One Wheel Electric Scooter Market Insights, 2031

The global one wheel electric scooter market was valued at USD 130.2 million in 2019, and is projected to reach USD 355.5 million by 2031, growing at a CAGR of 8.3% from 2022 to 2031.

One wheel electric scooter is a personal commuter transportation system driven by one wheel, which mainly gets power through electrical energy. This personal transportation system is mainly used by millennial and generation Z across the globe. Such transportation system is gaining traction in urban areas owing to changing outlook of the urban transportation.

One wheel electric scooter comprises of electric motor to drive the wheel and get the required torque for motion. These one wheel electric scooters are self-balancing system, which mainly operate through software. As one wheel electric are more prone to footpath and individual accidents, the use of these vehicles are regulated or banned in some countries.

There are prominent key factors that drive the growth of the one wheel electric scooter market, such as increasing green mobility, high portability as compared to other personal electric vehicles, rising urbanization and local commute requirements, decline in price of batteries per KWH, and changing outlook of leisure & recreational activities. Furthermore, the one wheel electric scooter market is affected by factors such as low safety as compared to other commuting options, uncomfortable riding experience due to design structure, and new regulations & rules, strong dealership and supplier network, continuous product development gains competitive advantage, and growing R&D investments for enhanced battery technologies However, each of these factors is anticipated to have a definite impact on the growth of the global market during the forecast period.

Asia-Pacific is one of the fastest growing region in one wheel electric scooter market. With the increased production, electric mobility, especially in China and Japan, is witnessing foremost position in the world. The vehicle electrification is the emerging trend in the region and manufacturers based in this region are focused toward developing the electrical driven technology to cater the changing demand for electric mobility. Asia-Pacific is holding a significant share in the global market owing to high presence of end consumer in the region. With increase in electrification of vehicles, micromobility has become an efficient and reliable means of transportation within cities in the Asia-Pacific region. This gives significant growth opportunities for the growth of the one wheel E-scooter market.

China is one of the leading players in the Asia-Pacific region and the country has majority of the one wheel electric scooter market players situated around the nation as it comprises manufacturing facilities and exports mainly to North America and Europe. China is the production hub for one wheel electric scooter as big market players have manufacturing facilities across nation. The growing environmental awareness of customers is driving the sales of one wheel electric scooters in China. The population in China has become concerned about the increasing pollution in the country and are choosing eco-friendly electric scooters over traditional vehicles, which is expected to drive the growth of the market.

