Luxury Travel Market Research, 2035

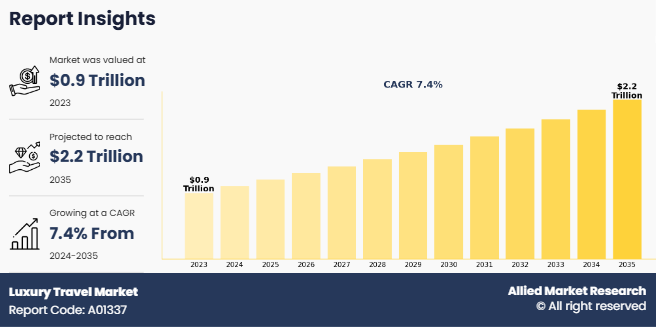

The global luxury travel market size was valued at $890.8 billion in 2023 and is projected to reach $2149.7 billion by 2035, growing at a CAGR of 7.4% from 2024 to 2035. Luxury travel refers to premium, high-end experiences that emphasize comfort, exclusivity, and personalized services, catering to affluent individuals or those seeking exceptional journeys. It is characterized by exclusive accommodations such as private villas, boutique hotels, and heritage properties, alongside private transport options such as chartered jets and yachts. Personalized itineraries, dedicated concierge services, and culturally immersive activities, such as private safaris or culinary events with renowned chefs, are central to luxury travel. Travelers often indulge in fine dining at Michelin-starred restaurants, access world-class wellness retreats, and enjoy tailored experiences that blend adventure with relaxation.

Market Dynamics

The increasing spending power of the middle and upper-middle-class segments is a key driver in the growth of the luxury travel market. As disposable incomes rise, particularly in emerging markets, these consumers are spending more on premium experiences and luxury travel. While traditionally the luxury travel market was dominated by high-net-worth individuals, the expanding middle and upper-middle-class demographic now seeks indulgent experiences, exclusive destinations, and higher-quality services, though at a slightly lower price point compared to ultra-high-net-worth travelers.

This group is more inclined to prioritize experiences over material goods, pushing demand for personalized travel itineraries, boutique hotels, fine dining, and curated activities. The availability of more affordable luxury options, such as boutique hotels, luxury cruises, and accessible first-class services has allowed the middle and upper-middle class to enjoy high-end travel experiences without the extreme costs associated with ultra-luxury offerings.

Growth in exposure of people to different forms of social media has enhanced their knowledge about various trends going on in society. Social media is increasingly becoming pseudo-travel agents, as it has been already taking on the role of unofficial travel agents. Customers are increasingly opting for travel services and products by taking advice from the people who have either stayed or traveled there before. They also refer to reviews and insights detailed on various social networking sites. Views and opinions shared on sites offer better transparency with respect to products, services, and experiences. Exposure to social media has resulted in conversant customers who wish for a unique travel experience. They are largely opting for customized travel packages, which is expected to create more opportunities for luxury travel market players in the upcoming years.

Modern travelers are prioritizing experiences over material possessions, thus driving the demand for personalized and experiential luxury travel. Customized itineraries, cultural immersions, and once-in-a-lifetime adventures are increasingly sought after, and are appealing to travelers looking for meaningful and transformative journeys.

The fluctuating global economic conditions, including inflation, currency instability, and market downturns, can significantly impact the spending capacity of even affluent travelers. Moreover, economic volatility often leads to reduced discretionary spending, thus affecting the demand for luxury travel experiences.

The growing awareness of environmental issues and the impact of over-tourism have led to increased scrutiny of the luxury travel sector. Eco-conscious travelers are becoming more selective, avoiding high-end experiences that do not prioritize sustainability, which can limit market growth for providers who fail to adapt to these expectations.

The integration of sustainable luxury travel presents a significant opportunity for the market. With an increasing number of eco-conscious travelers seeking environment-friendly yet premium experiences, businesses can differentiate themselves by offering carbon-neutral travel options, eco-lodges, and sustainable itineraries. This shift toward eco-luxury not only aligns with consumer values but also enables providers to attract a growing niche of high-net-worth individuals prioritizing environmental responsibility without compromising on comfort and exclusivity.

