Network Access Control Market Overview

The global network access control market was valued at USD 2.6 billion in 2022 and is projected to reach USD 16.2 billion by 2032, growing at a CAGR of 20.6% from 2023 to 2032.

With the rise in remote work and BYOD, the attack surface for potential security threats also expanded significantly. As a result, to provide enhanced services, network access control solutions have evolved to implement robust security measures, including authentication, authorization, and endpoint compliance checks. These measures further ensured that only authorized and secure devices can access the corporate network propelling the growth of the cloud local technologies market.

Introduction

Network access control is an enterprise security solution used to assess, manage, enforce, and optimize security and authentication policies through different measures like endpoint security measures, user access authentication, and network security policies. In addition, the fundamental goal of network access control is to create a security barrier that prevents illegal device activity, network-based threats, and unauthorized individuals from entering. Network access control used to be primarily concerned with network and computer security, making sure that all traffic was authorized. Network access control, however, has a far wider and more substantial impact area now that the internet of things (IoT), many linked endpoints, software-as-a-service (SaaS) applications, and personal gadgets that double as professional devices are all on the rise.

However, enterprise protection requires highly adaptable and modern network access and security specialists due to the constantly changing and dynamic nature of the cyber threat environment. In addition, high-profile data breaches have increased exponentially. On the other hand, cloud-based solutions and security for network access control is very necessary to figure out the security of operating systems and for greater scalability compared to on-premises systems. As a result, this allows for easier expansion of network access control systems to accommodate the growing number of devices and users in an organization.

The report focuses on growth prospects, restraints, and trends of the network access control market analysis. The study provides Porter five forces analysis to understand the impact of various factors, such as the bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the market.

Segment Review

The Network access control market is segmented on the basis of component, organization size, deployment mode, industry vertical, and region. On the basis of the component, the market is divided into hardware, software, and service. By deployment mode, it is categorized into on-premises and cloud. On the basis of the organization size, the market is bifurcated into large enterprises and small and medium-sized enterprises. By industry vertical, it is divided into IT and telecom, BFSI, healthcare, retail and E-commerce, manufacturing, government, and others. On the basis of region, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

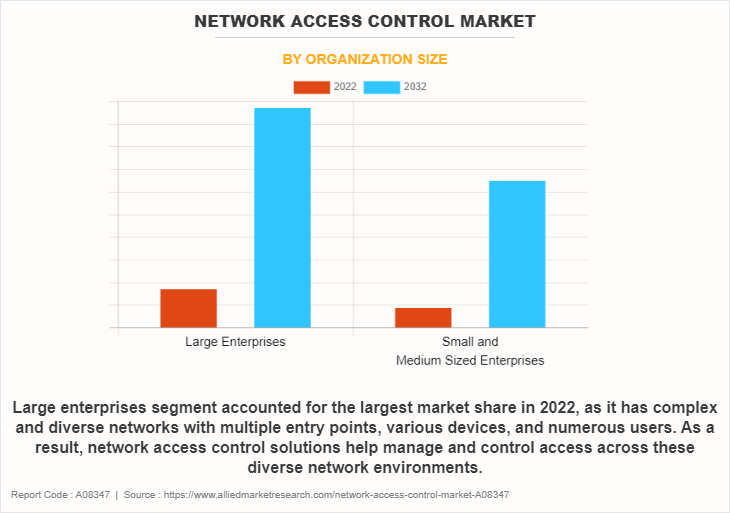

By organization size, the large enterprise segment held the largest market share in 2022, owing to the growing demand for network access control systems as they help prevent unauthorized access, mitigate risks of internal and external threats, and quickly respond to potential security breaches. However, the small and medium-sized enterprises segment is projected to manifest the highest CAGR from 2023 to 2032, owing to technology advances and the need for robust security, the role of SMEs in the network access control market continues to evolve, further fueling growth.

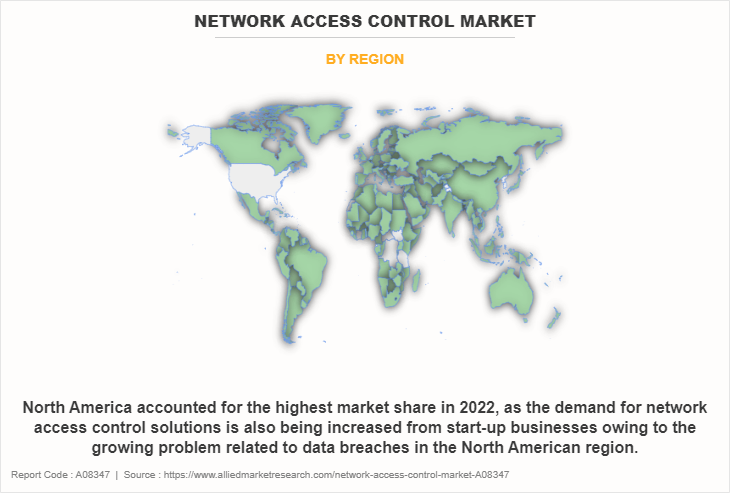

By region, North America attained the largest market share in the network access control market owing to the growing problem related to data breaches across the North America region. As a result, North American companies are rapidly deploying security and vulnerability management solutions and have the best, thereby driving the adoption of network access control. However, the market for Network access control is expected to develop at the fastest rate in the Asia-Pacific region, with the increasing digitalization of businesses and the proliferation of machine learning, artificial intelligence, and IoT devices, the threat landscape has expanded in Asia-Pacific.