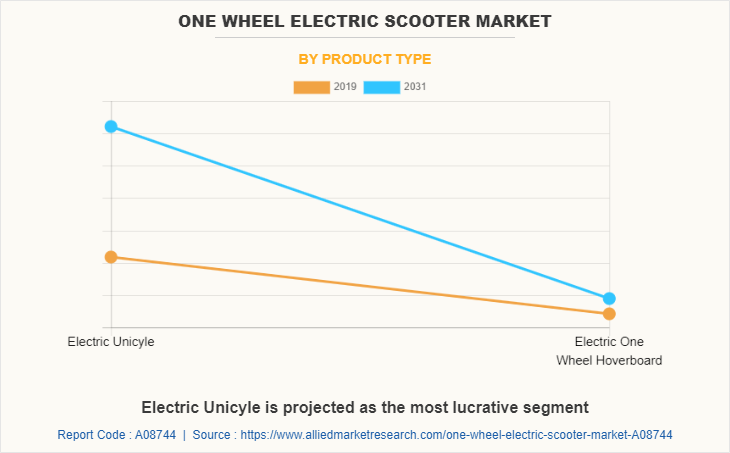

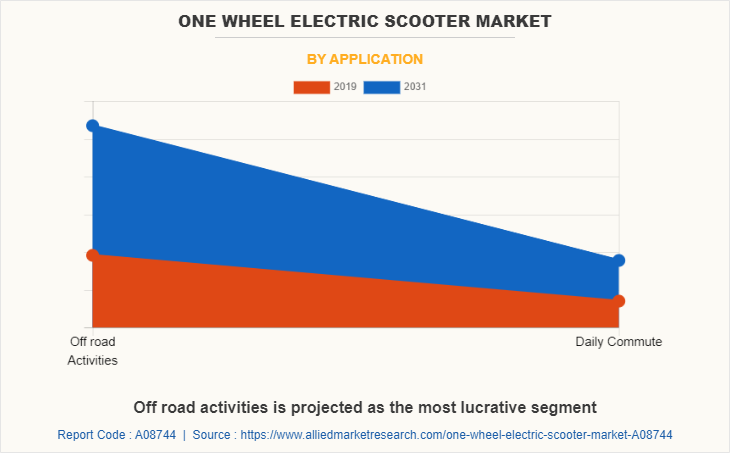

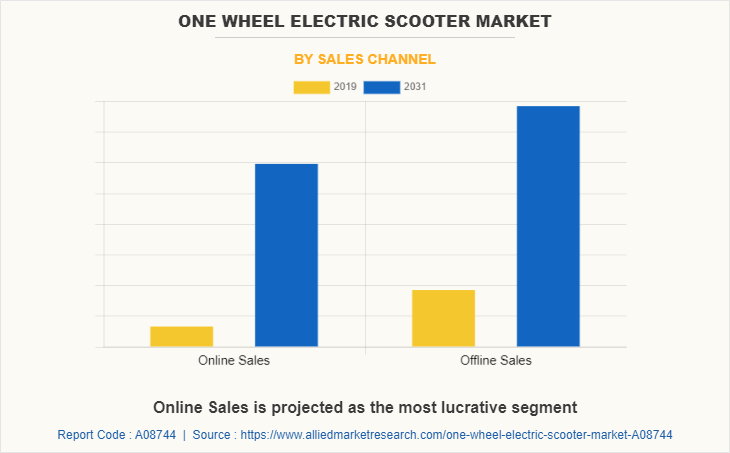

The one wheel electric scooter market is segmented on the basis of product type, application, sales channel, and region. By product type, the global market is categorized into electric unicycle, and electric one wheel hoverboard. By application, the market is categorized into off-road activities and daily commute. By sales channel, the global market is categorized into online sales and offline sales. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

To fulfil the changing demand scenarios, one wheel electric scooter market participants are concentrating product launch and product development efforts to expand their product portfolio and meet new business opportunities. For instance, in August 2022, INMOTION launched a new line of high-powered mobility solutions, including the world's fastest and most powerful electric unicycle Challenger, and the best waterproof dual-motor electric scooter Climber, exploring the limits of personal transportation. Moreover, in July 2020, King Song Intell Co., Ltd. launched the KS-S18 suspension electric unicycle.

Key players profiled in the one wheel electric scooter market report include, Airwheel Holding Limited, Changzhou Smilo Motors Co., Ltd., Dongguan Begode Intelligent Technology Co., Ltd., Future Motion Inc., Inmotion Technologies Co., Ltd., Inventist, Inc., IPS Electric Unicycle, King Song Intell Co., Ltd., Ninebot Asia Pte Ltd., Segway Inc., SuperRide, and Swagtron.

Driver: Increase in green mobility

Mobility outlook across the globe is witnessing significant change from the past decade as traditional mobility medium is replaced with electrically driven solution equipped with advanced technologies. The electric driven mobility enables majorly three benefits that include, economic benefit, environmental benefit, and technology benefit, to attain the optimum solution of the electric mobility. One wheel electric scooter is a trending personal commute solution, mainly driven by electric motor, which ensures zero carbon footprints and cost-effective solution in the urban areas. Increasing environmental concern and growing inclination toward e-mobility are estimated to support the growth of one wheel electric scooter market in the upcoming years. The one wheel electric scooter is electric and uses rechargeable batteries, due to which it has little impact on the environment.

