Insurance Brokerage Market Overview

The global insurance brokerage market was valued at USD 259.7 billion in 2022, and is projected to reach USD 628.3 billion by 2032, growing at a CAGR of 9.3% from 2023 to 2032. Rising demand for online brokerage and cashless transactions, increase in the adoption of digital tools such as portals and apps streamlining policy management, enhancing customer experience, and enabling remote interactions, are contributing to the growth of the market.

Market Dynamics & Insights

- The insurance brokerage industry in North America held a significant share of 39% in 2022.

- The insurance brokerage industry in India is expected to grow significantly at a CAGR of 16.6% from 2023 to 2032.

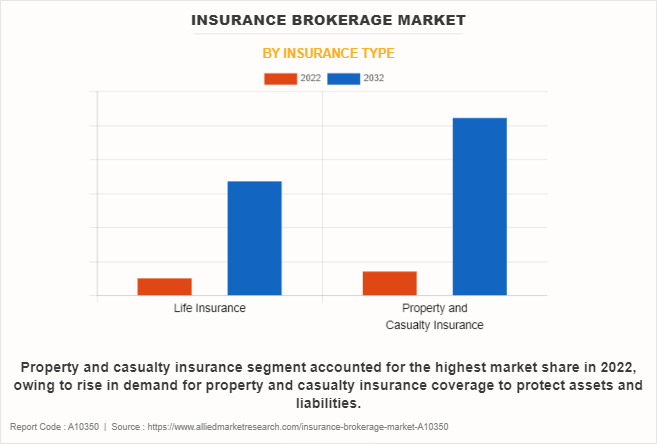

- By insurance, the property and casualty insurance segment dominated the insurance brokerage market, accounting for the revenue share of 52% in 2022.

- By brokerage type, the retail segment dominated the industry in 2022 and accounted for the largest revenue share of 81%.

Market Size & Future Outlook

- 2022 Market Size: USD 259.7 Billion

- 2032 Projected Market Size: USD 628.3 Billion

- CAGR (2023-2032): 9.3%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

What is Meant by Insurance Brokerage

An insurance broker plays a vital role in the growth of economic development and act as an intermediary between policyholder and insurers. Insurance brokers offer technical and professional advice about insurance products to their clients. The insurance products provided by brokers include medical insurance, property & casualty insurance, and health insurance. Insurance brokers work closely with their clients to cater to their needs with respect to coverage. Hence, insurance brokers represent consumers as they find proper terms, condition, and price and recommend them accordingly about the insurance policy that best fits the bill.

Increase in demand for insurance policies among the general public is a key driver for the growth of the insurance brokerage market. The insurance brokerage market has increased the demand for health insurance policies, car insurance, and life insurance. This increased demand is mainly due to rise in insurance awareness among consumers, who are aware of the importance and benefits of insurance policies more to the policyholders. Thus, increase in demand for the insurance policy has led to a boost in the insurance brokerage market. In addition, the expansion of digital brokers and integration of IT & analytic solutions are the major driving factors for the market.

However, availability of alternative platforms for purchasing insurance policy is a major factor that hampers the growth of the market. Increased availability of insurance intermediaries, online channels, and other third-part website, which do not require additional commission charges for insurance policy, restrains the market growth. Moreover, these intermediaries offer tailor-made policy and accelerate products & services for growing consumer demands, with exclusive ideas & solutions for their coverages.

However, favorable government initiatives regarding insurance policies presents a significant opportunity for the insurance brokerage market. Several government bodies are undertaking huge initiatives regarding insurance policies and allowing customers to avail benefits of a wide range of coverages. In addition, through survey data & publications, governments are making customers aware of the various opportunities and risk coverages that can be covered under an insurance policy.

The report focuses on growth prospects, restraints, and trends of the Insurance brokerage market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the Insurance brokerage market.

The insurance brokerage market is segmented into Insurance Type and Brokerage Type.

Insurance Brokerage Market Segment Review

The insurance brokerage market is segmented on the basis of insurance type, brokerage type, and region. On the basis of insurance type, it is divided into life insurance and property & casualty insurance. By brokerage type, it is categorized into retail and wholesale. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of insurance type, the property & casualty insurance segment attained the highest insurance brokerage market size in 2022. This is due to the fact that property & casualty insurance brokerage providers are prioritizing customer education. They offer webinars, seminars, and online resources to educate clients about the importance of property & casualty insurance insurance, policy options, and the role it plays in financial planning.

On the basis of region, North America held the highest insurance brokerage market share in 2022, owing to rise in adoption of insurance among the end users and increase in profit margins of insurance provider in the North America countries.