Key Industry Development

Recent partnerships in the NAC Market

For instance, in December 2023, IBM Corporation and Palo Alto Networks expanded their strategic partnership to enable clients to strengthen their end-to-end security postures and navigate evolving security threats. Palo Alto Networks, a global cybersecurity leader, will be in a select group of strategic IBM Consulting partners and IBM Consulting will be a premier security services partner for Palo Alto Networks.

Further, in November 2022, Cisco Systems Inc. expanded its portfolio of specializations available through the company's world-class partner program. Cisco's partner program continues to evolve to increase partner sales opportunities, add flexibility to partner certification requirements, and emphasize the importance of multi-architectural expertise. The six new specializations are tied to Cisco's customer priorities and represent fast-growing network access control market opportunities for Cisco and its partners in areas where Cisco has been investing and innovating.

Recent Collaboration in the NAC Market

In October 2023, Huawei unveiled its latest Intelligent Cloud-Network products and solutions at GITEX GLOBAL 2023, the leading technology event in the Middle East and Central Asia (MECA). The solution offers unmatched computing power and super-connectivity for AI-driven productivity in the intelligent era.

In February 2023, Juniper Networks, a leader in secure, AI-driven networks, today announced that the company plans to expand its collaboration with IBM to pursue the integration of IBM network automation capabilities with Juniper Radio Access Network (RAN) optimization and Open Radio Access Network (O-RAN) technology. The planned collaboration will seek to deliver a unified RAN management platform that will be designed to use intelligent automation to better enable communications service providers (CSPs) to monetize, optimize and scale their investments in next-generation networks and provide better experiences to mobile users.

Recent Product Launches in the NAC Market

In April 2023, Arista Networks Inc. launched a new network access control or NAC service on the opening day of this week RSA Conference in San Francisco. The vendor is best known as a high-performance network vendor but moved into the security industry when it acquired Awake Security, which brought network detection and response or NDR. Since then, the company has added wireless intrusion prevention, edge threat management, and other services.

Key Market Players

Some of the key players profiled in the report include Broadcom, Cisco Systems, Inc., Extreme Networks, Fortinet, Inc., Hewlett Packard Enterprise Development LP, Huawei Technologies Co., IBM Corporation, Juniper Networks, Inc., Microsoft Corporation, and VMware, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the network access control market.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the network access control market trends from 20t22 to 2032 to identify the prevailing network access control industry opportunities.

The report provides a comprehensive analysis of the current market estimations through 2022-2032, which would enable the stakeholders to capitalize on prevailing market opportunities.

In-depth analysis of network access control market growth assists in determining the prevailing network access control market opportunities.

The report includes an analysis of the regional as well as network access control market share, key players, market segments, application areas, and market growth strategies.

Major countries are mapped according to their revenue contribution to network access control market size.

Identify key players and their strategic moves in the network access control market forecast.

Assess and rank the top factors that are expected to affect the growth of the market outlook.

Network Access Control Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 16.2 billion |

| Growth Rate | CAGR of 20.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 363 |

| By Organization Size |

|

| By Component |

|

| By Deployment Mode |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Extreme Networks, Cisco Systems, Inc., Juniper Networks, Inc., VMware, Inc., IBM Corporation, Hewlett Packard Enterprise Development LP, Broadcom, Huawei Technologies Co., Ltd., Fortinet, Inc., Microsoft Corporation |

Analyst Review

As the network access control industry continues to evolve, CXOs are evaluating the opportunities and challenges regarding this emerging technology. Decision-making is an important aspect of every organization including the ICT and Media sector. A combination of digital technologies with analytical methods can provide the best result in achieving better decision-making. In addition, IT infrastructure transformation is one of the main advantages of network access control market. Such factors are expected to provide lucrative opportunities for network access control market growth during the forecast period.

Moreover, as network access control ensures authorized access to network resources, it secures against unauthorized user access. This provides a range of capabilities to enforce network security policies, authenticate and authorize users, and monitor and control network activity. In addition, remote working, mobile devices, and bring-your-own-device practices have become more common in recent years. As a result, it may lead to expanded threat surfaces and network management issues. However, network access control allows security teams to log BYOD authorizations and only authenticated devices to access resources. Such factors fuel the growth of the network access control market.

Furthermore, the Internet of things has become a vital tool for companies in diverse sectors. Flow of sensitive data in IoT devices such as automated equipment, sensors, smart grids, and even IoT-connected vehicle fleets can be regulated and protected through adaptive network access control solutions. NAC solutions can connect large numbers of IoT devices securely and systematically, ensuring that no rogue devices are left unmapped. This also applies to the proliferation of medical devices connected to the IoT. For instance, in November 2020, VMware, Inc. launched a modern network framework to enable businesses, and their IoT and application development teams, to accelerate adapting enhanced network access control services. These factors boost the growth and adoption of the network access control market.

The upcoming trends of the Network Access Control Market is increasing number of connected devices like IoT sensors creates new security challenges. NAC helps manage access for these devices and prevent security risks by providing granular access control for them, segmenting networks to isolate them from sensitive data, and monitoring and detecting suspicious activity from them.

NAC solutions are increasingly using AI and automation for tasks like policy enforcement, device identification, anomaly detection, threat analysis, and incident response.

North America is the largest regional market for Network Access Control.

The network access control market is projected to reach $ 16,163.81 million by 2032.

The key players profiled in the report include Broadcom, Cisco Systems, Inc., Extreme Networks, Fortinet, Inc., Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., IBM Corporation, Juniper Networks, Inc., Microsoft Corporation, and VMware, Inc.

Loading Table Of Content...

Loading Research Methodology...