Linux Operating System Market Overview

The global linux operating system market size was valued at USD 7.8 billion in 2022, and is projected to reach USD 24.3 billion by 2032, growing at a CAGR of 12.3% from 2023 to 2032.

Cost-effectiveness and open-source nature are significant driving factors for the linux operating system market growth. Linux offers a cost-effective alternative to proprietary operating systems such as Windows and macOS, making it particularly attractive to businesses and individuals looking to reduce their IT expenses. In addition, security and stability are key driving factors for the linux operating systems market which opens up a new avenue for growth.

However, The Linux operating system has gained popularity for its open-source nature, flexibility, and security features. However, its growth in the consumer and enterprise markets is hindered by the challenge of software compatibility. This lack of compatibility can be attributed to several factors. Furthermore, software developers often prioritize Windows and macOS due to their larger user bases. This leads to a delayed or complete lack of Linux versions for essential software, leaving Linux users with limited choices.

Linux is a Unix-like, open source and community-developed operating system (OS) for computers, servers, mainframes, mobile devices and embedded devices. Linux OS manages hardware resources, launches and handles applications, and provides some form of user interface. The enormous community for developers and wide range of distributions means that a Linux version is available for almost any task, and Linux has penetrated many areas of computing. For example, Linux has emerged as a popular OS for web servers such as Apache, as well as for network operations, scientific computing tasks that require huge compute clusters, running databases, desktop and endpoint computing, and running mobile devices with OS versions like Android.

On the contrary, the increasing adoption of cloud computing and containers is driving substantial growth opportunities for the market. Linux, an open-source operating system, has emerged as a preferred choice for cloud infrastructure and containerization due to its flexibility, security, and cost-effectiveness. Major cloud providers, such as Amazon Web Services (AWS) and Google Cloud Platform (GCP), rely heavily on Linux for their virtual machines and server instances, as Linux's open-source nature aligns well with the principles of scalability and customization that cloud platforms offer.

The report focuses on growth prospects, restraints, and trends in the linux operating system market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the linux operating system market share.

