Non-alcoholic Drinks Market Summary

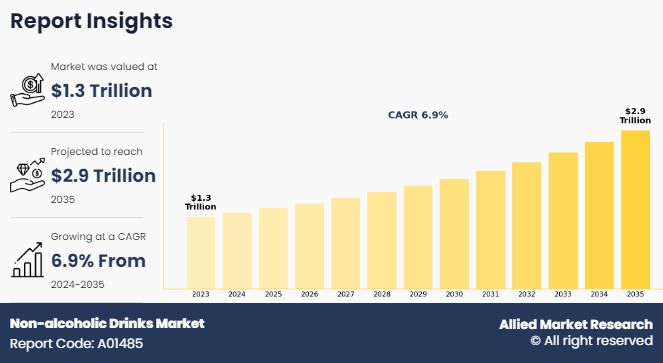

The global non-alcoholic drinks market size was valued at $1.3 trillion in 2023, and is projected to reach $2.9 trillion by 2035, growing at a CAGR of 6.9% from 2024 to 2035. The growth of the non-alcoholic drinks market is driven by health and wellness trends, changing consumer lifestyles, innovation in product development, and effective marketing efforts emphasizing taste, quality, and accessibility.

Key Market Trends and Insights

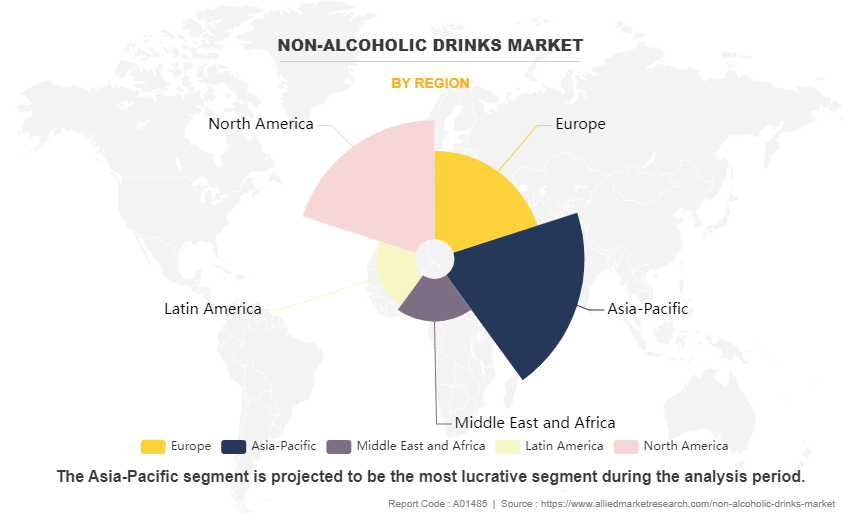

Region wise, Asia-Pacific generated the highest revenue in 2023.

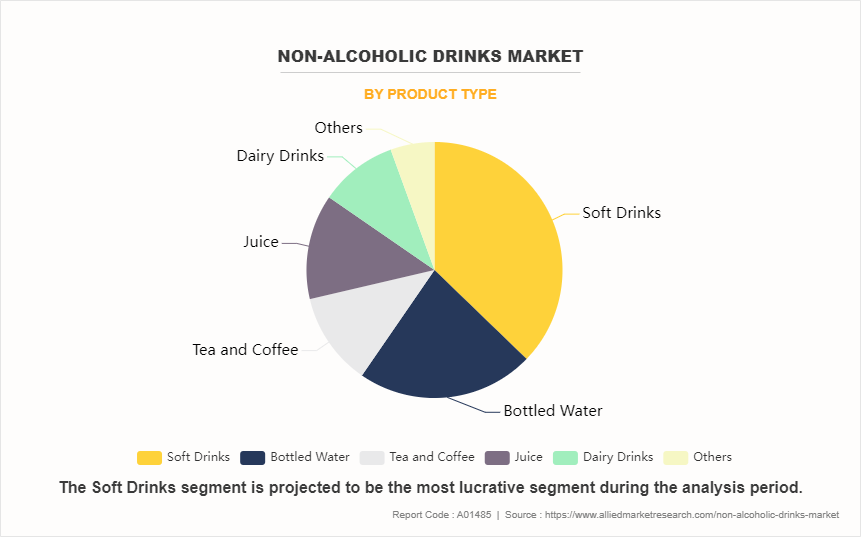

The global non-alcoholic drinks market share was dominated by the soft drinks segment in 2023 and is expected to maintain its dominance in the upcoming years

