Medical Aesthetic Devices Market Statistics - 2030

The global medical aesthetic devices market was valued at $13,529.65 million in 2020, and is projected to reach $38,916.60 million by 2030, growing at a CAGR of 10.7% from 2021 to 2030. Medical aesthetic is used to treat and enhance the aesthetic appearance of a person by treating various conditions, such as skin laxity, excessive fat, cellulite, scars, moles, wrinkles, unwanted hair, liver spots, spider veins, and skin discoloration. Traditionally, it includes dermatology, oral & maxillofacial surgery, reconstructive surgery, and plastic surgery. Aesthetic medicine comprises surgical & non-surgical procedures and a combination of both can be used to enhance the physical appearance of an individual. In addition, deformities caused due to accidents, trauma, and other congenital disorders are rectified by the use of aesthetic devices (particularly implants). In addition, aesthetic procedures help reverse the ageing process to a certain extent. Moreover, the importance of physical appeal is on rise and people globally are attracted to products and treatments that will help them retain their youth and beauty.

The medical aesthetic market size is expected to exhibit significant growth during the forecast period, due to increase in demand for minimally invasive & noninvasive reconstruction surgeries. The key factors driving the medical aesthetic market growth are rise in incidence of congenital face & tooth deformities and increase in awareness for aesthetic appearance.

However, high costs of treatment, low reimbursements, and risk of malfunctions associated with implants restricts the market growth. On the contrary, development of the medical tourism industry, emergence of tourism medical spas, and adoption of aesthetic procedures to enhance physical appearance are expected to provide several opportunities for key market players and enhance medical aesthetic industry .

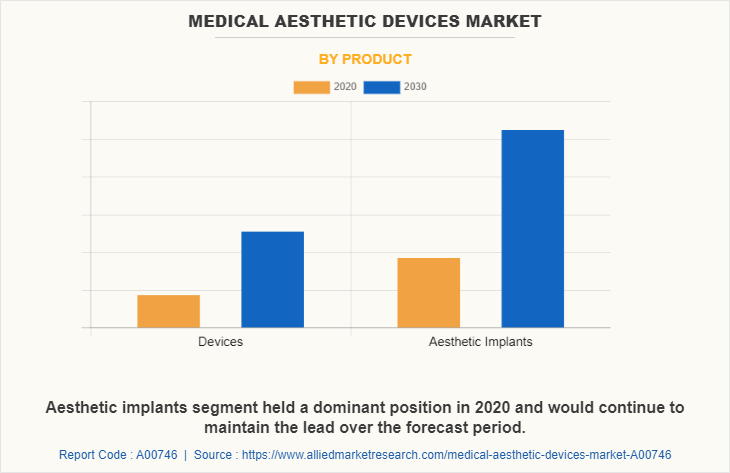

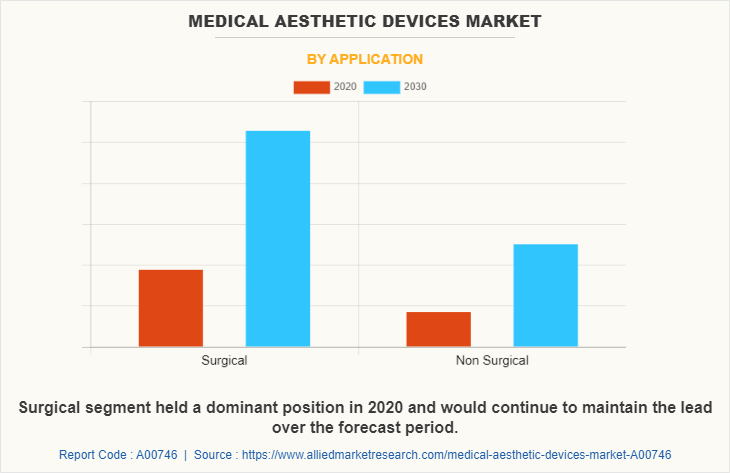

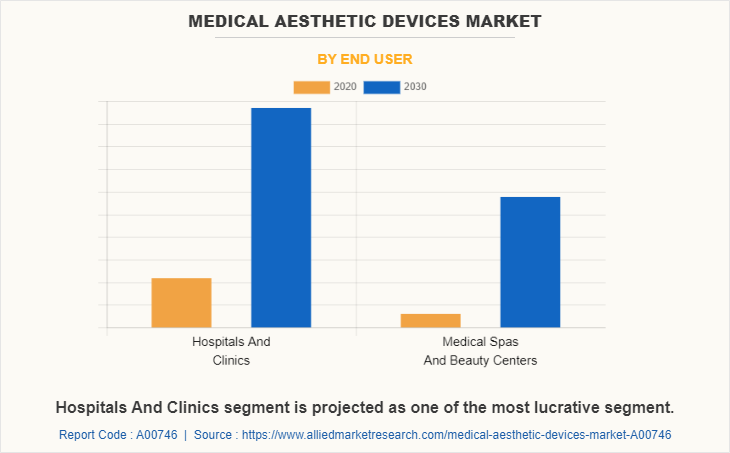

The global medical aesthetic market size is segmented into product, application, end user, and region. According to type of product, the market is divided into devices and aesthetic implants. On the basis of application, it is bifurcated into surgical and non-surgical. Depending on end user, it is segregated into hospitals & clinics and medical spas & beauty centers.

