Medical Implant Market Research, 2033

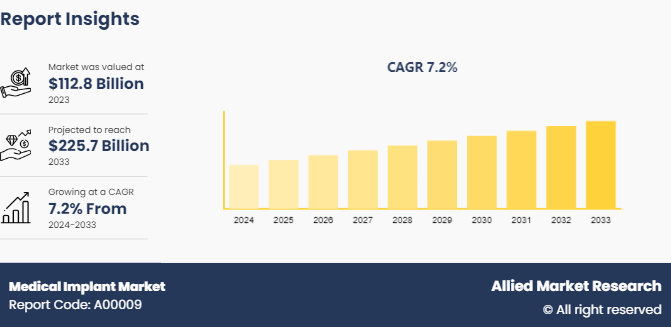

The global medical implant market size was valued at $112.8 billion in 2023, and is projected to reach $225.7 billion by 2033, growing at a CAGR of 7.2% from 2024 to 2033. Rise in aging population and increase in prevalence of chronic diseases are some of the major driving factors for the medical implants market. Aged people are more susceptible to chronic diseases such as cardiovascular diseases, orthopedic disorders, endovascular diseases, and dental disorders, thus being the major users of medical implants. For instance, with the increasing aging population, the demand for tooth loss is expected to grow. According to the American Academy Of Implant Dentistry (AAID), about 3 million people in the U.S. currently have dental implants, and this number is expected to grow by 500,000 annually.

Market Introduction and Definition

Medical implant is a medical device or tissue, which is surgically transplanted inside the body. These implants are used to replace or support any damaged body organs to normalize body functioning. They can be either implanted permanently or temporarily and can be removed when they are no longer required. Some of the implants are made up of bone, tissue, skin, ceramics, metals, plastics, and other natural materials.

Key Takeaways

- The medical implant market size study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period 2023-2033.

- More than 1, 500 product & service literatures, industry releases, annual reports, and other such documents of major medical implants industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The medical implant market share study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The medical implants market is experiencing significant growth, propelled by technological advancements, an aging population, and an increasing prevalence of chronic diseases. Innovations in materials science and biotechnology are leading to the development of more durable, biocompatible, and integrative implants. Technologies such as 3D printing are revolutionizing custom implant manufacturing, allowing for personalized solutions tailored to individual patient anatomies. Major segments such as orthopedic and cardiovascular implants are seeing substantial demand. Orthopedic implants benefit from the rising incidence of osteoarthritis, osteoporosis, and sports injuries, while cardiovascular implants such as pacemakers, stents, and defibrillators are in high demand due to the growing prevalence of cardiovascular diseases and advancements in minimally invasive procedures.

The market is further maintained by the increasing elderly population, who are more susceptible to conditions requiring implants. Neurostimulators and cochlear implants are also gaining traction due to their effectiveness in treating chronic pain, epilepsy, Parkinson’s disease, and severe hearing loss. Favorable regulatory frameworks and reimbursement policies in developed regions enhance market growth by ensuring the safety and efficacy of implants, boosting patient confidence and adoption rates. Additionally, emerging markets in Asia-Pacific and Latin America are experiencing rapid growth due to improving healthcare infrastructure and rising healthcare expenditure. The preference for minimally invasive surgeries, which offer reduced recovery times and lower risks, is also driving demand for associated implants, ensuring the market's sustained expansion.

Statement from Industry Leader

In April 2024, Amir Aghdaei, CEO of Envista Holdings Corporation, pointed out the strong growth trajectory in the dental implant sector, fueled by advancements in digital dentistry and patient-specific solutions. Aghdaei mentioned the company's innovative implant systems and digital workflows that enhance precision and efficiency in dental procedures. He also noted the rising demand for aesthetic and functional dental restorations, which is driving market expansion and technological developments |

