Lead Acid Battery Market Overview

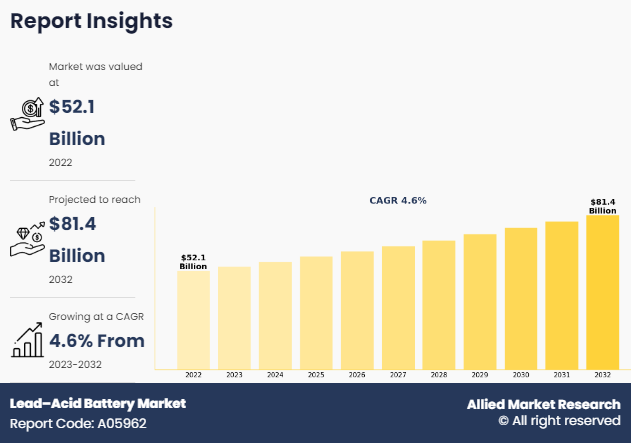

The global lead acid battery market was valued at USD 52.1 billion in 2022, and is projected to reach USD 81.4 billion by 2032, growing at a CAGR of 4.6% from 2023 to 2032. Some of the factors that surge the demand for lead acid batteries include rise in SLI applications in the automotive industry, growth in renewable energy production, and high demand for energy storage devices. Lead acid batteries are widely used in various applications such as telecommunications, data centers, healthcare facilities, emergency lighting systems, and other applications due to their unique characteristics and cost-effectiveness.

Key Market Trends & Insights

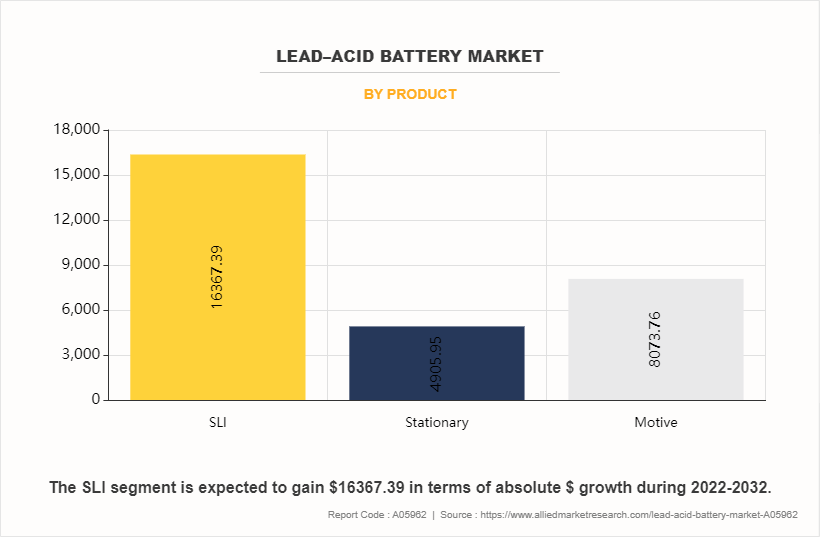

- The SLI segment accounted for the largest share and is expected to maintain its dominance throughout the forecast period.

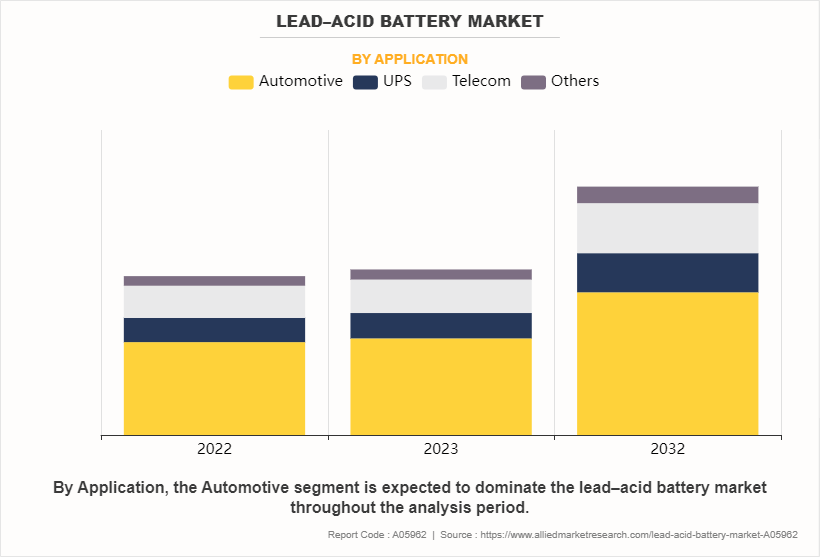

- The automotive segment holds the largest share, accounting for nearly three-fifths of market.

