In Vitro Diagnostics Market Research, 2032

The global in vitro diagnostics market size was valued at $92.5 billion in 2022, and is projected to reach $138.4 billion by 2032, growing at a CAGR of 4.1% from 2023 to 2032. In vitro diagnostics refers to a category of medical tests and procedures that are conducted using samples of bodily fluids, tissues, or other specimens taken from a patient outside of their body. These tests are performed in a controlled laboratory environment, typically using specialized equipment and techniques.

In Vitro Diagnostics Market Dynamics

One of the primary drivers of the in vitro diagnostics market is the rise in cases of infectious diseases and chronic diseases. Chronic diseases such as cardiovascular diseases, cancer, and infectious diseases require IVD tests for early detection, monitoring, and management of these conditions. In addition, the rise in aging population is another significant factor contributing to the growth of the in vitro diagnostics market. As individuals age, the risk of chronic diseases and conditions increases. IVD tests are essential for diagnosing age-related diseases, such as Alzheimer's disease, and various cancers.

Moreover, the elderly often require regular health monitoring, creating a sustained demand for IVD tests which propels market growth. Furthermore, the rise in advancements in technology in vitro diagnostics propels market growth. Innovative technologies have led to the development of more accurate, sensitive, and efficient diagnostic tests. These include molecular diagnostics, next-generation sequencing, liquid biopsy, and point-of-care (POC) testing. Technological progress enhances the precision and speed of diagnosis, leading to improved patient outcomes which support market growth.

The growth of the in vitro diagnostics market is expected to be driven by high potential in untapped emerging markets, due to availability of improved healthcare infrastructure, increase in unmet healthcare needs, rise in prevalence of chronic diseases, and surge in demand for advanced in vitro diagnostic testing. The rise in personalized medicine, which tailors’ treatment strategies to individual patients based on their genetic, molecular, and clinical profiles, has significantly impacted the IVD market. Companion diagnostics, a subset of IVD, are crucial for identifying patients who will benefit from specific therapies or those at risk of adverse reactions. This approach not only improves treatment efficacy but also reduces healthcare costs by avoiding ineffective treatments which further support the market growth.

The in vitro diagnostics industry is highly regulated to ensure patient safety and test accuracy. Obtaining regulatory approvals for new IVD tests may be a lengthy and expensive process. Stringent regulatory requirements, such as those imposed by the FDA and similar agencies worldwide, may slow down the introduction of new tests and technologies and hinder in vitro diagnostics market growth.

During a recession, governments and individuals often cut back on healthcare spending to save money. This may result in reduced demand for medical services, including diagnostic tests. Hospitals and healthcare facilities may experience budget constraints, leading to decreased orders for IVD equipment and tests. The economic health of a region or country may significantly impact healthcare budgets and spending. Economic downturns or financial crises can lead to reduced healthcare funding, affecting the adoption of IVD tests and investment in diagnostic technologies. However, innovation in healthcare delivery and a renewed emphasis on preventative care emerged as vital strategies for navigating the healthcare recession, which is expected to drive the market growth. Thus, global recession has moderate impact on the in vitro diagnostics (IVD) market.

IVD Market Segmental Overview

The IVD industry is segmented into product & services, technique, application, end user, and region. By product and services, the market is categorized into reagents & kits, instruments, and software & services. On the basis of technique, the market is segregated into immunodiagnostics, hematology, molecular diagnostics, tissue diagnostics, clinical chemistry, and others. By application, the market is segregated into infectious diseases, cancer, cardiac diseases, immune system disorders, nephrological diseases, gastrointestinal diseases, and others. The infectious disease segment is further categorized into RSV, Norovirus, HIV, Hepatitis A & C, Lyme disease, COVID-19, Chlamydia, and Shigellosis. By end user, the market is classified into supermarkets & hypermarkets, pharmacies & drug stores, and online providers. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

