IoT Insurance Market Research, 2032

The global IoT insurance market was valued at $31.5 billion in 2022, and is projected to reach $686.9 billion by 2032, growing at a CAGR of 36.4% from 2023 to 2032.

IoT in the insurance industry help insurers to collect granular data from a vast number of connected sensors to draw meaningful insights from the collected data. In addition, it delivers numerous benefits to insurance companies that include eliminating data duplications, speeding up and optimizing claims process, and removing customer frustrations. In addition, IoT-based equipment have been collecting and storing large amount of data that helps insurance companies to develop more accurate and customized insurance policy. Furthermore, IoT products deliver various features to insurance industries, which includes customer past experience, long-term analytics services, and important information that helps insurance companies to create accurate insurance premium for their customers.

Moreover, rise in adoption of IoT in developed and developing economies and growth in demand for cloud platform and other value-added services in the insurance industry are some of the important factors that boost the IoT insurance market across the globe. In addition, increase in investments by insurance companies in IoT technology to improve their operational efficiency propels the growth of the global IoT insurance market. However, security and privacy issues of personal information of customers and lack of skills among workers regarding the use of IoT devices restrict the growth of the market. Furthermore, increase in adoption of advance technologies such as machine learning and artificial intelligence among the insurance industry is expected to offer remunerative opportunities for expansion of the IoT insurance market forecast.

Segment Review

The IoT insurance market is segmented into Component, Insurance Type and Application.

The IoT insurance market is segmented on the basis of component, insurance type, application, and region. On the basis of component, the market is segmented into solution and service. On the basis of insurance type, the market is fragmented into life and health insurance, property and casualty insurance, and others. On the basis of application, it is bifurcated into automotive, transportation and logistics, life and health, commercial and residential buildings, business and enterprise, agriculture, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The global IoT insurance industry is dominated by key players such as International Business Machines Corporation, Cisco Systems, Inc., Oracle Corporation, SAP SE, Microsoft Corporation, Intel Corporation, Google LLC, Telit, Accenture and Synechron. These players have adopted various strategies to increase their market penetration and strengthen their position in the IoT insurance industry.

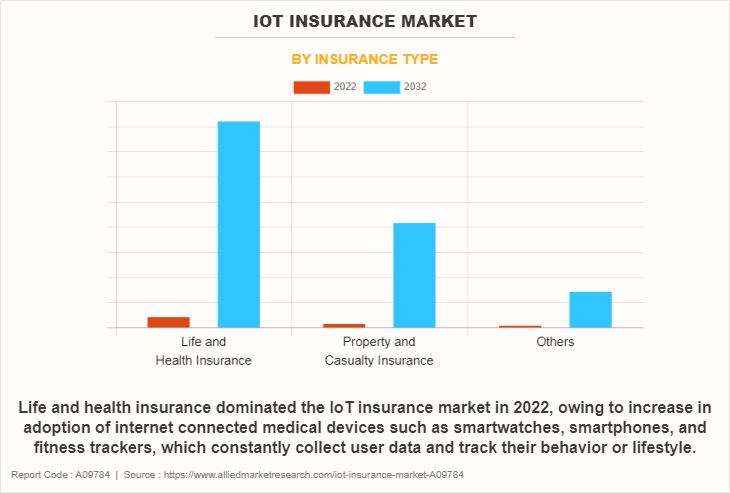

On the basis of insurance type, life and health insurance segment dominated the IoT insurance market growth in 2022 and is expected to maintain its dominance in the upcoming years owing to increase in adoption of internet connected medical devices such as smartwatches, smartphones, and fitness trackers, which constantly collect user data and track their behavior or lifestyle. However, property and casualty insurance segment is expected to witness the highest growth, owing to increase in adoption of machine to machine (M2M) communication products, implementing anti-lock brake systems to attain faster communication with vehicle users and increase in awareness among policyholders about premium are important factors that boost the IoT insurance market.

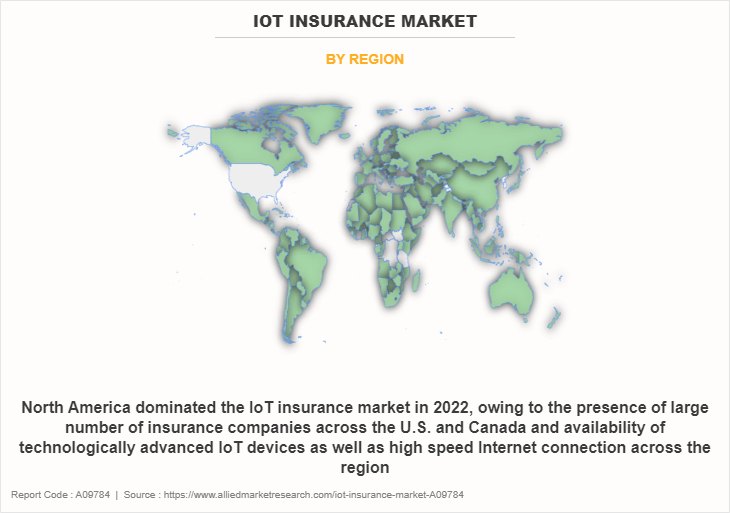

Region wise, the IoT insurance market size was dominated by North America in 2022 and is expected to retain its position during the forecast period, owing to the presence of large number of insurance companies across the U.S. and Canada and availability of technologically advanced IoT devices as well as high speed Internet connection across the region. However, Asia Pacific is expected to witness significant growth during the forecast period, owing to increase in use of IoT device such as drones, Wi-Fi dongles, wearables device, and inbuilt sensors among end-users that provides informative data.

