Off-Highway Electric Vehicle Market Insights, 2031

The global off-highway electric vehicle market was valued at USD 15.7 billion in 2021, and is projected to reach USD 168.7 billion by 2031, growing at a CAGR of 26.7% from 2022 to 2031.

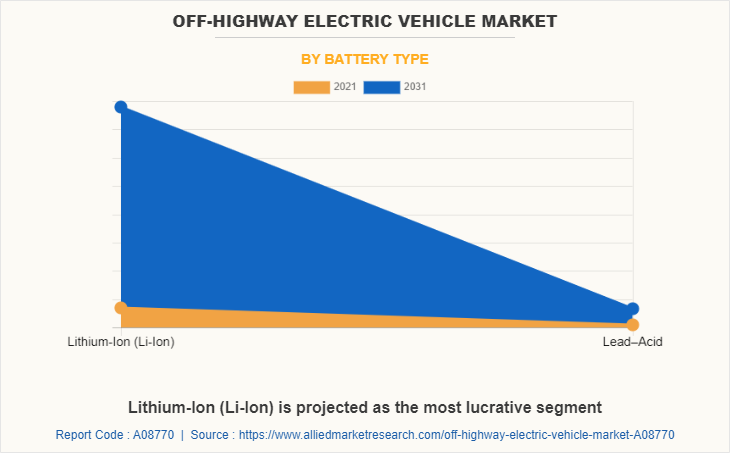

Off-highway electric vehicles (OHEVs) are a form of electric vehicles, which are designed to carry off-the-road operations. For propulsion, they use one or more electric motors. Further, these electric vehicles use a variety of batteries, including lead acid, nickel metal hybrid, and lithium-ion to store energy. Off-highway electric vehicles are used commonly in mining industry and construction industry where the roads are not properly straight & easy to drive. These vehicles are used for carrying load from one place to another and is also used for other applications in mining and construction industry.

The industry is currently moving from the old ‐˜electric drive‐™ designs to full hybrid and pure electric. Electrification is also crossing over with the journey toward automation and ultra-precision agriculture, with political changes and demographic pressures. Furthermore, rapid infrastructural development and revised government norms associated with construction activities are driving the off-highway electric vehicle market in the developed countries. For instance, in August 2020, SANY Group unveiled the electric version of its truck mixers with features such as 350 kW permanent magnet synchronous motors, high-energy-density lithium iron phosphate batteries along with modern monitoring functions such as real-time monitoring, performance analysis and remote diagnosis.

The factors such as increase in trend of recreational activities and adventure sports, rise in demand for electric machinery in construction sector, and increasing sales of electric vehicles supplement the growth of the off-highway electric vehicle market. However, high maintenance cost of off-highway electric vehicles and ban on ATV and UTV driving in wildlife area are the factors expected to hamper the growth of the market. In addition, technology development in off-highway electric vehicle and expansion of dealer network for effective product reach creates market opportunities for the key players operating in the off-highway EV market.