The supermarket/hypermarket segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2023 Market Size: USD 1.3 Trillion

- 2035 Projected Market Size: USD 2.9 Trillion

- Compound Annual Growth Rate (CAGR) (2024-2035): 6.9%

- Asia-Pacific: Generated the highest revenue in 2023

Non-alcoholic drinks, also known as ‘virgin drinks,’ ‘mocktails’ and ‘near beer,’ refer to the beverages that comprise less than 0.5% of alcohol content by volume. Non-alcoholic drinks market encompasses a wide range of refreshment beverages, including energy drinks, juices, soft drinks, coffee & tea, bottled water, and probiotics. The beverage industry has faced spectacular transformation in consumer preferences in the past decade.

Key Takeaways of Non-Alcoholic Drinks Market Report

- By type, the soft drinks segment was the highest revenue contributor to the market in 2023.

- As per distribution channel, supermarket/hypermarket segment was the largest segment in the global non-alcoholic drinks market during the forecast period.

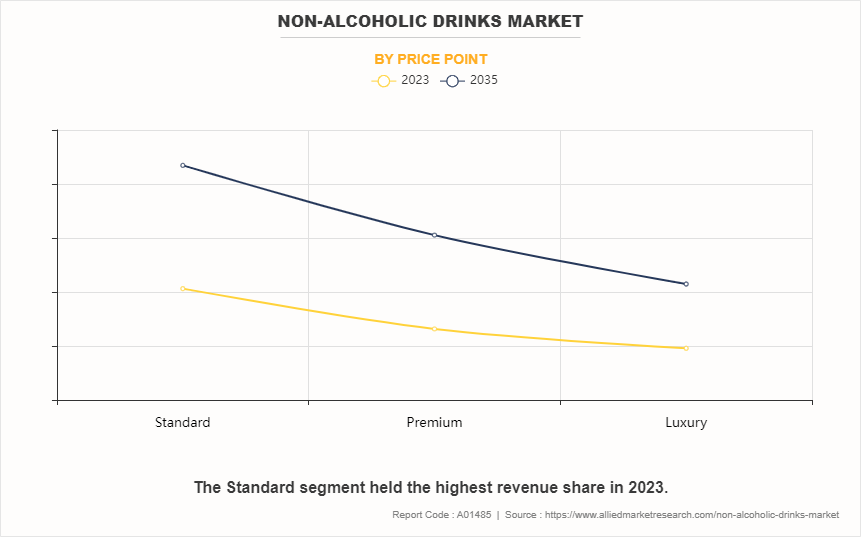

- Depending on price point, standard segment was the largest segment in 2023.

- Region-wise, Asia-Pacific was the highest revenue contributor in 2023.

Market Dynamics

Health and wellness trend is anticipated to drive the demand for non-alcoholic beverages which fundamentally reshape consumer preferences and consumption habits. As individuals increasingly prioritize their well-being, there is a growing antipathy towards beverages perceived as detrimental to health, such as sugary sodas and alcoholic drinks. This shift has propelled the popularity of non-alcoholic alternatives, which are often perceived as healthier options due to their lower sugar content, natural ingredients, and functional benefits. Consumers actively seek beverages that reduce their thirst and contribute positively to their overall health and vitality, which drives the demand for a wide range of non-alcoholic drinks, including flavored waters, herbal teas, and functional beverages fortified with vitamins, antioxidants, and other nutrients.

