Meal Kit Market Research, 2031

The global meal kit market size was valued at $11.1 billion in 2021, and is projected to reach $43.4 billion by 2031, growing at a CAGR of 14.9% from 2022 to 2031.

The meal kit market consists of the sales of meal kits by players in the market who prepare and deliver fresh ingredients, pre-cooked meals, half-cooked food products, and customized food ingredients to their consumers so they can conveniently finish preparing the meals at home. Meal kits are a good substitute for grocery shopping since they cut down on visits, offer a good nutrition diet, and save time and money.

Market Dynamics

According to the report of the National Library of Medicine, meal kit services, much like online grocery shopping, allow for greater social distancing and experienced a significant increase in usage in the first year of the pandemic. Before the pandemic, less than 15% of households had ordered a meal kit; in 2020, almost 25% of households had tried a meal kit service in the U.S.

The rapid increase in the female workforce is expected to drive the meal kit market growth owing to the busy schedule of both partners in a family which leads to a reduction in the time for cooking and buying vegetables. According to the report of the U.S. Bureau of Labor Statistics women’s labor force participation was 57.4% in 2019, up from 57.1% in 2018. According to the report of the NITI (National Institution for Transforming India) Aayog, the share of female labor in the total labor force increased from 23.1% to 27.9% in two years from 2018-2020. Such a rise in the female workforce coupled with rapid urbanization is expected to drive the growth of the market during the forecast period since more female workforce cause more time-poor consumers which is one of the main reasons for the use of meal kits.

The sudden surge in the adoption of cooking as a hobby by educated people is expected to drive the growth of the meal kit industry since they have less time so they tend to choose meal kits as an option instead of restaurant-prepared food to save time spent on buying vegetables. According to the National Library of Medicine, U.S., cooking increased overall from 2003 to 2016. The percentage of college-educated men cooking increased from 37.9% in 2003 to 51.9% in 2016 and college-educated women who cook increased from 64.7% in 2003 to 68.7% in 2016. Such a rise in the number of people adopting cooking as a hobby is expected to propel the meal kit market size as they have less time for cooking so they tend to avoid grocery shopping.

Most meal kit services provide vegan and gluten-free diets to the consumer. There are also a growing number of specialized meal kit services that cater to unique dietary needs and preferences. Nowadays consumers are more aware of what they are eating and the health effects of the food they are having and generally they prefer a healthy and nutritious diet for themselves and meal kit offers nutritious diet to consumers. The meal kit is generally healthier as compared to ready-to-eat food offered to consumers since its ingredients are fresh and there are no additives or preservatives. Players in the market are offering consumers to choose meals as per their diet or meals suggested by nutritionists that best suit their bodies and health. Such health benefits offered by meal kits is expected to drive the growth of the meal kit industry.

The meal kit services are not generally available in tier 2 and tier 3 cities which can hold back the growth of the meal kit market since a very big part of consumers remains untapped. Meal kits are not available in these cities owing to their short shelf life and the special care needed for them. Along with this, the high price of meal kits compared to the traditional way of cooking is also a factor that restraints tier 2 and tier 3 cities people from using meal kit services.

There has been a surge in the demand for plant-based food owing to a surge in the vegan population since veganism has emerged as a trend with increasing awareness of animal cruelty. According to a survey commissioned by the Vegan Society, the number of vegans in the UK quadrupled between 2014 and 2018. In 2019, there were 6,00,000 vegetarians, around 1.16% of the population. As per the survey commissioned by the government of the UK, Britain’s vegans are pretty new to the lifestyle, with 63% having started out only in the last five years. That being said, the overwhelming majority of Britain’s vegans (81%) graduated from veganism, so many have been avoiding meat for much longer than this. Companies are introducing plant-based meal packages as a result of the growing number of vegans. For instance, Freshly, Purple Carrot, and Fresh n’ Lean are dealing in plant-based meals, especially for plant-based diets which are expected to create an opportunity for the market to grow at a rapid pace.

