Master Data Management Market Overview

The global master data management market size was valued at USD 16.8 billion in 2022 and is projected to reach USD 74.5 billion by 2032, growing at a CAGR of 16.3% from 2023 to 2032.

Surge in growing amount and complexity of data and rise in need for data governance and regulatory compliance the major factors that is striking the master data management market growth during the forecast period. However, increasing cost and ROI and rise in culture Barriers posed by organizations is primarily restraining the market growth. Moreover, rise in integration of new technologies is expected to create a lucrative opportunity for the market growth during the forecast period.

Introduction

Master data management (MDM) is the process of creating and maintaining a single, accurate, and consistent version of master data throughout an organization. Master data is made up of important corporate data entities such as personnel records, supplier information, and information about customers, products, and suppliers. This master data is standardized, purified, and synchronized across many systems and applications used by the organization with the help of MDM. The main objective of MDM is to give different business units and apps access to a trustworthy and authoritative source of master data. MDM enables businesses to strengthen data governance, remove data duplication, and improve data quality by creating a single version of the truth for master data. As a result, organizations are able to make better decisions, run more efficiently, and improve customer experience. Furthermore, data integration, data quality management, data governance, and data stewardship capabilities are frequently included in MDM solutions.

With the aid of these solutions, businesses are able to combine and match master data from various sources, validate and clean it, develop data governance standards, and designate data stewards who are in charge of overseeing and preserving the quality and integrity of master data. MDM solutions be implemented on-premises or in the cloud, and they frequently connect with other business systems including supply chain management (SCM), customer relationship management (CRM), and enterprise resource planning (ERP).

Segment Overview

The master data management market is segmented into component, deployments model, enterprise size and end user. On the basis of component, it is categorized into solution and services. On the basis of deployment mode, it is bifurcated into on-premise and cloud. On the basis of enterprise size, it is bifurcated into large enterprise and small and medium-sized enterprises. On the basis of end user, it is fragmented into BFSI, IT and telecom, healthcare, retail and e-commerce, government, manufacturing, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The report focuses on growth prospects, restraints, and analysis of the global master data management market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global master data management market share.

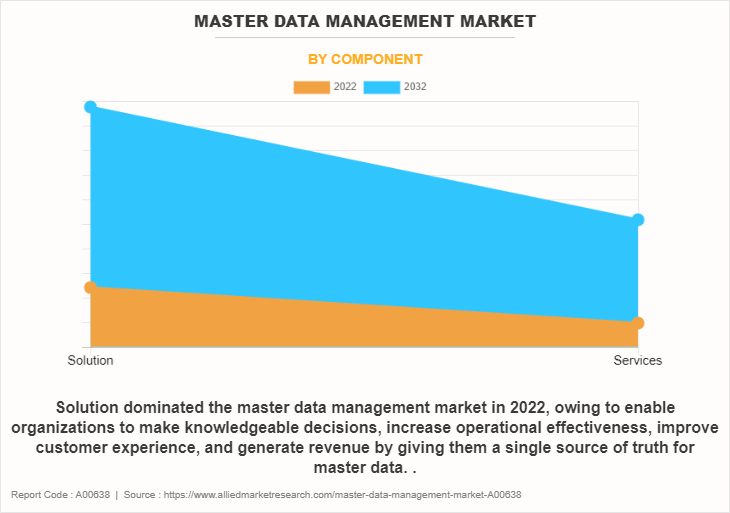

On the basis of component, solution segment dominated the MDM market in 2022 and is expected to maintain its dominance in the upcoming years owing to enable organizations to make knowledgeable decisions, increase operational effectiveness, improve customer experience, and generate revenue by giving them a single source of truth for master data propels the market growth significantly. However, the service segment is expected to witness the highest growth during the master data management market forecast, owing to provide organizations to businesses in maximizing the value of their data assets, enhancing decision-making, and enhancing operational effectiveness.

On the basis of region, North America region dominated the master data management market in 2022 and is expected to maintain its dominance in upcoming years owing to offers a centralized repository for high-quality, consistent data that is essential for decision-making based on data. However, the Asia Pacific region is expected owing to adoption of process automation across all industry verticals to enhance customer engagement and increase effectiveness of IT infrastructure in Asia-Pacific.

Top Impacting Factors

Growing Amount and Complexity of Data

The master data management (MDM) market is driven by the growing amount and complexity of data in the modern digital environment. The need to successfully manage and utilize this data becomes crucial as organizations generate and gather enormous amounts of data from multiple sources, including consumer interactions, transactions, and IoT devices. MDM solutions give organizations a centralized and uniform view of their data, enabling them to standardize, clean, and combine data from many sources. By ensuring data integrity, correctness, and consistency, organizations are better able to make informed decisions, increase operational effectiveness, and improve customer experiences.