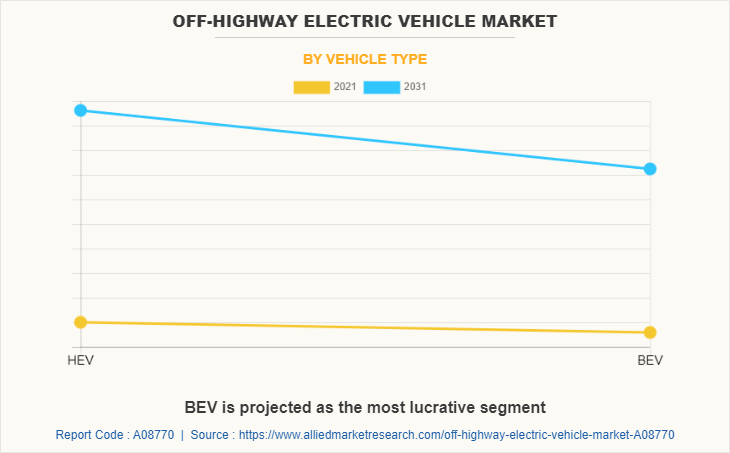

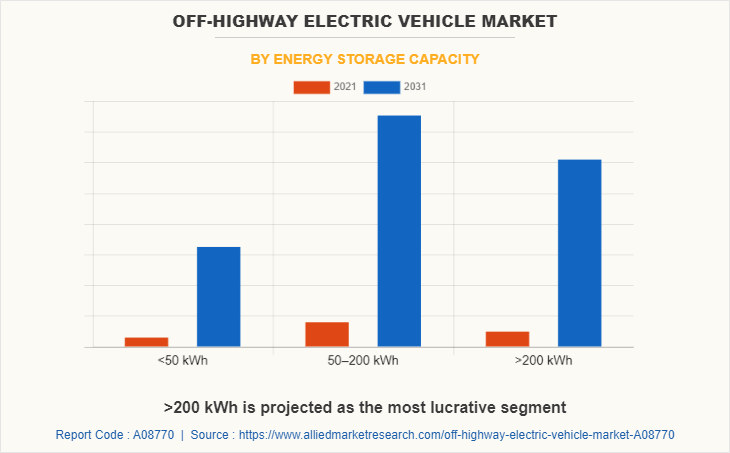

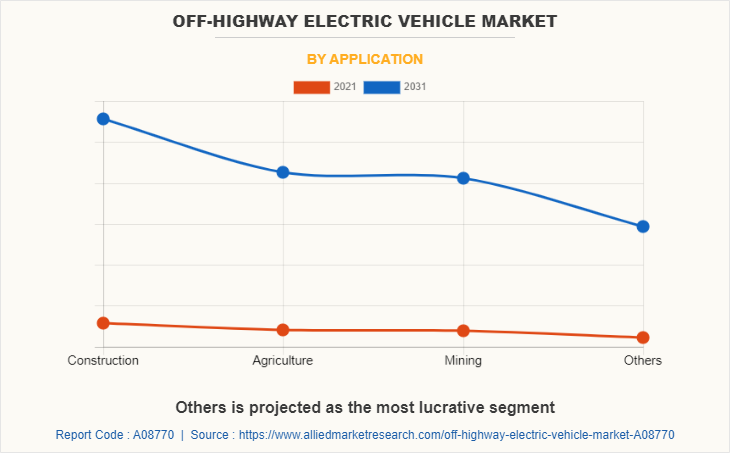

The off-highway electric vehicle market is segmented into vehicle type, energy storage capacity, battery type, application, and region. By vehicle type, the market is divided into hybrid electric vehicle (HEV) and battery electric vehicle (BEV). By energy storage capacity, it is fragmented into <50 kWh, 50‐“200 kWh, and >200 kWh. By battery type, it is categorized into lithium-ion (Li-Ion) and lead‐“acid. By application, it is further classified into construction, agriculture, mining, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading players operating in the off-highway electric vehicle market are AB Volvo, Anhui Heli Co., Ltd., Cargotec Corporation, Caterpillar, Clark, CNH Industrial N.V., DEERE & COMPANY, Epiroc AB, Hitachi Construction Machinery, Hyundai Construction Equipment Co., Ltd., JCB, Komatsu Ltd., Liebherr-International AG, Narrow Isle inc., Sandvik AB, SANY Group, and Toyota Motor Corporation.

Increase in trend of recreational activities and adventure sports

In recent years, sports enthusiasts and tourists are inclining toward trails of off-highway electric vehicles such as UTV and ATV along with related activities for recreational and sport activities purposes. For instance, in March 2021, Polaris, Inc. launched the 2021 model of its electric UTV, Ranger EV. Similarly, in March 2021, BRP Group announced its plans to introduce electric off-highway vehicles and power sports models by 2026. The company is set to invest $300 million over the coming years to electrify its product line. Several leisure activity organizers and tourism councils are introducing UTV and ATV related activities by building tracks and sport setups for these vehicles to attract and retain visitors. According to the 2020 industry analysis report by the Outdoor Industry Association, over half of the U.S. population aged six and above participated in at least one outdoor recreational activity in 2019. Moreover, several countries are organizing yearly championships, which are gaining popularity at a remarkable rate as anyone capable of driving ATV can participate in the race. Therefore, increase in trend of such adventure sports attracts tourists and propels demand for ATV and UTV vehicles, which, in turn, support the off-highway electric vehicle market growth.