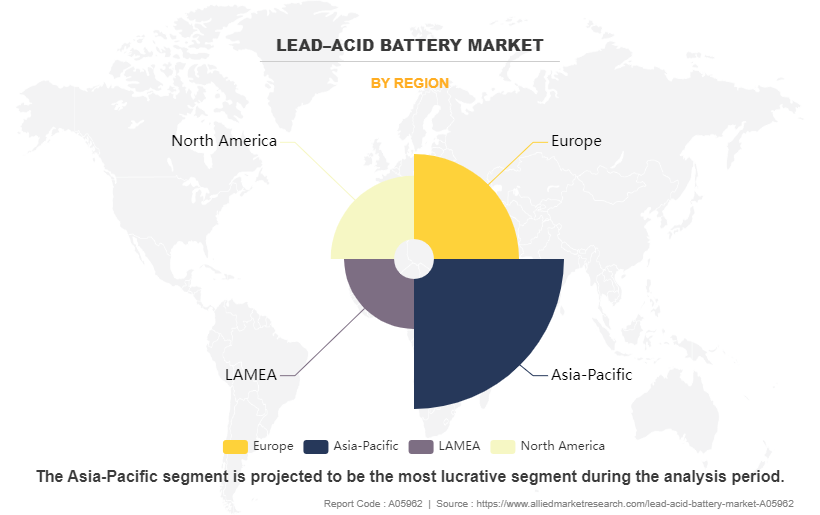

- Asia-Pacific led the market and is expected to remain dominant during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 52.1 billion

- 2032 Projected Market Size: USD 81.4 billion

- Compound Annual Growth Rate (CAGR) (2023-2032): 4.6%

Introduction

A lead cell is made from three basic components, such as anode, cathode, and electrolyte; where the anode is the negative terminal, cathode is the positive terminal, and electrolyte connects both these terminals to drive an electrochemical reaction to produce electricity. Lead acid batteries are widely used in various applications such as telecommunications, data centers, healthcare facilities, emergency lighting systems, and other applications due to their unique characteristics and cost-effectiveness.

Key Takeaways

- The lead acid battery market is highly fragmented, with several players including EnerSys, Crown Battery, East Penn Manufacturing Company, Inc., HOPPECKE, NorthStar, Hitachi Ltd., Exide Technologies, LLC, Teledyne Technologies Incorporated, Hankook AltasBX, and C&D Technologies.

- More than 6,765 product literatures, industry releases, annual reports, and other such documents of major industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study covers more than 20 countries in terms of lead acid battery market statistics value during the forecast period 2022-2032 is covered in the lead acid battery market report.

Market Dynamics

Developing countries are experiencing rise in infrastructure development, urbanization, and expanding telecommunications networks, which boost the demand for reliable power supply and backup power solutions. Lead acid batteries are a preferred choice for providing backup power in areas with intermittent or unreliable grid supply. These batteries are also used in off-grid or remote locations where access to electricity is limited, which is expected to boost the lead acid battery market in coming years.

Lead acid batteries are used as backup power systems in industries to provide uninterrupted power supply during outages or as a backup to various critical applications to avoid system crash due to sudden power cuts. Lead acid batteries are used in large material handling equipment applications, which drives the demand for lead acid batteries in industrial applications. Expansion of the telecom industry in countries such as the U.S., Brazil, India, and the UK leads to rise in adoption of lead acid batteries.

However, lithium-ion batteries are the major alternatives to lead acid batteries, as they have greater benefits. Therefore, availability of substitutes is anticipated to hamper the global lead acid battery market growth during the forecast period. Major technology giants including Google and Samsung are expanding their data centres to simplify data complexities. Hence, leading to rise in need for UPS systems in data centres across the globe, is expected to create lucrative growth opportunities in the global lead acid battery market during the forecast period.

Moreover, increase in penetration of renewable energy sources such as solar and wind power boosts the demand for energy storage systems and components in the market. Lead acid batteries are suitable for short-duration energy storage applications and may be cost-effective for small-scale renewable energy projects, which is expected to boost the lead acid battery market growth during the forecast period. Lead acid batteries are used to store excess energy generated from renewable sources and deliver it when needed, ensuring a more stable and reliable power supply.