Segment Review

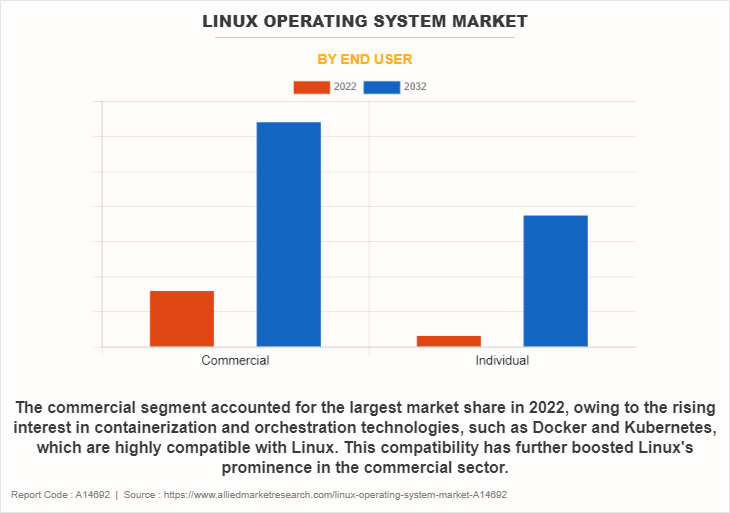

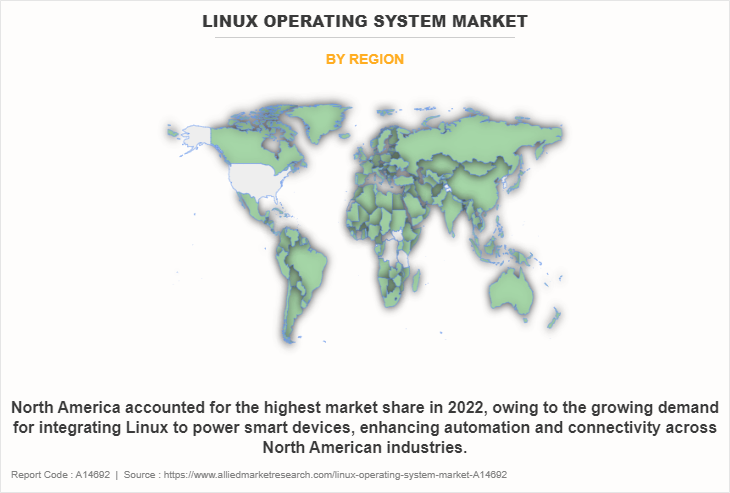

The linux operating system market forecast is segmented on the basis of application, end user, and region. On the basis of the application, the market is segmented into virtual machines, servers, and desktops. By end user, it is bifurcated into commercial and individual. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By end user, the commercial segment held the highest linux market share in 2022, owing to the demand in the commercial sector, with the rising interest in containerization and orchestration technologies, such as Docker and Kubernetes, which are highly compatible with Linux. However, the individual segment is projected to manifest the highest CAGR from 2023 to 2032, owing to its simplifying nature for the user experience to makes it more appealing to non-technical users. Building a stronger ecosystem of applications and software compatible with Linux can help drive its adoption, further fueling growth.

Based on region, North America attained the highest market share in the Linux operating system market owing to the increasing frequency of cyber threats, businesses are turning to Linux for enhanced protection and stability. As more companies realize the benefits of open-source solutions, especially in a post-pandemic landscape that demands flexibility and cost-efficiency. However, the market for linux operating system is expected to develop at the fastest rate in the Asia-Pacific region. The Asia-Pacific region provides fertile ground for Linux-based startups and service providers, as businesses seek cost-effective and tailored solutions. Government initiatives supporting open-source adoption further stimulate the market's potential.

Top Impacting Factors

Flexibility and Customization

Flexibility and customization are fundamental driving factors behind the linux operating system industry continued prominence in the linux operating system market. Linux offers a level of adaptability and control that is unparalleled in the realm of desktop operating systems. Its open-source nature empowers users to tailor the system to their precise needs, whether it be for personal use, enterprise-level server deployments, or embedded systems. This flexibility is instrumental in fostering innovation and problem-solving, as it permits users to modify the kernel and source code, creating a bespoke environment.

Moreover, Linux's modular design allows for easy integration of software and services, making it an ideal choice for businesses seeking cost-effective, scalable solutions. The ability to select from a multitude of distributions, each with its own characteristics and pre-configured packages, grants users the freedom to select the most suitable Linux flavor for their specific use case. This is especially advantageous in a world where one size does not fit all.

Lack of software capabilities

The Linux operating system has gained popularity for its open-source nature, flexibility, and security features. However, its growth in the consumer and enterprise markets is hindered by the challenge of software compatibility. Unlike Windows and macOS, Linux does not have a dominant software ecosystem, which means that many popular applications and games are not readily available for Linux users. This lack of compatibility can be attributed to several factors.

Furthermore, software developers often prioritize Windows and macOS due to their larger user bases. This leads to a delayed or complete lack of Linux versions for essential software, leaving Linux users with limited choices. In addition, compatibility issues arise from the fact that Linux comes in various distributions, each with different libraries and package management systems. This makes it challenging for developers to create software that works seamlessly across all Linux distributions.

Growing adoption of cloud computing and container is driving the demand for Linux-based solutions

Containers, powered by technologies like Docker and Kubernetes, have gained prominence in application development and deployment. Linux serves as the foundation for many containerized applications, offering compatibility, lightweight virtualization, and high performance. As organizations increasingly adopt containerization to streamline application management, Linux stands to benefit from this trend.

Furthermore, Linux's open-source nature allows developers to collaborate, innovate, and tailor the OS to their specific needs, making it an ideal choice for the ever-evolving cloud and container landscape. With more businesses embracing these technologies, the demand for Linux-based solutions is poised to grow, creating vast market opportunities for Linux distributions and service providers. Overall, Linux solutions offer a robust operating system foundation for these transformative technologies and are creating growth in the Linux OS market.

Key Market Players

Some of the key players profiled in the report include AWS, Canonical Ltd., ClearCenter, Dell Inc., Elementary Inc., IBM Corporation, Montavista Software, LLC, Oracle Corporation, and SUSE. These players have adopted various strategies to increase their market penetration and strengthen their position in the Linux operating system industry.