Market Segmentation

The medical implant market share is segmented into product, and biomaterial type. Depending on product type, the medical implant industry is categorized into orthopedic implants, cardiovascular implants, spinal implant, neurostimulators, ophthalmic implants, dental implants, facial implants, and breast implants. Orthopedic implants are further divided into Reconstructive Joint Replacements, Orthobiologics and Trauma & Craniomaxillofacial. Cardiovascular Implants are further classified into Pacing Devices, Stents, and Structural Cardiac Implants. Spinal Implants are divided into Spinal fusion implants, Spinal bone stimulators, Vertebral Compression Fracture (VCF) Devices, and Motion Preservation Devices/Non-Fusion Devices. Neurostimulators are segregated into Deep Brain Stimulation (DBS) , Sacral Nerve Stimulation (SNS) , Vagus Nerve Stimulation (VNS) , Spinal Cord Stimulation (SCS) , and Other neurostimulators. Ophthalmic Implants are bifurcated into Intraocular Lens and Glaucoma Implants. Dental Implants are bifurcated into Plate Form Dental Implants and Root Form Dental Implants. Based on biomaterial type, it is segregated into metallic biomaterials, ceramic biomaterials, polymers biomaterials, and natural biomaterials. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America occupies the largest market for medical implants, followed by Europe. This is due to advancements in medical technologies, growing elderly population, increasing prevalence of chronic diseases, rise in health care expenditure, and improved health care infrastructure in the region. The medical implants market in Asia Pacific is also expected to grow at a high CAGR during the medical implant market forecast years. This is attributed to the increasing aging population, growing awareness about therapeutic applications of medical implants, increasing prevalence of chronic diseases, rising disposable income, and developing health care infrastructure in the region. In addition, rising demographics and economies in developing countries, such as India and China, are expected to lead to the growth in the medical implants market in Asia.

Industry Trends:

- In April 2024, the Indian Union Textiles Ministry announced efforts to develop a fabric-based tooth as a cost-effective alternative to expensive implants made from ceramics, polymers, and composites, according to two informed sources. The initiative aims to use dental resins derived from polyester to restore and replace tooth structure. Research and development will be carried out in collaboration with the All India Institute of Medical Sciences (AIIMS) and Indian Institutes of Technology (IITs) . The project will undergo multiple testing phases, including clinical trials on humans, to ensure its efficacy and safety.

- In May 2024, as per RMS Company, the medical implants market is witnessing a growing trend towards the design and production of patient-specific implants. This approach leverages advanced imaging techniques such as CT scanning to create implants that precisely match an individual patient's anatomy. The process involves using a standardized base with off-the-shelf hardware, while the surfaces interfacing with the patient are customized. This trend highlights the effective use of additive manufacturing, enabling digital customization according to the surgeon’s preferences without necessitating changes to downstream CNC programs or additional manual processes.

Competitive Landscape

The major companies profiled in the report include BIOTRONIK, Boston Scientific Corporation, Conmed Corporation, Globus Medical, Inc., Institut Straumann AG, Integra Lifesciences Holdings Corporation, Johnson & Johnson, LivaNova Plc, Medtronic Plc and Nuvasive, Inc.

Recent Key Strategies and Developments

- In May 2024, Orthofix Medical Inc., announced that it has received U.S. Food and Drug Administration (FDA) 510 (k) clearance to market its Rodeo Telescopic Nail. The Rodeo system addresses biomechanical and procedural challenges of current OI telescopic rod systems. Its patented design ensures strong, reliable bone fixation for the fragile bones of OI patients. The streamlined implant procedure, along with optimized instrumentation and sterile pack configurations, enhances operating room efficiency, eliminates pre-surgery tray sterilization, and reduces costs, O.R. time, and contamination risks.

- In December 2023, Advanced Bionics, received FDA approval and announced the expansion of its cochlear implant sound processor product, Marvel CI, and feature offerings to improve hearing care delivery and patient outcomes. The expanded list of product offering will help the company to strengthen its product portfolio of cochlear implant.

Key Sources Referred

- World Health Organization

- International Society for Prosthetics and Orthotics (ISPO)

- World Federation of Orthodontists

- International Medical Device Regulators Forum (IMDRF)

- European Association for Medical Devices (EAMD)

- International Society for Prosthetic and Orthotic Education

- Home National Institutes of Health (NIH)

- Centers for Disease Control and Prevention (CDC)

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the medical implant market analysis from 2024 to 2033 to identify the prevailing medical implant market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the medical implant industry segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global medical implant market trends, key players, market segments, application areas, and medical implant market growth strategies.

Medical Implant Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 225.7 Billion |

| Growth Rate | CAGR of 7.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Product |

|

| By Biomaterial Type |

|

| By Region |

|

| Key Market Players | LivaNova PLC, CONMED Corporation, Boston Scientific Corporation, Institut Straumann AG, NuVasive, Inc., Medtronic plc, Integra LifeSciences Holdings Corporation, Biotronik, Johnson & Johnson, Globus Medical, Inc. |

Few trends in medical implants market include trends include personalized implants for enhanced patient outcomes and the integration of sensors for real-time health monitoring.

Orthopedic implants are the leading product segment in Medical Implant Market in 2023

North America is the leading regional market in Medical Implant Market in 2023

The medical implant market was valued at $112.81 billion in 2023 and is estimated to reach $225.74 billion by 2033, exhibiting a CAGR of 7.2% from 2024 to 2033.

BIOTRONIK, Boston Scientific Corporation, and Conmed Corporation are few of the top companies to hold major share in the medical implant market

Loading Table Of Content...