There has been a meal kit market opportunity for growth owing to the personalized kits being offered by the players in the market are attracting consumers as personalized kits offer consumers to choose meals according to their tastes and preference. For instance, HelloFresh and Home Chef are providing meal kits according to the preference of the consumer. Such an option to consumers of opting for their meal kit according to their diet and taste is attracting consumers to the market.

Segment Overview

The meal kit market is segmented on the basis of meal type, offering type, distribution channel, and region. On the basis of meal type, the market is classified into vegetarian and non-vegetarian. As per offering type, it is categorized into heat & eat and cook & eat. According to distribution channels, the market is fragmented into online, hypermarkets/supermarkets, convenience stores, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Meal Type

Non-vegetarian meal kits dominated the market in 2021 and is expected to maintain dominance during the forecast period.

As per the meal kit market forecast, depending on meal type, the non-vegetarian segment is expected to sustain its dominance during the forecast period. The non-vegetarian segment accounted for 68.5% of the meal kit market share in 2021. This dominance is attributed to the presence of proteins, minerals, and vitamins such as A, B6, B12, niacin, and thiamine in meat, that is making it appealing to consumers. Along with this, the availability of a wide range of fresh, value-added, and healthful meats from numerous product delivery service providers is expected to fuel the meal kit market demand for the segment. According to the report of the U.S. Department of Agriculture in 2018, 65.2 pounds of chicken per person were available for Americans to eat (on a boneless, edible basis), compared to 54.6 pounds of beef. Such a huge availability of chicken and beef is expected to propel the demand for the segment.

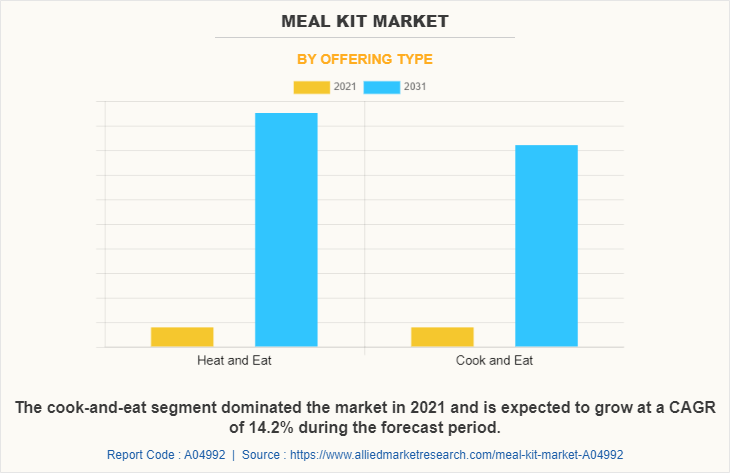

As per the meal kit market, on the basis of offering type, the cook-and-eat segment is expected to be the dominant segment during the forecast period. The cook-and-eat segment garnered revenue of around $5,568.6 million in 2021 and is expected to grow at a CAGR of 14.2% during the forecast period. The segment is expected to grow owing to the popularity of gourmet-style, home-cooking among youngsters. Along with this it also offers consumers to try various recipes or healthy meals without spending any extra money on eating at restaurants.