Due to the relatively low number of parts and mass production of electric scooter, the manufacturing process requires minimal energy. Owing to increase in awareness towards fuel efficient vehicles, large number of consumers have started adopting electric vehicles such as one wheel electric scooters for their daily commute. It releases zero CO2 emissions during use as it does not burn fuel during use. Adoption of eco-friendly transport such as one wheel electric scooter reduces the number of vehicles on roads and polluting emissions. In addition, moving from fossil fuel-based vehicles to sustainable modes of transport reduces the dependence on non-renewable energy sources. Therefore, use of one wheel electric scooter as an environment-friendly means of transport to reduce the need for fuel and gasoline to achieve green mobility is expected to drive the growth of the one wheel electric scooter market.

Driver: Rising urbanization and local commute requirements

In recent years, urbanization has been at its peak as majority of the population is shifting to urban areas owing to increasing work opportunities and rapid industrialization in urban areas. In this era of urbanization, daily commute between the workplace and residence is the need for the every individual passenger, which is associated with travel time. Moreover, urban passengers are more inclined toward the technologically advanced commute solution along with its time-effective commute option to avoid unnecessary long traffic jams along with green mobility. Owing to these above factors, urban passengers are more dependable on the technologically advanced commute solutions for daily commute. The one wheel electric vehicle is one of the leading solution with high-end technology along with its compact design. The one wheel electric scooter is one of the efficient and time effective commute system for these changing rider requirements. Hands-free, one wheel electric scooters make the daily commute easier for short trips.

One wheel electric scooters are becoming legitimate forms of urban transportation as they are a zero-emission portable transportation option that do not require gas or parking. One wheel electric scooters have become the suitable solution to last-mile transportation problems. Owing to the increasing use of one wheel electric scooters for daily commuting in urban areas and changing passenger perceptions of passengers, the demand for one wheel electric scooters is expected to grow in the coming years.

Restraint: Low safety as compared to other commuting options

In the recent years, personal commute solution has gained traction owing to growing urbanization and changing ridership outlook of the urban commuter. Urban commuters are demanding for compatible and cost-effective transport solution along with time-effective operations. One wheel electric scooter is one of the leading urban commute solutions catering to changing requirement of the urban commuter. However, one wheel electric scooter needs well trained operators for efficient operation. Owing to its design and requirement of skilled operators, there are high chances of accidents and low operators safety. Moreover, this device has low operational safety as compared to other personal commute solutions.

Low safety associated with one wheel electric scooter is estimated to hamper the growth in the upcoming years. The one wheel electric scooter cannot be driven on the grass, gravel, wet and slippery roads or other unsuitable road conditions. Scooters are likely to cause personal injury, death and/or property damage due to falls, uncontrolled spins, collisions, and more. Braking on a one wheel electric scooter is more complicated and requires more attention and effort. Moreover, one wheel electric scooters are less visible than other modes of transportation, making them less visible to riders. One wheel electric scooters are unstable and prone to tipping over as compared to other modes of transportation, which is expected to hinder the growth of the one wheel electric scooter market.

Opportunity: Strong dealership and supplier network

In the global one wheel electric scooter market, majority of the market participants’ marketing relies on distributors or dealer networks to trade their products and to be the experts and local face for their brand. Dealers and distributors provide personal relationship with end consumer that builds loyal customers and ultimately, increases sales. Selling one wheel electric scooter directly to end users may seem like an efficient way of generating revenue along with eliminating the administrative and operations expenses. Moreover, majority of the manufacturers are situated in China and the big markets for these are North America and Europe.

