Insurance Claims Services Market Research, 2032

The global insurance claims services market was valued at $193.8 billion in 2022, and is projected to reach $638.3 billion by 2032, growing at a CAGR of 12.8% from 2023 to 2032.

An insurance claim is a request to an insurance company for a payment based on the terms of the insurance policy. If approved, the insurance company issues the payment to the insured or an approved interested party on behalf of the insured or insurance adjuster. Further, insurance claims cover everything including death benefits on life insurance policies, personal accident claim, to routine and comprehensive medical exams. In some cases, a third party is able to file claims on behalf of the insured person. This factor notably contributes towards the growth of insurance claims services market. Furthermore, a paid insurance claim serves to compensate a policyholder against financial loss. An individual or group pays premiums as consideration for the completion of an insurance contract between the insured party and an insurance carrier. The most common insurance claims involve costs for medical goods and services, physical damage, loss of life, liability for the ownership of dwellings (homeowners, landlords, and renters), and liability resulting from the operation of automobiles.

The insurance claims services market is segmented into Type of Insurance, Insurance Providers and End User.

Increase in adoption of data-driven decision-making, stringent government initiatives to improve insurance coverage, and increase in acceptance for insurance services drive growth of the insurance claims services market. Further, increase in acceptance of insurance by individuals & further evolution of claims filing has led to rise in need for insurance claims services, which propels the growth of insurance claims services market. Furthermore, cost-effective nature of claim generation software, which can be implemented & maintained through digital techniques is a positive factor for infrastructure development in insurance claims services market.

However, increase in data breaches and increasing fraudulent insurance claims hamper growth of the insurance claims services market. On the contrary, developing economies offer significant opportunities for insurance claims services market companies to expand their offerings, owing to factors such as advancements in digital claim settlements, rapid urbanization, rise in literacy level, and increase in tech-savvy youth generation. Moreover, growth in developments & initiatives toward digitalized insurance services is anticipated to provide a potential growth opportunity for the insurance claims services market.

The report focuses on growth prospects, restraints, and trends of the insurance claims services market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the insurance claims services market outlook.

Segment Review

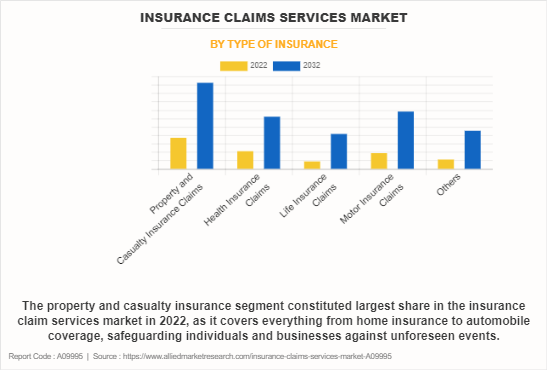

The insurance claims services market is segmented into type of insurance, insurance providers, end user, and region. By type of insurance, the market is differentiated into property and casualty insurance claims, health insurance claims, life insurance claims, motor insurance claims, and others. Depending on the insurance providers, it is fragmented into insurance providers, third-party administrators (TPAs), and specialized claim management firms. The end user segment is segmented into individual policyholders, commercial policyholders, and government & public sector. Region wise, the insurance claims services market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

By type of insurance, the property and casualty insurance claims segment of the insurance claims services market is estimated to acquire the highest share of insurance claims services market size in 2022. This is attributed to the fact that the insurance providers are increasingly using data analytics to analyze and asses the risks, detect fraud, and optimize the claims processing services more efficiently. Further, insurers are using advanced technologies such as AI and ML to mitigate the risks and gain operational efficiency in order to maximize the profits.

Region wise, North America dominated the insurance claims services market share in 2022, and is expected to maintain this trend during the forecast period. This is attributed to the increasing adoption of advanced technologies, such as artificial intelligence, machine learning, and blockchain, to enhance the efficiency of claims processing, reduce costs, and improve accuracy.

The key players operating in the global insurance claims services market include Pegasystems Limited, Hexaware Technologies Inc., Software AG, Avaya Inc., Cognizant Technology Solutions, Accenture PLC., International Business Machines Corporation, Oracle Corporation, HCL Technologies, DXC Technology Company. These players have adopted various strategies to increase their market penetration and strengthen their position in the insurance claims services industry.