Segmental Overview

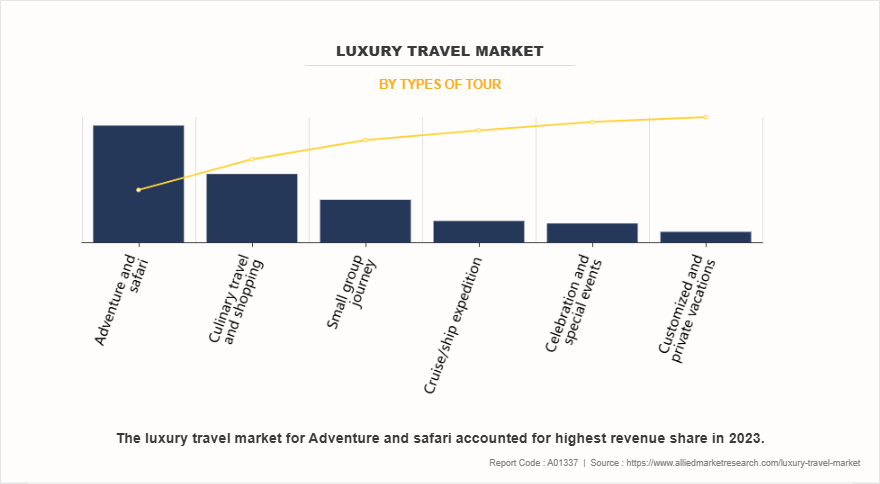

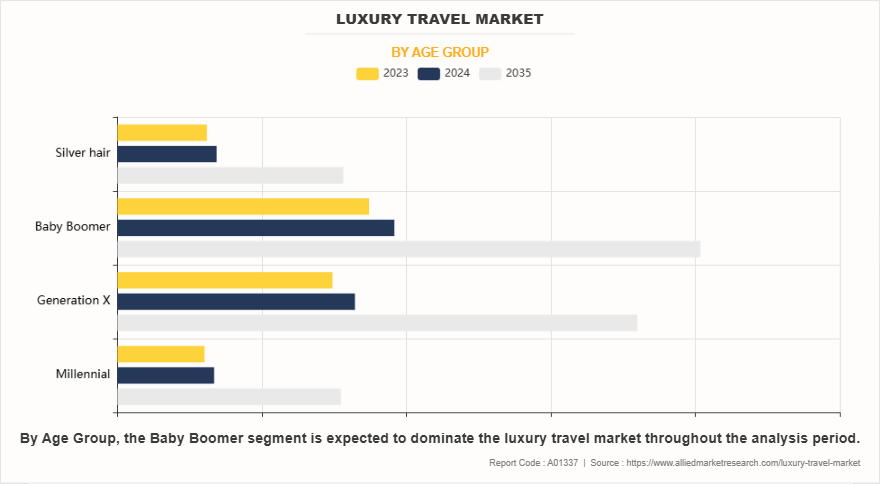

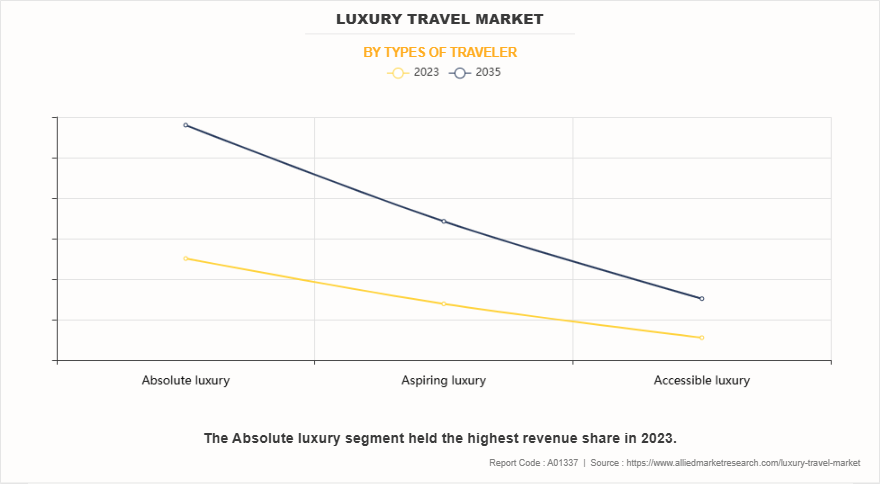

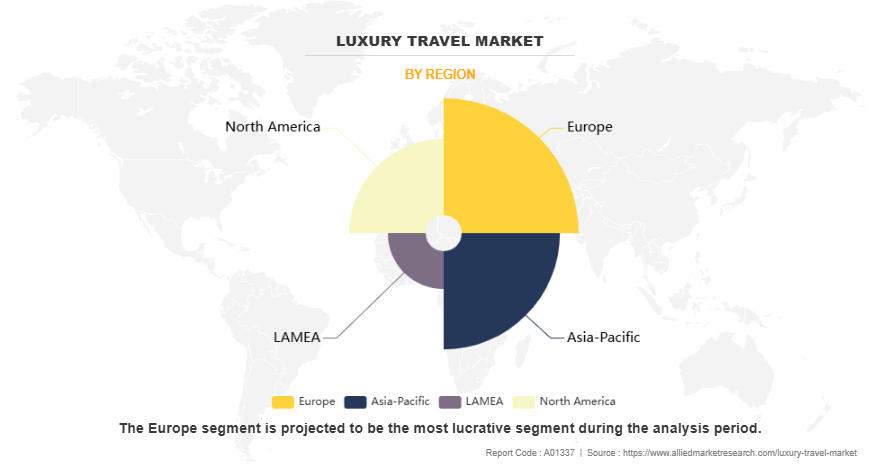

The luxury travel market is segmented on the basis of type of tour, age group, type of traveler, and region. By type of tour, the market is classified into customized and private vacations, adventure and safari, cruise/ship expeditions, small group journeys, celebration and special event, and culinary travel and shopping. Age groups of the luxury travel market are millennial (21-30), generation X (31-40), baby boomers (41-60), and silver hair (60 and above). The luxury travel market is further classified into type of traveler as absolute luxury, aspiring luxury, and accessible luxury. Region wise, the luxury travel market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, Spain, Italy, and Rest of Europe), Asia-Pacific (China, Singapore, India, and Rest of Asia-Pacific), and LAMEA (Middle East, Latin America, and Africa).

By Type of Tour

By type of tour, the adventure & safari segment dominated the luxury travel market in 2023 and is anticipated to maintain its dominance during the forecast period. The adventure and safari segment dominates the luxury travel market due to its unique appeal to high-net-worth individuals seeking transformative and exclusive experiences. Safaris and adventure travel offer unparalleled opportunities for immersion in nature, encounters with wildlife, and access to remote and pristine locations. Its features are highly valued by luxury travelers. The exclusivity of private game reserves, guided expeditions, and luxury lodges elevates these experiences, by blending adventure with comfort and personalized services which is expected to propel growth of luxury travel industry.

By Age Group

