Intelligent Process Automation Market Overview

The global intelligent process automation market size was valued at USD 13.4 billion in 2022, and is projected to reach USD 50.7 billion by 2032, growing at a CAGR of 14.6% from 2023 to 2032.

Introduction

Intelligence Process Automation (IPA) refers to the software of advanced technology, consisting of artificial intelligence (AI) and device-gaining knowledge of (ML), to streamline and beautify cognitive duties and choice-making tactics within numerous domains. This automation objective is to optimize workflows by correctly dealing with statistics analysis, pattern recognition, and trouble-solving, among other cognitive functions. Through IPA, repetitive and hard work-intensive tasks are computerized, allowing faster, more accurate, and insightful decision-making. In addition, IPA enables actionable insights to be extracted from many cases that would otherwise be difficult to handle manually. This increases good decision-making, leading to better processes and results. Moreover, automation reduces the possibility of human error, thus increasing reliability and reducing risks associated with incorrect decision-making.

The fusion of ML with analytics amplifies predictive capabilities, enabling proactive strategies rather than reactive approaches. This predictive power helps organizations forecast trends, identify potential risks, and seize opportunities swiftly. The increasing integration of ML and advanced analytics is thus reshaping the intelligence process automation market, fostering a landscape where businesses can leverage data-driven intelligence to optimize operations, innovate offerings, and gain a competitive edge is propelling the growth of the cloud local technologies market.

However, the expenses linked with developing, deploying, and maintaining these sophisticated systems pose a significant barrier to widespread adoption. The initial investment encompasses acquiring cutting-edge technologies, hiring skilled professionals, and customizing solutions to meet specific organizational needs. On the other hand, the integration of robust monitoring and fraud detection mechanisms not only fortifies security but also propels the development and adoption of more advanced technologies to meet evolving challenges in the realm of data protection and intelligence automation.

The report focuses on growth prospects, restraints, and trends of the market analysis. The study provides Porter five forces analysis to understand the impact of various factors, such as the bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the market.

Segment Review

The intelligent process automation market is segmented on the basis of component, technology, organization size, deployment mode, industry vertical, and region. On the basis of the component, the market is bifurcated into solution, and services. By technology, the market is classified into natural process automation, machine and deep learning, computer vision, virtual agents, and others. On the basis of the organization size, the market is bifurcated into large enterprises and small & medium-sized enterprises. By deployment mode, it is categorized into on-premises and cloud. By industry vertical, it is divided into BFSI, retail, manufacturing, healthcare, IT & telecom and others. On the basis of region, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

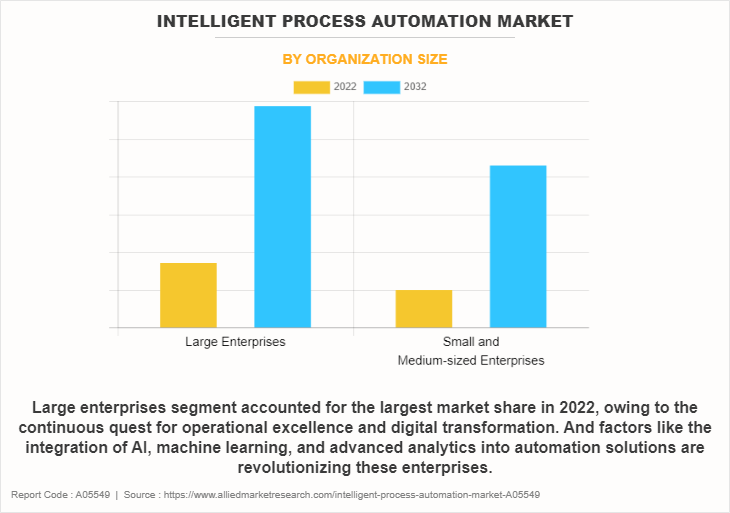

By organization size, the large enterprise segment held the highest intelligent process automation market share in 2022, owing to the growing trend of hybrid work models has accelerated the demand for IPA to enable seamless remote operations and collaboration. However, the small and medium-sized enterprises segment is projected to manifest the highest CAGR from 2023 to 2032, owing to the increase in cloud adoption among SMEs is opening avenues for IPA solutions delivered as a service, reducing upfront investment and maintenance costs, further fueling growth.

