Narrowband-Internet of Things (NB-IoT) Market Overview

The global narrowband-internet of things (NB-IoT) market was valued at $634.3 million in 2021, and is projected to reach $32.5 billion by 2031, growing at a CAGR of 48.4% from 2022 to 2031.

Increasing adoption of IoT along with better battery life for other connected devices and winding applications of NB-IoT Technology is boosting the growth of the narrowband-internet of things (NB-IoT) market. In addition, the rapid development in IoT industry and rising demand for new cellular communication technology positively impact the growth of the narrowband-internet of things (NB-IoT) market. However, the stringent competition from alternate technologies and the lack of standardization of IoT regulations is hampering the narrowband-internet of things market growth. On the contrary, increased investments by technology companies and telecommunications service providers is expected to offer remunerative opportunities for the expansion of the narrowband-internet of things (NB-IoT) market during the forecast period.

Narrowband IoT is a low power wide space (LPWA) technology that was developed to change a good variety of the latest IoT devices and services. The technology firmly and dependably handles little amounts of fairly occasional two-way knowledge. Narrowband IoT significantly betters user device power consumption, system capability, and spectrum potency. The technology allows many solutions and devices like wearables, utilities, industrial solutions moreover, and good parking. Narrowband IoT includes a name for dependability and permits the affiliation to an outsized range of devices at the same time whereas maintaining power consumption. Narrowband IoT is the sensible selection for carriers, device makers, and enterprise users. The narrowband-internet of things (nb-iot) market is segmented into Component, Deployment mode, Application and Industry Vertical.

Segment Review

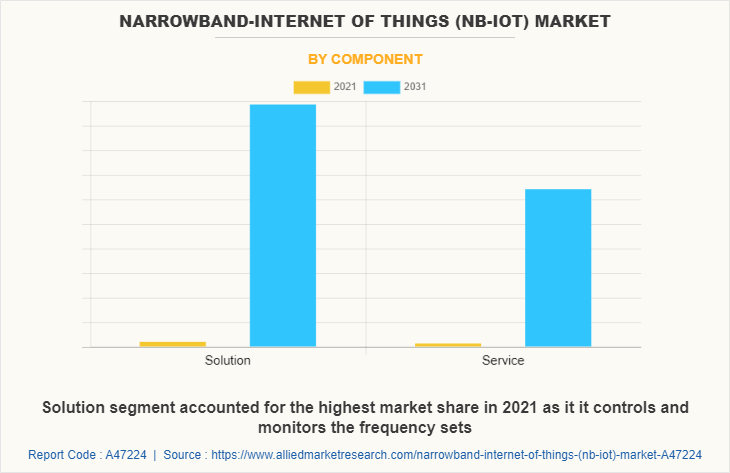

The narrowband-internet of things industry is segmented on the basis of by component, deployment mode, application, industry vertical and region. On the basis of the component, the market is categorized into solution, and service. By deployment mode, it is classified into in-band, guard band, and standalone. By application, it is divided into smart meter, smart parking, alarm and detector, smart lighting, tracker, wearable, and, others. By industry vertical, it is classified into infrastructure, agriculture, automotive, healthcare, energy and utilities, manufacturing, consumer electronics, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In terms of component, the solution segment holds the highest narrowband-internet of things market share share, as it suits applications that need wide-area coverage and data protocols enable coverage to reach deep indoors and underground areas. However, the service segment is expected to grow at the highest rate during the forecast period, owing to reduces power consumption of connected devices, while increasing system capacity and bandwidth efficiency.

Region-wise, the narrowband-internet of things market size was dominated by North America in 2021. The region is expected to retain its position during the forecast period, owing to the growing adoption of NB-IoT technology in the region and developed IT infrastructures. This is expected to drive the market for NB-IoT technology within the region during the forecast period. Asia-Pacific is also expected to witness significant growth during the forecast period, owing to increased adoption of new technologies and advancement in organizations across various industries.

The key players that operate in the narrowband-internet of things industry are Huawei Technologies Co., Ltd., Intel Corporation, MediaTek Inc, Verizon Communications Inc., Vodafone Group plc, AT&T Inc., Nokia Corporation, Orange S.A., Qualcomm Technologies, Inc., and Telefonaktiebolaget LM Ericsson. These players have adopted various strategies to increase their market penetration and strengthen their position in the narrowband internet of things (NB-IoT) industry.

Top Impacting Factors

Increasing adoption of IoT along with better battery life for other connected devices

Battery life is a major aspect in the world of IoT devices as well as other connected devices. Smartphone makers are continuously striving to improve devices with massive battery life because modern smartphones are so different from their models from only a few years ago. In addition, technologies are evolving and becoming more advanced and sophisticated every year. The market for connected devices is expanding, particularly in the industrial sector, as M2M communications become more prevalent. Furthermore, connectivity has been made possible by market trends, like IoT in practically every sector, encompassing healthcare, consumer electronics, and retail.