Regional Insight

The Linux Operating System market is experiencing notable growth across various regions, driven by its open-source nature, adaptability, and increasing demand across industries for secure, scalable, and cost-effective operating systems. Here are the key regional insights:

North America

North America leads the linux operating system market, largely due to the region’s robust technological infrastructure and the presence of major cloud service providers, tech companies, and data centers. The U.S. is a dominant player, with extensive adoption of Linux across enterprises, government organizations, and research institutions. Linux’s popularity in the region is driven by its widespread use in server environments, cloud computing platforms, and high-performance computing (HPC). The open-source community in North America is also highly active, further promoting Linux development and innovation. Additionally, large tech firms like Google, Facebook, and Amazon favor Linux for their infrastructure, fueling linux operating system market growth.

Europe

Europe is another significant market for Linux Operating Systems, particularly in countries like Germany, the UK, and France. The region’s emphasis on digital sovereignty, data privacy, and open-source technologies has contributed to the adoption of Linux, especially in government and defense sectors. Linux is also widely used in industries such as automotive, manufacturing, and telecommunications, where scalability and security are crucial. The European Union's support for open-source software and initiatives like GAIA-X, which promotes a decentralized digital infrastructure, further accelerates Linux adoption. Linux’s flexibility in integrating with cloud technologies and its role in enabling digital transformation across European enterprises are key growth drivers.

Asia-Pacific

Asia-Pacific is projected to witness the fastest growth in the linux operating system market. Countries like China, India, Japan, and South Korea are at the forefront of this expansion. In China, Linux is increasingly favored due to national policies promoting open-source solutions to reduce dependency on foreign software providers. Linux adoption is also growing in China’s telecom and manufacturing sectors. In India, the rising IT and software development ecosystem is fostering Linux usage, particularly in startups and enterprises seeking cost-effective solutions. Japan and South Korea are adopting Linux across various verticals, including automotive, electronics, and telecommunications, to drive innovation and ensure robust cybersecurity.

Latin America and Middle East & Africa

In Latin America, Linux adoption is growing steadily, particularly in Brazil, Mexico, and Argentina, driven by increasing digitalization and the need for cost-effective, secure IT solutions. Enterprises in industries such as government, education, and finance are migrating to Linux due to its flexibility and lower total cost of ownership compared to proprietary systems. The Middle East & Africa region is also seeing increased interest in Linux, especially in the UAE, Saudi Arabia, and South Africa. Linux adoption in these regions is driven by the growing demand for cloud-based solutions, digital transformation initiatives, and the need for secure and scalable operating systems in critical sectors like oil & gas, healthcare, and financial services.

Key Industry Development

Recent Product development in the Linux OS Market

In March 2023, Amazon Linux 2023 (AL2023) is the newest Linux operating system from AWS available to support workloads running on Amazon EC2. The team at Sysdig validated AL2023 with Sysdig Secure and Sysdig Monitor to ensure full support for cloud-native monitoring capabilities with this latest OS.

In June 2023, SUSE enhanced its reputation as the industry’s most secure open-source solution with advancements to SUSE Linux Enterprise and new security-focused updates to Rancher by SUSE. This continues to improve business continuity for customers with enhanced support, real-time patching, and automation, including AI support for Rancher Prime customers.

Recent partnership in the Linux OS Market

In June 2023, Canonical, the manufacturer of the Ubuntu Linux distribution and provider of a variety of open-source products and support services, partnered with HIPER Global, a designer, manufacturer, and supplier of application-specific computing solutions to provide their worldwide customers with the latest and greatest value-added services. These include a subscription to security fixes, long-term support services for the Ubuntu Linux distribution, and advanced Canonical products embedded in HIPER Global solutions.

In May 2022, IBM and SAP expanded its long-term partnership as IBM took one of the world's largest corporate transformation projects based on SAP® ERP software, designed to fuel the company's growth and better support its clients. As part of the expanded partnership, IBM is migrating to SAP S/4HANA®, SAP's next-generation ERP software, to perform work across more than 120 countries, 1,000 legal entities and numerous IBM businesses supporting software, hardware, consulting, and finance.

Recent Collaboration in the Linux OS Market

In September 2022, a new strategic collaboration between SUSE and AWS outlines shared programs and investment areas that will help ensure smoother migration of customers’ SAP landscapes to AWS. Collaboration will bring innovation to customers faster, helping them leverage the power of the cloud at the pace.

