Off Highway Vehicle Lighting Market Insights, 2034

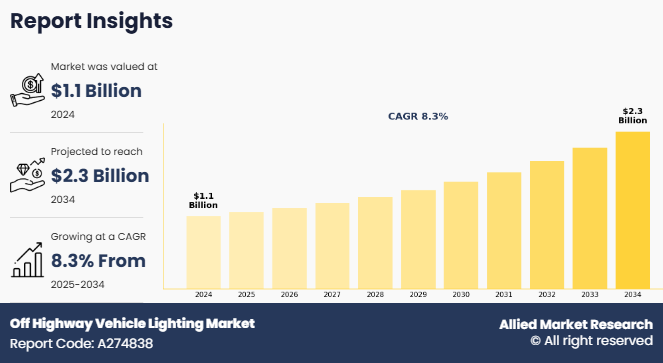

The global off-highway vehicle lighting market size was valued at USD 1.1 billion in 2024, and is projected to reach USD 2.3 billion by 2034, growing at a CAGR of 8.3% from 2025 to 2034.

Off-highway vehicle lighting refers to lighting solutions specifically designed for vehicles used in industries such as construction, mining, agriculture, forestry, and material handling, which operate outside of paved roads. These vehicles include bulldozers, excavators, tractors, and haul trucks, which require robust lighting to ensure safety and operational efficiency in rugged and often hazardous environments. Off-highway vehicle lighting industry includes various types of lighting systems such as headlights, work lights, tail lights, and signal lights, commonly using technologies such as LED for durability, energy efficiency, and long-lasting performance.

Key Takeaways

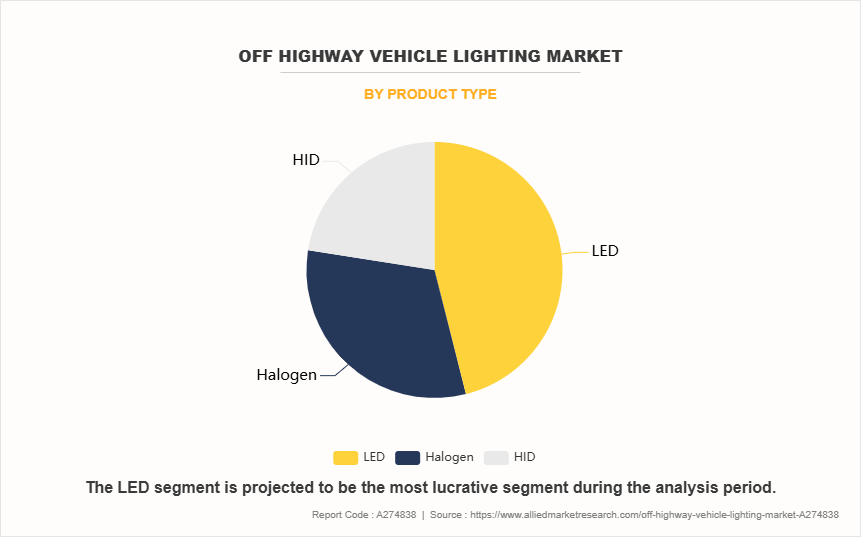

- On the basis of product type, the LED segment held the largest share in the Off-highway vehicle lighting market in 2024.

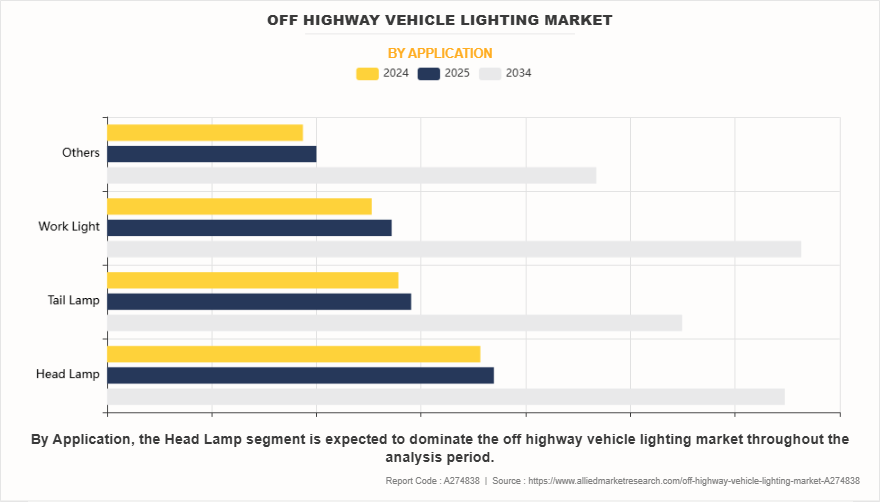

- By application, the head lamp segment was the major shareholder in 2024.

