Oil And Gas Data Management Market Overview

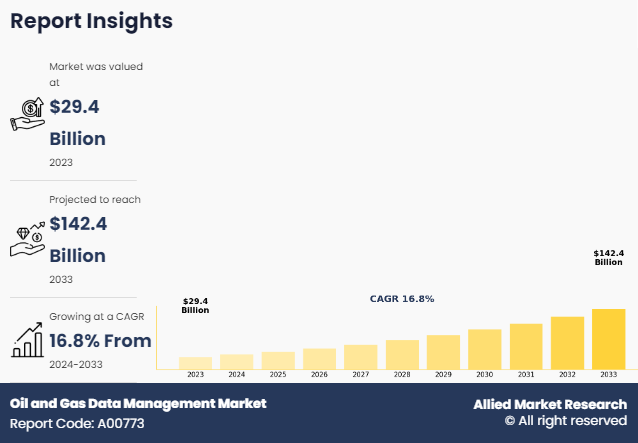

The global oil and gas data management market size was valued at USD 29.4 billion in 2023, and is projected to reach USD 142.4 billion by 2033, growing at a CAGR of 16.8% from 2024 to 2033.

Key Market Insights

- By deployment mode, the cloud segment accounted for the largest oil and gas data management market share in 2023.

- By technology, the SMEs segment is expected to witness the highest growth during the forecast period.

- By region, Asia-Pacific is expected to exhibit the highest growth during the forecast period.

Market Size & Forecast

- 2033 Projected Market Size: USD 142.4 Billion

- 2023 Market Size: USD 29.4 Billion

- Compound Annual Growth Rate (CAGR) (2024-2033): 16.8%

The oil and gas data management market refers to the collection, storage, processing, and analysis of data generated throughout the lifecycle of oil and gas exploration, production, and distribution. The market includes a wide range of data types, including geological, geophysical, petrophysical, production, operational, and environmental data.

These data are critical for making informed decisions, optimizing operations, enhancing productivity, and ensuring regulatory compliance within the oil and gas data management industry. Oil and gas companies generate vast amounts of data at various stages, such as seismic surveys, drilling operations, reservoir characterization, production monitoring, and asset management.

Effective data management involves the use of advanced technologies and software solutions to handle this data efficiently. These technologies include data warehousing, data integration, data quality management, data governance, and data analytics platforms. The technologies transform raw data into valuable insights that can drive operational excellence and strategic decision-making. The oil and gas data management market growth serves a diverse range of stakeholders, including exploration and production companies, oilfield service providers, drilling contractors, and regulatory bodies. Increasing complexity of exploration and production activities, the need for real-time data access and analysis, and the growing emphasis on digital transformation within the industry. In addition, the adoption of advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML) is enhancing the capabilities of data management solutions.

One of the key challenges in the market is the integration of data from disparate sources and systems, which can be a complex and resource-intensive task. Ensuring data accuracy, consistency, and security is also critical, as any compromise in data integrity can have significant operational and financial implications. Moreover, the oil and gas data management industry operates in a highly regulated environment, requiring stringent adherence to data privacy and compliance standards.

Overall, the oil and gas data management market is a vital component of the broader digital transformation landscape within the oil and gas industry. It enables companies to leverage data as a strategic asset, driving efficiency, innovation, and competitiveness. As the industry continues to evolve and embrace digital technologies, the demand for robust and scalable data management solutions is expected to grow, offering significant opportunities for technology providers and service vendors.

The report focuses on growth prospects, restraints, and trends of the oil and gas data management market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the oil and gas data management market.

