Liquid Packaging Carton Market Size & Insights:

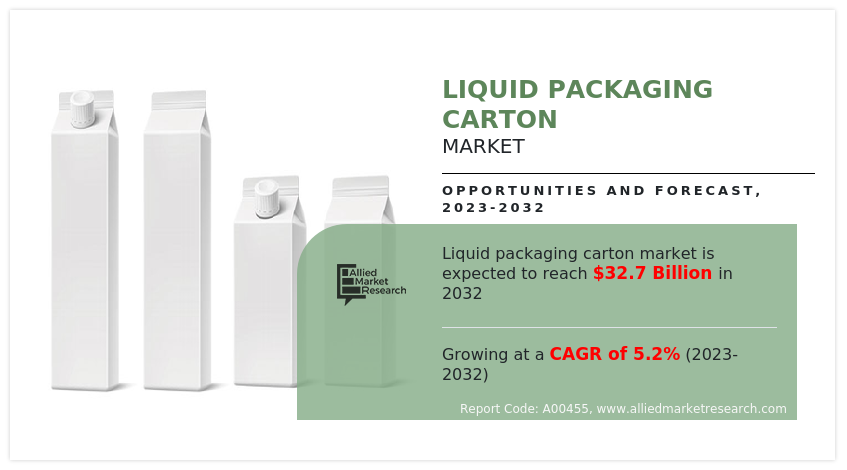

The global liquid packaging carton market size was valued at $19.8 billion in 2022, and is projected to reach $32.7 billion by 2032, growing at a CAGR of 5.2% from 2023 to 2032. The liquid packaging carton market is driven by rise in preference for convenient, sustainable packaging solutions, as consumers increasingly prioritize eco-friendly and lightweight options. In addition, rise in demand for processed food and beverages, such as dairy products, juices, and ready-to-drink beverages, boosts the need for packaging that ensures product freshness and long shelf life. Thus, these factors support the growth of the liquid packaging carton market globally.

Introduction:

Liquid packaging carton, also known as beverage carton, is utilized for safe storage and transportation of liquid products. Moreover, there is customized packaging on the basis of marketing requirements of manufacturers. It has an economic advantage over other packaging types. The raw material used is inexpensive compared to other conventional packaging types. Materials such as paperboard, aluminum, and plastic are utilized in the manufacturing of liquid packaging cartons. In addition, they prevent contamination and other damage to liquid food products. These cartons are preferred by manufacturers due to their benefits such as convenience, maneuverability, recyclability, and eco-friendly attribute.

Report key highlighters

Quantitative information mentioned in the global liquid packaging carton market includes the market numbers in terms of value (USD Million) and volume (Kilotons) with respect to different segments, pricing analysis, annual growth rate, CAGR (2023-32), and growth analysis.

The analysis in the report is provided based on carton type, shelf life, and end use. The study will also contain qualitative information such as the market dynamics (drivers, restraints, opportunities), Porter's Five Force Analysis, key regulations across the region, and value chain analysis.

A few companies, including Adam Pack S.A., Atlas Packaging, Elopak, Greatview Aseptic Packaging, ITC Limited, Nippon Paper Industries Co., Ltd., Refresco Group, Stora Enso, Tetra Laval Group, and WestRock Company, hold a large proportion of the liquid packaging carton market.

- This report makes it easier for existing market players and new entrants to the prepreg business to plan their strategies and understand the dynamics of the industry, which ultimately helps them make better decisions.

Market Dynamics:

Rise in demand for convenient and sustainable packaging solutions is a key driver for the liquid packaging carton market. As consumers increasingly prioritize eco-friendly options, liquid cartons, made from recyclable materials, offer a sustainable alternative to plastic. These cartons not only provide convenience with their portability and ease of use but also align with the global shift toward reducing environmental impact. Their ability to preserve product freshness, especially in beverages and dairy, further accelerates their adoption across industries.

However, competition from alternative packaging materials, such as plastic bottles, glass containers, and aluminum cans, is a significant restraint for the liquid packaging carton market. These alternatives often offer lower production costs, greater convenience, and longer shelf life, making them attractive to both manufacturers and consumers. In addition, plastic packaging has gained popularity due to its lightweight nature and durability, limiting the market growth, particularly in industries where cost-effectiveness and practicality are key considerations.

Rise in demand for sustainable packaging solutions presents a significant growth opportunity for the liquid packaging carton market. As consumers and industries focus on reducing plastic waste, liquid packaging cartons, made from renewable materials like paperboard, offer an eco-friendly alternative. These cartons are recyclable and biodegradable, aligning with global efforts to minimize environmental impact. This shift toward sustainability in packaging is driving adoption across various industries, particularly in beverages and food products, further driving the growth of the liquid packaging carton market.

