Sustainable Packaging Market Size & Insights:

The global sustainable packaging market size was valued at USD 93.6 billion in 2021, and sustainable packaging industry is projected to reach USD 190.6 billion by 2031, growing at a CAGR of 7.4% from 2022 to 2031.

The growing consumer demand for eco-friendly products is a significant driver of the Sustainable Packaging Market, as more consumers are prioritizing environmentally responsible choices in their purchasing decisions. This shift has led brands and manufacturers to adopt sustainable packaging solutions that reduce environmental impact, such as using biodegradable, recyclable, or compostable materials.

Key Market Insights

- By packaging type, the rigid packaging segment accounted for the highest market share for 2021.

- By end use, the food & beverage segment held the largest share of the market for 2021.

- By region, Asia-Pacific accounted for the largest share in the global sustainable packaging market for 2021.

Market Size & Forecast

- 2031 Projected Market Size: USD 190.6 Billion

- 2021 Market Size: USD 93.6 Billion

- Compound Annual Growth Rate (CAGR) (2022-2031): 7.4%

How to Describe Sustainable Packaging

Sustainable packaging refers to packaging solutions that are designed and produced with a focus on minimizing environmental impact throughout their lifecycle, from production to disposal. It involves using materials that are renewable, recyclable, biodegradable, or compostable, reducing the dependence on conventional plastics and other harmful substances. The goal is to reduce packaging waste, conserve resources, and promote the use of materials that have a lower carbon footprint. Sustainable packaging aims to protect the product effectively while also being responsible in terms of environmental preservation.

What are the key market dynamics driving the growth of this industry?

The growing consumer demand for eco-friendly products is a significant driver of the sustainable packaging market, as more consumers are prioritizing environmentally responsible choices in their purchasing decisions. This shift has led brands and manufacturers to adopt sustainable packaging solutions that reduce environmental impact, such as using biodegradable, recyclable, or compostable materials. Technological innovations in packaging materials further fuel this demand by enabling the development of more efficient, cost-effective, and environmentally friendly alternatives. Advances in materials science have led to the creation of plant-based polymers, innovative biodegradable films, and packaging solutions that use less energy and resources in production, making sustainable packaging increasingly accessible and appealing to both consumers and businesses. All these factors drive the demand for the sustainable packaging market.

The high production costs of sustainable materials are a significant restraint on the growth of the Sustainable Packaging Market. While eco-friendly packaging solutions offer numerous environmental benefits, they often come at a higher price compared to conventional plastic or other traditional materials. The production processes for biodegradable plastics, plant-based polymers, and other sustainable alternatives typically require more advanced technologies and raw materials, which can increase overall manufacturing costs. All these factors hamper the growth of the sustainable packaging market.

Plastic bags and pouches are expected to remain the standard form of packaging during the forecast period due to their ability to preserve food freshness and extend product shelf life. Additionally, petroleum-based plastic bags and pouches offer great visual aesthetics and are sustainable, which adds to the marketing advantages of their products. Companies are focusing on developing bio-based PVC. In October 2021, Cargill announced the addition of its biobased plasticizer, Biovero®, to its bioindustry solutions portfolio. It is used in a variety of product manufacturing applications such as flooring, clothing, wire, cable, plastic films and sheets to serve industrial customers. Throughout North America, there are plans to expand the product worldwide. Such cases are expected to drive the adoption of sustainable PVC in the coming years.

Also, Companies are offering new technologies to integrate sustainable plastic packaging. In May 2020, his YPACK for EU project developed an innovative sustainable plastic food packaging that extends the shelf life of food. YPACK's compostable packaging contains sustainable biopolymers, poly(3-hydroxybutyrate-co-3-hydroxyvalerate) (PHBV), produced by-products, cheese whey, and microcellulose from almond shells. The U.S. Food and Drug Administration recognizes PLA plastic as safe for all food packaging applications and is widely used in many single-use packaging applications. Other uses of PLA are automotive, textiles, foams and foils. Providers such as his WeforYou, a developer and producer of biopolymers and sustainable packaging solutions, offer pure PLA bags, PLA compounds, and laboratory and compounding services. PLA plastic is expensive compared to traditional petroleum-based plastics. On the other hand, they have less mechanical and physical properties.

Sustainable Packaging Market Segment Review

The sustainable packaging market forecast is classified on the basis of material type, packaging type, end-use industry and region. On the basis of material type, the market is bifurcated into paper & paperboard, plastics, aluminum and others. On the basis of packaging type, the market is divided into rigid packaging and flexible packaging. On the basis of end-use industry, the market is bifurcated into food & beverage, personal care, healthcare and pharmaceuticals and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific and LAMEA.

