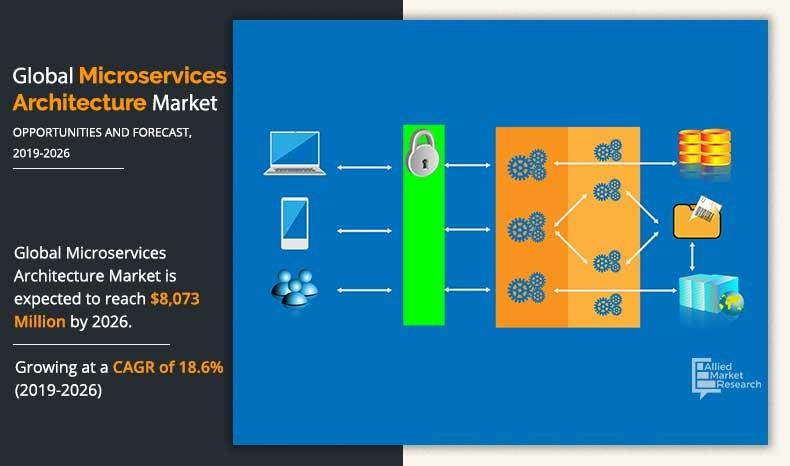

Microservices Architecture Market Statistics, 2026

The global microservices architecture market size was valued at $2,073 million in 2018, and is projected to reach $8,073 million by 2026, registering a CAGR of 18.6% from 2019 to 2026. Microservices architecture (MSA) is a process of developing software systems in which large monolithic applications are broken down into smaller manageable independent services. These services majorly focus on performing the tasks efficiently and communicate via language agnostic protocols. By using microservice architecture, organizations can focus on smaller independent services managed by different smaller teams instead of focusing all teams on one large application. Its adoption provides numerous benefits to organizations, which include improved productivity, faster development cycles, and superior scalable systems. The other key benefits of microservices architecture are it extends the reach of business, supports consumer choice, provides transparency & enablement, and improves business time to market by providing technology agility.

By component, the solutions segment garnered major share of the microservices architecture market in 2018, and is expected to remain dominant during the forecast period. The growth of this segment is attributed to the widespread adoption of microservices architecture among enterprises. Businesses are focusing more on streamlining application development process due to the advent of advanced technologies and digital transformation trends. Thus, organizations prefer adoption of microservices solutions to improve agility in the business process along with the faster time to market.

By Component

Service segment would exhibit the highest CAGR of 20.1% during 2019-2026.

By deployment mode, the on-premise segment led the in 2018, and is expected to remain dominant during the forecast period. However, cloud segment is expected to witness highest growth rate during the forecast period, owing to increase in preference of users toward the hybrid cloud deployments, as the hybrid cloud is an integrated service, which uses both public and private cloud with an orchestration between the two cloud services. In addition, the cloud deployment mode offers numerous benefits such as reduced risk, control, better performance, and cost efficiency, which is opportunistic for the market.

By Deployment Mode

Cloud would exhibit the highest CAGR of 21.2% during 2019-2026.

North America dominated the global market in 2018, and is expected to remain dominant during the forecast period, as the region is most advanced in terms of technology adoption. Moreover, the region holds the dominant position in the market, due to the presence of developed economies such as the U.S. and Canada, as they are majorly focused on innovations. However, Asia-Pacific region is expected to grow at the highest CAGR during the forecast period, owing to increase in adoption of microservices architecture among organizations to improve operational efficiency, achieve enhanced business agility, and reduce cost.

By Industry Vertical

BFSI segment is dominating the market and is expected to garner highest revenue during the forecast period.

The report focuses on the growth prospects, restraints, and trends of the microservices architecture market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the global market.

Top Impacting Factors

Current and future microservices architecture market trends are outlined to determine the overall attractiveness of the market. Top impacting factors highlight the opportunity during the forecast period. Factors such as increase in need for digital transformations, surge in penetration of connected devices, and rise in adoption of cloud-based solutions are expected to boost the market growth. However, security and compliance issues associated with the implementation of microservices architecture are expected to impede the market growth during the forecast period. On the contrary, increase in adoption of virtualized infrastructure is expected to provide major growth opportunities for the market in the upcoming years.