Segment Overview:

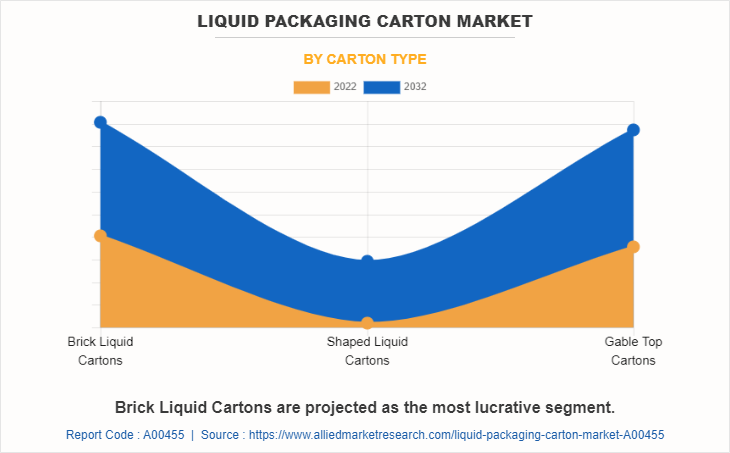

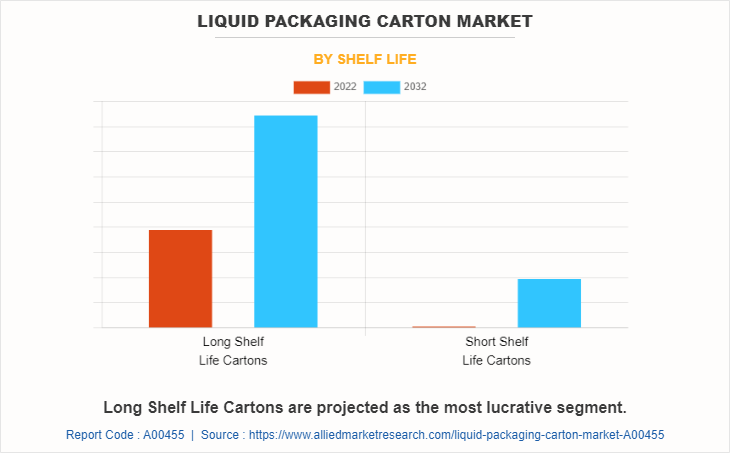

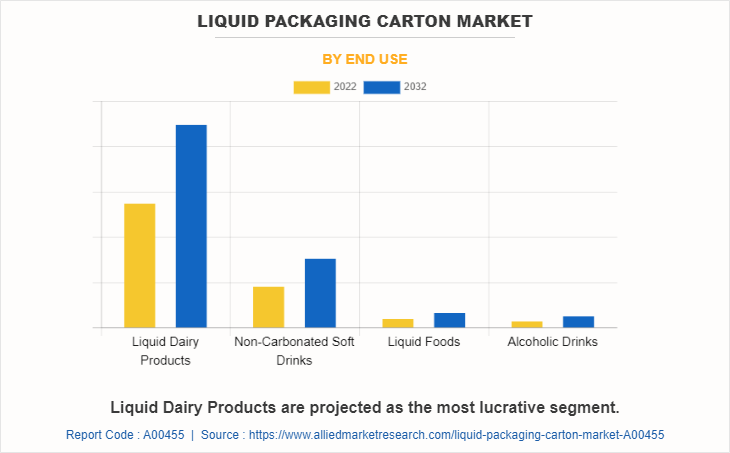

The liquid packaging carton market is segmented on the basis of type, shelf life, end use, and region. Depending on type, the market is categorized into brick liquid cartons, gable top cartons, and shaped liquid cartons. On the basis of shelf life, it is classified into long shelf life cartons and short shelf life cartons. By end use, it is divided into liquid dairy products, non-carbonated soft drinks, liquid foods, alcoholic drinks, and others. Region-wise, the liquid packaging carton market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By carton type, the brick liquid cartons segment held the largest market share in 2022. Brick liquid cartons provide convenience for both consumers and retailers. Their lightweight nature makes them easy to handle and transport, reducing logistical costs. The rectangular shape of these cartons allows efficient stacking and optimal use of storage space, further enhancing their convenience in the supply chain.

By shelf life, the long shelf life cartons segment held the largest market share in 2022. The multi-layer construction of these cartons acts as a barrier to light, oxygen, and moisture, preventing product degradation and ensuring the safety & quality of the contents. This is particularly important for products with sensitive nutritional properties that may deteriorate quickly when exposed to unfavorable conditions.