Market Trends and Landscape

The introduction of new and innovative products in the market by key players in insurance claims services market is driving the growth of insurance claims services market during the forecast period. For instance, in April 2023, Google Cloud announced a new AI-enabled Claims Acceleration Suite that streamlines health insurance prior authorization and claims processing. The solution, leveraging the newly created Claims Data Activator, help health plans and providers reduce administrative burdens and costs by converting unstructured data into structured data, enabling experts to make faster, more informed decisions that improve patient care. AI-enabled prior authorization is available to Google Cloud customers, and other features of the Claims Acceleration Suite would be available later in the year.

Moreover, increase in partnerships to digitalize online claims settlement processes and integration of the advance technologies are some of the trends flourishing the insurance claims services market growth. For instance, in May 2023, CCC Intelligent Solutions Inc. (CCC) and Verisk Analytics, Inc. (Verisk) announced a strategic partnership to leverage the two providers’ market-leading technologies to bring new innovations to P&C insurance claims. CCC is a leading cloud platform for the P&C insurance economy and Verisk is a leading global data analytics and technology provider.

Recent partnerships in insurance claims services market

In September 2023, Prudential Financial, Inc. made a new strategic partnership with EvolutionIQ, a technology company with an artificial intelligence-driven platform that will enhance Prudential’s disability claims ecosystem. With AI playing an increasingly crucial role in businesses, the integration of this platform into Prudential’s claims process augments the important work of the company’s disability claims examiners. EvolutionIQ uses proprietary, next-generation machine learning to provide specialized insights that will help Prudential streamline the disability claims process.

In September 2023, Newgen Software and Coforge Limited, a global digital services and solutions provider, elevated their partnership to deliver transformative insurance lifecycle management solutions in customer communications management (CCM) and document and content management (DCM) on the low code platform. This would steer in a new era of agility, customer-centricity, and operational efficiency for life and annuity (L&A) and property & casualty (P&C) insurers. By combining their respective strengths, the companies are uniquely positioned to address the intricacies of the insurance domain across the US, UK, EMEA, and ANZ markets.

In October 2020, Swiss Re and Daimler Insurance Services entered into a strategic partnership for automotive and mobility insurance and launched a new company called Movinx. Both shareholders of the 50/50 joint venture would leverage their complementary expertise to establish a new business model. The aim is to develop fully digital automotive and mobility insurance products that both fulfill changing customer needs and offer best-in-class service quality. Movinx has received all necessary competition clearances.

Recent product launches in insurance claims services market

In December 2023, Duck Creek Technologies, the intelligent solutions provider defining the future of property and casualty (P&C) and general insurance, announced the release of Duck Creek Clarity, an innovative, cloud-native technology solution and the successor to Duck Creek Insights, designed to empower insurers with advanced data management, reporting, and analytics capabilities. With the introduction of Duck Creek Clarity, the company also modernizes the traditional technology upgrade cycle through a unique “Active Delivery” approach, which provides continuous updates and eliminates the need for insurers to undergo timely and costly upgrade projects.

Top Impacting Factors

Increasing Incidents of Accident Claims

The growing number of accidents that happen in different work contexts and on the roads necessitates a greater reliance on insurance coverage. Individuals and organizations are experiencing the value of having comprehensive insurance coverage as car accidents, workplace disasters, and other unanticipated events are growing. This greater awareness, along with rapid urbanization and population growth, has resulted in an increase in accident-related claims resulting in growth of insurance claims services market. Furthermore, insurance claims services are essential in streamlining the payment procedure and guaranteeing policyholders receive prompt and effective payments. Modern lifestyles are complex and full of possible risk factors, which emphasizes the necessity for trustworthy insurance and, by extension, competent claims processing services. In addition to illustrating how the risk environment is changing, this trend also emphasizes how important insurance claims services are in helping those affected by unanticipated mishaps and occurrences feel financially secure and at ease. Thus, the increasing incidents of accident claims boost the growth of insurance claims services market.

