Lung Cancer Screening Market Research, 2031

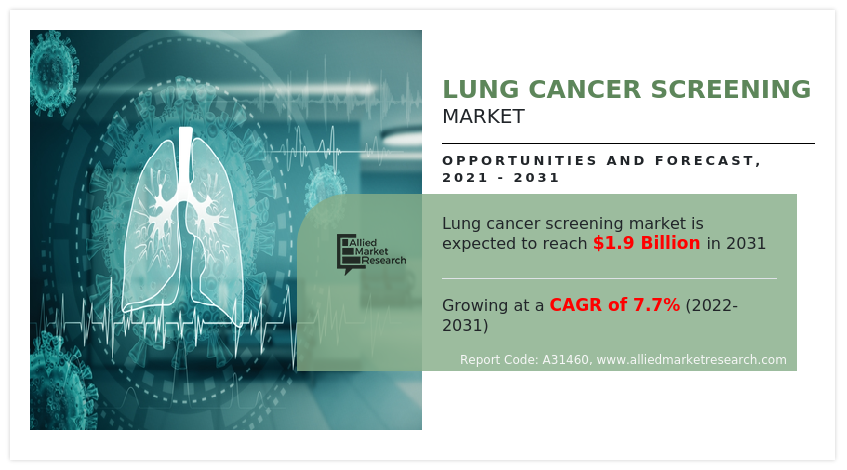

The global lung cancer screening market size was valued at $879.6 million in 2021, and is projected to reach $1,853.04 million by 2031, growing at a CAGR of 7.7% from 2022 to 2031. The term, lung cancer screening refers to methods for detecting the disease early, when it is more likely to be cured, before symptoms appear. Lung cancer incidence and prevalence make lung cancer screening extremely important. The goal of lung cancer screening is to detect lung cancer at a very early stage. Lung cancer screening is recommended for older adults who are longtime smokers and who don't have any signs or symptoms of lung cancer. Physicians use a low-dose computerized tomography (LDCT) scan or X-ray for screening. Lung cancer is the 2nd most common type of cancer according to World Health Organization (WHO).

Growth of the global lung cancer screening market is majorly driven by rise in technological advancement in lung cancer screening methods, growing population of smokers and tobacco consumers. For instance, according to Food and Drug Administration (FDA), in 2021, approximately 2.55 million students consumed tobacco products. In addition, according to Center for Disease Control and Prevention (CDC), in 2020, nearly 13 of every 100 U.S. adults aged 18 years and older smoke cigarettes. Moreover, rise in prevalence of lung cancer is the major factor responsible for rising demand of lung cancer screening devices and solutions, thus, driving the growth of the lung cancer screening market size.

Moreover, the global market expansion is being fueled by factors, such as increase in use of low-dose computed tomography for lung cancer screening by doctors. In addition, rise in awareness regarding innovative and affordable lung cancer screening techniques in the developing countries, such as India and China contribute towards the growth of the market. Furthermore, few market players are adopting inorganic strategies, such as collaborations with healthcare institutes with an aim to increase awareness about lung cancer among general people. For instance, Nuance Communications, Inc., collaborated with Baptist Health South Florida’s Miami Cancer Institute (MCI) and established a lung cancer screening program for conducting imaging tests for early diagnosis and effective treatment of disease.

On the other hand, high cost of screening is the factor expected to hamper the growth of the market. In addition, chest x-ray and computed tomography expose the chest to radiations, which cause health problems. This is the factor negatively affects the growth of the lung cancer screening market share.

Impact of COVID-19 on Lung Cancer Screening Market

Coronavirus Severe acute respiration syndrome (SARS-CoV-2) is an infectious disease caused by the novel coronavirus (COVID-19), which originated in the Wuhan district in China in the late 2019, and since has spread to 212 countries. The virus was initially referred to as “novel coronavirus 2019” (2019-nCoV) by the WHO, however, on February 11, 2020, it was given the official name of SARS-CoV-2 by the International Committee on Taxonomy of Viruses. WHO declared COVID-19 as pandemic on March 11, 2020, and by September 1, 2020, over 28.1 million people have been infected globally with over 909,000 deaths. COVID-19 symptoms include fever, cough, and shortness of breath.

