and differentiate themselves to stay ahead.

Moreover, by outsourcing non-core functions to BPO service providers, insurance companies can benefit from the expertise and technology that these providers bring to the table. In addition, BPO service providers are typically specialized in certain areas of insurance operations and can offer best practices, industry benchmarks, and innovative technology to improve efficiency, quality, and customer satisfaction. Overall, focusing on core business activities is a key driver for insurance companies to outsource their non-core functions to BPO service providers, which is expected to help them to achieve their strategic goals and gain a competitive edge in the insurance BPO market size.

Provides Scalability to Service Providers

The ability to scale operations up or down quickly is critical for insurance companies, particularly in a market where demand can fluctuate rapidly. Therefore, by outsourcing to BPO service providers, insurance companies can benefit from the provider's ability to scale their operations up or down quickly, depending on the level of demand. Furthermore, scalability allows insurance companies to be more agile and responsive to market changes. For instance, if an insurance company wants to expand its product offerings, it can easily do so by outsourcing certain functions to BPO service providers.

Furthermore, these providers can quickly ramp up their operations to support the new product offerings, without the insurance company needing to make significant capital investments. In addition, scalability is an important driver for the insurance BPO market as it allows insurance companies to be more flexible, responsive, and cost-effective in meeting changing market demands. Thus, by leveraging the scalability of BPO service providers, insurance companies can achieve greater operational efficiency, profitability, and competitiveness in the market.

Data Security Soncerns

The data security concerns is one of the significant restraints for the insurance BPO market. As insurance BPO companies handle a large volume of sensitive customer information, including personal and financial data, they become a prime target for cyber-attacks and data breaches. Furthermore, the potential loss of data due to security breaches can result in significant financial losses, damage to the reputation of the insurance company, and legal & regulatory penalties. Whereas, to mitigate such a risk of data breaches, insurance BPO companies can invest in robust cybersecurity measures, including encryption, access controls, firewalls, and regular security audits. However, these measures can be costly and implementing them effectively require specialized knowledge and expertise. Therefore, such factors could limit the growth of the insurance BPO market analysis.

Economic Downturn

During periods of economic uncertainty, many insurance companies reduce their operational costs by cutting back on outsourcing services, including BPO services. This is due to the fact that they may be more focused on cost-cutting measures and preserving cash flow during tough times. Furthermore, during economic downturns, insurance companies can experience a decline in business, which leads to a decrease in demand for BPO services. As a result, BPO providers may face lower revenues and reduced profitability.

However, it is important to note that the impact of an economic downturn on the insurance BPO market can vary depending on various factors such as the severity and duration of the downturn, the size & scale of the insurance BPO provider, the type of insurance services being outsourced, and the specific needs & requirements of individual insurance companies. For instance, some insurance companies may turn to outsourcing as a way to reduce costs during economic downturns, rather than hiring and training new employees in-house. Therefore, the economic downturn in the insurance BPO services limits the growth of the insurance BPO market share.

Offers Access to Specialized Expertise

Insurance companies often have complex processes and operations that require specialized knowledge and skills to execute efficiently. By outsourcing these processes to a BPO provider with expertise in insurance operations, companies can benefit from improved efficiency, cost savings, and enhanced quality. For example, a BPO provider with expertise in underwriting can help insurance companies streamline their underwriting process and improve their risk selection. Similarly, a BPO provider with expertise in claims processing can help insurance companies accelerate their claims settlement process, reduce errors, and improve customer satisfaction. Thus, BPO service providers can offer insurance companies access to specialized expertise and knowledge in a particular area, which can be particularly beneficial for non-core business processes. Moreover, the BPO providers help insurance companies to improve their efficiency, reduce costs, and enhance their overall service quality. Therefore, access to specialized expertise can provide significant opportunities for the insurance BPO market growth.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the insurance BPO market forecast from 2022 to 2032 to identify the prevailing insurance BPO market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the insurance BPO market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global insurance BPO market trends, key players, market segments, application areas, and market growth strategies.

Insurance BPO Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 24.6 billion |

| Growth Rate | CAGR of 12.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 394 |

| By Type |

|

| By Enterprise Size |

|

| By Application |

|

| By Region |

|

| Key Market Players | Canon Business Process Services., Patra, WNS (Holdings) Ltd., Acquire BPO Pty Ltd, Infosys Limited, Cogneesol, Solartis, Flatworld Solutions Pvt. Ltd., Accenture, Invensis Technologies Pvt Ltd |

Analyst Review

The insurance BPO (Business Process Outsourcing) market refers to the outsourcing of various insurance-related services and processes to third-party service providers. These services may include policy administration, claims management, underwriting, customer service, and other back-office & front-office functions. Furthermore, insurance companies often outsource these processes to BPO providers to reduce costs, improve efficiency, and focus on their core competencies. Moreover, the insurance BPO market is being driven by a number of factors, including the need for insurance companies to reduce costs, increase efficiency, and improve customer service. Thus, with rise in competition and a rapidly changing regulatory landscape, insurance companies are under pressure to streamline their operations and focus on their core competencies. In addition, outsourcing certain functions such as claims processing, policy administration, and underwriting to specialized BPO providers can help insurance companies achieve these goals. Therefore, advancements in technology such as AI and automation enable BPO providers to offer more sophisticated services and drive further cost savings. As a result, the insurance BPO market is expected to continue to grow in the coming years.

Furthermore, market players have adopted strategies such as acquisition for enhancing their services in the market and improving customer satisfaction. For instance, in January 2020, Xceedance, a global provider of insurance consulting, managed services, technology, data sciences, and blockchain solutions, has announced the acquisition of Activer Solutions. Thus, this new acquisition with Activer Solutions helps the Xceedance, in insurance operations and technology services for the front, middle, and back-office operations of property and casualty insurers. With this acquisition, in the next few months, Activer Solutions is anticipated to be absorbed into the U.S. operations of Xceedance. Therefore, such strategies are projected to foster the growth of the market in upcoming years.

Moreover, some of the key players profiled in the report are Accenture, Acquire BPO Pty Ltd., Canon Business Process Services., Cogneesol, Flatworld Solutions Pvt. Ltd., Infosys Limited, Invensis Technologies Pvt Ltd., Patra, Solartis, and WNS (Holdings) Ltd. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The upcoming trends in insurance BPO include increased use of automation, artificial intelligence, and data analytics to improve efficiency and accuracy. Companies are also focusing on providing personalized customer experiences and utilizing digital platforms to streamline processes and reduce costs. Additionally, there is a growing trend towards outsourcing of niche insurance services and expanding BPO services to emerging markets.

The leading application of the insurance BPO market is claims processing, which involves the administration of insurance claims and the settlement of payments. This process is time-consuming and requires a high degree of accuracy, making it a prime candidate for outsourcing to third-party providers. BPO companies specialize in claims processing, utilizing technology and expertise to ensure timely and accurate claims processing for their clients.

North America is the largest regional market for Insurance BPO

The global insurance BPO market was valued at $7,931.93 million in 2022, and is projected to reach $24,594.24 billion by 2032, growing at a CAGR of 12.3% from 2022 to 2032.

Accenture, Acquire BPO Pty Ltd., Canon Business Process Services., Cogneesol, Flatworld Solutions Pvt. Ltd., Infosys Limited, Invensis Technologies Pvt Ltd., Patra, Solartis, and WNS (Holdings) Ltd

Loading Table Of Content...

Loading Research Methodology...