Rise in demand for electric machinery in construction sector

The increasing demand for brand spanking new infrastructure is predicted to drive the demand for construction equipment across the world. Rapid infrastructural development and revised government norms associated with construction activities are driving the off-highway electric vehicle market in the developed countries. Thus, rapid urbanization is leading to the increasing demand for houses, thus propelling residential development across the globe. For instance, in August 2020, SANY Group unveiled the electric version of its truck mixers with features such as 350kW permanent magnet synchronous motors, high-energy-density lithium iron phosphate batteries along with modern monitoring functions such as real-time monitoring, performance analysis and remote diagnosis. Thus, rise in demand for off-highway electric mobility in construction sector is anticipated to drive the market growth during the forecast period.

High maintenance cost of off-highway electric vehicles

Off-highway electric vehicles have durable operational capability, owing to its working requirements as it operates on uneven terrains, however, are prone to part breakage, part failure, and overheating. Both used and new vehicle show wear & tear over time, however, aging utility vehicles such as ATVs, UTVs, and snowmobiles have completely different maintenance needs. Maintenance of new vehicles for a year is covered under one-year warranty by manufacturer, however, replacement of broken parts is not covered in this warranty. In addition, the cost of the battery and technology makes off-highway EVs costlier as compared to traditional off-highway vehicles. Hence, consumers find conventional off-highway vehicles superior in performance with same or less price. Majority of off-highway electric vehicles are majorly used in uneven terrain, mountains, and uphill, owing to which parts of these vehicles are prone to damage. Thus, regular maintenance of these vehicles for optimum performance is recommended due to damage caused to off-highway electric vehicles by driving on rough terrain. Further, efficiency of gas-powered off-highway vehicles may be less than off-highway electric vehicles, however, it outperforms electric vehicles, in terms of high range and ease of serviceability, whenever a vehicle requires servicing. Therefore, high maintenance cost of off-highway electric vehicle is anticipated to hinder growth of the off-highway EV market.

Technology development in off-highway electric vehicle

In recent years, all mobility solutions have witnessed drastic changes, in terms of technological evolution. Hence, to cater to changing demands of consumers such as cost-effective and operational proficient transportation along with fuel-efficient mobility requirements, market players are relying on electrical components, owing to their output efficiency and lightweight. For instance, in June 2021, Caterpillar announced the launch of the R1700 XE LHD battery electric vehicle at MINExpo, an international trade show sponsored by the National Mining Association. It could carry 15-tonne payload. Furthermore, it was capable of being fully charged in less than 30 minutes using a single charger or in less than 20 minutes using two chargers. Moreover, emission from vehicles is a crucial factor as harmful greenhouse gases are released, which increase environmental and health concerns. Thus, governments across the globe are implementing vehicle emission norms to control greenhouse emission and maintain environmental balance. Manufacturers need to comply with these regulations to control the emission level. For instance, from April 2020, the Government of India implemented BS6 emission standard to control outflow of air pollutants from vehicles. Thus, all these factors collectively escalate demand for off-highway electric vehicles and is expected to create market opportunity during the forecast period.

Key Benefits For Stakeholders

This study presents analytical depiction of the global off-highway electric vehicle market analysis along with current trends and future estimations to depict imminent investment pockets.

The overall off-highway electric vehicle market opportunity is determined by understanding profitable trends to gain a stronger foothold.

The report presents information related to the key drivers, restraints, and opportunities of the global off-highway electric vehicle market with a detailed impact analysis.

The current off-highway electric vehicle market is quantitatively analyzed from 2022 to 2031 to benchmark the financial competency.