Increasing Prevalence of Theft and Vandalism

Theft and vandalism are two property-related crimes that have dramatically escalated in a time of urbanization and socioeconomic complexity. This growing tendency is pushing people and companies to look for full insurance coverage to protect their assets from future losses. Owners of commercial real estate, individuals, and businesses are evaluating the need to have insurance plans that offer financial security in the event of theft or vandalism. These incidents are happening more frequently, which emphasizes the need for specialized insurance plans that include loss and property damage coverage. For policyholders impacted by theft or vandalism, insurance claims services are essential because they streamline the claims procedure and guarantee prompt payment. This factor boosts the growth of insurance claims services market. As the intricacies of modern living contribute to an environment where security risks are omnipresent, the demand for insurance claims services is propelled by the desire for financial reassurance in the face of property-related crimes. This growing awareness of the potential risks and the need for protective measures positions the insurance claims services market as an indispensable ally in mitigating the impact of theft and vandalism on individuals and businesses alike.

Technological Advancements in Insurance Sector

The insurance operations has been completely altered as owing to advancements in technologies like digital platforms, artificial intelligence, and data analytics. These developments have improved the accuracy, efficiency, and customer-centric claims processing process. Insurers currently employ automation and data-driven insights to review claims more quickly and effectively than they could with human processing. The emergence of digital gateways and mobile applications has additionally enabled policyholders to effortlessly submit claims and track their progress in real time. More client satisfaction is a result of this greater accessibility and transparency. Insurers are further able to get useful information on risk factors through the use of telematics and IoT devices, which helps with accurate claim assessments whci propels the growth of isurance claims services mrket. The insurance claims services market will grow as long as the insurance industry adopts and invests in these technological advancements.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the insurance claims services market forecast from 2022 to 2032 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities of insurance claims services market overview.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the insurance claims services market segmentation assists to determine the prevailing insurance claims services market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global insurance claims services market trends, key players, market segments, application areas, and market growth strategies.

Insurance Claims Services Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 638.3 billion |

| Growth Rate | CAGR of 12.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 260 |

| By Type of Insurance |

|

| By Insurance Providers |

|

| By End User |

|

| By Region |

|

| Key Market Players | DXC Technology Company, Avaya Inc, Oracle Corporation, Software AG, International Business Machines Corporation, Cognizant Technology Solutions Corp., HCL Technologies, Hexaware Technologies Ltd, Accenture, Pegasystems |

Analyst Review

The accelerated adoption of digital technologies, including artificial intelligence and automation, streamlining and expediting the claims process is driving the growth of insurance claims services market. Insurers are increasingly focusing on enhancing customer experiences through user-friendly digital interfaces, mobile apps, and transparent communication channels. Data analytics is playing a pivotal role, enabling insurers to assess risks more accurately, detect fraud, and optimize claims management. Remote claims processing has gained prominence, driven by the need for contactless interactions during the COVID-19 pandemic and a broader shift toward virtual solutions. Insurtech collaborations are flourishing, with traditional insurers partnering with innovative startups to leverage cutting-edge technologies. The growing concern over climate change is influencing the insurance landscape, with insurers incorporating advanced risk assessment tools to manage claims related to natural disasters.

The COVID-19 outbreak has a significant impact on the insurance claims services market, and has accelerated the usage & adoption of online claims processing processes for insurance companies and third party administrators, respectively. Moreover, during this global health crisis, the adoption of insurance claims services technology increased among large & small companies. This, as a result promoted the demand for insurance claims services, thereby accelerating the revenue growth.

The insurance claims services market is fragmented with the presence of regional vendors such as Pegasystems Limited, Hexaware Technologies Inc., Software AG, Avaya Inc., Cognizant Technology Solutions, Accenture PLC., International Business Machines Corporation, Oracle Corporation, HCL Technologies, DXC Technology Company. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With increase in awareness & demand for insurance claims services across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products.

The insurance claim services market is estimated to grow at a CAGR of 12.8% from 2023 to 2032.

The insurance claim services market is projected to reach 638.27 billion by 2032.

Increasing incidents of accident claims, increasing prevalence of theft and vandalism, and technological advancements in insurance sector majorly contribute toward the growth of the market.

The key players profiled in the report include insurance claim services market analysis includes top companies operating in the market such as Pegasystems Limited, Hexaware Technologies Inc., Software AG, Avaya Inc., Cognizant Technology Solutions, Accenture PLC., International Business Machines Corporation, Oracle Corporation, HCL Technologies, DXC Technology Company.

The key growth strategies of Insurance claim services players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...