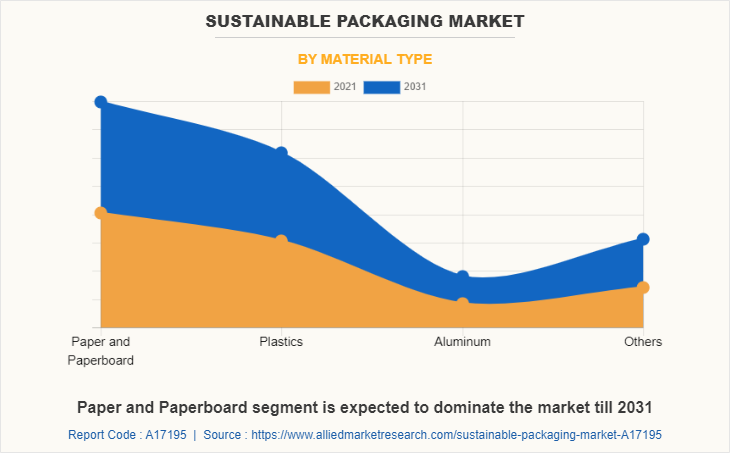

Sustainable Packaging Market By Material Type

As per sustainable packaging market analysis, by material type, the paper and paperboard segment dominated the global sustainable packaging market share in 2021. This is due to increased government campaigns to educate consumers about the benefits of paper packaging and eco-friendly products, which is expected to benefit sustainable packaging market growth. Paper is used in many flexible packaging applications such as confectionery, pet food and dry food. After years of declining demand, paper-based flexible packaging is gaining popularity among the general public as end-users seek more sustainable packaging solutions.

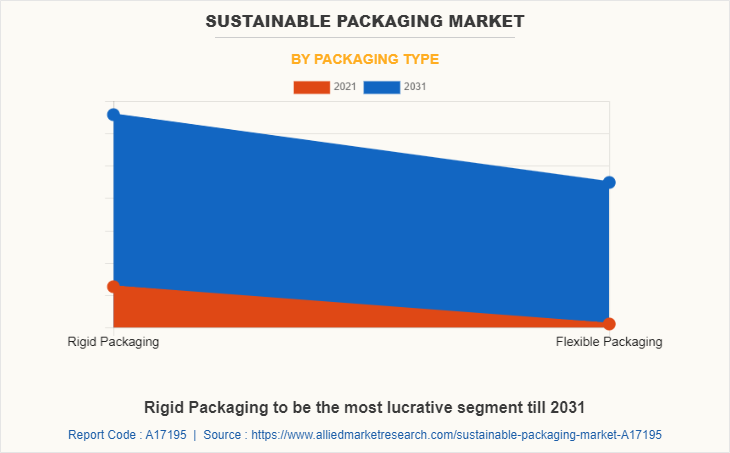

Sustainable Packaging Market By Packaging Type

By packaging type, the rigid packaging segment accounted for the highest market share of around 56.2% in 2021 and is projected to maintain the same during the forecast period. Increase in awareness for environment protection activities has made the customer become more linear toward using bioplastics-based flexible packaging films in various end use sectors including food & beverage, agriculture, and other end use sectors. This is projected to further boost the growth of the bioplastics market for rigid packaging applications.

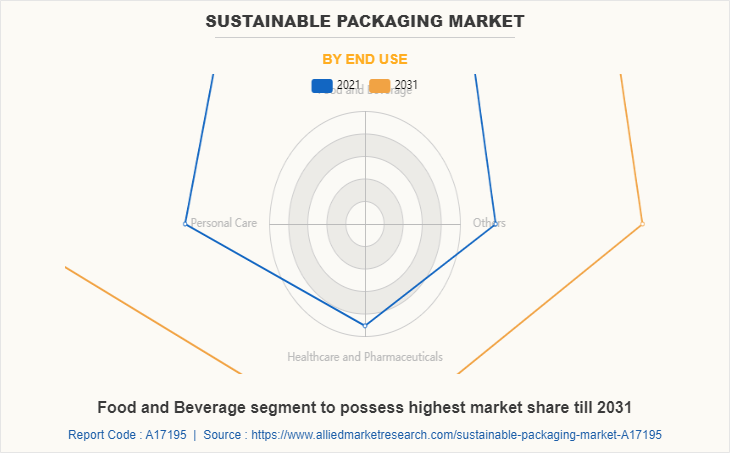

Sustainable Packaging Market By End Use Industry

By end use, the food & beverage segment held the largest share of the market in 2021 and is expected to remain dominant during the forecast period owing to huge demand for packaged and branded products. Sustainable packaging has become a necessity in the food and drink industries. To remain competitive in today's market and thrive in the future, food and beverage companies' packaging must be sustainable. Consumer wants and demands are driving R&D budgets for food and beverage manufacturers around the world. As countries like India and China continue to increase their gross domestic product, the food and beverage market expands and their packaging comes under fire. Another motivation for food and beverage manufacturers is consumer health. Therefore, demand for sustainable packaging is expected to grow, with increase in demand for food and beverages during the forecast period.