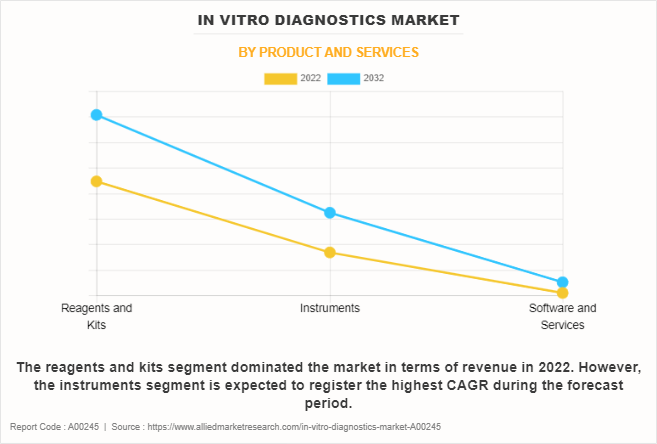

By Product & Services

The reagents and kits segment dominated the in vitro diagnostics market size in 2022 and is expected to remain dominant throughout the forecast period, owing to continuous demand for diagnostic testing solutions, the development of innovative and specialized reagents, and the increase in prevalence of diseases requiring accurate diagnostic procedures. However, instruments segment is expected to register the highest CAGR during the forecast period, owing to advancements in automation and technology, increase in adoption of in vitro diagnostic testing, and the need for faster and more efficient diagnostic processes in clinical laboratories and healthcare settings.

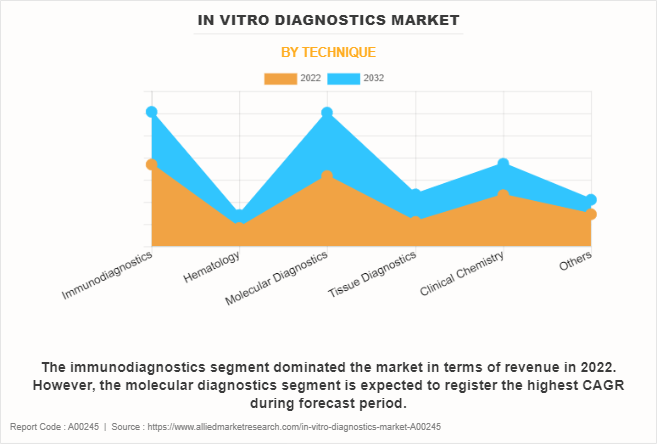

By Technique

The immunodiagnostics segment dominated the IVD market size in 2022 and is anticipated to continue this trend during the forecast period. This is attributed to its high sensitivity analysis, high throughput, low cost, and inherent specificity in the analysis of biological samples. However, the molecular diagnostics segment is expected to register the highest CAGR during the forecast period, owing to its crucial role in genomics, infectious disease detection, cancer management, and its application in various healthcare settings.

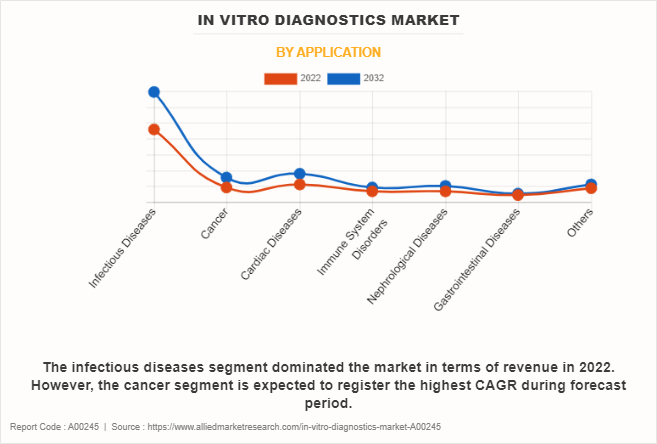

By Application

The infectious diseases segment held the largest in vitro diagnostics market share in 2022 and is expected to remain dominant throughout the forecast period, owing to surge in infectious diseases such as human immunodeficiency viruses (HIV) and hepatitis that require the diagnostic tests. However, the cancer segment is expected to register the highest CAGR during the forecast period, owing to an increase in cancer incidence, advances in biomarker discovery, and the expanding range of diagnostic technologies.

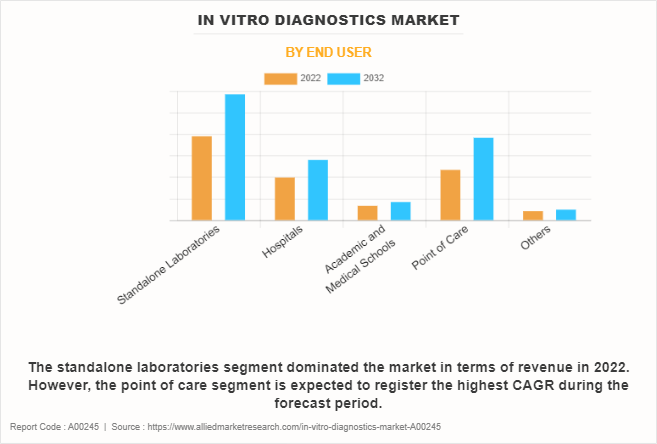

By End User

The standalone laboratories segment held the largest in vitro diagnostics market share in 2022 and is expected to remain dominant throughout the forecast period, owing to availability of professionally skilled technicians and surge in number of facilities offered by them for conducting various complex tests resulting in better test results. However, the point of care segment is expected to register the highest CAGR during the forecast period, owing to its ability to provide fast and accessible diagnostic solutions.