- By service type, the freight forwarding segment dominated the market, in terms of share, in 2024.

- By vehicle type, the tractor segment dominated the market, in terms of share, in 2024.

- By end-user, the construction segment dominated the market, in terms of share, in 2024.

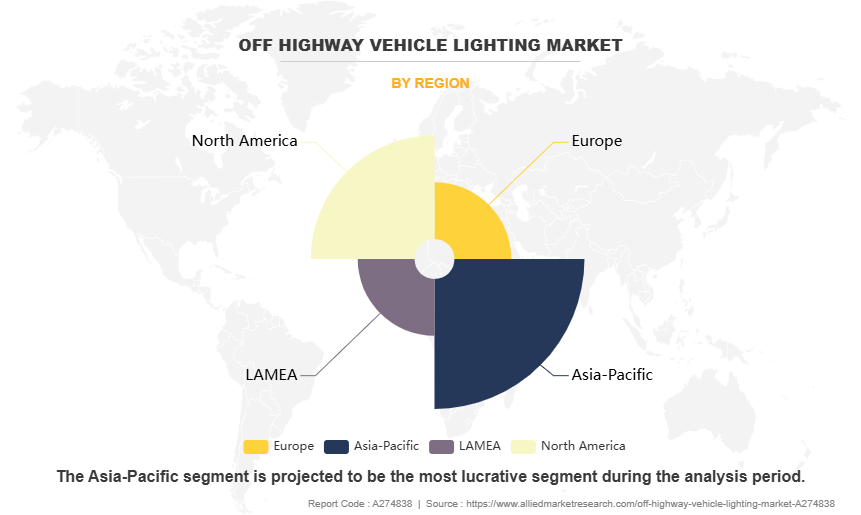

- Region wise, Asia-Pacific region held the largest market share in 2024.

These lighting systems are built to withstand extreme conditions, including dust, moisture, vibrations, and harsh temperatures, ensuring reliable functionality. The primary goal of off-highway vehicle lighting is to improve visibility during night operations, enhance safety by reducing accidents, and increase productivity by extending working hours. The increasing adoption of energy-efficient lighting, particularly LEDs, is a growing trend in the off-highway vehicle lighting industry.

For instance, in February 2025, FORVIA HELLA, a global supplier in the automotive industry, has expanded its SlimLine product range with the addition of a new LED combination lamp. Featuring a rectangular design, this new product enhances the SlimLine series, which now offers seven distinct lighting functions.

Moreover, in May 2022, Continental’s NightViu® premium lighting line, designed for off-highway applications like construction, mining, and agriculture, offers LED lights with up to 5,500 lumens and beam lengths of 440 meters, ensuring enhanced visibility, safety, and durability in harsh environments. Moreover, in October 2024, WESEM launched the CRP3 lamps, designed for durability and long-lasting performance in extreme conditions, making them ideal for forest operations, as well as construction and mining projects.

The increase in demand for safety and visibility in off-highway vehicle operations is driving the growth of the off-highway vehicle lighting market share. As industries like construction, mining, and agriculture expand, reliable lighting systems are essential for night operations and challenging conditions. Advanced solutions, including LED and smart lighting, improve visibility, reduce accidents, and enhance productivity, fueling the adoption of off-highway vehicle lighting solutions in rugged environments. Furthermore, growing adoption of energy-efficient LED lighting solutions, and expansion of infrastructure development and construction activities.have driven the demand for off-highway vehicle lighting.

However, The high initial cost of advanced lighting systems is hampering the growth of the off-highway vehicle lighting market trends. While LED and smart lighting technologies offer long-term benefits like energy efficiency and durability, their upfront investment remains a barrier for many end users. Small and medium-sized operators in sectors like construction and agriculture often find it challenging to allocate budgets for these premium systems, slowing widespread adoption across various applications. Moreover, Compatibility issues with existing vehicle systems are major factors that hamper the growth of the off-highway vehicle lighting market.

On the contrary, the rise in demand for off-highway electric vehicles with integrated lighting systems presents a lucrative opportunity for the off-highway vehicle lighting market. As industries focus on sustainability and energy efficiency, electric off-highway vehicles are gaining popularity. These vehicles require advanced, low-power lighting solutions to optimize battery performance and enhance safety. The shift toward electric machinery in sectors like construction, mining, and agriculture is creating strong growth prospects for innovative lighting technologies.

