Nondestructive Testing Equipment Market Research, 2030

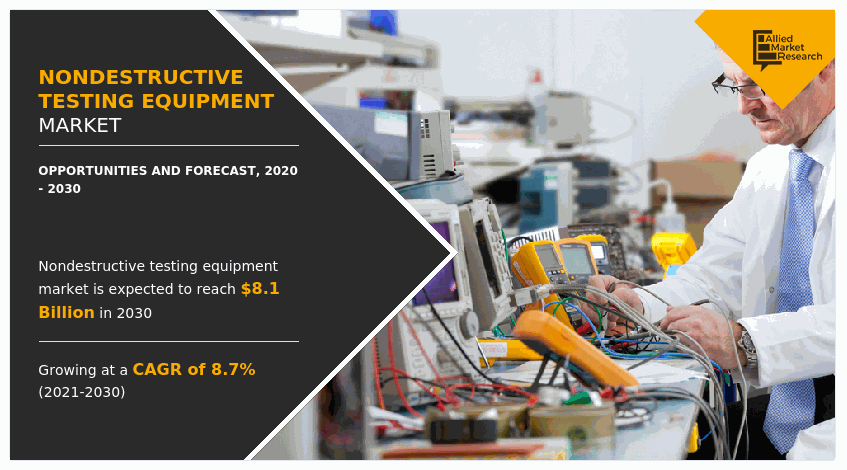

The nondestructive testing equipment market size was valued at $3.55 Billion in 2020, and is projected to reach $8.12 billion by 2030, registering a CAGR of 8.7% from 2021 to 2030.

Non-destructive testing (NDT) is a technique to identify defects and discontinuity in material, component, or structure. The NDT market is expected to witness considerable growth, owing to continuous evolution in robotics, automation, oil & gas, and electronics along with a growth in need for quality-assured machines. Companies need to have quality accredit in accordance with standards that includes ISO 9001 quality management system and other quality control assurance certifications. In addition, significant increase in use of NDT inspection equipment by several companies to improve processes, reduces waste, and limit liability drive the growth of the nondestructive testing equipment market analysis.

The key factor that drives growth of the nondestructive testing equipment market share includes the need to extend longevity of machines. Costs and challenges involved in building new infrastructure have encouraged end-user industries to extend operational life of their existing infrastructure. In addition, refineries in Latin America increase their capacity utilization, owing to deficiency of refined oil in the global market. Scarcity of refined oil is due to the restrictions imposed by the U.S. on Iran. Operating the machines at advanced capacities might result in breakdowns. Inspection and maintenance to safeguard these aging assets and run them at high capacities create huge demand for nondestructive testing machine in the region. Aging pipeline infrastructure requires various inspection and integrity equipment/services to ensure safety. Thus, the demand for inspection of aging assets drives the nondestructive testing equipment market growth. It is expected that the impact of this driver would remain high throughout the nondestructive testing equipment market forecast period.

The nondestructive testing equipment market growth is supplemented by the increase in stringent safety government regulations across different regions, due to increase in incidences of infrastructural failures, rise in need for extending the life of obsolete infrastructure, surge in maintenance optimization by various industries for efficient operations, and rise in quality/safety assurance. However, high cost of equipment and lack of skilled technicians hinder the nondestructive testing equipment market share. Increase in usage of advanced materials is expected to provide lucrative nondestructive testing equipment market opportunity.