Winding applications of NB-IoT Technology

Narrowband IoT market features indoor, outdoor, and underground coverage and is well-suited for battery-operated applications that transmit data occasionally. These features have fueled NB-IoT technology adoption in a wide range of applications. In addition, several key existing applications of NB-IoT technology include smart parking, management, smart irrigation system, and smart metering. Furthermore, many companies are piloting and testing the deployment of NB-IoT technology in various emerging applications these applications include condition monitoring and location monitoring in the industrial sector, smart grid in the energy and power sector, access control, building automation, fire detection, and video monitoring in the building automation industry and safety and security application in the home automation industry and fitness and performance monitoring in the wearable industry.

Digital Capabilities

Narrowband IoT (NB-IoT) is a new fast-growing wireless technology 3GPP cellular technology standard introduced in Release 13 that addresses the LPWAN (Low Power Wide Area Network) requirements of the IoT. It's been classified as a 5G technology, standardized by 3GPP. It is fast emerging as the best in class-leading LPWAN technology to enable a wide range of new IIoT devices, including smart parking, utilities, wearables, and industrial solutions. Furthermore, NB-IoT is characterized by excellent indoor coverage, support of a massive number of connections, cost efficiency, low device power consumption and optimized network architecture.

Moreover, NB-IoT can efficiently connect large fleets of devices - up to 50,000 per NB-IoT network cell while minimizing power consumption and increasing coverage range in locations not served by conventional cellular technologies. NB-IoT dramatically improves network efficiency, increasing the capacity to support a massive number of new connections using only a portion of the available spectrum. This efficiency, in turn, minimizes power consumption enabling a battery life of more than ten years.

Also, narrowband IoT market penetrates deep underground and into enclosed spaces providing 20+dB coverage indoors. Moreover, the underlying technology is less sophisticated than traditional cellular modules, simplifying design, development, and deployment for OEMs. Furthermore, it offers the same tried and true security and privacy features of LTE mobile networks, including support for user identity confidentiality, entity authentication, data integrity, and mobile device identification. NB-IoT is very flexible and can operate in 2G, 3G, and 4G band. It eliminates the need for a gateway, which saves cost in the long run. It is characterized by improved indoor coverage, support of a massive number of low throughput devices, low delay sensitivity, low device power consumption, optimized network architecture, and it is ultra-cost efficiency. Like LTE-M, NB-IoT can be deployed "in-band" within a standard LTE carrier or "standalone" for deployments in the dedicated spectrum.

Additionally, NB-IoT can also be implemented in an LTE carrier's guard-band. LTE-M, industry shorthand for "Long-Term Evolution (LTE) machine-type communications (MTC)," is an LPWA technology standard introduced by 3GPP in Release 13. As described by the GSMA, it is a 5G technology that supports simplified device complexity, massive connection density, low device power consumption, low latency, and it provides extended coverage while allowing the reuse of the LTE installed base

End-user Adoption

With an increase in competition, major market players have started collaborating with companies to expand their market penetration and reach. For instance, in September 2022, Sateliot, a satellite telecom operator, announced its collaboration with Amazon Web Services (AWS) to provide direct-to-satellite 5G-based NB-IoT connectivity. This fully virtualized cloud-native 5G core for its NB-IoT services, delivered by Low Earth Orbiting (LEO) satellites, is expected to be commercially available around the second half of 2023.

Due to technological advancements across the world and the rise in demand for NB-IoT market, various companies have expanded their current product portfolios and innovations with increased diversification among customers. For instance, in January 2022, Nokia and Nordic Semiconductor launched pioneering new approach to licensing the use of cellular IoT Standard Essential Patents. Companies purchasing IoT hardware from Nordic will now be given the opportunity to acquire licenses to Nokia’s industry leading portfolio of cellular patents.

For instance, in September 2022, Nordic Semiconductor (Nordic) has launched an ultra-low power dual-band Wi-Fi 6 companion chip called nRF7002 . nRF7002 offers Wi-Fi 6 connectivity and Wi-Fi-based location using service set identifier (SSID) detection of local hubs. These include the multiprotocol nRF52 and nRF53 series systems-on-chip (SoCs) and the cellular nRF91 Series IoT systems-in-package (SiPs). Also, the nRF7002 can be utilized with non-Nordic host devices. It delivers capabilities that are essential for ultra-low power IoT including Targeted Wait Time (TWT), orthogonal frequency-division multiple access (OFDMA), and 20 MHz channels offering up to 69 Mbps of data throughput with 64 quadrature amplitude modulation (QAM). Growing investment from smartphone manufacturers drives demand in the narrowband internet of things (NB-IoT) market.