In addition, the health and wellness movement has sparked innovation within the non-alcoholic drinks market, with companies introducing new products that cater to specific health concerns and dietary preferences. Plant-based milks have surged in popularity among consumers seeking dairy alternatives for health or ethical reasons. Moreover, the emergence of functional beverages, such as kombucha and cold-pressed juices, capitalizes on consumer interest in natural remedies and complete wellness practices. As a result, the market has witnessed a proliferation of innovative offerings that satisfy consumer demand for healthier beverages and tap into the growing desire for products that support overall well-being. All these factors contribute to the non-alcoholic drinks market growth.

Innovative ingredients play a pivotal role in driving market demand for non-alcoholic beverages by captivating consumer interest with unique flavors, functional benefits, and health-conscious formulations. As consumers become more adventurous in their culinary explorations and seek novel sensory experiences, beverage manufacturers are responding by integrating exotic and functional ingredients into their products. Ingredients such as superfoods, adaptogens, and botanical extracts add distinctive flavors and offer potential health benefits which demand consumers those who often enhance their well-being through their beverage choices.

Moreover, innovative ingredients enable non-alcoholic beverage brands to differentiate themselves in a competitive market and cater to specific consumer preferences and dietary restrictions. For example, the rising popularity of plant-based diets has encouraged the development of non-dairy milk alternatives made from almonds, oats, coconut, and other ingredients, offering lactose-intolerant and vegan consumers a wider array of choices. Furthermore, the inclusion of alcohol-free drinks and functional ingredients such as probiotics, vitamins, and antioxidants tap into consumer interest in non-alcoholic beverages which support digestive health, boost immunity, or provide antioxidant protection. Thus, all these factors contribute to the growth of the non alcoholic drinks industry.

Competition from alcoholic beverages poses a significant restraint on the market demand for non-alcoholic drinks, particularly in social venues and cultural contexts where alcoholic beverages traditionally hold influence. Alcoholic beverages often enjoy strong cultural associations and are deeply ingrained in social rituals and gatherings which makes it challenging for non-alcoholic alternatives to gain popularity. Many consumers perceive alcoholic drinks as offering a wider variety of flavors, textures, and sensory experiences compared to non-alcoholic options, which limit the demand and market penetration, especially among certain demographics or occasions where alcohol consumption is the normal.

In addition, the widespread marketing and advertising efforts of alcoholic beverage brands further intensify competition and pose obstacles for non-alcoholic drink manufacturers seeking to capture consumer attention and market share. Alcoholic beverages often leverage aspirational imagery, lifestyle branding, and endorsements from celebrities or influencers to reinforce their desirability and status. Moreover, the availability of a wide range of alcoholic beverage options, ranging from craft beers and premium wines to artisanal cocktails, provides consumers with numerous choices and reduces the demand of non-alcoholic alternatives. Thus, all these factors limit the the non-alcoholic drinks market growth.

Non-alcoholic drinks, especially those which are marketed as premium or containing specialized ingredients, tend to lead to higher prices compared to conventional sodas or tap water. This premium price deters price-sensitive consumers, particularly in markets where disposable income is limited or where there is a strong prominence on budget-conscious purchasing decisions. As a result, non-alcoholic beverage manufacturers face the challenge of striking a balance between offering products with desirable features, such as health benefits or exotic flavors, and ensuring affordability to appeal to a broad consumer base.

Moreover, the price sensitive consumers are intensified by the availability of lower-cost alternatives, such as tap water or homemade beverages, which provide hydration at minimal or no cost. In markets where access to clean drinking water is readily available, consumers may be less inclined to spend on bottled or packaged non-alcoholic drinks unless they perceive significant added value, such as unique flavors, convenience, or health benefits. Furthermore, the competitive landscape within the non-alcoholic drinks industry itself further strengthens price sensitivity, as consumers compare prices across different brands and product categories to make informed purchasing decisions and limits the growth of the non-alcoholic drinks market.