Segment Review

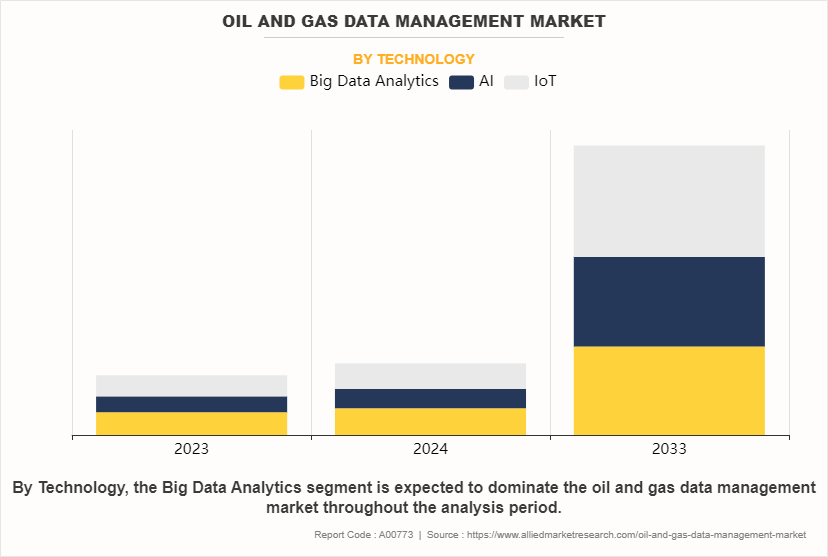

The oil and gas data management market size is segmented into technology, deployment mode, application, and region. By technology, it is divided into big data analytics, AI, and IoT. On the basis of deployment mode, the market is bifurcated into on-premise and cloud. By application, the market is divided into upstream, midstream, and downstream. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Depending on technology, the big data analytics segment dominated the oil and gas data management market share in 2023 and is expected to maintain its dominance in the upcoming years, it continued to dominate due to its ability to handle vast amounts of data, providing valuable insights that help in decision-making, optimizing operations, and increasing efficiency. However, the SMEs segment is expected to witness the highest growth, owing to the benefit that AI can enhance safety by monitoring operations in real-time and predicting potential hazards.

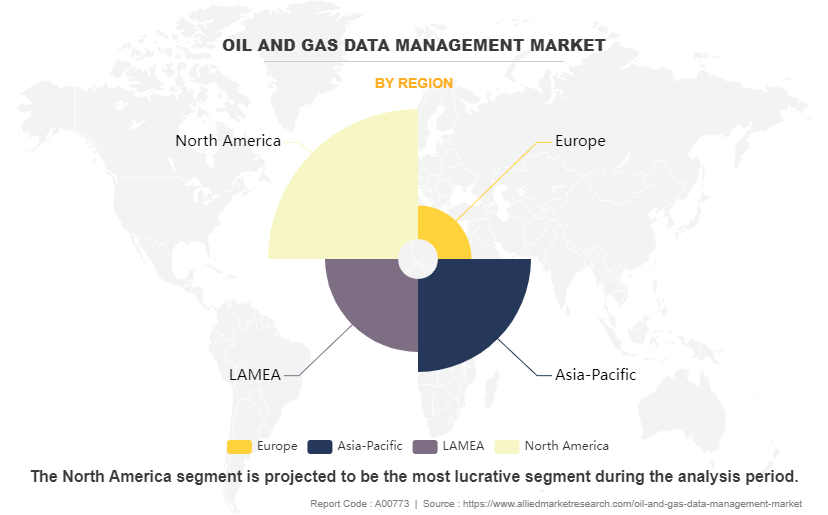

By region, North America dominated the market share in 2023 for the oil and gas data management market. The region has increased adoption of advanced technologies, innovations, and infrastructure, which is further anticipated to propel the growth of the oil and gas data management market. However, Asia-Pacific is expected to exhibit the highest growth during the forecast period. The region is experiencing a rise in demand for digitalization and high internet penetration, which is expected to provide lucrative growth opportunities for the market in this region.

What are the Top Impacting Factors in Market

Increase in Complexity of Exploration and Production Activities

The increasing complexity of exploration and production (E&P) activities is a significant driver for the oil and gas data management market. This complexity arises from various factors, including the need to explore and produce hydrocarbons in increasingly challenging environments, such as deepwater offshore, unconventional shale formations, and remote locations with harsh conditions. Such an environment requires advanced technologies and methodologies, generating vast and diverse data that must be managed effectively.

In modern E&P operations, data is collected from numerous sources such as seismic surveys, drilling operations, well logging, production monitoring, and reservoir simulations. The volume, variety, and velocity of data have grown exponentially, necessitating robust data management solutions to handle the sheer scale and complexity. Effective data management enables companies to integrate and analyze this data to make informed decisions, optimize operations, and reduce risks.

