Internet Advertising Market Size & Share:

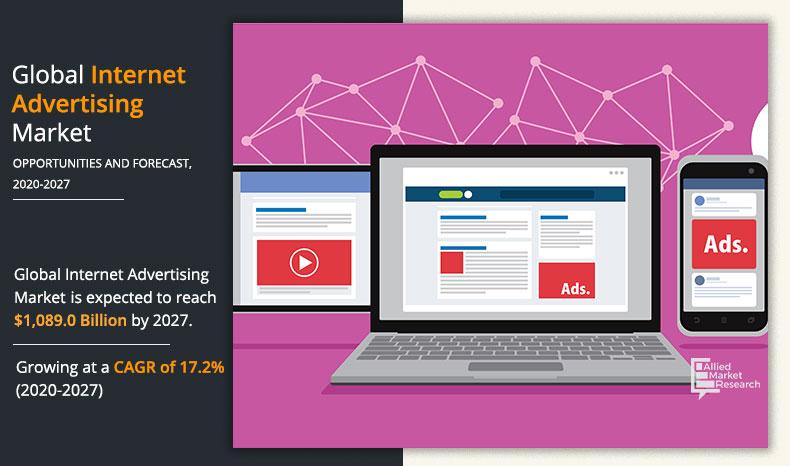

The global internet advertising market size was valued at USD 319 billion in 2019, and is projected to reach USD 1,089 billion by 2027, registering a CAGR of 17.2% from 2020 to 2027.

Internet advertising is the process of using the internet as a medium to deliver marketing or promotional messages to an identified as well as intended audience. It helps to attract website traffic & brand exposure, and is designed to encourage the targeted consumer to engage in a specific action such as making a purchase. It is one of the most effective ways for all businesses to find new customers, expand their reach, and diversify their revenue streams. Businesses use internet advertising (such as banners, pay-per-call ads, pay-per-click ads, and pop-ups) in e-newsletters, on search engines, on compatible websites, and in online versions of magazines and newspapers as a way of reaching out to people who use the internet for shopping or to gather information. Internet advertising not only helps brands to find the right audience but it is also the fast & easy way of advertising, which helps keep the target audience engaged.

By platform type, the global internet advertising market share was dominated by the mobile segment in 2019, and is expected to maintain its dominance in the coming years due to various factors such as increase in mobile device and mobile internet users, growth in popularity of social media, and time spent on mobile devices. Furthermore, the key players-operating in the mobile-based advertising industry create and develop mobile advertising content that can easily support mobile devices. Moreover, rise in trend of e-commerce and m-commerce further propels growth in internet advertising on mobile platform as more and more people use their mobile phones to browse the internet and enjoy internet-based shopping services.

By Platform Type

Mobile platform is projected as one of the most lucrative segments.

By industry vertical, the global internet advertising market share was dominated by the retail & e-commerce segment in 2019, and is expected to maintain its dominance in the coming years due to the rise in need for smaller businesses in the retail and consumer goods industry to compete with larger organizations in an increasingly competitive marketplace filled with innovation. Various retailers are advancing their internet advertising strategies to enable shoppers know about their business and drive traffic to their e-commerce site.

By Industry Vertical

Media & Entertainment industry is one of the most significant segments.

North America dominates the internet advertising market due to the surge in advertisers’ spending on digital advertising. This is a major factor that drives the growth of the market in this region. For instance, the Olympic Games in Tokyo and the 2020 elections are anticipated to boost ad spending in the U.S., helping to propel the internet advertising market growth. Magna Global, the strategic global media unit of IPG Mediabrands, expected the U.S. ad spending to increase at the rate of 5.1% in 2019 to 6.6% in 2020. H

owever, Asia-Pacific is expected to observe highest growth rate during the forecast period as the proliferation of mobile, social media, and apps is the major driving factor for the progressively growing internet advertising market across the region. Particularly, in countries, such as India, China, and Indonesia, apps are growing importance due to the ubiquity of smartphone usage as well as gaming.