Researchers and manufacturers are working on advancements in lead acid battery technology to improve their performance and characteristics. Advancements related to lead acid battery industry include developments in areas such as enhanced energy density, increased cycle life, faster charging capabilities, and improved tolerance to deep discharges. These advancements aim to expand the application range of lead acid batteries and make batteries more competitive with alternative battery technologies. Moreover, rise in focus on sustainability and environmental concerns is expected to create lucrative opportunities for lead acid battery market. The growth is attributed due to increase in battery recycling and the development of more sustainable battery materials.

In addition to their many advantages, lead acid batteries are extremely dangerous for the environment. Lead acid batteries contain lead, a toxic and environmentally hazardous material. Improper disposal or recycling of lead acid batteries may lead to environmental contamination and health risks. Stringent regulations and growing environmental concerns restrain the demand for lead acid batteries, particularly in regions with strong sustainability initiatives or regulations.

The technology used by lead acid batteries to store and transform electricity is outdated. Lead acid batteries have relatively slower charging and discharging rates as compared to other battery technologies. The slow charging factor may restrain the demand for lead-acid batteries in applications that require rapid energy transfer or high-power output.

Segment Overview

The lead acid battery market is segmented on the basis of product, construction method, application, and region. By product, it is segmented into SLI, stationary, and motive. By construction, it is bifurcated into the flooded lead-acid battery and valve regulated sealed lead acid battery (VRLA). By application, the market is divided into automotive, UPS, telecom, and others. The automotive segment is further divided into passenger cars, electric bikes, and transportation vehicles. Region-wise, it is studied across North America, Europe, Asia-Pacific, and LAMEA.

Global Market By Product

By product, the SLI segment accounted for the largest global lead acid battery market share in 2022. The primary advantage of SLI batteries is long cycle-life and weight reduction in vehicles. Additionally, rise in vehicle sales is expected to drive the sales of SLI batteries; thereby supporting the lead acid market growth. As per an article published by Elsevier B.V. in 2017, the demand for SLI batteries is expected to increase for many small and cheap ICE vehicles, especially in developing countries such as India, Indonesia, and China. This is attributed to lack of strict regulatory concerns governing the use of vehicle batteries and issues of CO2 emission penalties. Furthermore, these batteries are considered as a cost-effective source of energy by vehicle owners, who replace batteries after a specific time instead of buying expensive alternatives, such as lithium-ion battery, available in the market.

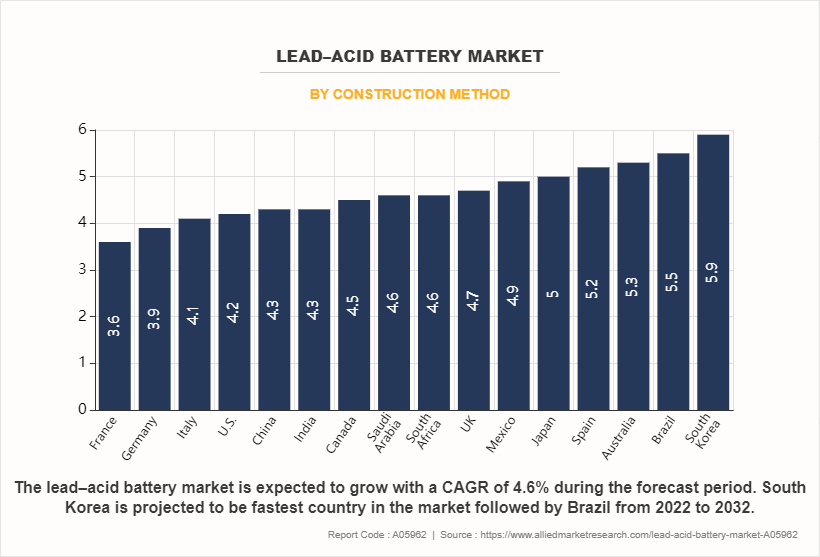

Global Market By Construction Method

By construction method, the flooded battery segment dominated the global lead acid battery market in 2023. The demand for flooded lead acid batteries is also high in diesel-electric submarines to power electric motors and nuclear submarines as an emergency power backup. Therefore, increasing marine trade activities are likely to offer healthy growth opportunities for flooded lead-acid batteries during the forecast period. The use of these batteries in forklift trucks is also rising significantly owing to their cost-effective nature, as forklift trucks are mainly used in the material handling industry, where productivity and low cost are of immense importance.

Global Market By Application

By application, the automotive segment dominated the global market in 2022. Balanced supply demand gap in the automotive industry, trend for electric vehicles, and demand for cost competitive energy sources are the major factors that drive the growth of the lead acid battery market.