Segment Overview

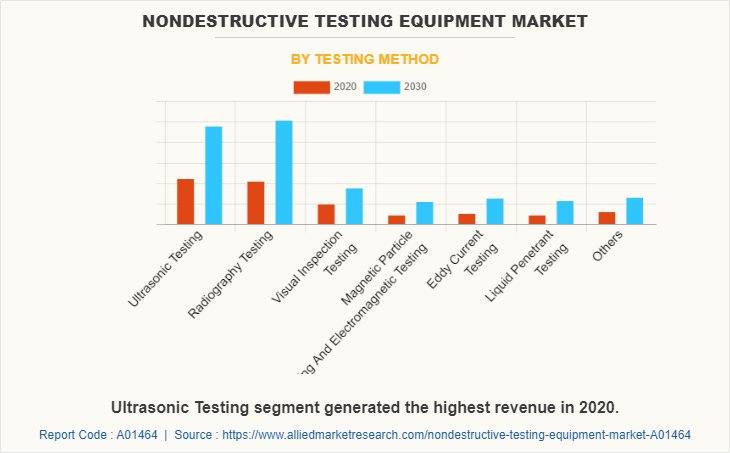

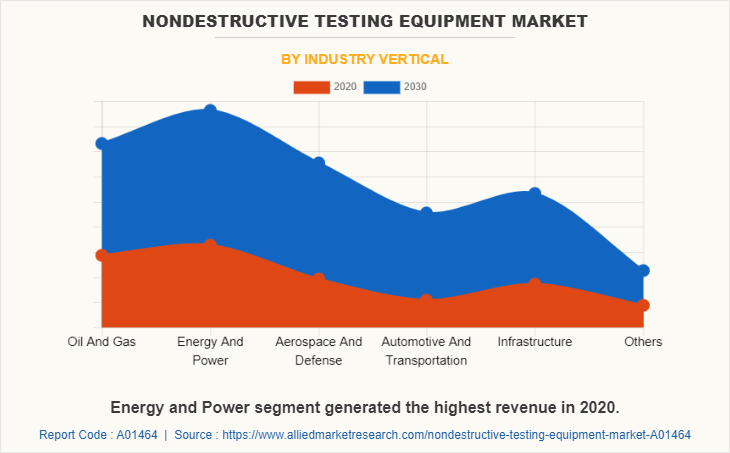

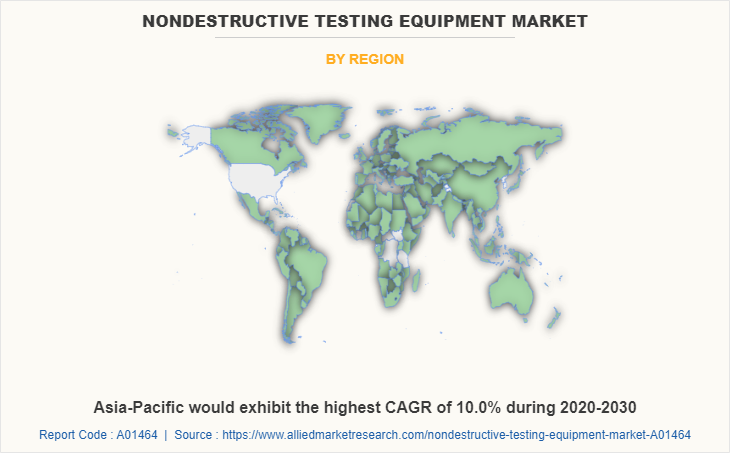

The nondestructive testing equipment industry is segmented on the basis of testing method, technique, industry vertical, and region. Depending on testing method, it is classified into ultrasonic testing, radiography testing, visual inspection testing, magnetic particle testing & electromagnetic testing, eddy current testing, liquid penetrant testing, and others. According to technique, it is categorized into volumetric examination, surface examination, and others. As per the industry vertical, it is fragmented into oil & gas, energy & power, aerospace & defense, automotive & transportation, infrastructure, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA along with its prominent countries.

The key players profiled in the nondestructive testing equipment industry include Ashtead Technology, Carestream Health, General Electric, Intertek Group, Mistras Group, Nikon Metrology, Olympus Corporation, Sonatest, SGS SA, and Zetec.

These key players have adopted strategies, such as product portfolio expansion, mergers & acquisitions, agreements, regional expansion, and collaborations to enhance their market penetration.

Top Impacting Factors

The notable factors positively impacting the nondestructive testing equipment market include increase in oil & gas and power generation projects, stringent safety government regulations, maintenance optimization by various industries to ensure safety and efficient performance of the machines, and rise in need for extending the life of obsolete infrastructure. However, lack of skilled and qualified labor to handle the NDT equipment hampers the nondestructive testing equipment market growth. Conversely, increase in use of advance NDT equipment by various industry verticals are expected to offer lucrative opportunities for the market growth in future.

