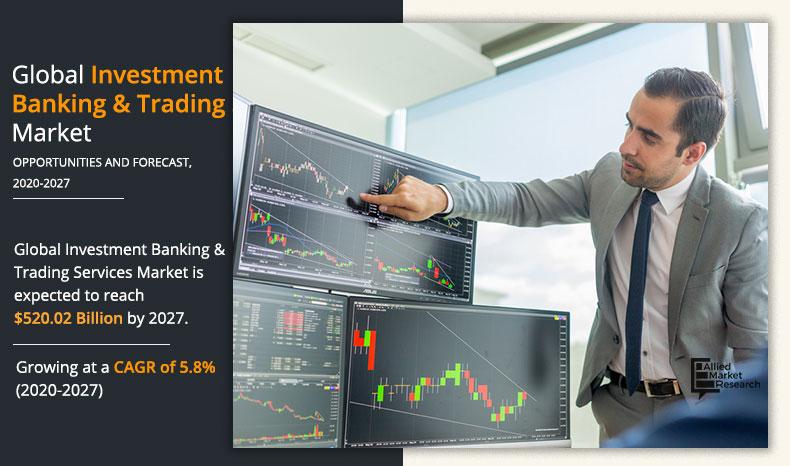

The global investment banking & trading services market size was valued at $267,864.0 million in 2019, and is projected to reach $520,026.0 million by 2027, growing at a CAGR of 5.8% from 2020 to 2027.

Investment banking involves the rising of capital & provides financial consultancy services to individuals and organizations. With becoming one of the major segments of the financial services industry, investment banking & trading services assists companies, institutions, and governments with underwriting services and executing transactions such as mergers and acquisitions (M&A), market-making, securities trading for both equities and fixed income, and others. Primarily, investment banking deals with the creation of capital for other companies, governments, and other entities.

Rise in huge financial challenge among business, investors, & other external forces that affects a business to arrange finances for their business expansions has become the foremost growth factor for the market. In addition, surge in demand for fundamental advisory from corporate companies and increase in need for capital requirements & business expansion among firms are the major factors that propel the investment banking & trading services market growth.

There is rapid growth in cyber-attacks & data thefts and stringent government regulations affecting the investment banking & trading services industry as several countries have specific regulations for financial operations in the market. These factors are expected to limit the investment banking & trading services market growth. Furthermore, developing economies offer significant opportunities for investment banking solution providers to expand & develop their offerings, especially among emerging economies such as Australia, China, India, Singapore, and South Korea. In addition, rise in mergers & acquisitions (M&A) and continuous improvement in business environment are expected to provide lucrative opportunities during to the investment banking & trading services forecast period.

On the basis of industry vertical, the BFSI segment acquired the major share of the investment banking & trading services market in 2019, and is projected to maintain its dominance during the forecast period. Moreover, investment banking primarily provides trading & related services such as underwriting and securities sales to manage risk & raise funds. In addition, demand for these services among financial operators such as banks, insurance companies, brokerages, and financial advisors are continuing to rise in the market.

The report focuses on growth prospects, restraints, and trends of the investment banking & trading services market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the investment banking & trading services market.

Segment review

The investment banking & trading services market is segmented on the basis of service type, industry vertical, and region. On the basis of service type, the market is segmented into equity underwriting & debt underwriting services, trading & related services, financial advisory, and others. Based on industry vertical, the market is segmented into BFSI, healthcare, manufacturing, energy & utilities, IT & telecom, retail & consumer goods, media & entertainment, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Service Type

Trading and related services accounted for the largest market share in 2019

The report analyses the profiles of key players operating in the investment banking & trading services market such as Bank of America Corporation, Barclays, Citigroup, Inc., CREDIT SUISSE GROUP AG, Deutsche Bank AG, Goldman Sachs, JPMorgan Chase & Co., Morgan Stanley, UBS, and Wells Fargo. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

COVID-19 impact analysis

In the wake of COVID-19 pandemic, investment banking & trading services providers has experienced significant revenue growth in the year 2020. However, key players have faced several challenges such as market democratization, increased client sophistication, evolving financial regulations, a shift to remote working arrangements, and rapid technology advances. Moreover, banks & financial institutions providing investment banking solutions are continuing to retool existing business models and operational platforms for sustaining in the market during the pandemic situation.