Advanced exploration techniques, such as 3D and 4D seismic imaging, produce high-resolution datasets that require sophisticated processing and interpretation. Similarly, complex drilling operations, including horizontal and directional drilling, generate extensive real-time data that must be monitored and analyzed to ensure safety and efficiency. Managing these data streams requires state-of-the-art data management systems capable of real-time data integration, storage, and analytics. Moreover, the drive to maximize hydrocarbon recovery from mature fields has led to the adoption e nhanced oil recovery (EOR) techniques, which generate additional data that needs to be managed and analyzed. Reservoir management strategies increasingly rely on dynamic models that integrate geological, geophysical, and production data to optimize field development plans and improve recovery rates.

Integration of Legacy Systems

Integration of legacy systems is a significant restraint in the oil and gas data management market, presenting multiple challenges that hinder the seamless adoption of advanced data management solutions. Many oil and gas companies have been operating for decades and rely on outdated systems and technologies that were not designed to be interoperable with modern data management tools. Legacy systems often use proprietary data formats and lack standardization, making data integration complex and time-consuming. These systems were typically developed in an era when data interoperability and seamless integration were not prioritized, leading to siloed data environments. As a result, integrating legacy systems with contemporary data management platforms requires substantial effort, including custom software development, data conversion, and extensive testing to ensure compatibility and data integrity.

The financial cost of integrating legacy systems is another major barrier. Upgrading or replacing outdated systems can be prohibitively expensive, involving significant investments in new hardware, software, and skilled personnel. In addition, the integration process can disrupt ongoing operations, leading to potential downtime and productivity losses. For many companies, the cost and risk associated with integrating legacy systems outweigh the perceived benefits of adopting new data management solutions. Technical expertise is also a critical factor. The integration of legacy systems often demands specialized knowledge of both the old and new technologies. Finding and retaining personnel with the necessary skills to manage such complex integrations can be challenging. Many legacy systems were built using technologies that are now obsolete, and the expertise required to understand and work with these systems is increasingly scarce.

Regulatory Compliance and Environmental Sustainability

Regulatory compliance and environmental sustainability present significant opportunities for the oil and gas data management market. As the industry faces increasing scrutiny from governments, regulatory bodies, and the public, companies must adopt robust data management solutions to ensure compliance with stringent regulations and to enhance their sustainability efforts. Effective data management systems enable oil and gas companies to collect, store, and analyze vast amounts of operational and environmental data. This capability is crucial for demonstrating compliance with regulatory requirements, which often mandate detailed reporting on emissions, waste management, water usage, and other environmental impacts.

By leveraging advanced data analytics, companies can generate accurate and timely reports that meet regulatory standards, thereby avoiding penalties and maintaining their license to operate. Environmental sustainability is also becoming a strategic priority for many oil and gas companies. Effective data management allows these companies to monitor and reduce their environmental footprint. For example, real-time data on emissions can help operators identify and mitigate sources of pollution more effectively, contributing to cleaner and safer operations. Additionally, data-driven insights can support the optimization of resource use, reducing waste and improving overall operational efficiency.

The integration of emerging technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) into data management systems further enhances these capabilities. AI and ML can predict and identify potential compliance issues before they become critical, allowing for proactive management. IoT sensors can provide continuous environmental monitoring, ensuring that companies adhere to regulatory limits and improve their sustainability performance.

Moreover, robust data management solutions can support corporate sustainability initiatives by providing the data needed for transparent reporting to stakeholders, including investors, customers, and communities. As environmental, social, and governance (ESG) criteria become more important in investment decisions, companies with strong data management capabilities are better positioned to attract investment and build trust with stakeholders. In conclusion, regulatory compliance and environmental sustainability represent substantial opportunities for the oil and gas data management market. By adopting advanced data management solutions, companies can ensure compliance with regulations, reduce their environmental impact, and enhance their reputation and competitiveness in a market increasingly focused on sustainability.

Which are the Key Companies in Oil and Gas Data Management

The following are the leading companies in the oil and gas data management market. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help to drive the growth of the oil and gas data management market globally.

IBM Corporation

Baker Hughes Company

Oracle Corporation

Teradata

Emerson Electric Co.

Honeywell International Inc.

TATA Consultancy Services Limited

SAP SE

Schlumberger Limited

AVEVA Group Limited

Quorum Business Solutions, Inc.