In addition, the complexity of data is a factor in the implementation of MDM solutions. A single version of accurate information is difficult to maintain within an organization since data is spread across several systems, forms, and places. By offering data integration features that allow the seamless integration of data from diverse sources, MDM systems assist organizations in navigating this complexity. MDM solutions help organizations acquire a complete and holistic perspective of their data by combining and integrating data, which improves data analysis, reporting, and decision-making. One of the main factors contributing to businesses engagement in MDM solutions and making the most of their data assets is the capacity to handle the growing volume and complexity of data.

Rise in Need for Data Governance and Regulatory Compliance

The master data management market is driven by the need for regulatory compliance and data governance. Different laws and compliance frameworks, such as GDPR, HIPAA, and CCPA, which require the proper administration and protection of sensitive data, are applicable to organizations across all industries. By offering strong data governance capabilities, MDM systems play a critical role in assisting organizations in meeting these compliance obligations. Data quality management, data lineage, data security, and privacy controls are some of these capabilities. To reduce the risk of non-compliance and potential penalties, organizations use MDM solutions to set up data governance frameworks, enforce data regulations, and assure data integrity, correctness, and privacy.

In addition, data governance has grown to be a crucial component of successful data management techniques. Organizations understand the importance it holds to have uniform processes, guidelines, and controls in operations for managing and governing their data assets. Data management roles and duties, as well as the ability to enforce data governance regulations, are all capabilities and features that MDM solutions provide to organizations. Organizations maintain data consistency, enhance data quality, and create a culture of data governance by using MDM solutions, which comply with industry's best practices and regulatory standards. The adoption of MDM solutions is also being driven by the growing emphasis on regulatory compliance and data governance as businesses work to protect data privacy, security, and compliance in a constantly changing regulatory environment.

Key Market Players

The key players companies in the master data management industry include SAS Institute Inc., Informatica Inc., Ataccama, Talend, IBM, SAP SE, Broadcom Inc, Cloud Software Group, Inc., Amazon Web Services, and Oracle Corporation. Furthermore, it highlights the strategies of the key players to improve the master data management market share and sustain competition for master data management industry.

Regional Insights

The master data management market is gaining momentum globally as organizations prioritize data governance, accuracy, and consistency to drive informed decision-making. Below are the key regional insights:

North America

North America dominates the MDM market, driven by the increasing adoption of advanced technologies such as cloud computing, artificial intelligence (AI), and big data analytics. The U.S., in particular, is a major contributor, as businesses across industries like healthcare, BFSI (Banking, Financial Services, and Insurance), and retail are focusing on integrating MDM solutions to manage vast data volumes. Regulatory requirements like the Health Insurance Portability and Accountability Act (HIPAA) and the Sarbanes-Oxley Act are also encouraging organizations to implement MDM for data accuracy and compliance. The high level of digital transformation in North American companies, along with strong IT infrastructure, further fuels master data management market growth in the region.

Europe

Europe is another significant player in the master data management market, primarily due to strict data protection regulations such as the General Data Protection Regulation (GDPR). Countries like Germany, the UK, and France are leading adopters of MDM solutions, especially in industries like manufacturing, telecommunications, and finance. With businesses facing increasing pressure to ensure data quality and accuracy for regulatory compliance, MDM solutions are becoming essential for effective data governance in Europe. Additionally, the rise of Industry 4.0 and digital transformation initiatives in the region is driving demand for cloud-based MDM platforms that offer scalability and flexibility.

Asia-Pacific

Asia-Pacific is projected to witness the fastest growth in the master data management market, with countries such as China, India, Japan, and South Korea at the forefront. The region’s rapid digitalization, growing adoption of cloud technologies, and expansion of sectors like manufacturing, retail, and BFSI are driving the need for robust MDM solutions. In China and India, the growing focus on improving data governance and operational efficiency in large enterprises and government initiatives to promote digital transformation are key drivers. The region’s increasing emphasis on data accuracy for better customer experience and competitive advantage is expected to further fuel MDM adoption.

Latin America and Middle East & Africa

In Latin America, countries like Brazil and Mexico are seeing a gradual rise in MDM adoption, particularly in industries like telecom, banking, and retail. As businesses in these regions embrace digital transformation and big data analytics, the need for data management solutions is growing. In the Middle East & Africa, the master data management market is also expanding, especially in the UAE, Saudi Arabia, and South Africa, where businesses are focusing on enhancing data quality and governance to improve decision-making and operational efficiency. The rising adoption of cloud technologies and e-governance initiatives in the region is further contributing to the market’s growth.

Key Industry Development

Recent Product Upgraded/Development in the Market

On February 2023, Talend enhanced its master data management and updated Talend Data Fabric, its end-to-end platform for data discovery, transformation, governance, and sharing. The addition of data observability enables data professionals to automatically and proactively monitor the quality of their data over time and provide trusted data for self-service data access. By leveraging dataset crawling or tags, users can easily uncover data blind spots to discover new datasets.