By end-use, the Liquid dairy products segment held the largest market share in 2022. Sustainability is a driving factor in the liquid packaging carton market growth. Consumers are conscious of the environmental impact of packaging materials. Liquid cartons, typically made from renewable resources such as paperboard, offer a more sustainable option compared to other packaging materials such as plastic. The recyclability of these cartons further supports sustainability efforts and resonates with consumers who prioritize eco-friendly choices.

By region, the market is categorized into North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific region is one of the fastest-growing regions in the world. Asia-Pacific has witnessed a shift toward healthier lifestyle choices, with consumers seeking beverages that provide added nutritional value. Liquid packaging cartons accommodate this trend by offering aseptic packaging solutions, which ensure that the beverages retain their nutritional content without the need for preservatives or refrigeration. This has led to the increased adoption of liquid packaging cartons for packaging juices, dairy alternatives, and health drinks.

Competitive Analysis:

Some of the major players analyzed in this report are Adam Pack S.A., Atlas Packaging, Elopak, Greatview Aseptic Packaging, ITC Limited, Nippon Paper Industries Co., Ltd., Refresco Group, Stora Enso, Tetra Laval Group, and WestRock Company.

Key Developments

- In June 2022, Nippon Paper Industries Co., Ltd. established a new local subsidiary in Australia to strengthen the liquid packaging carton business. This expansion will boost the growth of the liquid packaging carton market.

- In April 2022, Tetra Pak, an industry group of Tetra Laval Group launched tethered caps on carton packages by partnering with leading beverage producers. Five new tethered cap solutions are presently being introduced in Ireland, the Baltics, Spain, and Germany in various product categories. This product launch will boost the growth of the liquid packaging carton market.

- In August 2022, Greatview Aseptic Packaging (Greatview) acquired the assets of Alternapak Production srl at San Pietro in Gu, Italy. For many years, Alternapak Production srl has provided aseptic cartons to top companies in the liquid food sector in Europe, the Middle East, and the Americas. The recently acquired production facility will be Greatview's fifth unit worldwide and represents a significant step in the Group's international expansion strategy. This acquisition will boost the demand for liquid packaging cartons market.

- In December 2022, Refresco Group acquired Tru Blu Beverages Pty Ltd, a manufacturer of non-alcoholic beverages, by expanding its presence into Australia. This acquisition further strengthens its position as a beverage solutions provider to branded customers and leading retailers globally and provides new opportunities for future growth.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the liquid packaging carton market analysis from 2022 to 2032 to identify the prevailing liquid packaging carton market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the liquid packaging carton market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global liquid packaging carton market trends, key players, market segments, application areas, and market growth strategies.

Liquid Packaging Carton Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 32.7 billion |

| Growth Rate | CAGR of 5.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 357 |

| By Carton Type |

|

| By Shelf Life |

|

| By End Use |

|

| By Region |

|

| Key Market Players | ITC Limited, NIPPON PAPER INDUSTRIES CO., LTD., Stora Enso, WestRock Company, Greatview Aseptic Packaging, Elopak, Tetra Laval Group, Refresco Group, Adam Pack S.A., Atlas Packaging |

Analyst Review

According to the CXOs, the liquid packaging carton market witnessed significant growth in recent years. Packaging plays a crucial role in improving the aesthetic value of a product and draws the attention of consumers. Retailers and wholesalers have stressed the need for variations in packaging size as well as functionality to cater to the diversified needs and trends of various segments. The adoption of eco-friendly designs and other advanced packaging strategies for paper-based and other forest-based products is expected to revolutionize the global liquid packaging carton market.

These strategies not only focus on the renewability aspect, however, also emphasize on providing differentiated offerings to satisfy the varying functional and sustainability needs of diverse market segments. The Asia-Pacific liquid packaging carton market offers promising opportunities for packaging and paperboard manufacturers due to widespread consumption of packaged food & commodities and a rise in disposable income. The surge in demand for cartons with a prolonged shelf life is expected to increase in North America, owing to an upsurge in demand for liquid-packaged products.

Manufacturers are continually investing in innovative packaging designs to improve product differentiation, convenience, and shelf appeal. Features like resealable spouts, easy-to-pour caps, and attractive graphics have become popular to enhance user experience and attract consumers.

Liquid dairy products application are the potential customers of Liquid Packaging Carton Market industry

Asia-Pacific region will provide more business opportunities for Liquid Packaging Carton market in coming years.

The market players are adopting various growth strategies and also investing in R&D extensively to develop technically advanced unique products which are expected to drive the market size.

Adam Pack S.A., Atlas Packaging, Elopak, Greatview Aseptic Packaging, ITC Limited, Nippon Paper Industries Co., Ltd., Refresco Group, Stora Enso, Tetra Laval Group, and WestRock Company are the top players in Liquid Packaging Carton market.

Loading Table Of Content...

Loading Research Methodology...