Mobile Banking Market Research, 2032

The global mobile banking market was valued at $1.5 billion in 2022, and is projected to reach $7 billion by 2032, growing at a CAGR of 16.8% from 2023 to 2032.

Mobile banking is a service that allows consumers to perform various financial transactions and manage their accounts using a mobile device. It provides individuals with an easy and secure way to access their bank accounts, perform a wide range of banking transactions without physically visiting a branch.

The increases in demand for convenient banking services and increased smartphone penetration are fostering the growth of mobile banking market. Mobile banking allows users to check their account balances, review transactions, or make payments at any time of day. This flexibility aligns with the busy and often non-standard schedules of modern consumers. Moreover, mobile banking services are designed to save time. With a few taps on their smartphones, users can complete tasks that might have taken much longer through traditional banking channels. In addition, the growth in awareness about personal finance management drivers the mobile banking market growth.

However, rise in security and privacy concerns are major factors that hamper the growth of the mobile banking market. Mobile banking accounts contain a wealth of personal and financial information. The fear of identity theft is a significant concern, as a security breach could potentially expose individuals to fraudulent activities, leading them to reconsider using mobile banking for sensitive transactions. High-profile data breaches and cyberattacks targeting financial institutions can erode trust in mobile banking.

Contrarily, the integration of advanced technologies presents significant opportunities for the mobile banking industry. AI and machine learning could revolutionize mobile banking. This technology is used for personalized financial advice, predictive analytics, risk assessment and fraud detection. AI-powered chatbots and virtual assistants will provide real-time customer support and help users better manage their finances in the upcoming years.

The report focuses on growth prospects, restraints, and trends of the mobile banking market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the mobile banking market.

Segment Review

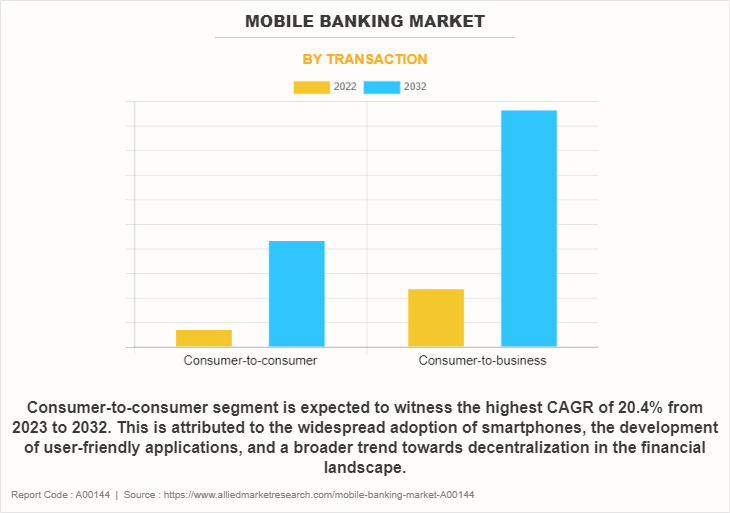

The mobile banking market is segmented on the basis of transaction, platform, and region. On the basis of transaction, it is categorized into consumer-to-consumer, and consumer-to-business. On the basis of platform, it is classified into android, iOS, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of transaction, the customer-to-business segment attained the highest mobile banking market size in 2022, owing to the fact that the customers are primarily using mobile banking for transferring money on a daily basis for various purchases made online, paying equated monthly instalment (EMI), and other such financial transactions in their day-to-day life.

On the basis of region, North America held the highest mobile banking market share in 2022, owing to the fact that North American mobile banking apps are increasingly incorporating biometric authentication methods, such as fingerprint recognition and facial recognition. These technologies enhance security by making it more difficult for unauthorized individuals to access users' financial information.

The report analyzes the profiles of key players operating in the mobile banking market such as American Express Company, Bank of America Corporation, BNP Paribas, Capital One, Citigroup Inc., JPMorgan Chase & Co., Mitsubishi UFJ Financial Group, Inc., UBS, HSBC Holdings plc, and Wells Fargo & Company. These players have adopted various strategies to increase their market penetration and strengthen their position in the mobile banking market.