On July 2022, SAS Institute Inc., enhanced its master data management and performs functions such as extracting business information from data sources, capturing data errors through user-defined business rules and sequesters the data for review and correction.

On March 2021, IBM Corporation enhanced its InfoSphere master data management 12.0 that provides better compliance support and the ability to speed task resolution decisions with machine learning assisted stewardship; usability improvements are provided by IBM InfoSphere Global Name Management 7.0 and IBM InfoSphere Identity Insight 10.0.

Recent Acquisition in the Market

On February 2022, IBM acquired Neudesic, a US-based cloud services consultancy specializing primarily in the Microsoft Azure platform, along with bringing skills in multi-cloud. This acquisition significantly expanded IBM’s portfolio of hybrid multi-cloud services and further advance the company’s hybrid cloud and AI strategy.

Recent Partnership in the Market

On May 2022, Informatica, an enterprise cloud data management leader partnered with Oracle that brings Informatica’s industry-leading data integration and governance products to Oracle Cloud Infrastructure (OCI). In addition, Oracle has named Informatica as a preferred partner for enterprise cloud data integration and data governance for data warehouse and lakehouse solutions on OCI. Through this initiative, Oracle and Informatica integrated Informatica’s Intelligent Data Management Cloud (IDMC) with Oracle Autonomous Database, Oracle Exadata Database Service, Oracle Exadata Cloud@ Customer, and Oracle Object Storage. Informatica and Oracle plan to make these offerings available in the Oracle Cloud Marketplace.

Key Benefits for Stakeholders:

This report provides a quantitative analysis of the master data management market size, segments, current master data management market trends, estimations, and dynamics of the master data management market analysis from 2022 to 2032 to identify the prevailing master data management market opportunities.

The master data management market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the market segmentation assists to determine the prevailing master data management market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global master data management market trends, key players, market segments, application areas, and master data management market growth strategies.

Master Data Management Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 74.5 billion |

| Growth Rate | CAGR of 16.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 349 |

| By component |

|

| By Deployments Model |

|

| By Enterprise size |

|

| By End User |

|

| By Region |

|

| Key Market Players | Ataccama, Amazon Web Services, SAS Institute Inc., Oracle Corporation, IBM, Informatica Inc., Talend, Broadcom Inc, Cloud Software Group, Inc., SAP SE |

Analyst Review

The leading companies, owing to organizations' growing requirement to manage and maintain accurate and consistent master data, the global master data management (MDM) market is expanding significantly. Data quality, data governance, and data integration concerns are addressed comprehensively using MDM solutions. By consolidating and balancing master data from many sources, these solutions assist organizations in creating a single version of the data that are accessed and used by numerous business units and applications. The complexity and volume of data generated by organizations, the requirement for data-driven decision-making, and the expanding need for regulatory compliance are some of the key drivers of the MDM industry. In addition, the combination of MDM with other cutting-edge technologies like machine learning (ML) and artificial intelligence (AI) is promoting industry expansion. Accurate and trustworthy master data are increasingly valued by businesses for increasing operational effectiveness, enhancing customer satisfaction, and propelling expansion. Furthermore, the complexity of data integration, the requirement for data governance and stewardship, and the high up-front expenses related to installing MDM solutions are some of the difficulties the MDM market needs to deal with. Advanced MDM solutions that provide greater data quality management, improved data governance capabilities, and seamless connectivity with other corporate systems are the main emphasis of vendors in the industry. The MDM industry is anticipated to have considerable growth in the upcoming years as organizations continue to prioritize data management and governance.

In March 2022, Oracle enhanced its enterprise data management solution. The cloud solution for Enterprise Data Management (EDM) improves the solution’s capabilities in a variety of areas. These additions address critical concerns such as data integrity, data transfer, and request tracking. When information from non-EDM users is required, efficiently resolving data integrity problems found by EDM validations might be difficult. Validation errors now be downloaded to an MS Excel file as of the March update. This allows EDM users to get help/feedback from others.

The global master data management market is expected to grow at a compound annual growth rate (CAGR) of 16.3% from 2023-2032 to reach $74.5 billion by 2032

Surge in growing amount and complexity of data and rise in need for data governance and regulatory compliance the major factors that is striking the master data management market growth during the forecast period.

The global master data management market size was valued at $16.8 billion in 2022, and is projected to reach $74.5 billion by 2032

Asia-Pacific is expected to witness significant growth during the forecast period

Major key players in the master data management market research report SAS Institute Inc., Informatica Inc., Ataccama, Talend, IBM, SAP SE, Broadcom Inc, Cloud Software Group, Inc., Amazon Web Services, and Oracle Corporation.

Loading Table Of Content...

Loading Research Methodology...