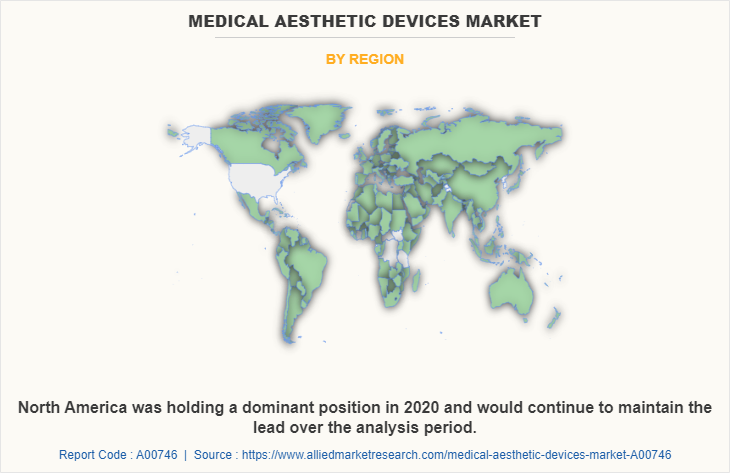

Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Medical Aesthetic Devices Market Segmentation

By type, the aesthetic implant segment was the major revenue contributor in 2020, and is anticipated to continue this trend during the forecast period, due to increase in awareness about cosmetic procedures escalated the market growth. On the other side, the demand for devices is projected to exhibit the fastest market growth during the forecast period, owing to rise in aging population, availability of consumer-friendly devices, and increase in trend to look aesthetically appealing.

On the basis of application, the non-surgical segment presently dominates the medical aesthetic market share, and is expected to remain dominant during the forecast period, as non-surgical medical aesthetic procedures are more accessible and affordable when compared with surgical procedures.

Depending on end user, the hospitals & clinics segment presently dominates the market, and is expected to remain dominant during the forecast period, as hospitals & clinics provide almost all the types of cosmetic procedures for patients

Region wise, North America dominated the market in 2020, accounting for the highest share, and is anticipated to maintain this trend throughout the medical aesthetic market forecast, owing to increased adoption of medial aesthetics, enhanced technological advancements, and development of novel products by key players. In addition, rise in geriatric population, favorable reimbursement rates, prevalence of congenital tooth & face deformities, and advanced healthcare infrastructure are anticipated to drive the medical aesthetic industry.

This report provides comprehensive competitive analysis and profiles of prominent market players such as key players operating in the Allergan PLC, Solta Medical Syneron Medical Ltd., Cynosure Inc. Lumenis Ltd. Johnson & Johnson, Merz Pharma GmbH & Co. KGaA, Alma Lasers Ltd. (acquired by Shanghai Fosun Pharmaceutical Co., GC Aesthetics Plc., Sientra Inc., Zimmer Biomet Holdings, Inc., and Dentsply Sirona Inc.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the medical aesthetic market analysis from 2020 to 2030 to identify the prevailing medical aesthetic market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the medical aesthetic devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global medical aesthetic market trends, key players, market segments, application areas, and market growth strategies.

Medical Aesthetic Devices Market Report Highlights

| Aspects | Details |

| By Product |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Johnson & Johnson, VALEANT PHARMACEUTICAL INTERNATIONAL, INC, MERZ PHARMA GMBH & CO. KGAA, Sientra Inc, SYNERON MEDICAL LTD, Dentsply Sirona Inc., LUMENIS LTD, Hologic, Inc., Allergan plc, Zimmer Biomet Holdings, Inc. |

Analyst Review

According to CXOs of key companies in the medical aesthetic industry, the adoption of medical aesthetic devices is expected to increase in future, owing to surge in incidence of congenital face & tooth deformities, increase in awareness for aesthetic appearance, and rise in demand for minimally invasive & noninvasive reconstruction surgeries.

According to the perspectives of CXOs of leading companies, the medical aesthetics market has piqued the interest of healthcare providers, owing to increased need of people to look aesthetically appealing. Increase in number of awareness programs has been witnessed, such as breast reconstructive awareness campaign (launched in the U.S.), to create awareness among breast cancer patients regarding breast implants. Furthermore, increase in the number of cosmetology surgeons has fueled the market growth. Asia-Pacific and LAMEA are expected to offer lucrative opportunities for market players during the forecast period. However, high cost of treatment, low reimbursements, and risk of malfunctions associated with implants restrict the market growth. Conversely, increase in medical tourism, emergence of tourism medical spas, adoption of aesthetic procedures to enhance physical appearance, and increase in the preference for a better quality of life are expected to present several opportunities for the market growth during the forecast period. Moreover, North America is expected to dominate the global market, followed by Europe.

The total market value of medical aesthetic devices market is $13,529.6 million in 2020.

The forecast period in the report is from 2021 to 2030

The market value of medical aesthetic devices Market in 2021 was $15,586.2 million

The base year for the report is 2020.

The top companies that hold the market share in medical aesthetic devices market are Allergan PLC, Solta Medical Syneron Medical Ltd., Cynosure Inc. Lumenis Ltd. Johnson & Johnson, Merz Pharma GmbH & Co. KGaA, Alma Lasers Ltd. (acquired by Shanghai Fosun Pharmaceutical Co., GC Aesthetics Plc., Sientra Inc., Zimmer Biomet Holdings, Inc., and Dentsply Sirona Inc.

The key trends in the medical aesthetic devices market are increase in demand for minimally invasive & noninvasive reconstruction surgeries, rise in incidence of congenital face & tooth deformities and increase in awareness for aesthetic appearance.

Loading Table Of Content...