Immunodiagnostics Market Research, 2033

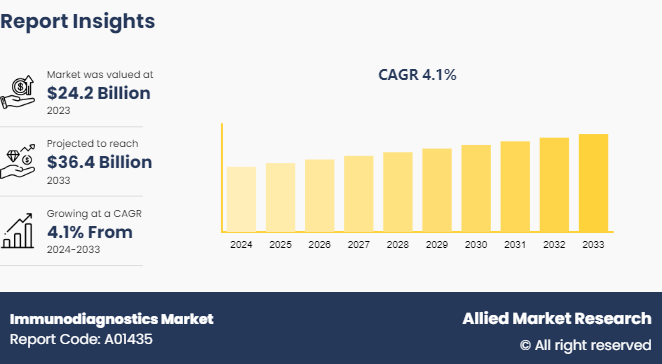

The global immunodiagnostics market was valued at $24.2 billion in 2023, and is projected to reach $36.4 billion by 2033, growing at a CAGR of 4.1% from 2024 to 2033. Increase in the prevalence of chronic diseases, advancements in immunodiagnostics technologies, and improvement in the diagnosis of complex diseases drive the growth of the market

Market Introduction and Definition

The sector of in vitro diagnostics known as immunodiagnostics is concerned with the use of antigen-antibody reactions to diagnose a variety of diseases. It is the main method used to diagnose endocrinology, autoimmune disorders, chronic illnesses like cancer and cardiovascular disease, and viral infections. The ability to pinpoint the areas for disease progression diagnosis has improved due to the notable advancements in immunodiagnostics technologies. The ability to diagnose complex diseases has improved with advancements in technology.

Key Takeaways

- The immunodiagnostics market size covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major immunodiagnostics industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The immunodiagnostics market growth is significantly influenced by the rise in infectious disease incidences (HIV, STI, hepatitis B, and others) , cardiovascular diseases, cancer, gastrointestinal disorders, and other chronic diseases worldwide as a result of the aging population and changes in demographics and lifestyle. Furthermore, as diagnostic kits, assays, and analyzers become more advanced technologically and patients and medical professionals become more aware of preventative health measures, the demand for immunodiagnostics goods is further stimulated, leading to a rise in growth.

The immunodiagnostics market opportunity is driven by the strong demand for immunochemistry-based tests among healthcare professionals, rise in incidences of chronic diseases, availability of cost-effective testing options, and widespread awareness of healthcare. Ongoing advanced research and improved diagnostic devices offer promising opportunities for the immunodiagnostics segment. One of the primary driving factor for the immunodiagnostics segment is its ability to provide highly specific and sensitive results, which makes it an invaluable tool in modern healthcare.

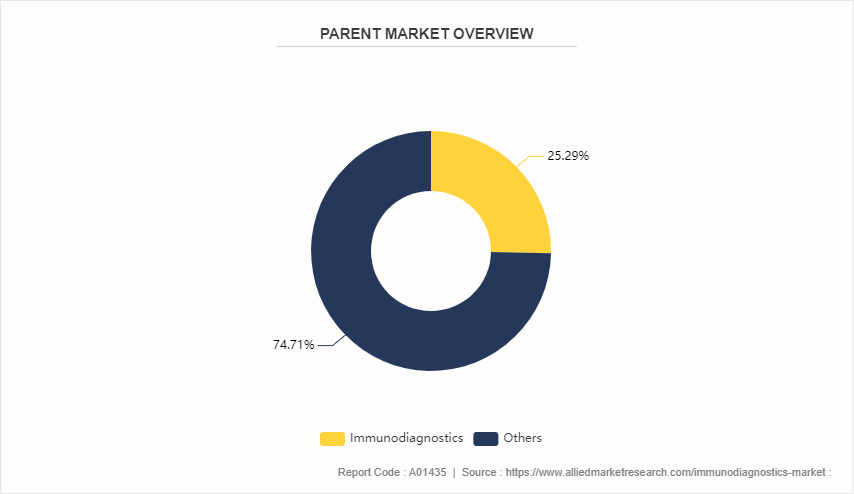

Parent Market Overview

In vitro diagnostics (IVDs) are tests that detect diseases, conditions, and infections. In vitro means these tests are typically conducted in test tubes and similar equipment, as opposed to in vivo tests, which are conducted in the body itself. In vitro diagnostics (IVD) includes a wide range of tools and techniques, including reagents, instruments, software, and services utilized for the examination of specimens such as blood, urine, stool, tissues, and various human body fluids. These diagnostic tools are essential for detecting diseases, conditions, and infections. IVD tests are conducted in various settings, including standalone laboratories, hospital-based facilities, and point of care centers. In addition, in vitro diagnostic techniques encompass a broad array of methodologies, including clinical chemistry, tissue diagnostics, immunodiagnostics, hematology, and more. Moreover, immunodiagnostics comprises about 25.3% share of the parent market.