The report focuses on growth prospects, restraints, and analysis of the global IoT insurance market trend. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global IoT insurance market share.

Top Impacting Factors

Rise in Adoption of IoT in Developed and Developing Economies

Growth in awareness regarding IoT technology, owing to its numerous benefits such as scalability, flexibility, security, and recovery are some of the major factors that are expected to drive the adoption of IoT products among developed and developing economies. In addition, several insurance organizations are inclined toward integrated customization services, which has increased adoption of IoT products across the globe. Moreover, rise in demand for IoT products among developing nations, owing to rise in connected devices among healthcare and automotive industries, propels the growth of the market.

Furthermore, leading technological innovators, especially cloud service providers are striving to innovate APIs that help insurance companies integrate workloads and applications into cloud with ease. Several market players have introduced new APIs in developing nations of Asia-Pacific and LAMEA to increase their market value and to surge their revenue opportunities, which drives the growth of the market.

Surge in Investment in IoT by Insurance Companies

Internet of Things is revolutionizing the traditional insurance businesses at an unprecedented rate. The IoT technology used in insurance companies helps insurers to collect large amounts of data from connected devices such as telematics and telemedicine and also assist companies to draw meaning full insight from it. Hence, most of the larger insurance providers such as UnitedHealth Group, Allianz SE, and State Farm Group have started investment in the IoT technology to improve their operational process. In addition, rise in need of advance technology among the insurance business for claim process flexibility and availability of high speed Internet connectivity across the globe are some of the important factors, which force insurance companies to make investment in IoT technology. The data collected from IoT devices offers numerous benefits to insurers that include immediate claim management process, creating affordable insurance product based on consumer behavior and reduce the claim settlement time, which attracts insurance providers to make investment in IoT technology.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the IoT insurance market analysis from 2022 to 2032 to identify the prevailing iot insurance market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the IoT insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global IoT insurance market opportunity.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players in IoT insurance market outlook.

- The report includes the analysis of the regional as well as global IoT insurance market trends, key players, market segments, application areas, and market growth strategies.

IoT Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 686.9 billion |

| Growth Rate | CAGR of 36.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 344 |

| By Component |

|

| By Insurance Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Telit, Accenture, Google LLC, Synechron, Cisco Systems, Inc., SAP SE, Oracle Corporation, Intel Corporation, International Business Machines Corporation, Microsoft Corporation |

Analyst Review

Adoption IoT insurance has increased over time, owing to its numerous benefits such as improving operational efficiency of insurance companies, speeding up of claim management process, and reducing fraudulent activities in the claim process. In addition, IoT technology helps vehicle insurance companies to deliver pay-as-you-drive insurance services, which enhances demand for IoT devices among insurance companies. Moreover, various insurance companies among developing nations of Asia-Pacific and LAMEA are rapidly adopting IoT devices to streamline field operations to boost competitive advantage in the market.??

Key providers of IoT insurance such as International Business Machines Corporation, Oracle Corporation, Microsoft Corporation, Cisco Systems Inc., and Accenture PLC account for a significant share in the market. According to industry experts, IoT insurance is expected to witness increased adoption in upcoming years, owing to rise in adoption of connected medical devices such as fitness tracker and smartwatches among people to get health information at a faster pace. Therefore, increase in adoption of advance IoT technology in insurance industries in developing nations, such as China, India, Japan, and Thailand, is expected to provide lucrative opportunities for the market growth. North America is expected to dominate the market during the forecast period while emerging countries in Asia-Pacific and Latin America are projected to offer significant growth opportunities.??

For instance in April 2022, Hitachi Solutions America, Ltd., a global systems with leading capabilities in Microsoft solutions and technologies, partnered BitBrew, a leader in enabling smart connectivity and mobility services. The alliance combines BitBrew’s Edge-to-AI Connected Vehicle Platform with Hitachi Solutions, America’s insurance industry knowledge, enterprise integration, and deployment expertise to deliver innovative, data-driven vehicle health, and driver behavior solutions for the insurance industry. BitBrew’s Connected Vehicle Platform provides an end-to-end, plug-configure-play AI-based framework that simplifies and speeds development of mobility solutions. Availability of this platform allows Hitachi Solutions America to leverage real-time telematics data streams to rapidly deliver rock-solid, data-driven models, and connected, high-value services that better satisfy the demands of the insurance industry.

The global IoT insurance market was valued at $ 31479.64 million in 2022 and is projected to reach $ 686878.24 million by 2032, registering a CAGR of 36.4% from 2023 to 2032.

North America is the largest regional market for IoT Insurance Market

The global IoT insurance industry is dominated by key players such as International Business Machines Corporation, Cisco Systems, Inc., Oracle Corporation, Sap Se, Microsoft Corporation, Intel Corporation, Google Llc, Telit, Accenture and Synechron. These players have adopted various strategies to increase their market penetration and strengthen their position in the IoT insurance market.

Increase in adoption of advance technologies such as machine learning and artificial intelligence among the insurance industry is the leading application of IoT Insurance Market

Rise in adoption of IoT in developed and developing economies are the upcoming trends of IoT Insurance Market in the world.

Loading Table Of Content...

Loading Research Methodology...