Motorcycle Loan Market Research, 2032

The global motorcycle loan market size was valued at $141.3 billion in 2023 and is projected to reach $250.7 billion by 2032, growing at a CAGR of 6.5% from 2024 to 2032. A two-wheeler loan helps customer to buy a scooter or motorcycle of their choice. Two-wheeler loans are available both for working professionals and self-employed individuals. Customer can repay the loan amount in Easy Monthly Instalments (EMIs). Motorcycle loans are available from banks, credit unions, and online lenders. These loans provide financing for new motorcycles and are beneficial for those lacking immediate cash.

Key Takeaways

The motorcycle loan market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2032.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major motorcycle loan industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global motorcycle loan markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Moreover, factors influencing terms and rates include loan amount, lender, income, and credit score. Borrowers can choose between secured loans (requiring collateral) or unsecured loans (based on creditworthiness), and manufacturer financing is an alternative to consider. Motorcycle manufacturer financing involves getting financing for a bike directly from the manufacturer.

Key market dynamics

The global motorcycle loan market growth is attributed to several factors such as rising popularity of motorcycle and rise in technological innovations. However, economic uncertainty and regulatory and policy changes act as restraints for the motorcycle loan market. In addition, increase in marketing strategies and awareness will provide ample opportunities for the motorcycle loan market development during the forecast period. Motorcycles are increasingly seen as a lifestyle choice and a symbol of freedom and adventure, particularly among younger demographics, which further is expected to propel the global motorcycle loan market forecast growth.

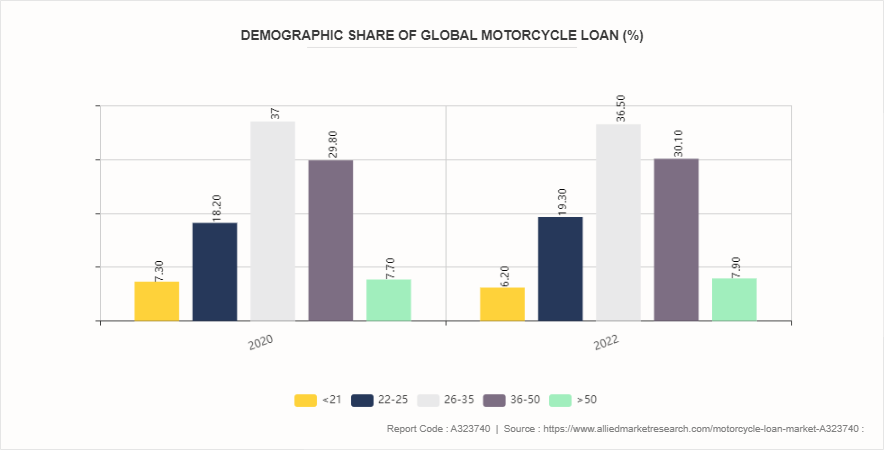

Demographic Insights of the Global Motorcycle Loan Market

The demographic insights of the motorcycle loan market outlook reveal various patterns and trends among borrowers. The demographic of adventure seekers <21 age is often attracted to motorcycles for the sense of freedom and adventure they provide. Experienced riders 22-25 age, many in this group have been riding for years and are looking to upgrade to newer models. Moreover, for the riders with the age 50 or plus, many in this age group are retirees who ride motorcycles as a hobby. Such trends are expected to propel the growth of global motorcycle loan market opportunity in these age groups.

Market Segmentation

The motorcycle loan market share is segmented into type, providers, tenure, and region. On the basis of type, the market is segregated into scooters, sport bike and mopeds. As per providers, the market is segregated into banks, NBFS (non-banking financial services) , OEM (original equipment manufacturer) , and other. On the basis of tenure, the market is segmented into less than 3 years, 3-5 years, more than 5 years. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America and Middle East and Africa.