Market Landscape and Trends

Contactless payment methods such as NFC-based mobile payments are on the rise in recent years. Consumers want the convenience of paying with their smartphones, especially in the wake of the global health crisis, which has led to the increasing use of biometric methods such as fingerprint recognition and facial recognition in mobile banking transactions. They enhance security and streamline the login and transaction approval processes. In addition, providing streamlined customer experience via mobile application while reducing the impact of fraud, creates a mobile banking market an opportunity for the bank to integrate advance technologies such as blockchain, chatbots, wireless application protocol (WAP), and others to sustain in the competitive market. The increase in demand for self-service and personalization on products and services fuel the growth of the mobile banking market.

Furthermore, technological advancements in mobile banking such as the delivery of personalized real-time customer service through smart bots, rise in usage of mobile devices allowing users to obtain instant customer assistance, drive the market growth. Therefore, the mobile banking market is constantly evolving, with new trends emerging as technology advances.

Top Impacting Factors

Increased Smartphone Penetration

Smartphones have security features such as biometric authentication and encryption that help ensure the security of mobile banking transactions. Many mobile banking apps use additional security measures, such as multi-factor authentication, to protect customer data. In addition, the processing power of smartphones with high-speed internet connections enables fast and efficient transactions. Customers transfer money, pay bills and even apply for loans using their smartphones with just a few taps on their smartphones. Further, the speed and efficiency of these transactions make mobile banking an attractive option for those who want instant order processing. Moreover, mobile banking offers personal financial management tools that allow users to track spending, set budgets and manage their financial goals. The mobility and accessibility of smartphones enhance capabilities. Thus, these factors are driving the growth of the mobile banking market.

Increase in Demand for Convenient Banking Services

One of the key features offered by mobile banking is the 24/7 accessibility of customers to their accounts. Traditional brick-and-mortar banks have limited hours of operation, and customers generally have to visit during these hours. Moreover, mobile banking allows users to check their account balances, track transactions, or make payments at any time of the day, any day of the week. In addition, mobile banking services are designed to save time. With a few taps on their smartphones, users navigate through banking channels to complete transactions that take a long time. For instance, money transferred between accounts or payments be made within seconds without having to wait in line at a bank or write a check so these features are driving the growth of the mobile banking market.

Growth in Awareness about Personal Finance Management

More people are using mobile banking to learn about new things such as budgeting, investing, saving and debt management. This enables consumers to make informed decisions about their finances. Personal financial planning skills lead to greater demand for financial tools and products. Mobile banking offers a wide range of services that help users to manage their finances, such as real-time account tracking, expense tracking, budgeting, and investing. These tools make it easier for individuals to take control of their financial lives through their smartphones. In addition, mobile banking gives user instant access to their account information, including balances, transaction history and pending transactions. This access enables individuals to have ongoing access to information about their financial health, which is key to effective personal financial management. Therefore, these factors foster the growth of the mobile banking market.

Rise in Security and Privacy Concerns

Mobile banking accounts contain a wealth of personal and financial information. The fear of identity theft is a significant concern, as a security breach could potentially expose individuals to fraudulent activities, leading them to reconsider using mobile banking for sensitive transactions. Massive data breaches and cyber-attacks targeting financial institutions could undermine confidence in mobile banking. When consumers hear about a data breach, they fear the security of their personal financial data. These concerns discourage people from adopting or continuing to use mobile banking market services.

Furthermore, financial services and banks are among the key targets for hacker attacks and data breaches are scrutinized at a large scale in those industries. In addition, the number of cases of data leakage has almost tripled for the last two years due to attacks that include phishing, key logger software, and other such attacks on financial data, thus restraining the growth of mobile banking market.

Integration of Advanced Technologies

The use of advanced technologies such as big data, chatbots, and blockchain technology help banks to support the end-to-end customer experience. Further, AI and machine learning have the potential to revolutionize mobile banking in the upcoming years. This technology is used for personalized financial advice, predictive analytics, risk assessment, and fraud detection.

Furthermore, banks have an opportunity to implement big data engines to improve risk assessment processes by providing streamlined customer experience while reducing the impact of fraud. Moreover, 39% of banking executives mentioned reducing costs is where technology has the greatest impact, compared to only 24% cited of improving customer experience. In addition, the integration of blockchain technology offers opportunities for secure and transparent transactions. Blockchain facilitates cross-border payments, reduces settlement time, and enable the creation of new financial products and services, such as digital currencies and smart contracts. Therefore, rise in the advanced technologies is expected to foster the growth of mobile banking market in the upcoming years.