By age group, the baby boomer segment held the major luxury travel market share in 2023 and is anticipated to maintain its dominance during the forecast period. The baby boomer segment dominates the luxury travel market due to its financial stability, ample leisure time, and preference for premium experiences. As a generation that has accumulated significant wealth through careers and investments, baby boomers are well-positioned to afford high-end travel which is expected to propel luxury travel market growth. Many are retired or approaching retirement, which grants them the time to indulge in extended trips and explore bucket-list destinations without the constraints of work schedules.

By Type of Traveler

By type of traveler, the absolute luxury segment dominated the luxury travel market in 2023 and is anticipated to maintain its dominance during the forecast period. This segment prioritizes experiences that emphasize privacy, uniqueness, and the highest level of comfort, such as private jets, ultra-luxury resorts, and bespoke travel packages. Affluent consumers are drawn to offerings that provide status, prestige, and access to rare, once-in-a-lifetime experiences, all of which are hallmarks of absolute luxury. In addition, the absolute luxury segment benefits from its clientele's insensitivity to economic fluctuations. Ultra-high-net-worth individuals are less affected by financial downturns, ensuring sustained demand for premium offerings even during challenging economic periods. This segment also thrives on the growing trend of experiential travel, as affluent travelers increasingly seek highly customized itineraries that go beyond traditional tourism to deliver meaningful and exclusive adventures, such as private island retreats, luxury safaris, or behind-the-scenes cultural immersions.