By Pricing Model

Hybrid revenue model is projected as one of the most lucrative segments.

The report focuses on the growth prospects, restraints, and internet advertising market opportunity. The study provides Porter’s five forces analysis of the internet advertising industry to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the internet advertising market trends.

By Enterprise Size

SME's are projected as one of the most lucrative segments.

Segment Review:

The internet advertising market is segmented on the basis of type, platform, organization size, industry vertical, and region. On the basis of type, it is categorized into search engine advertising/search engine marketing, display advertising, mobile advertising, social media advertising, video advertising, online classifieds ads, and others. Based on platform, it is classified into mobile; laptop, desktop, & tablets; and others. As per the enterprise size, it is bifurcated into large enterprises and small & medium-sized enterprises. Depending on industry vertical, it is divided into automotive, healthcare, media & entertainment, BFSI, education, retail & consumer goods, transport & tourism, IT & telecom, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Ad Format

Social Media Advertising ad format is projected as one of the most lucrative segments.

On the basis of Ad format, the search engine advertising or search engine marketing segment exhibited the highest growth in the internet advertising industry in 2019, and is expected to maintain its dominance in the coming years due to the rise in number of consumers who are shopping and researching for products online. In addition, the increase in need of multinational companies to become more reachable, searchable, and visible across the internet propels the growth of the search engine advertising market. However, the social media advertising segment is expected to witness the highest growth as the due to the accelerating demand of social media platforms.

By Region

Asia-Pacific region is projected as one of the most significant segments.

Top Impacting Factors:

The growth of the global internet advertising market is driven by factors such as extensive adoption of smartphones, emergence of high-speed internet, proliferation of social media, rise in advertising spends on digital media across various industries, and increase in popularity of streaming platforms. In addition, the increase in interest of business owners for online advertising due to COVID-19 to increase brand awareness and to gain competitive advantage fuels the market growth. However, rise in adoption of ad-blockers to avoid online advertising hinders the market growth to some extent.

On the contrary, emergence of advertising automation is anticipated to provide lucrative opportunities for the market growth. In addition, rise in adoption of identity-based pay-per-click marketing by businesses to achieve greater success in their marketing is expected to be opportunistic for the online advertising market growth during the internet advertising market forecast period.

Extensive Adoption of Smartphones and Emergence of High-speed Internet

The use of smartphones has grown rapidly and the way consumers interact with various brands or sellers has transformed, owing to the accessibility of high-speed internet on smartphones. This factor is expected to fuel the internet advertising market growth as it has become crucial for brands to understand consumers’ interests with the help of smartphone advertisements and to stimulate their decision to purchase. Smartphones provide real-time marketing opportunities for advertisers to engage with users who truly want to associate with their brands.

In addition, the market players offer new internet advertising solutions due to the rapidly growing demand for smartphone-based internet advertising, which is expected to further drive the internet advertising market. For instance, in October 2019, Tech Mahindra, an IT services provider, collaborated with InMobi, a marketing cloud firm, to offer a video advertising solution. The solution enables advertisers to develop and distribute engaging and innovative video advertisements on mobile phones.

Emergence of Advertising Automation

Automation technologies are rapidly emerging into the advertising sector. This is opportunistic for the online advertising market growth as automated internet advertising has provided benefits, such as efficiency, scale, and low cost, to advertising. The rise in adoption of automation technologies can be observed across various advertising platforms such as Google and Facebook.

For instance, Google has integrated advertising automation through automated bidding strategies, automated ad copy, and automated PPC reporting. On the other hand, Automated Rules by Facebook automatically check users’ campaigns, ad sets, & ads and help them manage multiple ads they are running at the same time. It is expected that by the end of 2020, 80% of the internet advertising process will be automated and the remaining 20% will consist of the advertising elements that would constantly need human connection such as storytelling, brand value, and other experiential tactics. Therefore, the emerging trend of automation technologies in internet advertising is expected to provide numerous opportunities for the internet advertising market.