The Emergence of Fintech Startups

Fintech startups leverage data analytics and artificial intelligence to deliver highly personalized mobile banking services. They deliver customized recommendations, financial insights and tailored solutions for individual users, increasing customer engagement and loyalty. Moreover, fintech startups often focus on niche markets or specific financial services, such as robo-advisors, peer-to-peer lending, or micro-investing platforms. These specialized services complement traditional mobile banking apps and offer users a broader array of financial solutions. In addition, regulatory frameworks such as open banking enable the secure exchange of customer data with third-party financial service providers. This creates opportunities for mobile banking apps to partnered with fintech startups and offer customers a wider range of financial products and services, such as investment platforms, insurance offerings, or lending services. Therefore, these trends are projected to further drive the growth of the mobile banking market during the forecast period.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the mobile banking market forecast from 2022 to 2032 to identify the prevailing market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities of mobile banking market outlook.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the mobile banking market segmentation assists in determining the prevailing mobile banking market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global mobile banking market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global mobile banking market trends, key players, market segments, application areas, and market growth strategies.

Mobile Banking Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 7 billion |

| Growth Rate | CAGR of 16.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 319 |

| By Transaction |

|

| By Platform |

|

| By Region |

|

| Key Market Players | JPMORGAN CHASE & CO., BANK OF AMERICA CORPORATION, MITSUBISHI UFJ FINANCIAL GROUP, INC., BNP Paribas, Wells Fargo, HSBC Group, American Express Company, Capital One, UBS, Citigroup Inc. |

Analyst Review

Banks are continuously investing in the development of their mobile banking applications, owing to the emergence of new technologies such as chatbots, bigdata, and blockchain, which is expected to transform the mobile banking market. Mobile banking has been primarily used by customers for transferring funds on a daily basis for various purchases made online, paying equated monthly installment (EMI), and other such financial remittances in their day-to-day life via mobile applications. Moreover, the trend such as voice recognition methods which is for two-way authentication providing access to private banking through smart devices such as Google Assistance or Siri, personalized real-time customer service via smart bots, significantly provided in mobile applications is changing whole dimension of the banking industry in the market. Further, the increase in digital transactions prompted the development of advanced cybersecurity measures and fraud prevention mechanisms within mobile banking apps, ensuring the safety of online transactions. These driving factors collectively contribute to the continued growth and importance of the mobile banking market.

The CXOs further added that market players have adopted strategies such as product launch for enhancing their services in the market and improving customer satisfaction. For instance, in October 2023, UBS launched Structured Products Digital, which allows clients to personalize and transact popular structured products via UBS E-Banking and UBS Mobile Banking. Through the platform, users can access investment products linked to 1,500 underliers across major equity markets, exchanges and sectors, create baskets of equities, customize these products and determine their parameters, set the tenors they deem the most appropriate, and confirm trades within minutes. Therefore, such strategies are expected to boost the growth of the mobile banking market in the upcoming years.

Moreover, some of the key players profiled in the report are American Express Company, Bank of America Corporation, BNP Paribas, Capital One, Citigroup Inc., JPMorgan Chase & Co., Mitsubishi UFJ Financial Group, Inc., UBS, HSBC Holdings plc, and Wells Fargo & Company. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The mobile banking market is projected to reach $7 billion by 2032.

The mobile banking market is estimated to grow at a CAGR of 16.8% from 2023 to 2032.

Growth in awareness about personal finance management, increase in demand for convenient banking services, and integration of advanced technologies contribute towards the growth of the market.

The key growth strategies of mobile banking players include product portfolio expansion, mergers & acquisitions, agreements, business expansion, and collaborations.

The key players profiled in the report include mobile banking market analysis includes top companies operating in the market such as American Express Company, Bank of America Corporation, BNP Paribas, Capital One, Citigroup Inc., JPMorgan Chase & Co., Mitsubishi UFJ Financial Group, Inc., UBS, HSBC Holdings plc, and Wells Fargo & Company.

Loading Table Of Content...

Loading Research Methodology...