Proliferation of connected devices

The rising adoption of the Internet of Things (IoT) has heavily impacted the adoption of connected devices in numerous organizations. For instance, according to survey by GSM Association’s Connected Life, by the end of 2020 there will be over 24 billion connected devices. In addition, according to Cisco’s recent Internet of Everything prediction, there would be over 37 billion intelligent things connected to the Internet such as, smartphones, appliances, tablets, cars, sensor, and others. Moreover, these devices in turn involve various complexities from communication, cooperation to application. Thus, with the microservice architecture and its distributed approach such complexities would be reduced significantly.

Increasing adoption of virtualized infrastructure

The market for virtualization of servers is growing for the recent past. The major reason behind the adoption of virtualization is mainly attributed to the maintenance and infrastructural cost associated with the servers. Moreover, many organizations have already invested into virtual infrastructure; also numerous cloud service providers are using virtual machines (VMs) for their infrastructure-as-a-service (IaaS) offerings. Furthermore, virtualization of servers divides a server into slots for various users using virtual machines (VMs). However, microservices architecture is considered to be more efficient than VMs as it can share an OS. On the contrary, virtual machines (VMs) require their own OS, in turn consumes more resources. Thus, such factors are anticipated to provide major opportunities for the microservices architecture market.

Segment Review

The global microservices architecture market is segmented into component, deployment mode, organization size, industry vertical, and region. Depending on component, the market is bifurcated into solution and services. On the basis of deployment type, the market is bifurcated into on-premise and cloud. By organization size, it is divided into large enterprises and small & medium enterprises. On the basis of industry vertical, it is classified into service providers, enterprises, data centers, BFSI, manufacturing, retail & ecommerce, IT and telecom, healthcare, government, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Region

Asia-Pacific would exhibit the highest CAGR 23.4% during 2019-2026.

The global MSA market is dominated by the global Microservices Architecture players such as Tata Consultancy Services Limited, IBM Corporation, Microsoft Corporation, Oracle, Salesforce.com., Datawire, MuleSoft Inc., Software AG, CA Technologies, and Syntel.

Key Benefits for Stakeholders:

- This study presents the analytical depiction of global microservices architecture market trends and future estimations to determine the imminent investment pockets.

- A detailed analysis of the microservices architecture market segment measures the potential of the market. These segments outline the favorable conditions for the market.

- The report presents information related to key drivers, restraints, and opportunities.

- The current market is quantitatively analyzed from 2018 to 2026 to highlight the financial competency of the industry.

- Porter’s five forces analysis illustrates the potency of buyers & suppliers in the microservices architecture industry.

Microservices Architecture Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Deployment Type |

|

| By Organization Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Software AG, Salesforce.com, Inc., CA TECHNOLOGIES, Oracle Corporation, Cognizant, Tata Consultancy Services Limited, Infosys Limited, Datawire, MICROSOFT CORPORATION, IBM CORPORATION |

Analyst Review

The adoption of Kubernetes, an open-source container orchestration system, is growing continuously, due to which a number of companies are recognizing that it is not enough to adopt it but they also have to change all aspects of their tools, processes, and architecture. Kubernetes is expected to provide a major push for company-wide changes. Moreover, it offers a superior way to manage containers and make microservices architectures practical at an enterprise scale. Moreover, owing to ongoing advancements in intelligent technology, the demand for microservice architecture is increasing in the manufacturing sector, as the traditional automation pyramid is dissolving, which is expected to drive the growth of the market. In addition, shift in trend of manufacturing IT toward service orientation and app-orientation is expected to boost the adoption of microservice architecture in the manufacturing industry in the upcoming years. Furthermore, the adoption of cloud-based technology is increasing among the manufacturing companies to gain a competitive edge in the market with the support of information technology and computer-aided capabilities.

The microservice architecture market is fragmented and key players are using different strategies, such as partnerships, acquisitions, and new product launches to strengthen their foothold in this market. For instance, in May 2017, Informatica launched Intelligent Cloud Service, which is the most advanced Integration platform-as-a-service (iPaaS) solution available for end-to-end enterprise cloud data management. The solution is expected to provide a next-generation user experience depending on a modern API-based microservices architecture.

Loading Table Of Content...