Nearly all industries have been impacted by the COVID-19 pandemic. The COVID-19 pandemic led to lock-down and strict following of the social distancing rules, this has resulted in a significant decrease in demand for the lung cancer screening devices. The main cause of the interruption experienced by patients getting screening tests done from the hospitals. In addition, significant disruption in lung cancer screening led to decrease in new patients screened, thus reducing the demand for lung cancer screening solution and devices. As a result, the COVID-19 outbreak is expected to slow down the global market growth of the lung cancer screening market share, which is expected to have a negative effect on the market's value in 2021 and beyond.

Lung Cancer Screening Market Segmentation

The lung cancer screening industry is segmented on basis of type, age group, end user, and region. On the basis of type, it is segmented into low-dose computed tomography and X-ray. By treatment, the market is bifurcated into 50 and older and below 50. On the basis of end user, the market is segmented into hospitals, diagnostic centers, and others. Region-wise, the lung cancer screening industry is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Type

By type, the low-dose computed tomography segment was the highest revenue contributor to the market in 2021, and is expected to continue this trend during the lung cancer screening market forecast period, due to increase in adoption of low-dose computed tomography as it shows accurate results.

By Type

Low-dose computed tomography (LDCT) segment held a dominant position in 2021 and would continue to maintain the lead over the forecast period.

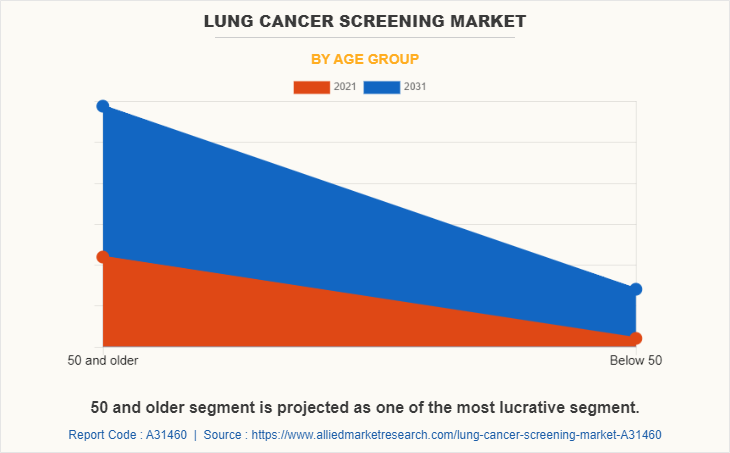

By Age Group

By age group, the 50 and older segment dominated the market in 2021, due to high prevalence of lung cancer among elderly individuals and rise in number of patients screened for lung cancer.

By End User

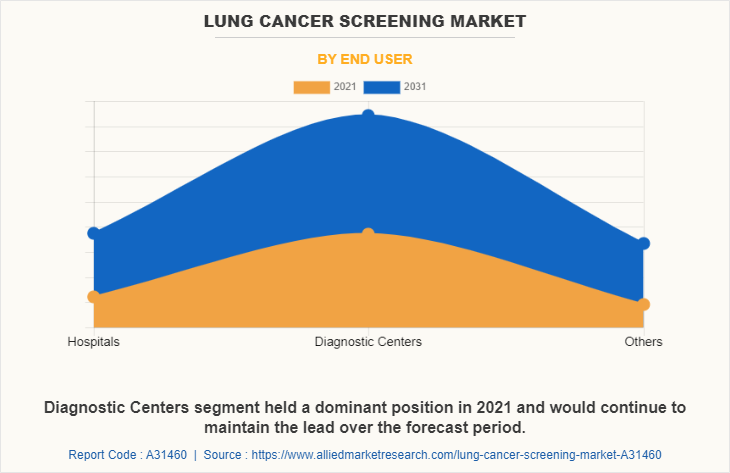

By end user, the diagnostic centers segment was the highest revenue contributor to the market in 2021, and is expected to remain dominant during the forecast period, due to increase in patients screening from diagnostic centers and rise in number of diagnostic centers.

