Mainframe Market Overview

The global mainframe market was valued at USD 2.9 billion in 2022, and is projected to reach USD 5.6 billion by 2032, growing at a CAGR of 7.3% from 2023 to 2032.

Rise in demand of high-performance computing, development of IoT landscape, increase in large data sets, and growth in adoption of mainframe as a service. Furthermore, cost issues associated with mainframe solutions and lack of mainframe skilled professionals are expected to considerably impact the growth of the mainframe market during the forecast period. Moreover, on-going mainframe modernization and the integration of blockchain in mainframe are expected to be opportunistic for the global mainframe market during the forecast period. However, each factor has its definite impact on the market.

Key Market Insights

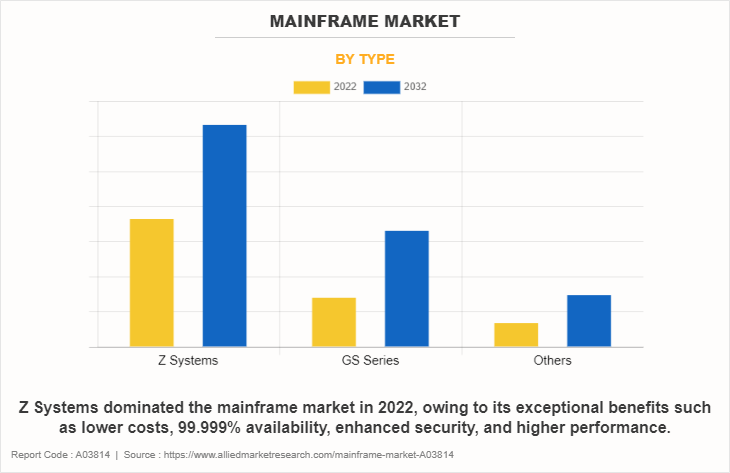

- By type, the GS series segment is expected to witness the highest growth during the forecast period.

- By end user, retail and e-commerce is expected to exhibit the highest growth during the forecast period.

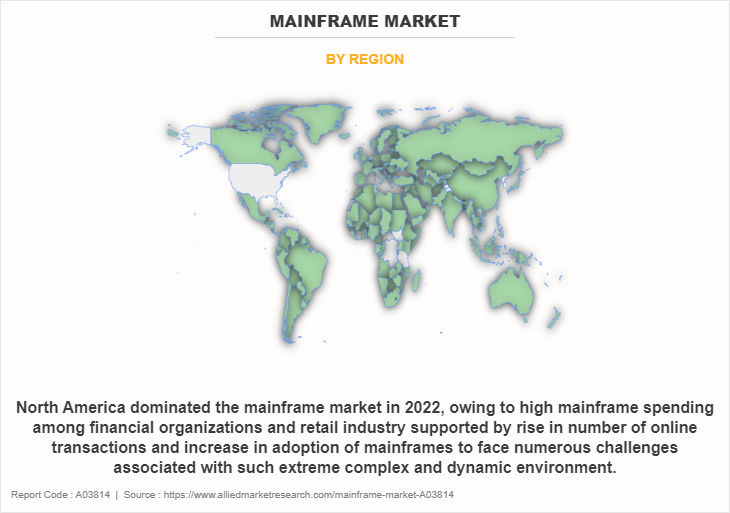

- By region, Asia-Pacific segment is expected to witness the highest growth during the forecast period.

Market Size & Forecast

- 2032 Projected Market Size: USD 5.6 Billion

- 2022 Market Size: USD 2.9 Billion

- Compound Annual Growth Rate (CAGR) (2023-2032): 7.3%

Additionally, the innovations have been driving the demand for mainframes and for high-performance computing equipment. The development of mainframe applications in emerging technologies such as AI, ML, block chain, and many others, is also contributing to the market's expansion. High scalability, reliability, and stability for corporate operations, as well as an increase in cyberattacks and data breaches has significantly propelled the market growth. Thus, due to the rapid expansion of digitalization across a number of industries, including BFSI, healthcare, and many others, the mainframe market is growing significantly. The mainframe market is segmented into Type, End User, and Region.

What is Mainframe

Mainframes are known for their dependability, which is an essential aspect in the industry. To ensure continuous functioning, mainframes are built with redundant parts such as power supply and CPUs. In addition, to avoid data loss and save downtime, they also have sophisticated error detection and correction mechanisms. For industries that cannot afford operational disruptions, this high level of dependability is crucial. Continuous innovation and modernization initiatives by mainframe suppliers are essentially defining the mainframe market. The vendors make research and development investments to improve mainframe performance, expand their capabilities, and support new technologies.

Mainframe Market Segment Review

The mainframe market is segmented on the basis of type, end user, and region. By type, it is divided into Z systems, GS series, and others. By end user, it is classified into BFSI, IT and telecom, government and public sector, retail and e-commerce, travel and transportation, manufacturing, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, Z systems segment dominated the mainframe market growth in 2022 and is expected to maintain its dominance in the upcoming years, owing to its exceptional benefits such as lower costs, 99.999% availability, enhanced security, and higher performance. The IBM Z mainframes consist of proprietary ASIC on-chip hardware dedicated for cryptographic processes, and keeps data always encrypted during its processing. However, the GS series segment is expected to witness the highest growth, owing to being capable of handling several processors and having a large quantity of memory, which allows them to process large volumes of data and run complex applications quickly.