Market Segmentation

The immunodiagnostics market size is segmented into product type, technology, application, end-user, and region. Based on product type, the market is classified into reagents, instruments, and software & services. Based on technology, the market is classified into enzyme-linked immunosorbent assay, chemiluminescence immunoassay, fluorescent immunoassay, radioimmunoassay, and others. Based on application, the market is classified into infectious diseases, oncology & endocrinology, bone & mineral diseases, autoimmunity disorders, cardiac biomarkers, drug monitoring, and other applications. Depending on end-user, the market is classified into hospitals, clinical laboratories, academic & research institutes, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America accounted for a major immunodiagnostics market share owing to the presence of several major players, availability of advanced healthcare facilities; and high healthcare infrastructure expenditure by the government organizations in the region which drive the growth of the market.?Moreover, this is attributed to rise in incidences of chronic diseases, increase in the number of diagnostic tests, and the strong presence of key market players in the region.

Asia-Pacific immunodiagnostics market share is estimated to grow with the highest CAGR during the forecast period, owing to enhancements in healthcare facilities, increase in prevalence of chronic diseases, surge in awareness about early disease diagnosis, and increase in healthcare expenditure. In addition, this region offers lucrative opportunities for the immunodiagnostics market key players, owing to a rising awareness of advanced medical technologies. Companies are focusing on this region to expand their immunodiagnostics industry presence.

Competitive Landscape

The major players operating in the immunodiagnostics market are Abbott, Becton Dickinson, Agilent Technologies, Inc., Exact Sciences Corporation, Guardant Health, Illumina, Inc., Diaosorin, NeoGenomics Laboratories, F. Hoffmann-La Roche Ltd., and Thermo Fisher Scientific.

Recent Developments

- In May 2023, Freenome announced that it has acquired Oncimmune Ltd, a UK-based global immunodiagnostics developer with a commercialized CE-IVD marked EarlyCDT Lung blood test, autoantibody platform and research and development pipeline of 7+ cancer detection signatures.

- In February 2021, Agilent Technologies Inc. announced the launch of the Agilent Dako SARS-CoV-2 IgG Enzyme-Linked Immunosorbent Assay (ELISA) kit intended for the qualitative detection of immunoglobulin G (IgG) antibodies to SARS-CoV-2 in human serum or plasma.

- In July 2022, F. Hoffmann-La Roche Ltd announced the launch of the Elecsys HCV Duo immunoassay in countries that accept the CE Mark.

- In August 2022, Thermo Fisher Scientific announced the clearance of ImmunoCAP Specific IgE (sIgE) Allergen Components for wheat and sesame allergies by the U.S. Food and Drug Administration (FDA) for in vitro diagnostic use.

Key Sources Referred

- National Center for Biotechnology Information

- World Health Organization (WHO)

- National Library of Medicine

- The United States Food and Drug Administration

- U.S. Department of Health & Human Services

- Centers for Disease Control and Prevention

- Australian Institute of Health and Welfare

- Johns Hopkins Medicine

- National Centre for Disease Control (NCDC)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the immunodiagnostics market analysis from 2024 to 2033 to identify the prevailing immunodiagnostics market forecast.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the immunodiagnostics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the immunodiagnostics industry.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global immunodiagnostics market trends, key players, market segments, application areas, and market growth strategies.

Immunodiagnostics Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 36.4 Billion |

| Growth Rate | CAGR of 4.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Product Type |

|

| By Technology |

|

| By Application |

|

| By End-user |

|

| By Region |

|

| Key Market Players | Abbott, Diaosorin, Exact Sciences Corporation, F. Hoffmann-La Roche Ltd., Illumina, Inc., Guardant Health, NeoGenomics Laboratories, Agilent Technologies, Inc., Thermo Fisher Scientific Inc., Becton Dickinson |

Increase in the number of infectious disease and surge in the diagnosis are the upcoming trends of Immunodiagnostics Market in the globe.

Infectious Diseases is the leading application of Immunodiagnostics Market.

North America is the largest regional market for Immunodiagnostics

The global immunodiagnostics market was valued at $24.2 billion in 2023, and is projected to reach $36.4 billion by 2033, growing at a CAGR of 4.1% from 2024 to 2033.

The major players operating in the immunodiagnostics market are Abbott, Becton Dickinson, Agilent Technologies, Inc., Exact Sciences Corporation, Guardant Health, Illumina, Inc., Diaosorin, NeoGenomics Laboratories, F. Hoffmann-La Roche Ltd., and Thermo Fisher Scientific.

Loading Table Of Content...