The report analyzes the profiles of key players operating in the insurance brokerage market such as Acrisure, LLC, Aon plc, Brown & Brown, Inc, Gallagher, HUB International Limited, Lockton companies, Marsh & McLennan Companies Inc., Truist Insurance Holdings, USI Insurance Services L.L.C, and Willis Towers Watson. These players have adopted various strategies to increase their market penetration and strengthen their position in the Insurance brokerage market.

Market Landscape and Trends

The adoption of digital tools and platforms is reshaping the insurance brokerage industry. Providers are leveraging technology for online policy management, claims processing, customer interactions, and underwriting. Digital transformation enhances efficiency, convenience, and customer experiences. Moreover, the use of data analytics is becoming essential for insurance brokerage providers. Data-driven insights help them assess risks accurately, personalize recommendations, and anticipate market trends, ultimately enhancing decision-making processes. In addition, insurtech startups are introducing innovative solutions to the insurance industry. Insurance brokerage providers are partnering with insurtech companies to integrate advanced technologies such as AI, blockchain, and IoT into their services.

Furthermore, insurance brokerage providers are exploring alternative distribution channels beyond traditional methods. This includes partnerships with online platforms, direct-to-consumer models, and collaborations with affinity groups. Therefore, the insurance brokerage market is constantly evolving, with new trends emerging as technology advances.

What are the Top Impacting Factors in Insurance Brokerage Market

Increase in Demand for Insurance Policies Among the General Public

The insurance brokerage market has increased the demand for health insurance policies, car insurance, and life insurance. This increased demand is mainly due to increased insurance awareness among consumers, who are aware of the importance and benefits of insurance policies more to the insured. Thus, increase in demand for the insurance policy has led to a boost in the insurance brokerage market, as the policy holders need the services of a broker while purchasing a policy that is suitable based on their needs & preferences. Furthermore, the increasing population of baby boomers and millennials is leading to growth opportunities for insurance brokerage firms. Insurance brokers focus on policies that provide maximum benefits, which has increased the demand for insurance products. Therefore, these factors foster the insurance brokerage market growth.

Expansion of Digital Brokers

Digital brokers make it easier for customers to research, compare, and buy insurance policies from the comfort of their devices. The 24/7 availability of online platforms eliminates the need for in-person visits to physical stores, allowing a wider audience to better access insurance. Moreover, digital merchants provide consumers with transparent information about insurance policies, billing information, terms, and costs. This transparency allows consumers to make informed decisions, as they can easily understand what they are buying. In addition, many digital brokers use data analytics and algorithms to provide personalized insurance recommendations based on customer profiles, needs, and preferences, which ensures they present coverage options tailored to their individual customers. Further, digital brokers are investing in user-friendly interfaces and intuitive online experiences. Customers can go through program options, ask questions, and get help through chatbots or customer service representatives, enhancing their overall experience. Thus, these features are expected to drive the insurance brokerage market growth significantly.

Integration of IT & Analytic Solutions

The insurance industry is transforming at a fastest growth rate in terms of technology adoption. In addition, market vendors are integrating IT and analytics solutions to maximize their sales. Analytics solutions help to create effective marketing strategies and underwriting services. Data analytics helps firms with product design and customer targeting through simulation and stochastic techniques. Moreover, insurance brokers use data analytics tools to maintain a competitive edge. Such tools use complex models and predict possible future outcomes to identify hidden data patterns. Furthermore, analytic solutions can help identify potential fraud by detecting unusual patterns or behaviors within insurance applications and claims. For instance, in April 2023, Coalition, the world's first Active Insurance provider designed to prevent digital risk before it strikes, introduced CoalitionAI, a new initiative to deploy generative AI and large language models to help brokers and businesses protect themselves from cyber risk. Therefore, these strategies are projected to further foster the growth of the insurance brokerage industry.

Availability of Alternative Platforms for Purchasing Insurance Policy

Increase in availability of insurance intermediaries, online channels, and other third-party website, which do not require additional commission charges for insurance policy restrains the insurance brokerage market growth. Moreover, these intermediaries offer tailor-made policy and accelerate products & services for growing consumer demands, with exclusive ideas & solutions for their coverages. Furthermore, massive information provided on the internet regarding insurance policies, which is available free of cost, allow customers to take a proper decision regarding purchase of a new insurance policy by comparing premium prices. In addition, online platforms often provide transparent pricing and allow customers to compare multiple insurance quotes side by side. This transparency appeals to customers seeking competitive rates. Therefore, the need for insurance brokers tends to fall due to availability of alternative platforms, which hampers the market growth.