Key Benefits for Stakeholders:

- This study includes the internet advertising market analysis, trends, and future estimations to determine the imminent investment pockets.

- The report presents information related to key drivers, restraints, and opportunities of the online advertising market.

- The internet advertising market size is quantitatively analyzed from 2019 to 2027 to highlight the financial competency of the industry.

- Porter’s five forces analysis illustrates the potency of buyers & suppliers in the internet advertising market.

Internet Advertising Market Report Highlights

| Aspects | Details |

| By PLATFORM TYPE |

|

| By Ad Format |

|

| By Pricing Model |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | ALIBABA GROUP HOLDINGS LIMITED, GOOGLE LLC, VERIZON COMMUNICATION INC., BAIDU , INC., MICROSOFT CORPORATION, INTERNATIONAL BUSINESS MACHINES CORPORATION, FACEBOOK ,INC., TWITTER INC., AMAZON WEB SERVICES, INC., HULU LLC. |

Analyst Review

The internet advertising industry is going through an enormous transformation and growth. Technological transformation as well as boundless changes took place, owing to rise of mobile devices, data broker’s data gathering capabilities, social networks, behavioral targeting, and real-time bidding. This technological transformation also enables the concerns relating to consumer security, privacy, advertising effectiveness, and metrics fraud. However, the global internet ad spending is mounting at an average rate of about 13% per year, which is mainly driven by mobile internet advertising.

Internet advertising has brought an opportunity for small businesses and startup brands to compete with big as well as established corporations in real-time. The current business scenario is witnessing an upsurge in the usage of internet advertising across various verticals such as automotive, healthcare, media & entertainment, BFSI, education, and retail & consumer goods. Internet advertising has enabled quick turnarounds for small businesses in these industries to establish and maintain brand image, engagement, reputation, and growth with proper tools and implementation. In addition, rise in trend among small as well as large businesses to use social media promotions is anticipated to fuel the market growth during the forecast period. For instance, as per the 2019 survey, 48% of small businesses planned to use social media as one or more of their marketing tactics in 2019.

Moreover, the rapid growth of multimedia content on the internet creates enormous opportunities for the internet advertising market, thereby enabling push-based advertising to become trust-based advertising. According to IAB’s 2019 Video Advertising Spend Report, 74% of the U.S. consumers (13+) watch online or streaming video at least weekly and 41% watch daily. In addition, 78% of digital video viewer wishes to watch online advertising in exchange for free content. This scenario has led to increase in digital video ad spend to climb as the online video viewers pay closer attention to both content and ads, especially while watching educational videos.

Furthermore, emerging technologies and developments across advertising industries are expected to further boost the internet advertising market. These developments include advancements in connected TV and OTT, which are expected to enable consumers to interact with ads from their televisions & phones and lead to increased product placement within streaming video. Artificial intelligence (AI) development for online content is projected to enable more personalization in digital video. Furthermore, 5K technology is anticipated to transform how consumers use online content, which is expected to sharply escalate the use of mobiles among all age groups. These factors are expected to provide lucrative growth opportunities for the internet advertising market.

The internet advertising market is competitive and comprises a number of regional and global vendors competing based on factors such as cost of solutions & services, reliability, efficiency of the advertisement, and support services. The market is concentrated with major players consuming 50–60% of the share. The degree of concentration is expected to remain the same during the forecast period. Moreover, vendors operating in the market offer advanced internet advertising solutions to improve the marketing strategies of enterprises, owing to the intense competition. In addition, companies heavily invest in R&D activities to develop effective internet advertising technology and service, which is opportunistic for the market growth. For instance, the business of Facebook is heavily dependent on technology and continuously invests in new advertising technologies to grow its business and the effectiveness of its advertisements & advertising campaigns. The R&D investment of Facebook for the quarter ending of September 2020 was $4.763 billion, which is 34.24% increase year-over-year.

Loading Table Of Content...