By Region

The in vitro diagnostics market size is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the in vitro diagnostics market in 2022 and is expected to maintain its dominance during the market forecast. Presence of several major players, such as Illumina, Inc., InterVenn Biosciences, F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific, Inc., and others and advancement in manufacturing technology of in vitro diagnostics in the region drive the growth of the market.

Asia-Pacific is expected to grow at the highest rate during the in vitro diagnostics market forecast. The market growth in this region is attributable to presence of purchasing power of populated countries, such as China and India. Moreover, the rise in demand for personalized medicine and adoption of high-tech processing to improve the production of in vitro diagnostic products, drive the growth of the market.

Asia-Pacific offers profitable in vitro diagnostics market opportunity for key players operating in the in vitro diagnostics market, thereby registering the fastest growth rate during the forecast period, owing to the growing infrastructure of industries, as well as well-established presence of domestic companies in the region. In addition, the increase in incidence of chronic diseases, such as diabetes, cardiovascular diseases, and cancer, is a significant driver for IVD market in the Asia-Pacific region. Diagnostic tests are crucial for early detection, management, and monitoring of these conditions.

Competition Analysis

Competitive analysis and profiles of the major players in the in vitro diagnostics, such as Freenome Holdings, Inc., Invitae Corporation, Natera, Inc., Agilent Technologies, Inc., Exact Sciences Corporation, Guardant Health, Illumina, Inc., InterVenn Biosciences, NeoGenomics Laboratories, F. Hoffmann-La Roche Ltd., and Thermo Fisher Scientific, Inc. are provided in this report. Major players have adopted product launch, acquisition, partnership, product approval, and expansion as key developmental strategies to improve the product portfolio of the in vitro diagnostics market.

Recent Product Launches in the In Vitro Diagnostics Market

- In February 2022, Invitae Corporation, a leading medical genetics company, launched its first CE-IVD Cancer Testing Kits in Europe with the availability of FusionPlex Dx and LiquidPlex Dx.

- In March 2021, Agilent Technologies Inc. announced the launch of a real-time reverse transcription (qRT) PCR-based diagnostic kit for the detection of SARS-CoV-2 RNA.

- In March 2023, NeoGenomics, Inc., a leading provider of oncology testing and global contract research services, announced the expansion of their next-generation sequencing (NGS) portfolio of innovative products with the commercial availability of multiple tests, including Neo Comprehensive - Solid Tumor, a comprehensive genomic profile (CGP) for solid tumor cancers, and Neo Comprehensive - Myeloid Disorders, a CGP for myeloid neoplasms.

- In February 2021, Thermo Fisher Scientific, the world leader in serving science, launched its CE-IVD-Marked, Applied Biosystems TaqPath COVID–19 HT Kit that is compatible with the Amplitude platform.

Recent Acquisitions in the IVD Market

- In May 2023, Freenome, a privately held biotech company, announced that it has acquired Oncimmune Ltd, a UK-based global immunodiagnostics developer with a commercialized CE-IVD marked EarlyCDT Lung blood test, autoantibody platform and research and development pipeline of 7+ cancer detection signatures.

- In March 2020, Invitae Corporation, a leading medical genetics company, announced the acquisition of Diploid, a privately held Belgian company that developed Moon, artificial intelligence (A.I.) software capable of diagnosing genetic disorders in minutes based on next-generation sequencing data and patient information.

Recent Expansions in the In Vitro Diagnostics Market

- In January 2022, Natera, Inc., a leader in personalized genetic testing and diagnostics, announced its expansion into the early cancer detection (ECD) market to advance the company’s strategic growth objectives in emerging areas of ECD and screening.

- In April 2022, Agilent Technologies Inc. announced it has expanded CE-IVD marking in the European Union for its PD-L1 IHC 28-8 pharmDx as an aid in identifying esophageal squamous cell carcinoma patients.