Sustainable Packaging Market By Region

By region, Asia-Pacific accounted for the largest share in the global sustainable packaging market in 2021. China's major courier companies and e-commerce platforms are taking proactive measures to reduce packaging consumption. For example, SF Express used recyclable packaging that can be reused about 10 times on average. The developments in India's middle class, rapid expansion of organized retail, growth in exports, and India's burgeoning e-commerce sector should enable further growth. This has created a need for sustainable packaging that can reduce environmental impact while maintaining the highest quality.

What are the Leading Companies in Sustainable Packaging

The key players operating in the global sustainable packaging market. These players have adopted product launch, acquisition, and business expansion as their key strategies to increase their market shares.

- Amcor plc

- Ardagh Group S.A.

- Ball Corporation

- BASF SE

- Crown Holdings, Inc.

- DS Smith

- Elopak AS

- Emerald Packaging

- Mondi, Nampak Ltd.

- Plastipak Holdings, Inc.

- Sealed Air

- Sgf packaging Co. Ltd,

- Smurfit Kappa Group PLC

- Sonoco Products Company

- Tetra Pak and WestRock Company

What are the Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the sustainable packaging market analysis from 2021 to 2031 to identify the prevailing sustainable packaging market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the sustainable packaging market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global sustainable packaging market trends, key players, market segments, application areas, and market growth strategies.

Sustainable Packaging Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 190.6 billion |

| Growth Rate | CAGR of 7.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 347 |

| By Material Type |

|

| By Packaging Type |

|

| By End Use |

|

| By Region |

|

| Key Market Players | BASF SE, Emerald Packaging, Mondi plc, Ardagh Group S.A., WestRock Company, SGF Packaging Co., Ltd., Nampak Ltd., Sealed Air Corporation, Elopak AS, Sonoco Products Company, Crown Holdings, Inc., Amcor plc, Plastipak Holdings, Inc., Tetra Pak, Ball Corporation, DS Smith plc, Smurfit Kappa Group PLC |

Analyst Review

According to CXO Perspective, Sustainable packaging refers to the development and use of packaging with improved sustainability. Growing environmental awareness has led to a shift to eco-friendly packaging. Consumer preference for low cost, lightweight and biodegradable packaging has increased the need for lightweight, recyclable and sustainable packaging. Therefore, the adoption of sustainable packaging in the packaging industry projects significant growth for the sustainable packaging market during the forecast period.

Growing public awareness of the concept of recycling and reusing products to protect the environment from harmful effects has led to the growth of the sustainable packaging market. In addition, the use of biodegradable packaging materials provides consumers with an eco-friendly and healthy option. This concept has played a key role in creating new dimensions of innovation. The sustainable packaging industry offers a wide range of opportunities for both suppliers and manufacturers. suppliers can provide raw materials to new entrants who have invested in the sustainable packaging industry, such as Dell. Dell has started shipping products in packages containing mushroom ingredients that combine mushrooms and straw.

Rise in demand for sustainable food packaging and government regulations favoring sustainable packaging are the key factors boosting the Sustainable packaging market growth.

The market value of Sustainable packaging in 2031 is expected to be $190.6 billion

Amcor plc, Ardagh Group S.A., Ball Corporation, BASF SE, Crown Holdings, Inc., DS Smith, Elopak AS, Emerald Packaging, Mondi, Nampak Ltd., Plastipak Holdings, Inc., Sealed Air, Sgf packaging Co. Ltd, Smurfit Kappa Group PLC, Sonoco Products Company, Tetra Pak and WestRock Company

Packaging industry is projected to increase the demand for Sustainable packaging Market

The sustainable packaging market is segmented on the basis of material type, packaging type, end-use industry and region. On the basis of material type, the market is divided into paper & paperboard, plastics, aluminum and others. On the basis of packaging type, the market is classified into rigid packaging and flexible packaging. On the basis of end-use industry, the market is categorized into food & beverage, personal care, healthcare and pharmaceuticals and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific and LAMEA.

High demand from end-use industries is the Main Driver of Sustainable packaging Market.

Post covid-19, The growth of market was mainly due to the consumption of sustainable packaging products in different end-use industries including food & beverage industry, healthcare, cosmetics & personal care, and e-commerce. There is an increase in flexible, rigid plastics, and corrugated packaging. The food packaging industry continued to robust the demand of the sustainable packaging products owing to the increase in awareness regarding the hygiene. Moreover, there was high growth for rigid packaging for e-commerce and grocery deliveries. There was an incline towards the growth of sustainable packaging products in healthcare sector, including flexible blister foils, pumps, closures and rigid plastics. Also, the packaging used in dietary supplements such as vitamins and for essential supplies, such as allergy medication has boosted the market.

Loading Table Of Content...