For instance, in May 2019, Samsung Electronics Co., Ltd., a world leader in advanced semiconductor technology, today announced a new Internet of Things (IoT) solution, the Exynos i T100, which enhances the security and reliability of devices designed for short-range communications. Along with the previously introduced Exynos i T200 for Wi-Fi and Exynos i S111 for long-range narrow-band (NB) communications, the launch of the Exynos i T100 allows the company to cover a wider gamut of connectivity for today’s IoT devices.

Moreover, with an increase in competition, major NB-IoT market players have started acquiring with companies to expand their market penetration and reach. For instance, in July 2020 STMicroelectronics acquired BeSpoon and of the cellular IoT connectivity assets of Riot Micro to enable developers of IoT, automotive and mobile communication applications to provide services such as secure access, and precise indoor & outdoor mapping.

Government Regulations

All well-governed industries should be able to demonstrate due diligence to ensure regulatory compliance in applicable fields, including IT. Organizations are increasing adoption of advance electronics heavily influenced by COVID-19. In addition, federal and state governments are improving their track plans for various privacy laws, which are applicable for data that are involved in their operations. For instance, the Gramm-Leach-Bliley Act not only covers banks, but also securities firms, and insurance companies, and companies providing many other types of financial products and services.

For instance, in March 2022, U.S. and European Commission announce New Trans-Atlantic Data Privacy framework to put in place new safeguards to ensure that signals surveillance activities are necessary and proportionate in the pursuit of defined national security objectives. Furthermore, the GDPR act imposed by the European Government mitigates the risk of cyber security and any potential data breaches. Emerging countries of Asia-Pacific are developing stringent regulations, which comprise privacy, government regulatory environment, and intellectual property protection.

Key Benefits for Stakeholders

The study provides an in-depth analysis of narrowband-internet of things market forecast along with current trends and future estimations to explain the imminent investment pockets.

Information about key drivers, restraints, and opportunities and their impact analysis on narrowband-internet of things market Trends is provided in the report.

Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

The narrowband narrowband-internet of things market analysis from 2022 to 2031 is provided to determine the market potential.

Narrowband-Internet of Things (NB-IoT) Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 32.5 billion |

| Growth Rate | CAGR of 48.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 283 |

| By Component |

|

| By Deployment mode |

|

| By Application |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Verizon Communications Inc., Vodafone Group plc, Nokia Corporation, MediaTek Inc, Huawei Technologies Co., Ltd., Telefonaktiebolaget LM Ericsson, Orange S.A., Qualcomm Technologies, Inc. , Intel Corporation, AT&T Inc. |

Analyst Review

NB-IoT is a 5G-compatible network solution that enables IoT to create connected space quickly. The proliferation of 5G will drive the market demand for NB-IoT solutions, allowing increased control of service-based use cases. Also, the penetration of location-based services and remote monitoring applications escalates the market value. Moreover, it provides better network coverage for M2M communications, support maximum connections, and lower power consumption.

The global narrowband-internet of things (NB-IoT) market is expected to register high growth due to expanding NB-IoT ecosystem enables utilities, energy, and other critical infrastructure industries to deploy massive IoT solutions supporting internal operations and local communities are expected to drive industry growth. Thus, an increase in the adoption of narrowband-internet of things (NB-IoT)s owing to its flexibility, is one of the most significant factors driving the growth of the market.

With surge in demand for a narrowband-internet of things (NB-IoT), various companies have established alliances to increase their capabilities. For instance, in August 2020, Skylo a Satellite network provider partnered with Sony Semiconductor Israel (formerly Altair Semiconductor) to develop and cellular IoT chipsets that connect via geostationary satellites using the 5G NB-IoT protocol.

In addition, with further growth in investment across the world and the rise in demand for narrowband-internet of things (NB-IoT), various companies have expanded their current product portfolio with increased diversification among customers. For instance, in April 2020, Qualcomm launched world’s most power-efficient NB2 IoT chipset allowing for extremely low average power consumption. To support wide range of batteries and longer life span of the device in th

provisions for adapting power usage according to varying source power levels – allowing end devices with power supply levels as low as 2.2 volts.

The narrowband-internet of things (NB-IoT) market is estimated to grow at a CAGR of 48.4% from 2022 to 2031.

The narrowband-internet of things (NB-IoT) market is projected to reach $ 32.53 billion by 2031.

Increasing adoption of IoT along with better battery life for other connected devices and winding applications of NB-IoT Technology is boosting the growth of the narrowband-internet of things (NB-IoT) market. In addition, the rapid development in IoT industry and rising demand for new cellular communication technology positively impact the growth of the narrowband-internet of things (NB-IoT) market.

The key players profiled in the report include Huawei Technologies Co., Ltd., Intel Corporation, MediaTek Inc, Verizon Communications Inc., Vodafone Group plc, AT&T Inc., Nokia Corporation, Orange S.A., Qualcomm Technologies, Inc., and Telefonaktiebolaget LM Ericsson.

The key growth strategies of narrowband-internet of things (NB-IoT) market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...