Medical Image Analysis Software Market Research, 2031

The global medical image analysis software market size was valued at $3.9 billion in 2021, and is projected to reach $12.3 billion by 2031, growing at a CAGR of 12.2% from 2022 to 2031. Medical imaging software allows medical professionals to track, archive, manipulate, and manage patient images and administrative workflow. Medical image analysis software is an important part of diagnostic machines and it helps to enhance the features of an image thereby increasing the effectiveness and efficiency of medical treatment. This software is for storing, viewing, training, and sharing medical data.

Historical Overview

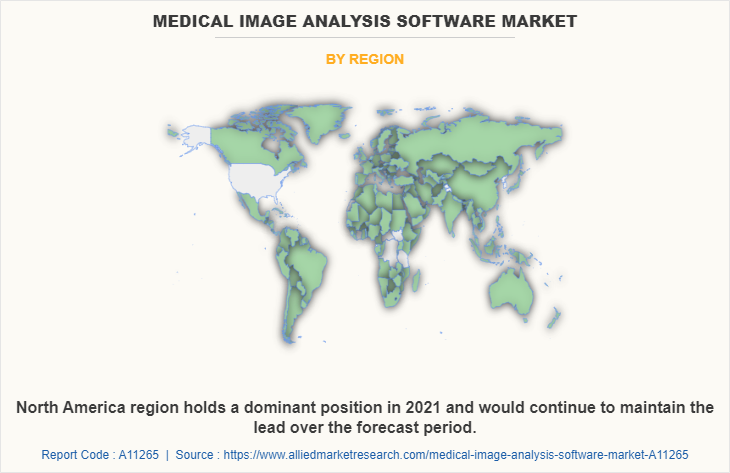

The market has been analyzed qualitatively and quantitatively from 2021 to 2031. The medical image analysis software market witnessed growth at a CAGR of around 12.2% from 2022 to 2031. Most of the growth during this period was from North America owing to the increase in the adoptions of medical image analysis software, rise in incidences of injuries and trauma, as well as well-established presence of domestic market players in the region.

Market Dynamics

Growth & innovations in the medical devices industry for the adoption of medical image analysis software technology is driven by the massive pool of chronic diseases like cardiovascular and neurological conditions. The rise in the number of patients of various diseases creates an opportunity for the Medical Image Analysis Software Industry. Moreover, the rise in the number of strategies adopted by the Medical Image Analysis Software Industry players like product launch, product approval, and agreements by various key players across the globe is set to affect the growth of Medical Image Analysis Software Market Size positively. For instance, in November 2019, Royal Philips announced that U.S. Food and Drug Administration has approved its Philips SmartCT application software. SmartCT is a key component of Philips Image Guided Therapy System Azurion providing interventionalists with CT-like 3D images to support diagnosis, therapy planning, treatment, and follow-up for interventional radiology procedures.

The demand for medical image analysis software is not only limited to developed countries but is also being witnessed in the developing countries, such as China, Brazil, and India, which fuels the growth of the market. Factors such as rise in the number of diagnostic procedures performed and increase in awareness toward benefits of medical image analysis software further drive the growth of the market. Furthermore, rise in awareness related to advanced healthcare options boosts the adoption of medical image analysis software. In addition, an increase in research activities by manufacturers for developing innovative solutions in medical image analysis software technology is expected to fuel the adoption of medical image analysis software in the near future. However, the risks associated with the data safety of the software for medical image analysis in the hospitals are hampering the Medical Image Analysis Software Market Growth.

Segmental Overview

The global medical image analysis software market is segmented based on type, modality, imaging type, application, end user, and region. On the basis of type, the market is classified into integrated and standalone. As per modalities, the market is classified into tomography, ultrasound imaging, radiographic imaging, and combined modalities. According to imaging type, the market is classified into 2D imaging, 3D imaging, and 4D imaging. Depending on application, the market is classified into orthopedic, dental, neurology, cardiology, oncology, obstetrics & gynecology, and others. On the basis of end user, the market is classified into hospitals, diagnostic centers, ambulatory surgical centers, and others. Region wise, the market is studied across North America (the U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

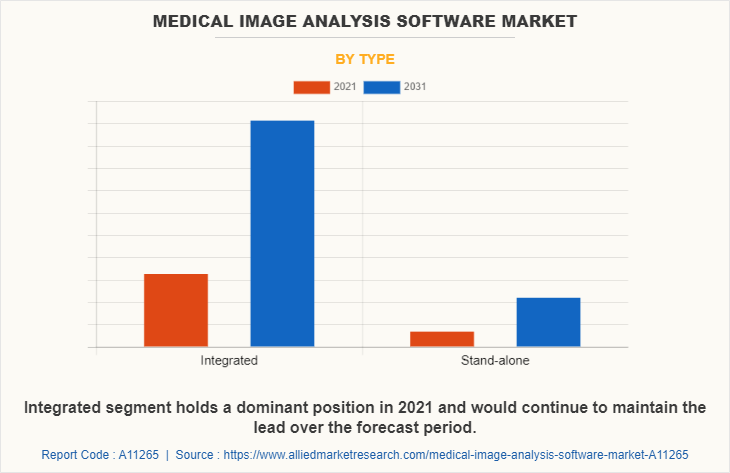

By Type

On the base of type, the integrated segment dominated the global Medical Image Analysis Software Market Size in 2021 and is expected to remain dominant throughout the forecast period, owing to increase in adoption of integrated medical imaging software for image analysis and availability of several types of software that are developed by various key players in the market. Moreover, the rise in the practice of medical imaging also boosts the demand of medical image analysis software devices.