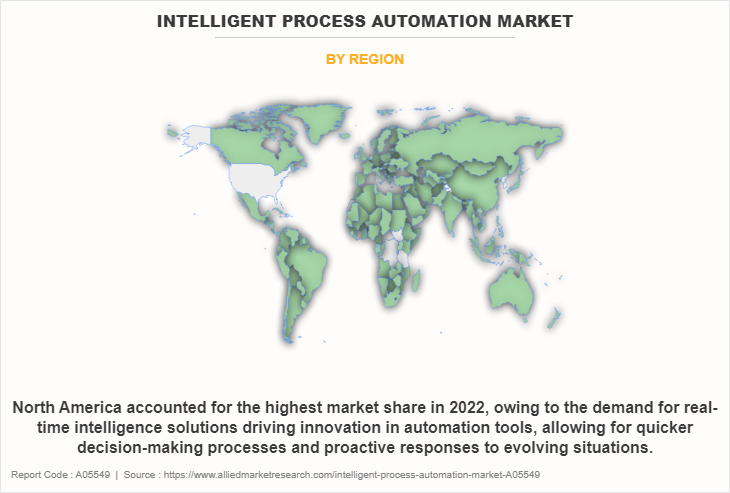

By region, North America attained the highest intelligent process automation market share in the market owing to the growing emphasis on cybersecurity creating a significant opportunity within the intelligence process automation market. With the escalating frequency and sophistication of cyber threats, there's a pressing need for automated intelligence systems that can swiftly detect, analyze, and respond to potential breaches or attacks. However, the market for intelligent process automation is expected to develop at the fastest rate in the Asia-Pacific region, owing to the growing focus on digital transformation initiatives by governments and enterprises propelling the intelligent process automation Industry growth across the Asia-Pacific region.

Key Market Players

Some of the key players profiled in the report include Accenture, Atos SE, Capgemini, Cognizant, Genpact, HCL Technologies, IBM Corporation, Infosys, Pegasystems, and Tech Mahindra. These players have adopted various strategies to increase their market penetration and strengthen their position in the market.

Key Industry Devlopment

Recent partnerships in the Market

For instance, in May 2023, Bain & Company had a strategic alliance with Ashling Partners, a leading global provider of automation consulting and implementation services and an industry-recognized expert leader in these fields. Bain is directly investing in Ashling to deepen its collaboration with a key partner in Bain‐™s Vector digital practices. Ashling is backed by THL, a premier private equity firm investing in middle-market growth companies.

Further, in June 2023, Robocorp, the forefront Intelligent Process Automation (IPA) company, has announced its partnership with Siili Solutions Plc, a full-service development partner for innovating, designing, building, and running digital services. This collaboration brings together two champions of open-source automation and empowers organizations in their transition from legacy to new-generation intelligent process automation.

Recent Collaboration in the Market

In June 2023, expanding their decades-long collaboration, Accenture and Microsoft collaborated to help organizations adopt the disruptive power of generative AI, accelerated by the cloud, to fundamentally transform their businesses. Together with their joint venture Avanade, the companies are co-developing new AI-powered industry and functional solutions to help clients harness generative AI across the enterprise.

Recent Product Launches in the Market

In November 2023, Hikrobot participated in the 16th edition of Automation Expo-2023 to showcase its latest cutting-edge technology and intelligent solutions. Hikrobot launched the four new products at the event. It has also displayed three types of Mobile Robots (LMR, FMR and CTU). The event was inaugurated by the Chief Guest Vinayak Pai, Managing Director and CEO, Tata Projects in the presence of guest of honor Vinayak Marathe, Head India Business Operations, Phillips Townsend Associates and other dignitaries from the Indian Automation Industry.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of market analysis from 2022 to 2032 to identify the prevailing intelligent process automation industry opportunities.