Halliburton Energy Services, Inc.

Viridien.

Recent Partnerships in the Oil and Gas Data Management Market:

For instance, in October 2021, Patterson-UTI Energy, Inc. (PTEN), a provider of oil drilling and completion services, partnered with Corva, a software developer for oil and gas companies, for data analytics and visualization collaboration to equip oil and gas producers with the digital tools to drill and complete more productive and profitable wells while hitting lower emissions targets.

Recent Product Launches in the Oil and Gas Data Management Market:

For instance, in June 2021, Schlumberger and IBM launched the industry’s first commercial hybrid cloud Enterprise Data Management Solution for the OSDU Data Platform. The hybrid cloud offering is designed to expand access to customers globally including those in locations where data residency requirements and local regulations may affect the use of global public cloud and is engineered to reduce time for analysis and accelerate decision-making, with all workflow data available in one place.

Key benefits for stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the oil and gas data management market forecast from 2024 to 2033 to identify the prevailing market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities of oil and gas data management market outlook.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the oil and gas data management market segmentation assists in determining the prevailing Oil and gas data management market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global oil and gas data management market trends, key players, market segments, application areas, and market growth strategies.

Oil and Gas Data Management Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 142.4 billion |

| Growth Rate | CAGR of 16.8% |

| Forecast period | 2023 - 2033 |

| Report Pages | 294 |

| By Technology |

|

| By Deployment Model |

|

| By Application |

|

| By Region |

|

| Key Market Players | Viridien S.A., AVEVA?Group Limited, Emerson Electric Co., Oracle Corporation, Teradata, TATA Consultancy Services Limited, Baker Hughes Company, SAP SE, IBM Corporation, Quorum Business Solutions, Inc., Honeywell International Inc., Halliburton Energy Services, Inc., Schlumberger Limited |

| | CliQr Technologies, Inc., SimpliVity, Teradata, OpenDNS, Bapco (Bahrain Petroleum Company), Noah Consulting, LLC, Schlumberger, Reltio |

Analyst Review

The global oil and gas data management market is projected to witness healthy growth in the near future, especially in the Asia-Pacific and LAMEA regions. This is attributed to growth in need for operations & performance improvement, increase in popularity of real-time analysis & predictive analytics solutions, and increased awareness among end users regarding benefits of data management solutions and services. The market is projected to grow at a significant CAGR of around 16%, owing to surge in digitization and growing trend of data-driven decision making among end user companies.

Advanced analytics solutions are anticipated to play a crucial role in improving the efficiency of conventional, unconventional, and midstream operations. Furthermore, the adoption of data analytics solutions is projected to assist oil and gas companies to improve their productivity by 6-8%.

Generally, oil and companies adopt operational models with functional excellence, which are successful in predictable processes. However, these models are not successful and efficient in real-time environment such as during unconventional production. Thus, oil and gas companies are expected to adopt an asset-based organizational model to enable a clear and integrated view of various operations.

Prominent players in the oil and gas data management market are projected to introduce enhanced cloud-based data management solutions and services to enable oil and gas companies to reduce non-productive time, operational costs, and mitigate uncertainty & risks. Furthermore, business expansion in the emerging and untapped markets is projected to increase the revenue potential of data management infrastructure, solutions, and services providers, owing to low penetration of data management hardware and software.

Prominent players-offering oil and gas data management technologies and services-are projected to focus on acquisition or strategic alliance with startups and well-established local players to expand their market presence and sustain the market competition.

The shift towards cloud-based data management solutions continues to gain momentum in the oil and gas industry.

Upstream is the leading application of Oil and Gas Data Management Market.

North America is the largest regional market for Oil and Gas Data Management.

$142.3 billion is the estimated industry size of Oil and Gas Data Management.

IBM Corporation, Baker Hughes Company, Oracle Corporation, Teradata, Emerson Electric Co., Honeywell International Inc., TATA Consultancy Services Limited, SAP SE, Schlumberger Limited, AVEVA?Group Limited, Quorum Business Solutions, Inc., Halliburton Energy Services, Inc. and Viridien.are the top companies to hold the market share in Oil and Gas Data Management.

Loading Table Of Content...

Loading Research Methodology...