E-commerce expansion presents significant opportunities for growth and market reach in the non-alcoholic drinks sector. By leveraging online platforms and direct-to-consumer (DTC) sales models, non-alcoholic beverage brands overcome traditional distribution barriers, reach a wider audience, and provide personalized shopping experiences. E-commerce allows brands to enter global markets beyond their geographical limitations, which enables them to access consumers in regions where traditional retail presence may be limited or costly to establish. This expanded reach opens new revenue streams and growth opportunities for non-alcoholic beverage companies by allowing them to scale their businesses and increase non-alcoholic drinks market share in a digitally connected world.

Furthermore, e-commerce platforms offer non-alcoholic beverage brands unparalleled flexibility and agility in product offerings, pricing strategies, and marketing initiatives. Through e-commerce channels, brands experiment with innovative flavors, limited-edition releases, and exclusive promotions to drive consumer engagement and loyalty. Moreover, direct interaction with consumers through e-commerce platforms enables brands to gather valuable data and insights into consumer preferences, purchasing behaviors, and market trends, empowering them to refine their product offerings and marketing strategies. Thus, all these factors present numerous opportunities for the non-alcoholic drinks market.

Segmental Overview

The non-alcoholic drinks market is segmented into product type, distribution channel, price point, and region. By product type, the market is classified into soft drinks, bottled water, tea & coffee, juice, dairy drinks, and others. By distribution channel, the market is classified into supermarket/hypermarket, convenience stores, specialty stores, online retails, and others. By price point, the market is classified into standard, premium and luxury. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, the UK, Italy, France, Poland, Netherlands, Hungary and the Rest of Europe), Asia-Pacific (China, Japan, India, Australia, and the rest of Asia-Pacific), and Latin America (Brazil, Argentina, Colombia and Rest of Latin America) Middle East and Africa (GCC, South Africa, and Rest of MEA).

By Type

By type, the soft drinks segment dominated the global non-alcoholic drinks market in 2023 and is anticipated to maintain its dominance during the forecast period. Carbonated sodas have established themselves as iconic beverages enjoyed by consumers worldwide for generations. Soft drinks attract a broad demographic, including children, teenagers, and adults and make them a staple in households, restaurants, and vending machines. Moreover, soft drink brands invest heavily in marketing and advertising which creates strong brand recognition and loyalty among consumers. These beverages offer a wide variety of flavors, formulations, and packaging options to cater to diverse tastes and preferences. Furthermore, despite increasing competition from healthier alternatives, soft drinks continue to hold a significant share of the non-alcoholic drinks industry due to their convenience, refreshing taste, and cultural ubiquity.

By Distribution Channel

By distribution channel, the supermarket/hypermarket segment dominated the global non-alcoholic drinks market size in 2023 and is anticipated to maintain its dominance during the forecast period. These retail outlets typically offer a vast selection of non-alcoholic beverages, ranging from carbonated sodas and fruit juices to flavored water and functional drinks, all under one roof. Consumers appreciate the convenience of being able to purchase a variety of non-alcoholic drinks during their regular grocery shopping trips. Moreover, supermarkets and hypermarkets often provide competitive pricing, promotions, and bulk purchase options, making them attractive destinations for stocking up on beverages for both individual consumption and social gatherings.

By Price Point

By price point, the standard segment dominated the global non-alcoholic drinks market in 2023 and is anticipated to maintain its dominance during the forecast period. Non-alcoholic beverages are often priced competitively at a standard level that appeals to the mass market, making them accessible to individuals across various income levels. Standardized pricing strategy allows non-alcoholic drink brands to reach a broader audience and capture market share by offering products at price points that are within reach for most consumers. Moreover, standard pricing promotes consumer loyalty and repeat purchases, as customers are more likely to choose familiar brands and products that they perceive as offering consistent value for money.

By Region

Region-wise, Asia-Pacific is anticipated to dominate the market with the largest share during the non-alcoholic drinks market forecast period. The region's large and rapidly growing population presents a vast consumer base with diverse tastes and preferences, driving substantial demand for non-alcoholic beverages. Moreover, the rising disposable incomes and urbanization contribute to increased consumer spending on beverages, further boosting market growth. Asia-Pacific region has rich cultural heritage and culinary traditions offer opportunities for innovation and localization of non-alcoholic drink offerings to cater to specific tastes and preferences. Furthermore, expanding distribution networks, including the proliferation of supermarkets, convenience stores, and online retail platforms, enhance accessibility to non-alcoholic beverages across Asia-Pacific region.