The direct entry into these markets along with additional office and manufacturing unit incurs additional capital expenditure and add on working capital requirement. Developing distributors network primarily minimize the operating as well as capital expenditure along with ready-made client base of the distributors to expand its product reach. Market participants such as F-wheel, Ninebot, and others, are developing dealer’s network across the global one wheel electric scooter market to optimum product reach along with operational efficiency. To get high revenue opportunities along with optimum capital expenditure, market participants need to develop a strong distributor’s network

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the one wheel electric scooter market analysis from 2019 to 2031 to identify the prevailing one wheel electric scooter market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the one wheel electric scooter market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global one wheel electric scooter market trends, key players, market segments, application areas, and market growth strategies.

One Wheel Electric Scooter Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 355.5 million |

| Growth Rate | CAGR of 8.3% |

| Forecast period | 2019 - 2031 |

| Report Pages | 202 |

| By Product Type |

|

| By Application |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Dongguan Begode Intelligent Technology Co., Ltd., Segway Inc., SWAGTRON, CHANGZHOU SMILO MOTORS CO.,LTD, SuperRide, IPS Electric Unicycle, Inventist, Inc., Airwheel Holding Limited, King Song Intell Co., LTD., Ninebot Asia Pte Ltd., INMOTION Technologies Co., Ltd., FUTURE MOTION INC. |

Analyst Review

The one wheel electric scooter is the new urban personal transportation solution, which supports the changing urban transportation outlook where majority of end users are inclined toward green mobility. Majority of the one wheel electric scooter manufacturers are located in China and these market players are delivering the one wheel electric scooter through distributors and dealers. Online sales is the new way of product distribution adopted by majority of the market participants by developing own or third party E-commerce platforms.

One wheel electric vehicle is a new generation personal commute solution and is gaining momentum in the various nations across the globe. The increasing penetration of the electric mobility and increasing demand for personal commute solution are expected to gain traction in the upcoming decade. One wheel electric scooters have been gaining popularity from the last decade and continue in the present era of green mobility. The manufacturers of one wheel electric scooters are involved in R&D activities to cater to the changing requirements of the end use customers. Manufacturers need to invest more in R&D activities to develop fully integrated and high-end technologically supported devices. The advanced feature of one wheel electric scooter, such as Bluetooth customization that helps users access and play their music has gained significant popularity. With built-in Bluetooth and the ability to lock and turn on the device with a mobile app, the user has full control over the device. The Suspension Electric Unicycle (sEUC) is one of the latest innovations in one wheel electric scooters. Suspension gives the rider better control and traction when riding the bike over rough and unpredictable terrain, such as potholes and technical off-road obstacles, tree roots, and other uneven surfaces. Suspended unicycles also improve rider comfort because they do not feel any bumps in the road. Therefore, continuous product development and catering to the changing requirement of the end users are creating competitive advantages in the market.

The major players operated in the one wheel electric vehicle market include, Airwheel Holding Limited, Changzhou Smilo Motors Co., Ltd., Dongguan Begode Intelligent Technology Co., Ltd., Future Motion Inc., Inmotion Technologies Co., Ltd., Inventist, Inc., IPS Electric Unicycle, King Song Intell Co., Ltd., Ninebot Asia Pte Ltd., Segway Inc., SuperRide, and Swagtron

The global one wheel electric scooter market was valued at $130.2 million in 2019, and is projected to reach $355.5 million by 2031, registering a CAGR of 8.3% during the forecast period.

Key players profiled in the one wheel electric scooter market report include, Airwheel Holding Limited, Changzhou Smilo Motors Co., Ltd., Dongguan Begode Intelligent Technology Co., Ltd., Future Motion Inc., Inmotion Technologies Co., Ltd., Inventist, Inc., IPS Electric Unicycle, King Song Intell Co., Ltd., Ninebot Asia Pte Ltd., Segway Inc., SuperRide, and Swagtron.

In 2021, North America is the largest regional market for one wheel electric scooter

By Sales Channel, Online Sales segment is expacted to gain traction over the forecast period in the global one wheel electric scooter market

Development of highly portable and low weight one wheel electric scooter is the key upcoming trend in the global market

Loading Table Of Content...