Neobanking Market Overview

The global neobanking market was valued at $69 billion in 2022, and is projected to reach $3.3 trillion by 2032, growing at a CAGR of 47.3% from 2023 to 2032. Rising digitalization of banking and growing demand for digital solutions, along with increased mobile banking usage, are contributing to the growth of the market.

Market Dynamics & Insights

- The neobanking industry in Europe held the largest share of 37% in 2022.

- By account type, the business account segment dominated the market, accounting for the revenue share of 69% in 2022.

- By service type, the mobile banking segment dominated the market, accounting for the revenue share of 48% in 2022.

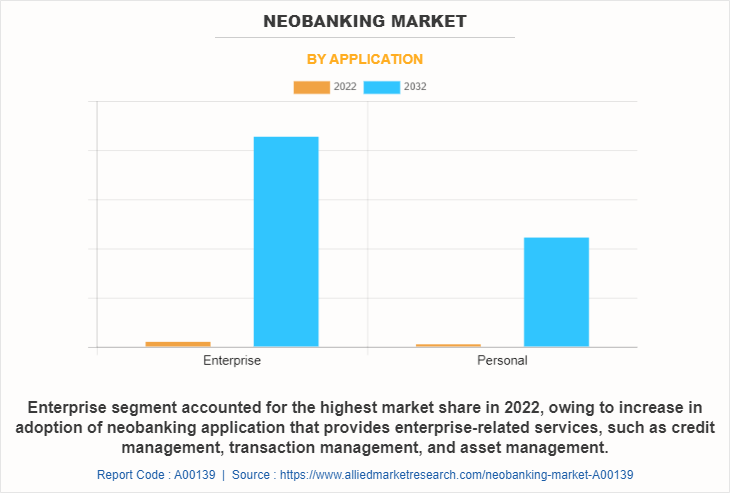

- By application, the enterprise segment held the largest share in the market, accounting for the revenue share of 71% in 2022.

Market Size & Future Outlook

- 2022 Market Size: $68.95 Billion

- 2032 Projected Market Size: $3252 Billion

- CAGR (2023-2032): 47.3%

- Europe: dominated the market in 2022

- Asia-Pacific: Fastest growing market

What is Meant by Neobanking

Neobanks are financial institutions that digitally offer a wide range of banking and financial services. Neobanks operate exclusively online without any physical infrastructure. Neobanks rely on the use of fintech to provide banking services. Neobanks typically provide all the major services traditional banking institutions offer, such as savings and checking accounts, credit cards, payment and fund transfer services, vehicle and personal loans, mortgages and investments, and insurance products.

Increase in digitalization of banking activities and increase in demand for digital banking solutions is boosting the growth of the global neobanking market. In addition, increase in use of mobile banking is positively impacts growth of the market. However, security issues and privacy concerns and high implementation cost is hampering the neobanking market growth. On the contrary, rising Investments in fintech industry is expected to offer remunerative opportunities for expansion of the market during the forecast period.

Neobanking Market Segment Review

The neobanking market is segmented on the basis of account type, service type, application, and region. On the basis of account type, the market is categorized into business account, and saving account. On the basis of service type, the market is fragmented into mobile banking, payments & money transfer, checking/saving accounts, loans, and others. By application, it is classified into enterprise, personal, and other. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In terms of application, the enterprise segment holds the highest neobanking market share, owing to increase in adoption of neobanking application that provides enterprise-related services, such as credit management, transaction management, and asset management. However, the personal segment is expected to grow at the highest rate during the forecast period, owing to the high penetration rate of smartphones has enabled customers to widely opt for neobanking services.

Region-wise, the neobanking market size was dominated by North America in 2022 and is expected to retain its position during the forecast period, owing to growing innovation and technological progression in this region. In addition, companies are paying attention to launching product platforms and forming partnerships to support their market position in this region. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to increasing mergers and acquisitions activities, and the growing adoption of online transactions in this region.

The key players that operate in the neobanking market are Monzo Bank Limited, Movencorp, Inc., WeBank, PRETA S.A.S., N26 AG, Revolut Ltd., Ubank, Pockit LTD, Starling Bank Limited, and Atom Bank PLC These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Key Benefits

Neobanking is one of the major fintech innovations to have come over the last few years, the next evolutionary step in banking after net banking, mobile banking, app-based banking and online payments. Neobanks offer limited and highly specialized banking services to customers. Designed with the purpose of disrupting the financial industry, neobanks operate entirely digitally and often tailor services for use on mobile devices. These newcomers to the banking space bring a variety of benefits that are worthy of serious consideration by financial institutions.