Segment Review

The global off-highway vehicle lighting market is segmented on the basis of product type, application, vehicle type, end user, and region. On the basis of product type, the market is divided into LED, halogen, and HID. By application, it is classified into head lamp, tail lamp, work light, and others. On the basis of vehicle type, it is categorized into excavator, loader, crane dump truck, tractor, and others. By end user, the market is bifurcated into construction, and agriculture. Region-wise, it is studied across North America, Europe, Asia-Pacific, and LAMEA.

By Product Type

On the basis of product type, the LED segment attained the highest market share in 2024 in the off-highway vehicle lighting market insights. This is driven by the superior benefits of LED technology over traditional lighting solutions. LEDs offer higher energy efficiency, longer operational life, greater durability, and better illumination, making them ideal for demanding off-highway environments such as construction, mining, and agriculture. Their ability to withstand vibrations, extreme temperatures, and harsh weather conditions further supports their adoption. The growing emphasis on improving operator safety and reducing maintenance costs has encouraged industries to invest in LED lighting systems, strengthening their leadership across multiple off-highway vehicle applications.

By Application

On the basis of application, the head lamp segment acquired the highest market share in 2024 in in the off-highway vehicle lighting market growth. This is due to its critical role in ensuring visibility and safety during vehicle operations in low-light and challenging conditions. Headlamps are essential for construction, mining, agriculture, and forestry vehicles that often operate during nighttime or in environments with poor lighting. The shift toward advanced LED headlamps, offering brighter illumination, energy efficiency, and durability, further fuels segment growth. Increasing regulatory focus on workplace safety and the need for better operational efficiency have also driven the demand for high-performance headlamps in off-highway vehicles.

By Region

Region wise, Asia-pacific attained the highest market share in 2024 and emerged as the leading region in the off-highway vehicle lighting market. This is due to Rapid industrialization, expanding construction and mining activities, and growing agricultural mechanization are driving demand for durable and energy-efficient lighting solutions. Countries such as China, India, and Southeast Asian nations are investing heavily in infrastructure development, boosting the need for advanced off-highway vehicles equipped with robust lighting systems to ensure safety and operational efficiency.

However, North America is projected to grow at the fastest rate during the forecast period. This due to Strong demand from industries such as construction, mining, and agriculture, combined with high adoption of advanced technologies such as LED lighting, fueled regional growth. Strict safety regulations, increasing infrastructure projects, and the presence of key market players contributed significantly to North America's dominance in the off-highway vehicle lighting sector.

The report focuses on growth prospects, restraints, and trends of the off-highway vehicle lighting market analysis. The study provides Porter’s five forces analysis to understand the impact of numerous factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the off-highway vehicle lighting market.

Competitive Analysis

The report analyses the profiles of key players operating in the off-highway vehicle lighting market such as Valeo, HELLA GmbH & Co. KGaA, truck-lite co., llc, WESEM, APS Lighting and Safety, Grote Industries, J.W. Speaker Corporation, Peterson Manufacturing Co., hamsar diversco inc., and ECCO Safety Group. These players have adopted various strategies to increase their market penetration and strengthen their position in the Off-highway vehicle lighting market.

Increase in Demand for Safety and Visibility in Off-Highway Vehicle Operations.

The increase in demand for safety and visibility in off-highway vehicle operations is significantly boosting the growth of the off-highway vehicle lighting market size. Industries such as construction, agriculture, mining, and forestry rely heavily on off-highway vehicles that often operate in challenging environments with low visibility. For instance, in March 2023 ZeroNox, a leader in off-highway vehicle electrification, is becoming the first public company of its kind through a merger with The Growth for Good Acquisition Corporation. This move strengthens ZeroNox’s efforts to provide zero-emission solutions for industries like construction, where demand for sustainable and efficient machinery is rising. Their technology supports cleaner, more reliable operations on construction sites, aligning with global goals for reduced emissions and improved environmental performance. Moreover, proper lighting systems are essential to ensure worker safety, prevent accidents, and maintain operational efficiency. As a result, companies are investing in advanced lighting technologies such as high-intensity LEDs, smart lighting controls, and durable fixtures designed to withstand harsh conditions. Furthermore, regulatory bodies worldwide are also introducing stringent safety standards, further encouraging the adoption of superior lighting solutions. The need for enhanced night-time operation, extreme weather resilience, and energy efficiency has made advanced lighting systems a critical component of off-highway vehicles. This growing emphasis on safety, combined with technological advancements, continues to drive steady demand for innovative and reliable lighting products across global off-highway vehicle markets.

Growing Adoption of Energy-efficient LED Lighting Solutions.