Rise in Personalized Insurance Policies

Personalized insurance policies allow brokers to craft coverage solutions that precisely match each client's risk profile and requirements. By understanding individual circumstances, brokers recommend coverage that is neither excessive nor inadequate, enhancing customer satisfaction. Moreover, offering personalized policies demonstrates a deep understanding of clients' needs. This fosters stronger relationships and engagement, as clients recognize that brokers are dedicated to addressing their specific concerns. In addition, personalized policies leverage data analytics to understand client behaviors, claims history, and potential vulnerabilities. These insights allow brokers to offer proactive risk management advice and preventative measures. Furthermore, brokers offering personalized policies differentiate themselves from competitors, particularly from more automated online insurance platforms that may lack the same level of customization. Therefore, rise in personalized insurance policies presents attractive opportunities for the insurance brokerage market.

Favorable Government Initiatives Regarding Insurance Policies

Several government bodies are undertaking huge initiatives regarding insurance policies and allowing customers to avail benefits of a wide range of coverages. In addition, through survey data & publications, governments are making customers aware of the various opportunities and risk coverages that can be covered under an insurance policy. Furthermore, governments are providing various schemes, which helps the insurance industry to provide insurance policies to all sections of the society. For instance, in July 2023, Square Insurance, one of India's fastest growing Insurtech startups, announced a strategic partnership with the Government of Rajasthan through Rajasthan Information Services Limited. With access to over 78,000 e-Mitra Kiosks across Rajasthan, this collaboration aims to transform insurance service delivery across the state. Therefore, these initiatives by government are expected to provide lucrative opportunities to the insurance brokerage market in the upcoming years.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the insurance brokerage market forecast from 2022 to 2032 to identify the prevailing market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities of insurance brokerage market outlook.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the insurance brokerage market segmentation assists in determining the prevailing insurance brokerage market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global insurance brokerage market trends, key players, market segments, application areas, and market growth strategies.

Insurance Brokerage Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 628.3 billion |

| Growth Rate | CAGR of 9.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 257 |

| By Insurance Type |

|

| By Brokerage Type |

|

| By Region |

|

| Key Market Players | Arthur J. Gallagher & Co., Brown & Brown Insurance Inc., HUB International Limited, WTW, Aon plc, Acrisure, LLC, Truist Insurance Holdings, Lockton Companies, Marsh & McLennan Companies, Inc., USI Insurance Services LLC |

Analyst Review

The insurance industry plays a major role in economic growth by providing financial protection to individuals, assets, and businesses against uncertain events. As digital technologies evolve, insurance broking firms are finding new ways to optimize processes, reduce costs, and most importantly, connect with their customers. Brokers are continuing to boost investments in AI, automation and big data while expanding the use of mobile devices. In addition, Internet of Things (IoT) can provide clients, brokers, and insurers extensive data and insights to design holistic risk management tools and systems. This is expected to boost their customer information repository, thereby enabling them to offer timely, pertinent coverage based on individual needs. Furthermore, availability of data has empowered insurance brokers to provide more accurate risk assessments and pricing strategies. By utilizing data analytics, brokers can analyze historical trends, industry benchmarks, and market data to offer clients informed recommendations and help them make well-informed insurance decisions.

The CXOs further added that market players are adopting strategies such as partnership for enhancing services in the market and improving customer satisfaction. For instance, in July 2023, Heffernan Insurance Brokers, one of the largest full-service, independent insurance brokerage firms in the U.S. announced a partnership with TrustLayer, to allow customers to access TrustLayer's artificial intelligence (AI)-powered collaborative risk management platform. With the help of this partnership, TrustLayer is anticipated to enable faster and more efficient proof of insurance verification and help Heffernan customers better manage risk by using its innovative digital solution. TrustLayer uses robotic process automation (RPA) and artificial intelligence to automate this process securely, so companies can automatically verify the insurance and licenses of their vendors, suppliers, borrowers, and tenants. Therefore, such strategies are expected to boost the growth of the insurance brokerage market in the upcoming years.

Moreover, some of the key players profiled in the report are Acrisure, LLC, Aon plc, Brown & Brown, Inc, Gallagher, HUB International Limited, Lockton companies, Marsh & McLennan Companies Inc., Truist Insurance Holdings, USI Insurance Services L.L.C, and Willis Towers Watson. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The global insurance brokerage market was valued at $259.7 billion in 2022, and is projected to reach $628.3 billion by 2032, growing at a CAGR of 9.3% from 2023 to 2032.

The insurance brokerage market is estimated to grow at a CAGR of 9.3% from 2023 to 2032.

The insurance brokerage market is projected to reach $628.33 billion by 2032.

Increase in demand for insurance policies among the general public, expansion of digital brokers and integration of IT & analytic solutions majorly contribute toward the growth of the market.

The key players profiled in the report include insurance brokerage market analysis includes top companies operating in the market such as Acrisure, LLC, Aon plc, Brown & Brown, Inc, Gallagher, HUB International Limited, Lockton companies, Marsh & McLennan Companies Inc., Truist Insurance Holdings, USI Insurance Services L.L.C, and Willis Towers Watson.

The key growth strategies of insurance brokerage players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...