Increase in oil & gas and power generation projects

Increase in oil & gas and power generation projects, particularly in the nuclear energy sector in Asia-Pacific, drives the NDT equipment market significantly, as NDT inspection plays a vital role in the functioning of these two industries. Latin American oil production is dominated by Brazil, Mexico, and Venezuela. These countries are responsible for about 75% of the region's total output and are also giants on the international stage, ranking as the world's 10th, 11th, and 12th biggest oil producers, respectively.

Lack of skilled and qualified professionals

Lack of skilled technicians is the major restraint for the nondestructive testing equipment market. Most technicians required for the inspection process are only certified and do not possess the required essential skills to perform quality inspection at satisfactory levels. In addition, most training institutes train technicians on outdated equipment that is phased out of the market as they do not have latest equipment for training. This is a major hindrance to the growth of the nondestructive testing equipment market, since it restricts the adoption of advanced products and technologies.

Increase in use of advanced NDT equipment

Advancement in technology acts as an opportunity in the nondestructive testing equipment market as it offers more reliable and accurate inspection data. Advanced technologies in this equipment include eddy current array and phased array ultrasonic, which provide superior ways of presenting data and generate inspection reports of advanced value to consumers

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the nondestructive testing equipment market analysis from 2020 to 2030 to identify the prevailing nondestructive testing equipment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the nondestructive testing equipment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global nondestructive testing equipment market trends, key players, market segments, application areas, and market growth strategies.

Nondestructive Testing Equipment Market Report Highlights

| Aspects | Details |

| By Testing Method |

|

| By Technique |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | General Electric, sgs, nikon metrology, ashtead technology, sonatest ltd, carestream health, Olympus, Intertek Group plc, Mistras Group, Inc., zetec |

Analyst Review

The non-destructive testing (NDT) equipment market is highly competitive, owing to strong presence of the existing vendors. NDT technology vendors, who have access to extensive technical and financial resources, are anticipated to gain a competitive edge over their rivals, as they have the capacity to cater to the market requirements. The competitive environment in this market is expected to further intensify with increase in technological innovations, product extensions, and different strategies adopted by the key players.

The NDT equipment market is expected to witness a significant growth with increase in adoption from various industries to improve operations efficiency and government safety regulations across different regions. Technological advancements have augmented the overall industrial development within wide range of industries. Oil & gas, energy & power, and aerospace & defense are some of the leading sectors, which use NDT techniques to ascertain the quality of end products related material during manufacturing and gain operations efficiency.

The energy & power and oil & gas sectors constituted the largest market share due to presence of huge shale oil & gas reserves in various region. In addition, increase in energy & power operation, particularly in the nuclear energy sector drives the NDT equipment market significantly as NDT inspection plays vital role in functioning of the energy & power sector. Ultrasonic testing currently holds largest market share; however, radiography testing is expected to surpass ultrasonic testing in the next five years, owing to the decline in average price of ultrasonic test equipment.

The non-destructive testing equipment market provides numerous growth opportunities to the market players such as Ashtead Technology, Carestream Health, General Electric, Intertek Group, Mistras Group, Nikon Metrology, Olympus Corporation, Sonatest, SGS SA, and Zetec.

Rapid development in smart infrastructure and vehicle technology have resulted in desire to adopt this technology, particularly in the developing countries such as China, India, Brazil, Mexico, and UAE

Energy and Power is the leading application of nondestructive testing equipment market

North America is the largest regional market for nondestructive testing equipment market

The non-destructive testing(NDT) equipment market was valued at $3.55 billion in 2020, and is projected to reach $8.12 billion by 2030, growing at a CAGR of 8.7% from 2021 to 2030

The key players profiled in NDT equipment industry include Ashtead Technology, Carestream Health, General Electric, Intertek Group, Mistras Group, Nikon Metrology, Olympus Corporation, Sonatest, SGS SA, and Zetec

Loading Table Of Content...