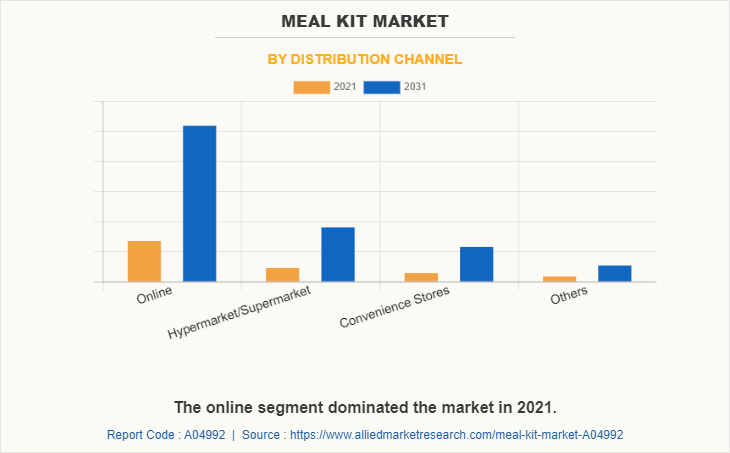

Based on the distribution channel, the online segment dominated the market with a 60.2% market share of the global market in 2021 and is expected to dominate the market during the forecast period. The segment accounts for the major share since the online sales channel has increased consumer reach owing to which it has evolved as a key source of revenue for many companies. Consumers are becoming more aware of the many purchase patterns that exist in society as technology advances and internet services become more widely available. The technology attracts millennials and generation Z and is expected to influence the buying pattern of products.

Region-wise, the meal kit market has been analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America dominated the market in 2021, garnering a market share of 43.7% followed by Europe with 23.5% share. Asia-Pacific is expected to witness the highest growth during the forecast period, owing to the surge in the number of time-poor consumers coupled with rising disposable income in the region. Asia-Pacific, the market, is expected to witness a CAGR of 16.8% owing to the convenience and freshness offered by meal kits. Furthermore, COVID-19 has increased the interest in home-cooked food and surged the demand for the product in the region. According to the report of the USDA, Foreign Agricultural Service China is the world’s second-largest retail market after the U.S. According to the National Library of Medicine, in 2018, the number of double-earner households was 46.3%, and women’s participation rate in economic activities was 52.9% in South Korea and is gradually increasing each year.

Competition Analysis

The prominent meal kit market players include Blue Apron, LLC., Daily Harvest, Fresh n' Lean, Global Belly, Gobble, Gousto, HelloFresh, Hungryroot, Marley Spoon AG, Nestlé Group, Oisix ra Daichi Inc., Pruvit Ventures, Inc., Snap Kitchen, LLC., The Kroger Co., and Yumble.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the meal kit market analysis from 2021 to 2031 to identify the prevailing meal kit market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the meal kit market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global meal kit market trends, key players, market segments, application areas, and market growth strategies.

Meal Kit Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 43.4 billion |

| Growth Rate | CAGR of 14.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 226 |

| By Meal Type |

|

| By Offering Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | The Kroger Co., Snap Kitchen, LLC., Fresh n' Lean, Daily Harvest, HelloFresh, Gousto, Gobble, Pruvit Ventures, Inc., Marley Spoon AG, Hungryroot, Global Belly, Blue Apron, LLC, Nestle S.A., Yumble, Oisix ra daichi Inc. |

Analyst Review

According to the CXO, the factors such as the increasing female workforce coupled with rising disposable income will drive the demand for meal kits. However, the unavailability of meal kits in tier 2 and tier 3 cities and the short shelf life of the kits are expected to hamper the market growth during the forecast period.

CXOs further added that the increasing urbanization rate will propel the growth of the market and personalization coupled with the rising number of time-poor consumers is expected to propel the demand for the meal kits.

Conversely, an increase in R&D activities in the meal kit market is expected to provide substantial growth opportunities for the industry players in the near future.

The global meal kit market size was valued at $11.1 billion in 2021, and is projected to reach $43.4 billion by 2031

The global Meal Kit market is projected to grow at a compound annual growth rate of 14.9% from 2022 to 2031 $43.4 billion by 2031

Blue Apron, LLC, Daily Harvest, Global Belly, Fresh n' Lean, Yumble, HelloFresh, Pruvit Ventures, Inc., Oisix ra daichi Inc., Marley Spoon AG, Hungryroot, Gobble, Snap Kitchen, LLC., The Kroger Co., Gousto, Nestle S.A.

North America dominated the market in 2021

The sudden surge in the adoption of cooking as a hobby by educated people is expected to drive the growth of the meal kit industry

Loading Table Of Content...