By region, North America dominated the mainframe market size during the forecast period, owing to high mainframe spending among financial organizations and retail industry supported by rise in number of online transactions and increase in adoption of mainframes to face numerous challenges associated with such extreme complex and dynamic environment. However, Asia-Pacific segment is expected to witness the highest growth, owing to growing finance industry supported by rising mobile and credit card transactions in China and India are the major factors that fuel the growth of the mainframe market.

What are the Top Impacting Factors in Mainframe Market

Increase in IoT Landscape

Internet of Things (IoT) has been one of the most useful innovations in the last decades, leading to the introduction of billions of IoT-based devices across the globe, which is further projected to grow significantly in the upcoming years. The data analysing and processing should be more secure and sophisticated, as the IoT landscape is evolving and getting complex. Growth in IoT landscape has led to high demand for collection of data from sensors and devices and it is expected to increase further over the coming decade.

The connected devices across different industry verticals such as healthcare, retail, production and others need real-time updates of its data. Each of these unique updates consists of data accesses, database storage, and various computing cycles, which can increase by 20x or 100x depending on the operations performed. All these factors demand high end computing and fast processing, which is solvable by mainframes. Leveraging the power of the mainframe to virtualize IoT data in real-time can be considered as a standard practice for real-time analysis. As a result, growth in IoT-based devices drives the adoption of mainframe systems.

Rise in Adoption of Mainframe as a Service

In this digital and rapidly evolving era, mainframe technology is still lagging. However, there is an increase in its adoption. In addition, mainframe is still a preferred choice for many private & public organizations and companies, due to its stability and security, as cybersecurity is becoming a major concern for every industry. The major adopters of the mainframes are the government institutions as they heavily depend on it. Thus, Mainframe as a Service provides various benefits such as scalability, easy migration, business continuity, other support and reduced cost benefits to its users.

Moreover, Mainframe as a Service (MaaS) is expected to provide major opportunities for market growth in the upcoming years, as it can offer mainframe power through PaaS, IaaS, and SaaS. Also, mainframe has the ability to drastically change the mainframe capabilities, by eliminating most of the challenges faced by the developers and helps businesses to run mission-essential workloads in a cloud environment. The users are able to gain access to the latest mainframe technology by shifting from a capital-expense to operating-expense model. The key benefit provided by this technology can decrease cost, risk-avoidance, and IT infrastructure burden for the organizations. Furthermore, IBM, one of the major market players, recently announced its first cloud services with mainframe-level data protection. The cloud service thus allows developers and clients to build, deploy, and host applications along with providing robust data protection.

Which are the Key Companies in Mainframe Market

International Business Machines Corporation

Broadcom

DXC Technology Company

Fujitsu

Hewlett Packard Enterprise Development LP

Atos Se

Dell Inc.

HCL Technologies Limited

BMC Software, Inc.

Cognizant.

What are the Key Benefits for Stakeholders:

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the mainframe market analysis from 2022 to 2032 to identify the prevailing mainframe market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the mainframe market forecast assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global mainframe market share.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global mainframe market trends, key players, market segments, application areas, and market growth strategies.

Mainframe Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 5.6 billion |

| Growth Rate | CAGR of 7.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 261 |

| By End User |

|

| By Type |

|

| By Region |

|

| Key Market Players | BMC Software, Inc., Hewlett Packard Enterprise Development LP, Dell Inc., Cognizant, International Business Machines Corporation, Atos SE, Fujitsu, HCL Technologies Limited, Broadcom, DXC Technology Company |

Analyst Review

The mainframe market is expected to grow owing to the increased reliability of organizations in a variety of sectors on these potent computing systems for their mission-critical workloads. For sectors such as banking, finance, healthcare, and government, mainframes are the best option because of their unmatched stability, scalability, and security.

Moreover, in order to guarantee continuous operation with a minimum amount of downtime, mainframes are built with redundant components and sophisticated fault detection and repair methods. For companies where uninterrupted processing is critical, reliability on systems with minimum downtime is important. In addition, mainframes can accommodate thousands of users at once and handle increasing workloads with ease. Furthermore, organizations can increase their processing capability without affecting operations by adding additional processors, memory, and storage.

This adaptability is especially beneficial for sectors with varying or quickly rising processing requirements. In today's digital environment, security is most important for organizations, and mainframes provide strong security measures. In-built security features on mainframes guard against unauthorized access, data breaches, and online dangers. Mainframes offer a secure environment for processing sensitive data owing to the system's strict access controls, encryption features, and audit trails. Additionally, the ongoing innovation and modernization initiatives of mainframe providers also benefit the market. The suppliers make research and development investments to improve mainframe performance, expand their capabilities, and support new technologies. As mainframes combine with cloud computing, AI, and analytics, businesses may take advantage of new technologies while maximizing the dependability and scalability of mainframes in the future.

For instance, in December 2022, IBM Corporation partnered with AWS to drive mainframe modernization. Through this partnership, both companies have enhanced their mainframe product portfolio and it made a superior impact on the growth of the global mainframe market.

Rise in demand of high-performance computing and development of IoT landscape are the upcoming trends of Mainframe Market in the world.

On-going mainframe modernization is the leading application of Mainframe Market

North America is the largest regional for Mainframe Market

The global mainframe market was valued at $2,846.59 million in 2022 and is projected to reach $5,550.08 million by 2032, registering a CAGR of 7.3% from 2023 to 2032.

The dominated key players are International Business Machines Corporation, Broadcom, DXC Technology Company, Fujitsu, Hewlett Packard Enterprise Development LP, Atos Se, Dell Inc., HCL Technologies Limited, BMC Software, Inc., Cognizant. These players have adopted various strategies to increase their market penetration and strengthen their position in the Mainframe Market.

Loading Table Of Content...

Loading Research Methodology...