Nutritional Food And Drink Market Research, 2032

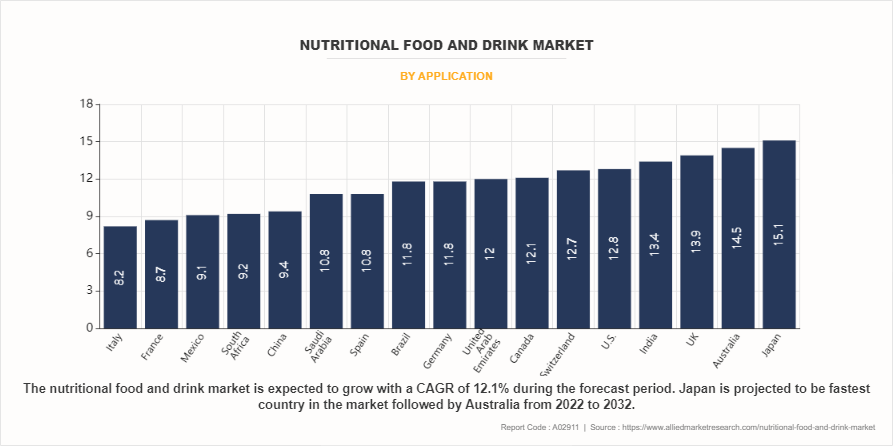

The global nutritional food and drink market size was valued at $105.3 billion in 2022, and is projected to reach $320.7 billion by 2032, growing at a CAGR of 12.1% from 2023 to 2032. Nutritional food and drink are products that contain essential ingredients for the human body's optimum functioning. These nutrients include macronutrients (carbohydrates, proteins, and fats) as well as micronutrients (vitamins and minerals), which are all necessary for growth, energy, and overall health. Nutritional foods and beverages provide a well-balanced combination of key macronutrients and micronutrients while limiting the intake of potentially harmful components such as added sugars, excessive salt, and potentially harmful trans fats. They improve health, stimulate growth and development, and aid in the prevention of diet-related illnesses when consumed as part of a well-balanced diet.

The rising prevalence of chronic diseases worldwide is one of the major factors projected to drive the market revenue growth. Furthermore, increasing urbanization and rising disposable income levels are factors projected to boost nutritional food and drink market growth. Another important factor driving the market growth is rising health consciousness among the population and a hectic lifestyle . As a result of this factor, consumers are progressively adapting a healthy lifestyle that promotes fitness while lowering the risk of lifestyle diseases. This aspect, along with others such as growing healthcare costs promotes demand for sports nutrition products. In addition, the growing interest in fitness & wellness has led to the popularity of nutritional products catering to athletes, fitness enthusiasts, and individuals with specific dietary and performance goals.

The market, on the other hand, is expected to be impeded by the increasing usage of artificial flavors and preservatives. In developing countries, a lack of food control infrastructure and services are factors expected to hamper market expansion. The emergence of unfavorable conditions as a result of the COVID-19 pandemic and a lack of knowledge are projected to be the major restraining factors, hampering the market growth. In addition, nutritional foods and drinks can be more expensive than less nutritious options. Fresh produce, organic items, and specialty health foods frequently come with a higher price tag. This is often attributed to factors such as the cultivation practices involved in organic farming, the careful handling and transportation of fresh produce to maintain quality, and the specialized nature of ingredients used in health-conscious or specialty food items. Some people find nutritional foods less delicious than processed and junk foods, which can make it challenging to maintain a healthy diet. All these factors are anticipated to restraint the nutritional food and drink market demand in the upcoming years.

The fitness industry has seen a significant growth, with more people participating in various forms of physical activities, from gyms to yoga to outdoor sports. These people often need products that can improve their performance and aid their recovery. Many people are looking to control weight, build muscle, or improve body composition. Nutritional products that provide the right balance of macronutrients, vitamins and minerals are essential to achieving these goals. These factors are anticipated to create several growth opportunities in the market. The majority of the world's young people do not have time to prepare food due to due to hectic lifestyle and busy work schedules. Therefore, individuals seek dietary selections that are readily available and high in nutrients. Nutritional drinks also serve as a filler food, reducing the intake of greasy foods between meals and, as a result, preventing weight gain in individuals.

Segmental Overview

The nutritional food and drink market is segmented on the basis of type, application, and region. By type, the market is divided into food (sugar & fat replacers, fiber-enriched products, nutritional supplements, and others) and drink (energy drinks, flavored & enhanced waters, juices, and others). By application, the market classified into healthcare, sports & fitness, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