By Region

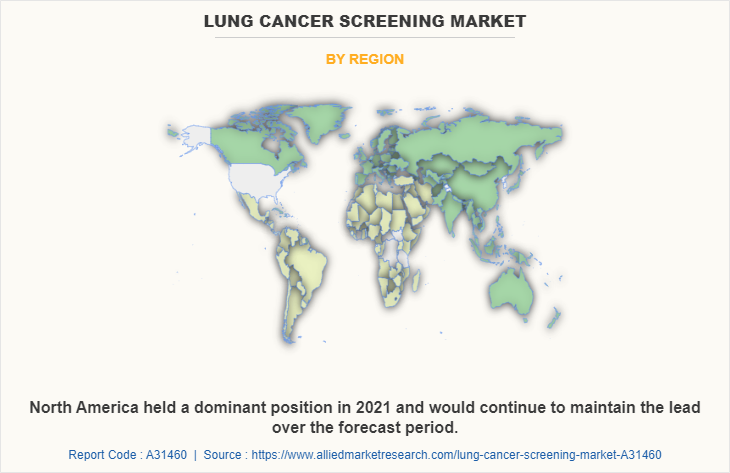

The North America market was dominant, in terms of revenue among other regions in 2021, due to increase in awareness regarding early-stage lung cancer screening benefits and increase in adoption of new solutions and devices for screening of lung cancer. On the other hand, Europe was the second-largest contributor in the market in 2021, owing to rise in prevalence of lung cancer and increase in patient screening for lung cancer.

Competition Analysis

Some of the major companies that operate in the global lung cancer screening market include, Canon Medical Systems U.S. Inc, Eon Health, Fujifilm Holdings Corporation, General Electric Company (GE Healthcare), Koninklijke Philips N.V., Medtronic Plc, Microsoft Corporation (Nuance Communications, Inc), Penrad Technologies Inc., Siemens Ag, and Volpara Solutions Limited.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the lung cancer screening market analysis from 2021 to 2031 to identify the prevailing lung cancer screening market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the lung cancer screening market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global lung cancer screening market trends, key players, market segments, application areas, and lung cancer screening market growth strategies.

Lung Cancer Screening Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1.9 billion |

| Growth Rate | CAGR of 7.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 271 |

| By Type |

|

| By Age group |

|

| By End User |

|

| By Region |

|

| Key Market Players | Volpara Solutions Limited, Eon Health, Medtronic plc, Nuance Communications, Inc., Canon Medical Systems Corporation, FUJIFILM Holdings Corporation, Siemens AG (Siemens Healthineers AG), General Electric incorporated (GE Healthcare), Penrad Technologies Inc, Koninklijke Philips N.V. |

Analyst Review

This section provides various opinions of the top-level CXOs in the global lung cancer screening market. According to the insights of the CXOs, the global lung cancer screening market is expected to exhibit high growth potential owing to increase in prevalence of lung cancer across the globe, rise in R&D activities in innovative screening devices & development, and increase in awareness about early-stage screening for lung cancer in developed countries. Moreover, adoption of screening solutions in healthcare facilities contributes toward the growth of the market.

The CXOs further added that low-dose computed tomography (LDCT) helps in early detection of cancer. Furthermore, North America is expected to witness the highest growth, in terms of revenue, owing to rise in prevalence of non-small cell lung cancer, and strong presence of key players. For instance, according to American Cancer Society (ACS), about 84% of all lung cancer are non-small cell lung cancer. However, Asia-Pacific is anticipated to witness notable growth, owing to rise in smoking population more prone to develop lung cancer and rise in awareness about early-stage screening for lung cancer.

The upcoming trends of Lung Cancer Screening Market including increase in prevalence of lung cancer across the globe, increase in smoking population, and technological innovations in screening methods

Lung cancer is the leading application of Lung Cancer Screening Market.

North America is the largest regional market for Lung Cancer Screening.

Lung Cancer Screening is projected to reach $1,853.04 million by 2031, registering a CAGR of 7.7% from 2022 to 2031.

Major key players that operate in the global lung cancer screening market are Canon Medical Systems U.S. Inc., Eon Health, Fujifilm Holdings Corporation, General Electric Company (GE Healthcare), Koninklijke Philips N.V., Medtronic Plc, Microsoft Corporation (Nuance Communications, Inc.), Penrad Technologies Inc., Siemens Ag, and Volpara Solutions Limited.

The base year is 2021 in Lung Cancer Screening market

Yes, the Lung Cancer Screening market report provides PORTER Analysis

Loading Table Of Content...