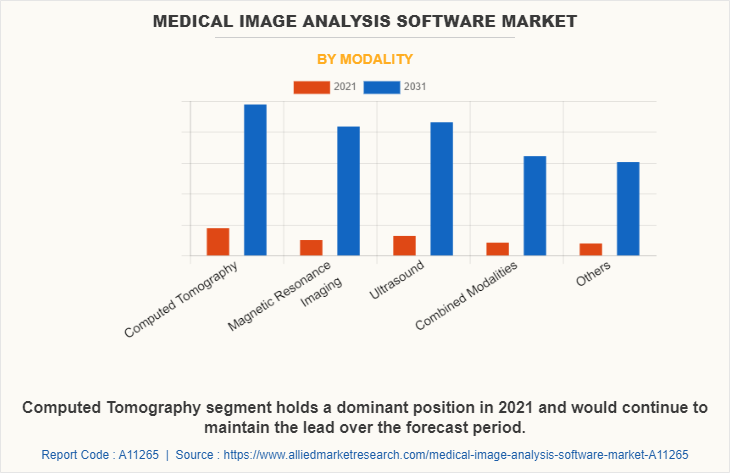

By Modality

By modality, the Computed Tomography segment dominated the global Medical Image Analysis Software Market Share in 2021 and is anticipated to continue this trend during the Medical Image Analysis Software Market Forecast period. This is attributed to the increase in the adoption of the software in CT scan imaging. However, the Magnetic Resonance Imaging segment holds the highest CAGR during the analysis period owing to the software used in Magnetic Resonance imaging also undergoing various developments which helps in the growth of demand for the software.

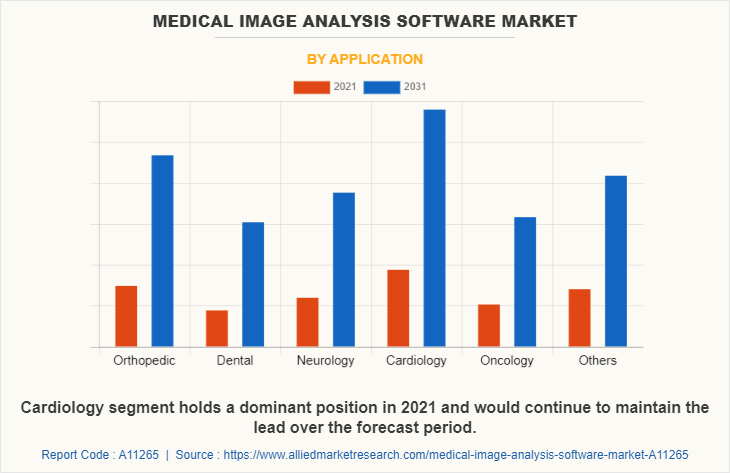

By Application

By application, the Cardiology segment dominated the global market in 2021 and is anticipated to continue this trend during the forecast period. This is attributed to the increase in the prevalence of chronic disorders among the population like cardiovascular diseases. However, the Dental segment holds the highest CAGR during the analysis period owing to, growth in awareness regarding medical imaging software drives the growth of market.

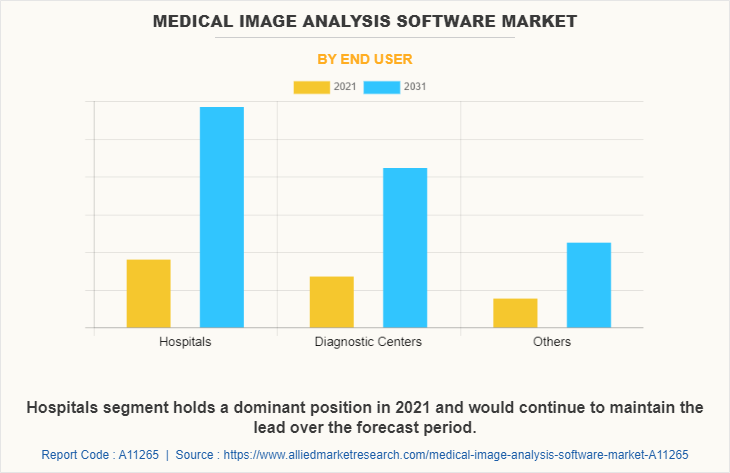

By End User

By end user, the hospitals segment held the largest Medical Image Analysis Software Market Share in 2021 and is expected to remain dominant throughout the forecast period, owing to increase the preference of adoption of medical image analysis software in hospitals, ease of the accessibility of the patients to the hospitals and rise in the number of hospital admissions of the patients.