There are many appeals of neobanks to customers, as they add convenience and simplicity to the process of money management and decision making. Neobanks are emerging all around the global financial industry. Some begin as FinTech startups, while others are created for use by already established banking institutions. No matter where they come from, however, neobanks offer customers an incredibly simple method for everyday money management.

Digital Capabilities

Neobanking industry are tech-based companies that offer exclusively digital banking services. This can include everything from paying bills to mobile depositing of checks. These financial institutions operate exclusively online, without any physical branches, and provide all banking services, and more, digitally. By leveraging technology, such as artificial intelligence (AI), automation, and cloud computing, neobanks offer highly personalised services at lower costs. A neo-bank offers a digital banking solution, typically mobile-first and branchless, which is attempting to disrupt a specific segment of financial services in a customer-centric and technology-driven manner. The primary driver of this disruption is the usage of technology to better the user experience of the end customer. Blockchain technology in cross-border transactions can enable secure transfers between an infinite number of bank ledgers. This allows one entity to bypass banking intermediaries who usually are the middlemen that help transfer money from one bank to another. In this way, the transaction is secure quick, and cheap. It also provides end-to-end visibility anywhere in the world.

What are the Top Impacting Factors in Neobanking Market

Increase in Digitalization of Banking Activities

Increase in the adoption of digital technologies such as the cloud, big data, and artificial intelligence (AI) has changed the landscape of the banking industry. In addition, the integration of such technologies with the banking process assists in advancing their visualization capabilities, resolving customer queries, and making complicated data usable. Moreover, these technologies help in increasing connectivity and providing advanced security methods in banks & financial institutions. For instance, according to SAS insights, 30% of the employees in the banking industry rely on and trust AI driven outputs and utilize them for enhanced business analysis.

Furthermore, AI-based neobanking provides real time insights to end-users and helps to improve network security, accelerating digital businesses and offering a better customer experience. The rise in adoption of such technologies is expected to create numerous opportunities for players in the market. Key companies focus on completing partnerships and collaborations with other players to launch advance solutions based on core technologies such as AI and others. For instance, in January 2023, Temenos launched the next generation of its AI-driven, corporate lending solution to enable banks to consolidate global commercial loan portfolios and unify servicing all on the Temenos banking platform. Moreover, the solution simplifies complex loan processing and lifecycle management across lending lines and regions, addressing the needs of large tier one and regional banks, many of which are struggling to seize the growth opportunity in corporate lending due to disparate systems and a lack of integration. These technical developments in improved AI standards drive the market growth.

Increase in Demand for Digital Banking Solutions

Consumers expect efficient and convenient banking services with the growth in adoption of digital technologies. Neobanking service providers presents solutions that allow banks and financial institutions to offer digital banking services such as online banking, mobile banking, and digital payments fueling market growth in this space. Moreover, banks and other financial institutions are prioritizing improving their customer experience to stay ahead of the competition in the market. Neobanking solutions offer personalized, seamless experiences to customers, which propels demand for these solutions.

Moreover, BPOs are adopted by various banks and financial institutions for the better management of their business operations while offering improved collaboration, simplified compliance, productivity, and risk management. In addition, BPOs are being adopted increasingly, as they offer effective planning and streamlining of data under one platform. This helps in regulating operational costs, enhancing decision-making, and increasing sales. The adoption of digital technologies in banking is expected to grow in the upcoming years with an increase in focus of banks toward improving their operational and business process efficiency. This is anticipated to subsequently fuel the growth of the neobanking market during the forecast period.

Restraint

Security Issues and Privacy Concerns

Security is one of the most significant concerns associated with BPO implementation. Lack of awareness among banks regarding sharing account information and confidential data online hampers market growth. In addition, possibilities of unauthorized access to accounts of users via hacked log in credentials create huge security & privacy concerns among banks. Furthermore, sharing sensitive customer data by banks to BPO service provider results in disclosure of personal information and exposes business to security risk. For instance, in the U.S., official statistics of BPO from the country government projected that around 3,500 cyber-attacks against banks were recorded in the first seven months of 2019. As a result, security and privacy concerns have become a major factor that hampers market growth.

