North America IVD Market Overview:

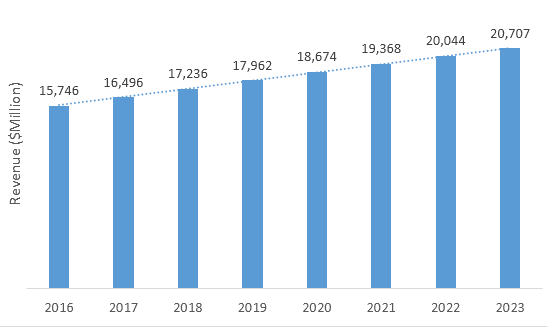

The North America IVD Market is accounted for $20,886 million in 2016, and is estimated to reach $27.820 million by 2023, growing at a CAGR of 4.1% during the analysis period 2017-2023.

IVD products are those agents, instruments, and systems utilized to examine samples such as blood, urine, stool, tissues, and other body fluids. These samples are derived from the human body to detect diseases, conditions, and infections. The tests can be performed in standalone laboratory, and hospital-based laboratory. IVD utilizes several techniques, such as polymerase chain reaction, microarray techniques, sequencing technology and mass spectrometry for test sample preparation to detect diseases.

Rise in incidence & prevalence of chronic diseases, technological advancements in testing techniques, and the increase in healthcare expenditure fuel the market growth during the analysis period. However, stringent regulatory policies and unclear reimbursement policies restrict the growth.

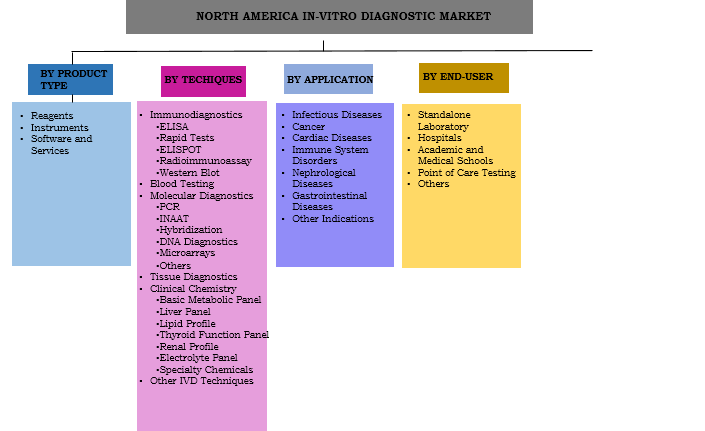

North America IVD Market Segmentation

Segment Review

Based on product type, the market is categorized into reagents, instruments, and software & services. The reagent segment accounted for the highest market share in 2016, and the software and services is expected to grow at the highest growth rate during the forecast period. The growth of the reagent market is attributed to the recent introduction of new novel reagents and wide availability of effective and cost-efficient reagents. On the basis of technique, the immunodiagnostics segment captured the highest market share in 2016, due to the increase in demand of personalized medicines. On the basis of application, infectious diseases segment captured the highest market share in 2016, because of the increase in prevalence of infectious diseases and rise in healthcare awareness among the population. Based on end users, the standalone laboratory segment captured the highest market share in 2016, primarily due to non-availability of complex tests in hospitals and commercial clinics.

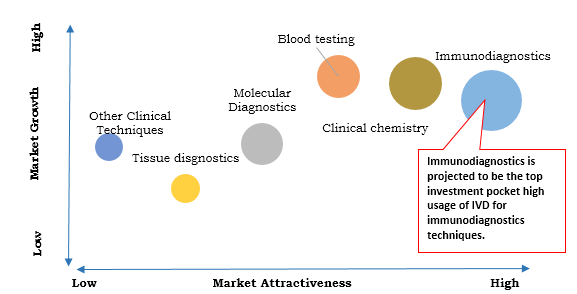

Top Investment Pocket

Country Wise Review

By geography, the North America IVD market is analyzed across the U.S., Canada, and Mexico. The U.S. accounted for the highest market share in 2016, followed by Canada. Mexico is anticipated to witness the highest growth rate during the forecast period.

U.S. IVD Market ($Million), 2017-2023

Increase in Prevalence of Infectious Diseases

IVD market in North America is its growth stage due to increase in incidences of infectious diseases such as tuberculosis, HIV, AIDS, malaria, rabies, ebola virus, and pertussis. Increase in incidences of infectious diseases predominantly drives the IVD market.

Rising Aging Population

The North America IVD market is on an increase due to growth in geriatric population as the number in volume of chronic and infectious diseases increases. From 2000 and 2050, the number of older people is projected to increase by 135%. In addition, the population aged 85 and above is projected to increase by 350%. Creating healthcare awareness among the masses as well as adoption of advance in vitro techniques for disease diagnosis is another major opportunity for the growth of the market in North America. The IVD market is affected by the taxes implied on the IVD instruments, as it adds up the marked cost.

Key Market Benefits:

- The study provides an in-depth analysis of the North America IVD market with current trends and future estimations to elucidate the imminent investment pockets.

- The report provides a quantitative analysis from 2016 to 2023 to enable the stakeholders to capitalize on prevailing market opportunities

- Extensive analysis by technology and application helps understand various trends and prevailing opportunities in the respective market

- Comprehensive analysis of all geographical regions is provided, which determines the main opportunities in these geographies

- Key market players within the market are profiled in this report and their strategies are analyzed thoroughly, which predict the competitive outlook of the North America IVD

North America IVD Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Techniques |

|

| By Application |

|

| By End Users |

|

| By Country |

|

| Key Market Players | THERMO FISHER SCIENTIFIC INC., JOHNSON & JOHNSON, DANAHER CORPORATION, BECTON DICKINSON AND COMPANY, BIO-RAD LABORATORIES, ALERE INC., BAYER AG, F. HOFFMANN-LA ROCHE AG, BIOMERIEUX, SYSMEX CORPORATION |

Analyst Review

In vitro diagnostics tests are used to diagnose various diseases and infections. In this technique, biological samples such as blood, urine, stool, tissues, and other body fluids are used to analyze and diagnose diseases.

The U.S. accounted for the highest share in North America due to increase in government expenditure in the healthcare sector, rise in chronic diseases, and demand for non-invasive techniques. Mexico is growing with the highest CAGR owing to rise in prevalence of chronic and infectious diseases such as cancer, tuberculosis, diabetes, HIV, and others. In addition, government initiatives for the improvement of healthcare sector and rise in technological advancement in IVD technology are expected to make way for growth opportunities in the market.

Major companies operating in this market adopt product launch as their key development strategy. Companies profiled in this market include, Thermo Fisher Scientific Inc., Alere Inc., Biomerieux, Danaher Corporation, F. Hoffmann-La Roche AG, Becton Dickinson and Company, Bio-Rad Laboratories, Bayer AG, Sysmex Corporation, and Johnson & Johnson among others.

Loading Table Of Content...