By Region

By Region wise, the medical image analysis software market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, North America was the dominant region and is expected to remain dominant throughout the forecast period, owing to a high prevalence rate of chronic disorders like cardiology, oncology, obstetrics & gynecology, increase in the number of market players, and surge in the number of software available in the region. However, Asia-Pacific is expected to witness the highest CAGR during the analysis period, owing to the presence of high populace countries such as India and China, which in turn increases the number of chances of suffering from various types of chronic and fatal conditions, and the increasing number of strategies and trends adopted by the market players that include product development, product approval, partnership, collaboration, and agreement

Competitive Analysis

Competitive analysis and profiles of the major players in the medical image analysis software, such as Koninklijke Philips N.V., GE Healthcare, Siemens Healthineers, Spacelabs Healthcare, Agfa-Gevaert Group, MIM Software, Inc., Toshiba Medical Systems Corporation, Esaote SpA, Merge Healthcare, Inc., and Aquilab SAS are provided in this report. Various players have adopted strategies like product launch and product development as key developmental strategies to improve the product portfolio of the medical image analysis software market.

Product development in the market

- In December 2021, Canon Medical has announced integration of its available software with Spectronic Medical's MRI Planner software to strengthen its presence in the field of radiotherapy planning. The MRI Planner software provided by Spectronic Medical is a technology that utilizes standard MR images to create synthetic CT images, including depictions of organs at risk.

- In March 2021, Siemens Healthineers had introduced a new software solution that speeds up the entire reading workflow for breast imaging namely Mammovista B.smart. It also comes with a new teamplay Mammo Dashboard which is a tool for dashboard-based visualization of key performance indicators (KPIs) in the breast imaging process that serves to optimize workflows.

- In March 2022, Agfa HealthCare had showcased its innovative solution, the Enterprise Imaging Platform in Orlando which creates the Imaging Health Record to align with and complete clients' Electronic Health Record (EHR) strategies.

Agreement in the market

- In January 2023, Heilig Hart hospital in Belgium, a long-term customer of Agfa HealthCare, deployed the latest enterprise imaging solution for radiology, including a hospital wide VNA and the XERO Universal Viewer, in Microsoft's Azure public cloud platform, to support both current and future image management needs.

Acquisition in the market

- In April 2022, Coexya, announced the acquisition of Aquilab. This acquisition allowed Coexya to consolidate its leading position in the healthcare sector and more specifically in oncology. Coexya was then able to share its technical expertise with Aquilab’s 350 customers in Europe, and Aquilab will be able to accelerate its product development thanks to Coexya’s recognized skills in data processing and artificial intelligence.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the medical image analysis software market analysis from 2021 to 2031 to identify the prevailing medical image analysis software market Medical Image Analysis Software Market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the medical image analysis software market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global medical image analysis software market trends, key players, market segments, application areas, and market growth strategies.

Medical Image Analysis Software Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 12.3 billion |

| Growth Rate | CAGR of 12.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 220 |

| By Type |

|

| By Modality |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | MIM Software, Inc, Koninklijke Philips N.V. , Coexya, Agfa Healthcare, Siemens Healthineers, CANON MEDICAL SYSTEMS CORPORATION, ESAOTE SPA , IBM Corporation, GE Healthcare, Spacelabs Healthcare |

Analyst Review

In accordance with several interviews conducted, the medical image analysis enables medical device manufacturers and researchers to minimize clinical errors, unneeded tests, misdiagnosis cases, and raise care quality. It offers technological support to researchers, medical innovators and medical device manufacturers for tackling complex challenges in preventing, diagnosing, and treating diseases. 3D image analysis of particular body parts has certain specifics to it. It is ready to handle the needs in analyzing tissues, bones, muscles and organs in depth for liver, spleen, kidneys, gallbladder, and the genitourinary & endocrine systems that include urinary bladder, prostate, reproductive organs, thyroid, and cardiovascular system.

Asia-Pacific is expected to witness the highest CAGR during the analysis period, owing to the increase in the research and development expenditure for the development of the innovative and advanced software that increases the demand for the software in diagnosis procedure packed with enhanced benefits, increase in awareness about the medical imaging software, and increase in government support for amputation procedures among the amputees and other related trends adopted by the market players.

The base year for the report is 2021.

The increase in the adoption of software with diagnostic tools, the presence of key players, and high population base.

North America is the largest regional market for Medical Image Analysis Software

The total market value of the Medical Image Analysis Software Market is $3917.91 million in 2021.

The top companies that hold the market share in the Koninklijke Philips N.V., GE Healthcare, Siemens Healthineers, Spacelabs Healthcare, Agfa Healthcare, MIM Software, Inc., Canon Medical Systems Corporation, ESAOTE SPA, IBM Corporation (Merge Healthcare, Inc.), and Coexya.

The key trends in the Medical Image Analysis Software Market are the increasing prevalence of chronic disease, the rising adoption of softwares in healthcare sector, and a surge in technological advancement in Medical Image Analysis Software.

The forecast period in the report is from 2022 to 2031

There are 10 Medical Image Analysis Software manufacturing companies are profiled in the report

Loading Table Of Content...

Loading Research Methodology...