Opportunity

Rise in Investments in Fintech Industry

Fintech companies have increased investment in ML and AI solutions to transform management of financial institutes for providing enhanced services to the end users and to automate the necessary solutions. In addition, with rise in complexity and competition in the neobanking market, the demand for industry-specific solutions increased to meet the goals of the companies and AI-based financial solutions are helping Fintech and other industries to enhance their security and upsurge their revenue opportunity, which drive the growth of the market. Furthermore, AI and ML are expected to assist financial institutes at various stages of risk management processes ranging from identifying risk exposure, measuring, estimating, to assessing its effects. Moreover, increase in investments in AI and ML offers the potential to transform the area of automation for time-consuming, mundane processes, and offering a far more streamlined and personalized customer experience, which enhances the growth of the market. In addition, key financial institutes such as Bank of America, JPMorgan, and Morgan Stanley, have invested heavily in ML technologies to develop automated investment advisors and train systems to detect flags such as money laundering techniques and for other fraud cases, which in turn is expected to provide lucrative opportunity for the growth of the neobank market.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the neobanking market analysis from 2023 to 2032 to identify the prevailing neobanking market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- In-depth analysis of the neobanking market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global neobanking market forecast.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global neobanking market trends, key players, market segments, application areas, and market growth strategies.

Neobanking Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.3 trillion |

| Growth Rate | CAGR of 47.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 239 |

| By Service Type |

|

| By Application |

|

| By Account Type |

|

| By Region |

|

| Key Market Players | Movencorp Inc., Revolut Ltd, Starling Bank, PRETA S.A.S., Monzo Bank Limited, UBank, Atom Bank, WeBank, N26, Pockit Ltd |

Analyst Review

Neobanks are new-age banks without any physical location. They provide digital, mobile-first financial solutions for payments, money transfers, lending, and others. They allow customers to make deposits and withdraw money, and offer debit cards, investment facilities, and more. In addition, they provide credit and lending services. Neobanks have become a preferred choice of banking for many customers as they offer multiple benefits to meet the evolving needs of new-age users. They focus on enhancing the banking user experience. Moreover, neobanks offer several services including individual and startup loans, and aim to serve some of the underbanked communities. Neobanks thus assist in addressing and bridging the gap between traditional banks, individuals, and growing businesses across the country.

The global neobanking market is expected to register high growth, owing to rise in demand for convenience among customers in the banking sector. The increase in adoption of neobanking, owing to its high reliability and low latency networks is thus one of the most significant factors which drives the growth of the market. Various companies have established alliances to increase their capabilities with the surge in demand for neobanking. For instance, in April 2021, Google Pay co-creators launched Fi, a neobank, in partnership with the Federal Bank to provide an instant savings account with debit cards for salaried millennials. Technological advancements and notable increase in internet penetration globally allow financial service providers to offer novel digital services to customers.

In addition, with further growth in investment across the world and the rise in demand for neobanking, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in March 2023, Estonian launched multilingual mobile financial service called GIG-A which helps users to open bank accounts, manage deposits, and money transfer in Japan based on API integration with UI Bank.

Moreover, major market players have started acquisition companies to expand their market penetration and reach. For instance, in December 2021, Open, an SME neobanking platform provider, announced the acquisition of Finin, a consumer neobanking platform, for USD 10 million in cash and stock deal.

The Neobanking market is estimated to grow at a CAGR of 47.3% from 2023 to 2032.

The Neobanking market is projected to reach $3,251.95 million by 2032.

Increase in digitalization of banking activities and increase in demand for digital banking solutions boost the growth of the global neobanking market. In addition, increase in use of mobile banking positively impacts the growth of the neobanking market. However, security issues and privacy concerns and high implementation cost hampers the neobanking market growth. On the contrary, rise in investments in fintech Industry is expected to offer remunerative opportunities for expansion of the neobanking market during the forecast period.

The key players profiled in the report include Monzo Bank Limited, Movencorp Inc., WeBank, PRETA S.A.S., N26, Revolut Ltd., UBank, Pockit LTD, Starling Bank, and Atom Bank.

The key growth strategies of Neobanking market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...