By Region

Region-wise, Europe dominated the luxury travel industry in 2023 and is anticipated to maintain its dominance during the forecast period. Europe has long dominated the luxury travel market due to its rich cultural heritage, diverse landscapes, and world-renowned luxury offerings. The continent is home to iconic luxury destinations such as Paris, Rome, Geneva, and the Swiss Alps, which are synonymous with premium experiences, high-end fashion, gourmet dining, and historical significance. Europe’s longstanding reputation for refined craftsmanship, such as luxury cars, watches, and couture fashion, has helped cement its status as a top destination for affluent travelers seeking exclusivity and sophistication.

Competition Analysis

The key players profiled in luxury travel market report include Abercrombie & Kent Ltd, Cox and Kings Ltd., TUI group, Micato Safaris, Ker and Downey, Tauck, Thomas Cook Group, Scott Dunn Ltd., Kensington Tours, and Butterfield & Robinson Inc.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the luxury travel market analysis from 2023 to 2035 to identify the prevailing luxury travel market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the luxury travel market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global luxury travel market trends, key players, market segments, application areas, and market growth strategies.

Luxury Travel Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 2149.7 billion |

| Growth Rate | CAGR of 7.4% |

| Forecast period | 2023 - 2035 |

| Report Pages | 248 |

| By Types of Tour |

|

| By Age Group |

|

| By Types of Traveler |

|

| By Region |

|

| Key Market Players | Tauck, Inc., Thomas Cook India Ltd., Scott Dunn Ltd., Kensington Tours Ltd., TUI GROUP, Butterfield & Robinson Inc., Abercrombie & Kent USA, LLC, Zicasso, Inc., Micato Safaris, Travelopia Holdings Limited |

Analyst Review

The global luxury travel market is anticipated to witness robust growth in regions such as Asia-Pacific and LAMEA. The growth in the number of HNI’s globally and easy availability of on-arrival visa propel the growth of the overall luxury travel market. According to industry experts, French, Germans, Spaniards, and Australians opt for adventure and safari trips. In addition, Russian travelers opt for places like Goa in India, where they can relax and enjoy the tropical weather as they spend most of their time in a cold region. Culinary tours are also witnessing significant growth in the travel market. There is an increase in the number of private and culinary trips in Europe, owing to growth in interest of people in local culture and their aspiration to have a better understanding of local cuisines and people.

Countries such as China and India have huge growth potential and are the major investment pockets in the luxury travel market. Affluent Arabs prefer to spend their holidays in the most luxurious way like visiting London and splurging on high-end shopping. In addition, they opt for destinations, where they can spend huge amounts on shopping. Affluent Chinese millennial travelers prefer to have quality travel experience; thus, they opt for high-end accommodation and luxurious ways of traveling, which is propelling the growth of the overall luxury travel market. Key market players are adopting various growth strategies such as product launch (tour packages) and acquisition to sustain in the competitive market.

The global luxury travel market was valued at $638,206.8 million in 2023 and is projected to reach $ 2,149,683.4 million by 2035, registering a CAGR of 7.4% from 2024 to 2035

The luxury travel market is segmented on the basis of type of tour, age group, type of traveler, and region. By type of tour, the market is classified into customized and private vacations, adventure and safari, cruise/ship expedition, small group journey, celebration and special event, and culinary travel and shopping. Age groups of the luxury travel market are millennial (21-30), generation X (31-40), baby boomers (41-60), and silver hair (60 and above). The luxury travel market is further classified into type of traveler as absolute luxury, aspiring luxury, and accessible luxury. Region wise, the luxury travel market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, Spain, Italy, and Rest of Europe), Asia-Pacific (China, Singapore, India, and Rest of Asia-Pacific), and LAMEA (Middle East, Latin America, and Africa).

Europe is the largest regional market for luxury travel

The key players profiled in the luxury travel market report include Abercrombie & Kent Ltd., Cox and Kings Ltd, TUI group, Micato Safaris, Ker and Downey, Tauck, Thomas Cook Group, Scott Dunn Ltd., Kensington Tours, and Butterfield & Robinson Inc.

The global luxury travel market report is available on request on the website of Allied Market Research.

Loading Table Of Content...

Loading Research Methodology...