Porter‐™s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Off-Highway Electric Vehicle Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 168.7 billion |

| Growth Rate | CAGR of 26.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 339 |

| By Vehicle Type |

|

| By Energy Storage Capacity |

|

| By Battery Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Clark, Epiroc, CNH Industrial, Caterpillar, Toyota Motor Corporation, AB Volvo, Cargotec corporation, DEERE & COMPANY, Hyundai Doosan Infracore Co. Ltd., JCB, Hitachi Construction Machinery, Anhui Heli Co., Ltd., SANY Group, LIEBHERR-International Deutschland GmbH, Sandvik, Narrow Isle inc., Komatsu Ltd. |

Analyst Review

This section provides the opinions of various top-level CXOs in the global off-highway electric vehicle market. Stringent emission norms for off-highway vehicles have been implemented by various government establishments, such as regulations for Greenhouse Gas (GHG) emissions by the U.S. Environmental Protection Agency (EPA), China VI, and India BS-VI. This has encouraged equipment manufacturers to focus on alternative powertrain sources such as full and hybrid off-highway electric vehicles, thus driving market growth. Moreover, increased awareness of the usage of electric vehicles, lower upgrading cost, and better efficiency, drive the growth of the global off-highway electric vehicle market. For instance, in December 2021, Cargotec Corporation launched three electric powered equipment, the Kalmar Electric Reachstacker, Kalmar Electric Heavy Forklift and the Kalmar Ottawa Electric Terminal Tractor which expanded their range of electric powered vehicles.

Furthermore, market participants such as The Honda Motor Company, Ltd., Hyundai Construction Equipment Co., Ltd., and Kubota Corporation are developing dealer network across the globe for optimum product reach along with operational efficiency. For instance, in December 2021, Hyundai Construction Equipment Co., Ltd. announced its plans to invest $170 million over a period of four years in the Ulsan Factory. This increased the overall production capacity, assembly & logistics costs and maximized the efficiency of the off-highway electric vehicle manufacturing plant.

The market growth is supplemented by factors such as increase in trend of recreational activities and adventure sports, rise in demand for electric machinery in construction sector, and increasing sales of electric vehicles supplement the growth of the off-highway electric vehicle market. However, high maintenance cost of off-highway electric vehicles and ban on ATV and UTV driving in wildlife area are the factors expected to hamper the growth of the off-highway electric vehicle market. In addition, technology development in off-highway electric vehicle and expansion of dealer network for effective product reach creates market opportunities for the key players operating in the off-highway electric vehicle market.

Among the analyzed regions, Asia-Pacific is the highest revenue contributor, followed by North America, Europe, and LAMEA. On the basis of forecast analysis, Europe is expected to lead during the forecast period, owing to the increased infrastructure development activities and rising awareness for environment safety & the developments carried out in the automobile industry.

The global Off-Highway Electric Vehicle market is projected to grow at a compound annual growth rate of 26.7% from 2022-2031.

The global off-highway electric vehicle market was valued at USD 15.7 billion in 2021, and is projected to reach USD 168.7 billion by 2031,

Asia-Pacific is the largest regional market for off-highway electric vehicle

The factors such as increase in trend of recreational activities and adventure sports, rise in demand for electric machinery in construction sector, and increasing sales of electric vehicles supplement the growth of the off-highway electric vehicle market. However, high maintenance cost of off-highway electric vehicles and ban on ATV and UTV driving in wildlife area are the factors expected to hamper the growth of the market.

The leading players operating in the off-highway electric vehicle market are AB Volvo, Anhui Heli Co., Ltd., Cargotec Corporation, Caterpillar, Clark, CNH Industrial N.V., DEERE & COMPANY, Epiroc AB, Hitachi Construction Machinery, Hyundai Construction Equipment Co., Ltd., JCB, Komatsu Ltd., Liebherr-International AG, Narrow Isle inc., Sandvik AB, SANY Group, and Toyota Motor Corporation

Loading Table Of Content...