In April 2023, IBM Corporation collaborated with Microsoft, to focus on helping clients to implement and scale Azure OpenAI Service. The new IBM Consulting Azure OpenAI Service offering, which is available on Azure Marketplace, is a fully managed AI service that allows developers and data scientists to apply powerful large language models, including their GPT and Codex series. It aims to help businesses define an adoption strategy and an initial set of specific and value-added generative AI use cases.

Recent Contract in the Linux OS Market

In August 2023, CIQ, Oracle and SUSE intented to form the Open Enterprise Linux Association (OpenELA), a collaborative trade association to encourage the development of distributions compatible with Red Hat Enterprise Linux (RHEL) by providing open and free Enterprise Linux (EL) source code.

Recent Product Launches in the Linux OS Market

In September 2021, IBM Corporation developed the new IBM Power E1080 server, the first in a new family of servers based on the new IBM Power10 processor, designed specifically for hybrid cloud environments. The IBM Power10-equipped E1080 server is engineered to be one of the most secured server platforms and is designed to help clients operate a secured, frictionless[i] hybrid cloud experience across their entire IT infrastructure.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the linux operating system market analysis from 2022 to 2032 to identify the prevailing Linux operating system market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the market segmentation assists in determining the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global linux operating system market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes an analysis of the regional as well as global linux operating system market trends, key players, market segments, application areas, and market growth strategies.

Linux Operating System Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 24.3 billion |

| Growth Rate | CAGR of 12.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 375 |

| By Distribution Model |

|

| By End User |

|

| By Region |

|

| Key Market Players | Arch Linux, IBM Corporation, Oracle Corporation, Canonical Ltd., Dell Inc., SUSE, Amazon Web Services, Montavista Software, LLC., ClearCenter, Inc., Elementary Inc |

Analyst Review

Containerization and orchestration technologies, like Docker and Kubernetes, have gained momentum, and Linux plays a vital role in supporting these tools. Containers run seamlessly on Linux, facilitating efficient application deployment and management. Another trend is the growth of Linux on the desktop. User-friendly Linux distributions like Ubuntu and Linux Mint have improved the desktop experience, making Linux more accessible to average users. This has led to an uptick in Linux usage for personal computing. Overall, the Linux operating system market is characterized by increased cloud and data center adoption, containerization and orchestration, desktop usage, security focus, and a strong presence in IoT and embedded systems. These trends reflect Linux's adaptability and resilience in the ever-evolving technology landscape.

Moreover, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction. For instance, in February 2023, Elektrobit and Canonical jointly developed EB corbos Linux built on Ubuntu, an industry-first bringing the largest open-source Linux community to automotive software. This new solution provides OEMs and Tier 1 suppliers with the benefits and flexibility of an open-source operating system for developing electronic control units (ECUs) in software-defined vehicles. It integrates Ubuntu, provided by Canonical, in a solution that addresses the specific needs of the automotive sector. Further, in September 2022, Dell Technologies is introducing a new telecom cloud infrastructure solution, co-engineered with Wind River, to help communications service providers reduce complexity and accelerate their cloud-native network deployments. To further power these solutions, Dell’s telecom partner certification program simplifies the process for technology partners to validate and integrate their products within a rapidly growing open technology ecosystem.

Some of the key players profiled in the report include AWS, Canonical Ltd., ClearCenter, Dell Inc., Elementary Inc., IBM Corporation, Montavista Software, LLC, Oracle Corporation, and SUSE. These players have adopted various strategies to increase their market penetration and strengthen their position in the Linux operating system market.

The global Linux operating system market size was valued at USD 7.8 billion in 2022, and is projected to reach USD 24.3 billion by 2032

The global Linux operating system market is projected to grow at a compound annual growth rate of 12.3% from 2023 to 2032 to reach USD 24.3 billion by 2032

The key players profiled in the report include AWS, Canonical Ltd., ClearCenter, Dell Inc., Elementary Inc., IBM Corporation, Montavista Software, LLC, Oracle Corporation, and SUSE.

North America is the largest regional market for Linux Operating System.

Cost-effectiveness and open-source nature are significant driving factors for the linux operating system market growth.

Loading Table Of Content...

Loading Research Methodology...