The growing adoption of energy-efficient LED lighting solutions is significantly driving the demand for the off-highway vehicle lighting market. LED technology offers several advantages, including lower energy consumption, longer lifespan, and enhanced durability, making it highly suitable for demanding environments such as construction, mining, agriculture, and forestry. Operators are increasingly choosing LED lighting to improve visibility, enhance operational safety, and reduce maintenance costs associated with frequent bulb replacements. For instance, in April 2025, Valeo partnered with Appotronics to develop next-generation front lighting systems, leveraging advanced LED technology. This partnership aims to enhance vehicle safety and visibility by incorporating high-performance LEDs that offer improved brightness, energy efficiency, and adaptability. The new lighting solutions will be crucial for off-highway vehicles, providing superior illumination in challenging environments, thereby boosting operational efficiency and ensuring safety in industries such as construction and agriculture. Moreover, LEDs provide superior brightness and reliability in harsh conditions such as dust, moisture, and extreme temperatures, ensuring uninterrupted performance. As industries continue to prioritize sustainability and cost-efficiency, the shift toward LED solutions is becoming more prominent. Governments and regulatory bodies promoting energy-saving technologies further support this transition. In addition, advancements in LED technology, such as smart control systems and adaptive lighting, are expanding their application scope, fueling further growth in the off-highway vehicle lighting market and meeting the evolving needs of modern operations.

High Initial Cost of Advanced Lighting Systems.

The high initial cost of advanced lighting systems is a significant challenge for the off-highway vehicle lighting market demand. Many off-highway vehicles, particularly in industries like construction, mining, and agriculture, require robust, high-performance lighting solutions to ensure safety and visibility in harsh environments. However, the upfront cost of advanced systems, such as LED lights, thermal management technologies, and smart lighting solutions, can be prohibitively expensive for businesses, especially in price-sensitive regions. While these systems offer long-term energy efficiency and durability, the initial investment is often a deterrent for companies, particularly small and medium-sized enterprises. In addition, the integration of these technologies into existing fleet vehicles requires additional expenses, which can impact the overall cost-benefit equation for operators. As a result, the adoption of advanced off-highway vehicle lighting systems may be delayed or limited, slowing the overall market growth despite the increasing demand for improved safety and operational efficiency.

Expansion of Mining and Construction Projects in Developing Regions

The expansion of mining and construction projects in developing regions presents a lucrative opportunity for the off-highway vehicle lighting market forecast. Rapid urbanization, infrastructure development, and industrial growth in countries across Asia-Pacific, Africa, and Latin America are driving demand for heavy-duty machinery and vehicles used in these sectors. For instance, in January 2022, UK Automotive Products has partnered with J.W. Speaker to deliver advanced LED lighting solutions tailored for commercial vehicles, aiming to enhance visibility, durability, and safety in off-highway environments such as construction and agriculture. Moreover, these vehicles operate in low-visibility environments and extended hours, requiring advanced lighting systems to ensure operational safety and efficiency. LED lighting solutions, known for their durability, low energy consumption, and superior brightness, are increasingly being adopted to meet these needs. Government investments in large-scale projects such as roads, bridges, and mining operations further accelerate the demand for off-highway vehicles with reliable lighting systems. Moreover, harsh environmental conditions in these regions demand lighting products that can withstand vibration, dust, and moisture. As a result, lighting manufacturers focusing on robust and energy-efficient products are well-positioned to capitalize on the growing needs of emerging economies' industrial sectors.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Off-highway vehicle lighting market analysis from 2023 to 2032 to identify the prevailing Off-highway vehicle lighting market forecast.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Off-highway vehicle lighting market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global Off-highway vehicle lighting market trends, key players, market segments, application areas, and market growth strategies.

Off Highway Vehicle Lighting Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 2.3 billion |

| Growth Rate | CAGR of 8.3% |

| Forecast period | 2024 - 2034 |

| Report Pages | 405 |

| By Product Type |

|

| By Application |

|

| By Vehicle Type |

|

| By End-User |

|

| By Region |

|

| Key Market Players | Valeo, ECCO Safety Group, HELLA GmbH & Co. KGaA, WESEM, Hamsar Diversco Inc., Peterson Manufacturing Co., Grote Industries, J.W. Speaker Corporation, APS Lighting and Safety, Truck-Lite Co., LLC |

LED technology adoption are the upcoming trends of Off Highway Vehicle Lighting Market in the globe

Head Lamp is the leading application of Off Highway Vehicle Lighting Market

Asia-Pacific is the largest regional market for Off Highway Vehicle Lighting

$1075.2 million is the estimated industry size of Off Highway Vehicle Lighting

Valeo, HELLA GmbH & Co. KGaA, truck-lite co., llc, WESEM, APS Lighting and Safety, Grote Industries, J.W. Speaker Corporation, Peterson Manufacturing Co., hamsar diversco inc., and ECCO Safety Group.

Loading Table Of Content...

Loading Research Methodology...