- In April 2022, Agilent Technologies Inc. announced CE-IVD marking in the European Union for its PD-L1 IHC 28-8 pharmDx immunohistochemical assay to extend the use of the test to patients diagnosed with muscle-invasive urothelial carcinoma (MIUC) who have tumor cell PD-L1 expression ≥ 1% for adjuvant treatment with OPDIVO (nivolumab).

Recent Product Approvals in the IVD Market

- In March 2021, Natera, Inc., a pioneer and global leader in cell-free DNA testing, announced that the U.S. Food and Drug Administration (FDA) has granted two Breakthrough Device Designations (BDDs) covering new intended uses of the Signatera molecular residual disease (MRD) test.

- In December 2022, Agilent Technologies Inc. announced that the U.S. Food and Drug Administration (FDA) has approved Agilent Resolution ctDx FIRST as a companion diagnostic (CDx) to identify advanced non-small cell lung cancer (NSCLC) patients with KRAS G12C mutations who may benefit from treatment with KRAZATITM (adagrasib).

Recent Agreement in the IVD Market

- In January 2021, Thermo Fisher Scientific Inc., the world leader in serving science, announced it has entered into a definitive agreement to acquire Mesa Biotech, Inc., a privately held molecular diagnostic company.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the in vitro diagnostics market analysis from 2022 to 2032 to identify the prevailing in vitro diagnostics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the in vitro diagnostics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global in vitro diagnostics market trends, key players, market segments, application areas, and market growth strategies.

In Vitro Diagnostics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 138.4 billion |

| Growth Rate | CAGR of 4.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 391 |

| By End User |

|

| By Product and Services |

|

| By Technique |

|

| By Application |

|

| By Region |

|

| Key Market Players | Exact Sciences Corporation, Invitae Corporation, Freenome Holdings, Inc., F. Hoffmann-La Roche Ltd., Guardant Health, InterVenn Biosciences, NeoGenomics Laboratories, Natera, Inc., Thermo Fisher Scientific, Inc., Illumina, Inc., Agilent Technologies, Inc. |

Analyst Review

The growth of the in vitro diagnostics market is attributed to factors such as surge in demand in vitro diagnostic testing as they provide high accuracy and precise techniques coupled with a wide range of applications across various medical conditions, such as oncology, sexually transmitted diseases (STDs), chronic diseases, genetic testing, and infectious diseases.

In addition, advancements in vitro diagnostics technologies such as molecular diagnostics, next generation sequencing enhancement in polymerase chain reaction, and multiplex assays make it an essential method in clinical decision-making, thereby driving the market growth. Further, surge in demand for early disease diagnosis also drives the demand for in vitro diagnostics products, which boosts the market growth. However, stringent regulatory policies and lack of skilled laboratory technologist in vitro diagnostics restrain the growth of the market.

Furthermore, North America witnessed the highest growth in 2022, in terms of revenue, owing to rise in prevalence of chronic disease, increase in vitro diagnostic testing, and easy availability of the in vitro diagnostics tests. However, Asia-Pacific is expected to register the highest CAGR during the forecast period, owing to rise in technological advancement, development of healthcare settings, and surge in prevalence of chronic diseases.

The total market value of in vitro diagnostics market is $92,515.25 million in 2022.

The market value of in vitro diagnostics market in 2032 is $138,358.86 million.

The forecast period for in vitro diagnostics market is 2023 to 2032.

The base year is 2022 in in vitro diagnostics market.

Top companies such as F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific, Inc., Agilent Technologies, Inc., Illumina, Inc., and Exact Sciences, held a high market position in 2022. These key players held a high market position owing to the strong geographical foothold in North America, Europe, Asia-Pacific, and LAMEA.

The reagents and kits segment is the most influencing segment in in vitro diagnostics market owing to rise in adoption of reagents for diagnostic purpose as the reagents are essential components used in IVD tests to facilitate the detection and measurement of specific analytes in patient samples, such as blood or urine.

The major factors driving the growth of in vitro diagnostics market are surge in incidences of chronic and infectious disease, cost-effective diagnostic solutions, and increase in demand for real time polymerase chain reaction (RT-PCR) testing.

In vitro diagnostic (IVD) refers to development, manufacturing, and distribution of a wide range of medical devices, reagents, instruments, software, and services used for the examination of biological specimens such as blood, urine, tissue samples, and other bodily fluids outside the human body.

Loading Table Of Content...

Loading Research Methodology...