Regional/Country Market Outlook

The adoption of motorcycle loan market varies across different countries, influenced by factors such as smart financial infrastructure, industry needs, regulatory frameworks, and investment in research and development. Developed countries like the U.S., Germany, Japan, and South Korea have been at the forefront of motorcycle loan adoption, particularly in professional educational programs. These countries possess advanced financial capabilities, robust research institutions, and a strong focus on innovation, driving widespread adoption of private loan solutions. In emerging economies such as China, India, Brazil, and Russia, there is a growing interest in motorcycle loan fueled by rapid change in education system, and government initiatives to promote digitalization and innovation.

In January 2024, Suzuki Motorcycle India Private Limited, partnered with SMFG India Credit Co. Ltd. (Formerly Fullerton India Credit Co. Ltd.) to provide quick and hassle-free financing on purchase of Suzuki two-wheelers.

In July 2023, China’s state banks are offering local government financing vehicles loans with ultra-long maturities and temporary interest relief to prevent a credit crunch amid growing tension in the $9 trillion debt market, according to people familiar with the matter.

Industry Trends:

In September 2023, the Biden administration offered $12 billion in grants and loans for auto makers and suppliers to retrofit their plants to produce electric and other advanced vehicles.

In October 2022, the Japan International Cooperation Agency (JICA) signed a 9.9 billion yen loan agreement with Muangthai Capital Public Company Limited (MTC) in Thailand to provide a fund for low-income groups such as farmers, small businesses, and individuals in the country through Private Sector Investment and Finance (PSIF) .

Competitive Landscape

The major players operating in the motorcycle loan market include Ally Financial Inc., Bank of America Corporation, GM Financial Inc., Capital One Financial Corporation, Ford Motor Credit Company, Citigroup, Toyota Financial Services, JPMorgan Chase, Manba Finance and Wells Fargo.

Recent Key Strategies and Developments

In April 2024, FAW Group launched a loan program with no down payment, becoming one of the first providers to make such a move since the removal of government-set minimum payments.

In March 2024, HDFC Bank launched ‘Xpressway’ two-wheeler mega loan mela in Uttar Pradesh and Uttarakhand from March 6, 2024 to March 7, 2024. This saw participation from more than 750+ branches across Uttar Pradesh and Uttarakhand. Further, the bank has invited major two-wheeler dealers to display their latest two-wheeler offerings at the Bank’s branches.

In March 2024, L&T Finance Holdings (LTFH) unveiled its latest offering – Super Bike Loans, targeting motorcycle enthusiasts seeking the thrill of riding cutting-edge motorcycles. With funding options of up to Rs 20 lakh and competitive interest rates starting at 5.99% per annum, the Super Bike Loans are poised to cater to the diverse needs of riders across the country.

Key Sources Referred

Finaid

MEFA

OEDB

The Institute for College Access & Success

Key Benefits For Stakeholders

This report provides a quantitative analysis of the motorcycle loan market segments, current trends, estimations, and dynamics of the motorcycle loan market analysis from 2023 to 2032 to identify the prevailing motorcycle loan market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the motorcycle loan industry segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global motorcycle loan market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global motorcycle loan market trends, key players, market segments, application areas, and market growth strategies.

Motorcycle Loan Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 250.7 Billion |

| Growth Rate | CAGR of 6.5% |

| Forecast period | 2024 - 2032 |

| Report Pages | 350 |

| By Type |

|

| By Providers |

|

| By Tenure |

|

| By Region |

|

| Key Market Players | Capital One Financial Corporation, GM Financial Inc., ford motor credit company, Bank of America Corporation, Manba Finance, Ally Financial Inc., JPMorgan Chase & Co, Citigroup, Toyota Financial Services Corporation, Wells Fargo |

One notable trend driving the motorcycle loan market growth is the increasing popularity of electric motorcycles, which are gaining traction due to their environmental benefits and lower operating costs.

North America is the largest regional market for Motorcycle Loan Market in 2023.

$250.70 billion is the estimated industry size of Motorcycle Loan market in 2032.

Ally Financial Inc., Bank of America Corporation, GM Financial Inc., Capital One Financial Corporation, Ford Motor Credit Company, Citigroup, Toyota Financial Services, JPMorgan Chase, Manba Finance and Wells Fargo. are the top companies to hold the market share in Motorcycle Loan market.

Banks is the leading provider of Motorcycle Loan in 2023.

Loading Table Of Content...