Competitive Analysis

Players operating in the global non-alcoholic drinks market have adopted various developmental strategies to expand their non-alcoholic drinks market share, increase profitability, and remain competitive in the market. Key players profiled in this report include A.G. Barr, Dr. Pepper Snapple Group, DydoDrinco, Attitude Drinks, Co., Livewire Energy; Calcol, Inc., Danone, Nestlé S.A., PepsiCo, Inc., and The Coca-Cola Company.

Several upcoming brands are vying for market dominance in the expanding non-alcoholic drinks industry. Smaller, niche firms are more well-known for catering to consumer demands and tastes. Private label brands created by merchants and e-commerce platforms are another aspect of the competitive market. While they provide more affordable options, they have different recognition or range of products than well-known companies. An important competition component is innovation in non-alcoholic drinks products, sourcing, and sustainability policies. Brands that are able to change the tastes of their target market and align with their ethical & environmental values have an advantage over rivals.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the non-alcoholic drinks market analysis from 2023 to 2035 to identify the prevailing non-alcoholic drinks market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the non-alcoholic drinks market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global non-alcoholic drinks market trends, key players, market segments, application areas, and market growth strategies.

Non-alcoholic Drinks Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2035 |

| Report Pages | 282 |

| By Product Type |

|

| By Distribution Channel |

|

| By Price Point |

|

| By Region |

|

| Key Market Players | Danone, DydoDrinco, A.G. Barr, PepsiCo, Inc., Dr. Pepper Snapple Group, Attitude Drinks, Co., The Coca-Cola Company, Livewire Energy, Nestlé S.A., Calcol, Inc. |

| Other players in the value chain include | Kraft Foods Group, Inc., Suja Life, LLC, FreshBev, Pressed Juicery, Suntory Beverage & Food, Unilever, Asahi Group, Jacobs Douwe Egberts, Kirin Holdings Co. |

Analyst Review

According to CXOs of leading companies the global non-alcoholic drinks market holds a substantial scope for growth. On-going advancements in non-alcoholic drinks due to innovative efforts proliferates the demand for these drinks. Primarily, due to consumer demands for a healthier lifestyle and stringent government regulations for controlling the addition of preservatives, many companies have shifted their focus to organic or natural ingredients. Furthermore, seasonal demands and campaigns such as “Dryathlete,” a non-alcoholic drink, have escalated the demand for non-alcoholic drinks. Overall, it is anticipated that these factors could have a positive impact on the market over the coming years and may facilitate key players’ expansion in new market segments. All these factors fuel the increase in sales of the non-alcoholic drinks market.

Some of the governments have restricted the sale of alcohol on some special days, at some places & density, limiting the consumption of alcohol. In addition, governments of many nations have set minimum legal age for purchase of alcohol and have increased the price & tax on alcohol to reduce its consumption. Moreover, advertisement ban on alcoholic drinks by governments of some nations have reduced the market awareness for alcohol and contributes to the growing demand for non-alcoholic drinks market.

The global non-alcoholic drinks market size was valued at $1.3 trillion in 2023, and is projected to reach $2.9 trillion by 2035

The global Non-Alcoholic Drinks market is projected to grow at a compound annual growth rate of 6.9% from 2024 to 2035 $2.9 trillion by 2035

Key players profiled in this report include A.G. Barr, Dr. Pepper Snapple Group, DydoDrinco, Attitude Drinks, Co., Livewire Energy; Calcol, Inc., Danone, Nestlé S.A., PepsiCo, Inc., and The Coca-Cola Company.

Region-wise, Asia-Pacific is anticipated to dominate the market with the largest share during the non-alcoholic drinks market forecast period.

Health And Wellness Trends, Innovative Ingredients, Functional And Wellness Beverages

Loading Table Of Content...

Loading Research Methodology...