Global Market By Region

Among all regions, Asia-Pacific was the largest regional market in 2023 and is expected to be the largest during the lead acid battery market forecast period. High demand for cost-effective energy storage devices, active participation of Asia-Pacific countries in mandatory renewable energy targets, growth in population, and rise in demand for UPS systems mainly drive the growth of the market. Moreover, flourishing automotive production across the globe further contributes to the growth of this market.

Key Lead Acid Battery Companies:

The major players operating in the lead acid battery industry include

- EnerSys

- Crown Battery

- East Penn Manufacturing Company, Inc.

- HOPPECKE

- NorthStar

- Hitachi Ltd.

- Exide Technologies, LLC

- Teledyne Technologies Incorporated

- Hankook AltasBX

- C&D Technologies

In 2023,Exide Industries subsidiary, Chloride Metals, has recently launched commercial production of its fourth lead battery recycling plant in India. This plant, located in Maharashtra, has an initial capacity of 96,000 metric tonnes per annum, with plans to increase it to 120,000 metric tonnes per annum.

Key Market Trends

- On the basis of product, the SLI segment registered the highest accounting for nearly three-fifths of the lead acid battery market size and is projected to maintain the same during the forecast period.

- On the basis of construction method, flooded segment registered the highest market share accounting for nearly three-fourth of the market share in 2022.

- On the basis of application, automotive segment dominates the highest market share accounting for nearly three-fifths of the market share in 2022.

- On the basis of region, Asia-Pacific dominates the market, accounting for nearly two-fifths of the market share in 2022.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the lead acid battery market overview segments, current trends, estimations, and dynamics of the lead acid battery market analysis from 2022 to 2032 to identify the prevailing lead acid battery market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the lead acid battery market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global lead acid battery market trends, key players, market segments, application areas, and market growth strategies.

Lead-Acid Battery Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 81.4 billion |

| Growth Rate | CAGR of 4.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 210 |

| By Product |

|

| By Construction Method |

|

| By Application |

|

| By Region |

|

| Key Market Players | Teledyne Technologies Incorporated, C&D Technologies, Crown Battery, HOPPECKE, Hankook AltasBX, Exide Technologies, LLC, Hitachi Ltd (Hitachi Chemical Co Ltd), EnerSys, NorthStar, East Penn Manufacturing Company, Inc. |

Analyst Review

The global lead-acid battery market continues to demonstrate resilience and sustained growth, driven by diverse applications across various industries, during the forecast period. The lead-acid battery market remains a prominent segment within the broader energy storage industry. The market's stability is attributed to its well-established technology, cost-effectiveness, and versatility in catering to diverse applications. Automotive, UPS, and telecom sectors continue to be major contributors, with robust demand sustained by the growing need for reliable energy storage solutions.

The global lead-acid battery market is undergoing a notable transformation marked by a gradual shift towards advanced technologies. SEOs report a growing adoption of enhanced flooded batteries (EFB) and absorbent glass mat (AGM) batteries, which promise enhanced performance, extended cycle life, and reduced maintenance requirements. This technological evolution is pivotal in meeting the demands for diverse applications. Moreover, the lead-acid battery market is experiencing surge in demand within renewable energy systems, especially in off-grid applications. As the deployment of renewable energy installations continues to rise, lead-acid batteries are playing a critical role in efficiently storing and supplying power during intermittent energy production. Simultaneously, ongoing research and development efforts are dedicated to technological innovations aimed at improving the overall performance of lead-acid batteries. These innovations focus on concerns related to energy density, charge efficiency, and environmental impact, reflecting the industry's commitment to advancing sustainability and meeting the evolving needs of the energy storage landscape.

The lead-acid battery market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Among the analyzed regions, Asia-Pacific is expected to account for the fastest-growing market during the forecast period, followed by LAMEA, North America, and Europe. Asia-Pacific hosts some of the fastest developing countries such as China and India. The presence of huge population and rapid industrialization in these countries has increased the demand for electricity from renewable resources. The presence of demand for renewable energy in this region and government initiatives and investment to develop infrastructure related to smart cities in this region have led to the presence of significant importance towards the lead-acid battery market.

Upcoming trends in the global lead acid battery market include the growing adoption of energy storage systems and the increasing demand from data centers.

Asia-Pacific is the largest regional market for lead acid battery market in 2022.

The lead acid battery market is dominated by key players such as EnerSys, Exide Technologies LLC, Hitachi Ltd., Teledyne Technologies Inc., and Hankook AltasBX.

Automotive is the leading application of lead acid battery market.

The estimated industry size of lead acid battery market is $52.1 billion in 2022.

Loading Table Of Content...

Loading Research Methodology...