By Industry Vertical

Healthcare is expected to attain significant growth during the forecasted period

Top impacting factors

Increase in need for capital requirements & business expansion among firms

Several enterprises or firms operating at a large-scale & medium scale generally require capital & expansion of existing business in terms of size and operations. In addition, investment banking & trading services helps these firms raise funds and plays a vital role in the launch of initial public offerings (IPOs) to meet their needs of capital requirement & business expansion. Moreover, in firms having limited access to funds, investment banking helps in preparing a bond offering, negotiates a merger, or arranges a private placement of bonds for running their business operations. Therefore, capital requirement by both large-scale & medium scale firms is becoming a major driving factor for the investment banking & trading services market.

Untapped potential of emerging economies

Developing economies offer significant opportunities for investment banking & trading services providers to expand their offerings as financial activities are continuing to rise in the emerging economies. High investments for digital transformation, adoption of new technologies, such as artificial intelligence, Big Data, machine learning, & chatbots, and rapid expansion of domestic enterprises especially among countries such as Australia, China, India, Singapore, and South Korea are expected to create potential for the investment banking & trading services market in the coming years. Moreover, in these developing countries, the economy is rising at a faster rate and business activities are expanding. These factors are creating a huge demand for investment banking & trading services to keep up with the growing environment.

By Region

Asia-Pacific would exhibit the highest CAGR of 12.3% during 2020-2027.

Key benefits for stakeholders

- The study provides in-depth analysis of the global investment banking & trading services market share along with current & future trends to illustrate the imminent investment pockets.

- Information about key drivers, restrains, & opportunities and their impact analysis on the market size are provided in the report.

- Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the industry.

- An extensive analysis of the key segments of the industry helps to understand the global investment banking & trading services market trends.

- The quantitative analysis of the global investment banking & trading services market from 2020 to 2027 is provided to determine the market potential.

Investment Banking & Trading Services Market Report Highlights

| Aspects | Details |

| By Service Type |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | BARCLAYS, BANK OF AMERICA CORPORATION, GOLDMAN SACHS, CITIGROUP, INC., MORGAN STANLEY, CREDIT SUISSE GROUP AG, .DEUTSCHE BANK AG, UBS, JPMORGAN CHASE & CO., WELLS FARGO |

Analyst Review

Increase in mergers & acquisitions (M&A) and rapid expansion of business are becoming major trends in the market. In addition, investment banking underwrites stock & bond and issues new securities & buying public primarily institutional investors, such as mutual funds or pension funds, which are the major factors that propel the global investment banking & trading services market growth. In addition, the COVID-19 outbreak has a moderate impact on the investment banking market due to several factors, such as changing consumer expectations, emerging technologies, and new business models, during the pandemic. Moreover, to curb the spread of coronavirus, banks are rebuilding & redesigning their existing business operations to continue providing effective investment banking services. However, a considerable number of banks perceive that they have minimum investment banking exposure. This scenario is changing, and 2019 has witnessed an increase in sales of investment banking, owing to rise in mergers & acquisitions among firms & businesses across regions. This led to the high demand for investment banking solutions, which led to innovations & new trends in the global investment banking & trading services market.

The investment banking & trading services market is consolidated with the presence of regional vendors such as Goldman Sachs, JPMorgan Chase & Co., and Morgan Stanley. North America and Europe dominated the investment banking market, in terms of revenue in 2019, and are expected to retain their dominance during the forecast period. However, Asia-Pacific is expected to experience significant growth in the future, owing to emerging economies and increase in government support toward banking & financial institutions for providing investment banking & trading services in the region. Furthermore, the investment banking & trading services market is particularly brisk in countries, such as India, Australia, China, Japan, Indonesia, and Singapore, with high GDP growth and rise in per capita income.

Some key players profiled in the report include Bank of America Corporation, Barclays, Citigroup, Inc., CREDIT SUISSE GROUP AG, Deutsche Bank AG, UBS, and Wells Fargo. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Loading Table Of Content...