The report provides a comprehensive analysis of the current market estimations through 2022-2032, which would enable the stakeholders to capitalize on prevailing market opportunities.

In-depth analysis of intelligent process automation market growth assists in determining the prevailing market opportunities.

The report includes an analysis of the regional as well as market share, key players, market segments, application areas, and market growth strategies.

Major countries are mapped according to their revenue contribution to intelligent process automation market size.

Identify key players and their strategic moves in the intelligent process automation market forecast.

Assess and rank the top factors that are expected to affect the growth of intelligent process automation market outlook.

Intelligent Process Automation Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 50.7 billion |

| Growth Rate | CAGR of 14.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 356 |

| By Component |

|

| By Technology |

|

| By Deployment Mode |

|

| By Organization Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | IBM Corporation, Pegasystems, Atos SE, Genpact, HCL Technologies Limited, Accenture, Capgemini, Infosys Limited, Cognizant, Tech Mahindra Limited |

Analyst Review

According to CXOs of the leading companies, IPA contributes to cost savings by reducing human involvement in repetitive and labor-intensive tasks. This enables quality allocation and operational efficiencies, resulting in a cost-effective business model. Moreover, integrating IPA fosters a culture of innovation by empowering end users with business insights and data-driven techniques. This innovation-driven approach propels organizations towards growth, competitiveness, and sustained success in their respective industries. Overall, Intelligence Process Automation empowers end-users by augmenting decision-making capabilities, enhancing operational efficiency, fostering adaptability, driving cost savings, and nurturing a culture of innovation within organizations.

The increasing adoption of Robotic Process Automation (RPA) has been a driving force behind the growth of the Intelligence Process Automation (IPA) market. RPA involves the use of software robots or "bots" to automate repetitive, rule-based tasks, allowing businesses to streamline operations and enhance efficiency. However, the initial investment encompasses acquiring cutting-edge technologies, hiring skilled professionals, and customizing solutions to meet specific organizational needs. In addition, ongoing costs include regular updates, maintenance, and data security measures. Such substantial financial commitments often dissuade smaller organizations or those with limited budgets from embracing IPA solutions.

Despite those obstacles, the cloud local utility marketplace is expected to be bigger as more organizations realize the benefits of intelligent process automation natively within the cloud. Intelligent automation helps drive cost optimization, which is a top priority for organizations given the current geopolitical and financial disruptions impacting the market. In May 2023, Everest Group recognized Capgemini as a Leader in its Intelligent Process Automation (IPA) Solutions PEAK Matrix® 2023, for the third year running. According to Everest Group, Capgemini’s strength in IPA is its vision to help enterprises accelerate their automation journey through reusable and interconnected industry-specific automation competencies. And digital twin offering that leverages process mining partnerships to create a virtual representation of its clients’ finance functions to identify bottlenecks and inefficiencies

Some of the key players profiled in the report include Accenture, Atos SE, Capgemini, Cognizant, Genpact, HCL Technologies, IBM Corporation, Infosys, Pegasystems, and Tech Mahindra. These players have adopted various strategies to increase their market penetration and strengthen their position in the intelligent process automation market.

The global intelligent process automation market size was valued at USD 13.4 billion in 2022, and is projected to reach USD 50.7 billion by 2032

The global intelligent process automation market is projected to grow at a compound annual growth rate of 14.6% from 2023 to 2032 to reach USD 50.7 billion by 2032

Accenture, Atos SE, Capgemini, Cognizant, Genpact, HCL Technologies, IBM Corporation, Infosys, Pegasystems, and Tech Mahindra is the top companies to hold the market share in Intelligent Process Automation

North America is the largest regional market for Intelligent Process Automation.

The Intelligent Process Automation market is driven by the need for operational efficiency, digital transformation, and effective data management. Its scalability, flexibility, and ability to reduce costs and errors further fuel adoption across industries.

Loading Table Of Content...

Loading Research Methodology...