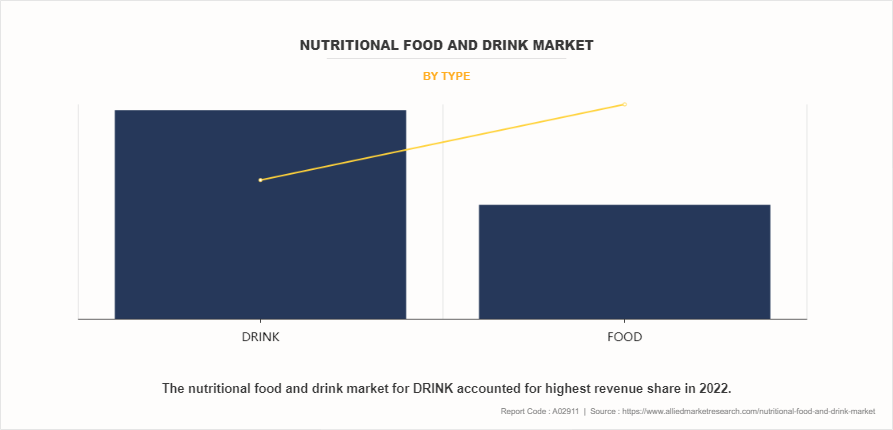

By Type

By type, the drinks sub-segment dominated the market in 2022. Sugar and fat substitutes are becoming more popular as people strive to minimize their sugar and fat intake in order to address health issues such as obesity and diabetes. Sugar replacements such as stevia, erythritol, and monk fruit are popular, as are low-fat and reduced-sugar versions of traditional items. This category also contains fat substitutes such as avocado and coconut oil-based goods, which provide better fat options. A healthy and balanced diet is part of nutrition. Foods and beverages offer the energy and nutrients required to maintain good health. Sports nutrition is booming as the general public's emphasis on health and fitness increases. Fitness fans and professional athletes take part in support campaigns and social media platforms that encourage people to stay fit and healthy. As the world's population becomes more prone to ailments such as diabetes, obesity, and cardiovascular disease, people are turning to sports and sports nutrition foods to lower their risk. Therefore, these factors are projected to drive the nutritional food industry expansion.

By Application

By application, the sports & fitness sub-segment dominated the global nutritional food and drink market share in 2022, due to the increase in awareness about health and fitness as well as the extensive availability of sports supplements in the market. One of the main elements leading to the expansion of this category is the increasing number of gyms and fitness facilities. In addition, the growing number of new product releases and ongoing research into new ingredients are factors projected to boost market growth in the future. Increasing consumer awareness regarding health & fitness, as well as an increase in the number of fitness and health facilities, are some of the reasons predicted to boost the market in North America. The rising number of new product launches in this category is likely to boost demand for nutrition food & drinks in the future. Bodybuilding.com, for example, debuted its own line of private-label crispy protein bars in two varieties in 2018, including chocolate, peanut butter, and cookies and cream.

By Region

By region, North America dominated the global market in 2022. Increasing health & fitness consciousness is driving up demand for nutritional food and beverages in this region. Furthermore, the frequency of new product launches in the sports supplements category is increasing, indicating that these goods will be in high demand in the upcoming years. Another key factor encouraging product uptake in this region is an increase in the number of government initiatives supporting sports-related activities. The aging population in North America is sparking interest in nutritional products that promote healthy aging. This includes products fortified with vitamins and minerals, as well as supplements targeting joint health, bone health and cognitive function. The popularity of sports and fitness activities has created a strong market for sports nutrition products in North America. Athletes and fitness enthusiasts are looking for protein supplements, energy bars and functional drinks to support their workouts and performance.

Competitive Landscape

The key players profiled in this report include Nestle, Abbott, Bayer AG, DUPONT, Amway, Health Food Manufacturers’ Association, Glanbia Plc, Bionova, GSK plc, and Herbalife International of America, Inc. Investment and agreement are common strategies followed by major market players. In May 2022, PerfectTed launched a healthy beverage line based on natural energy drinks made from matcha green tea to combat fatigue. The brand's goal is to transform caffeine consumption into something healthier by using matcha ingredients that have been used for over 800 years.

Impact of COVID-19 on the Global Nutritional Food and Drink Industry

- The COVID-19 outbreak had a direct and significant influence on the global nutritious food sector. Lockdowns to stop and contain the outbreak had a significant impact on distribution systems

- The nutritional food and drink industry, like many others, faced challenges in sourcing ingredients, production, and distribution due to lockdowns, transportation issues, and labor shortages. This led to disruptions in the availability of certain products.

- Regulatory bodies have been closely monitoring health claims related to COVID-19. Companies had to ensure that their marketing and labeling comply with regulations and do not make misleading health claims. Some companies have responded to the pandemic by innovating and introducing new products that align with changing consumer preferences, such as functional foods and beverages.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the nutritional food and drink market analysis from 2022 to 2032 to identify the prevailing nutritional food and drink market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the nutritional food and drink market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global nutritional food and drink market trends, key players, market segments, application areas, and market growth strategies.

- Based on region, North America registered the highest market share in 2022 and is projected to maintain its position during the nutritional food and drink market forecast period.

Nutritional Food and Drink Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 320.7 billion |

| Growth Rate | CAGR of 12.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 320 |

| By APPLICATION |

|

| By Type |

|

| By Region |

|

| Key Market Players | Abbott, Amway, Herbalife International of America, Inc., Glanbia Plc, Bionova, GSK plc, DUPONT, Bayer AG, Nestle, Health Food Manufacturers’ Association |

The global nutritional food and drink market size was valued at $105.3 billion in 2022, and is projected to reach $320.7 billion by 2032

The global Nutritional Food and Drink market is projected to grow at a compound annual growth rate of 12.1% from 2023 to 2032

The key players profiled in this report include Nestle, Abbott, Bayer AG, DUPONT, Amway, Health Food Manufacturers’ Association, Glanbia Plc, Bionova, GSK plc, and Herbalife International of America, Inc.

By region, North America dominated the global market in 2022.

Increasing prevalence of chronic diseases, Growing demand for health supplements, Rising health consciousness among people

Loading Table Of Content...

Loading Research Methodology...