Online Payday Loans Market Research, 2032

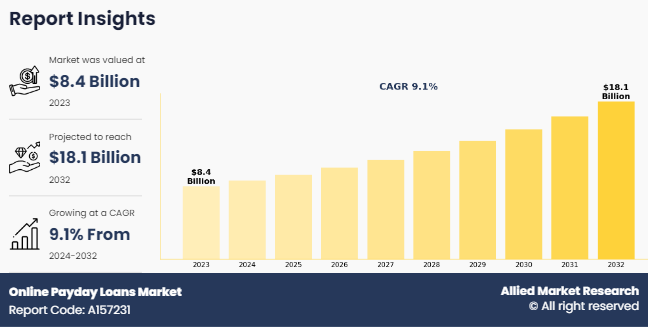

The global online payday loans market was valued at $8,387.53 million in 2023 and is estimated to reach $18,094.01 million by 2032, growing at a CAGR of 9.1% from 2024 to 2032.

The online payday loans market refers to the virtual platform or digital space where online payday loan services are provided and accessed over the Internet. Online payday loans are short-term, unsecured loans typically designed to provide immediate financial assistance to individuals who require quick cash to cover unexpected expenses or bridge gaps between pay checks. In the online payday loans market, borrowers can submit loan applications electronically through websites or mobile applications. The loan process is typically streamlined and expedited, allowing borrowers to receive quick decisions and access to funds, often within a matter of hours or even minutes. The convenience and accessibility of online payday loans have made them increasingly popular among individuals facing urgent financial needs.

Key Takeaways

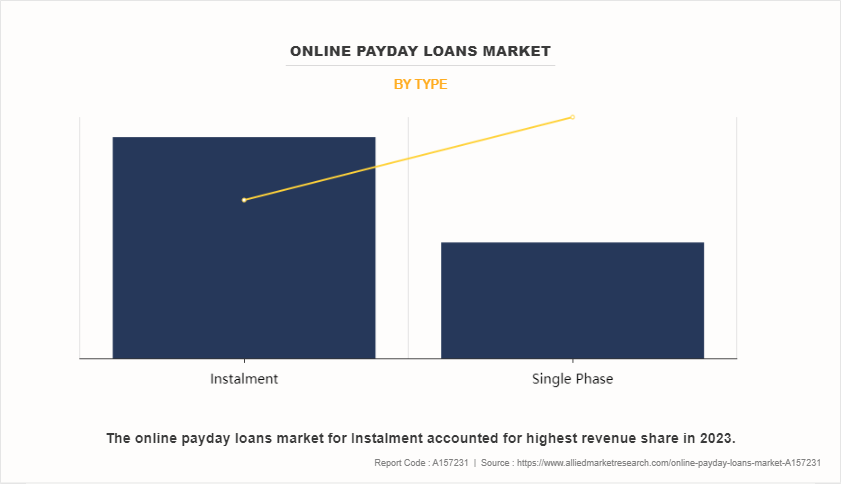

Depending on type, the single phase accounted for the largest Global online payday loans market share in 2023.

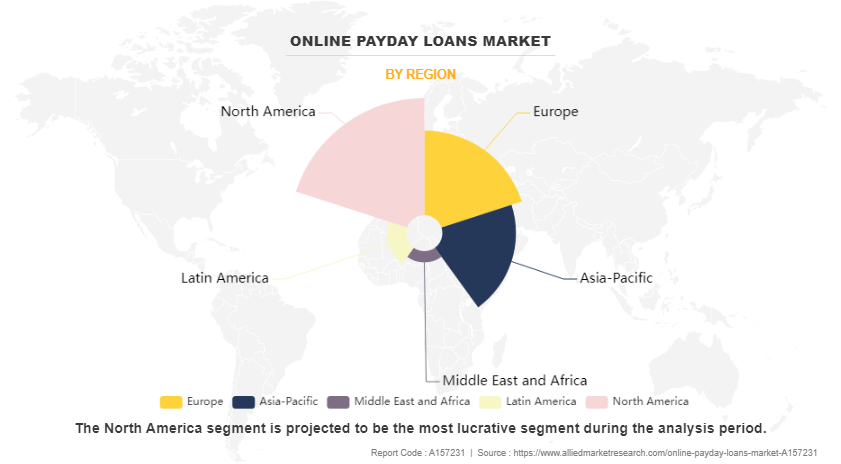

Region-wise, North America accounted the highest revenue in 2023.

Depending on marital status, the single segment generated the highest revenue in 2023.

Growing awareness about online payday loans among the youth population and fast loan approval with no restriction on usage boost the growth of the global online payday loans market. In addition, the presence of many payday lenders positively impacts the growth of the online payday loans market. However, factors such as high-interest rates and the negative impact of online payday loans on credit scores are expected to hamper the online payday loans market growth. On the contrary, the rise in the adoption of advanced technology among payday lenders is expected to offer remunerative opportunities for the expansion of the payday loans market during the forecast period.

The report focuses on growth prospects, restraints, and trends of the global online payday loans market analysis. The study provides Porter‐™s five forces analysis to understand the impact of various factors, such as the bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the global online payday loans market trends.

Segment Review

The online payday loans market is segmented by type, marital status, customer age outlook, and region. In terms of type, the market is fragmented into installments and single phases. Depending on marital status, it is bifurcated into married, and single. By customer age outlook it is divided into less than 21, 21-30, 31-40, 41-50, and more than 50. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By type, the online payday loans market was led by the single phase segment in 2022 and is projected to maintain its dominance during the forecast period, owing to increasing demand for policies that offer the potential for higher returns than traditional online payday loans. However, the installment segment is expected to grow at the highest rate during the forecast period, owing to technological advancement and a rise in awareness among the people is projected to attract many new consumers, which boost the global online payday loans market.

Region-wise, the online payday loans market size was dominated by North America in 2022 and is expected to retain its position during the forecast period. This is attributed to several factors such as the penetration of new online payday loans among the youth and improvement in the economy. In addition, the presence of many clouds' online payday loan vendors in the U.S. and Canada is expected to provide lucrative opportunities for the online payday loans market. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to the presence of the large number of online payday loan enterprises, which are turning toward digital solutions to efficiently manage their business processes, particularly in developing countries such as China, India, and Singapore.

The key players that operate in the online payday loans industry are Clear View Loans, Bad Credit Loans, Cash USA, Personal Loans, Check Into Cash, Cash Net USA, Advance America, Speedy Cash, Ace Cash Express, and Money Mutual. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Market Landscape & Trends

The online payday loans market has undergone substantial evolution in recent years, reflecting changing consumer preferences and technological advancements. Traditionally dominated by brick-and-mortar stores, the market has seen a significant shift towards digital platforms. This transition offers borrowers greater convenience and accessibility, with the ability to apply for loans and receive funds entirely online. Key players in online payday loans market, such as CashNetUSA, LendUp, and ACE Cash Express, have adapted their services to cater to the growing demand for online payday loans. Moreover, the entry of traditional financial institutions and fintech startups into the online lending space has intensified competition and led to the development of innovative loan products and digital lending platforms. Despite the convenience offered by market, the market faces challenges related to regulatory scrutiny. Concerns over high-interest rates and predatory lending practices have prompted regulators to impose stricter regulations on the industry. As a result, companies operating in this market are increasingly focused on compliance and transparency to maintain consumer trust and regulatory compliance.

Competition Analysis

Recent Strategies in Online Payday Loans Market

On July 7, 2023, Flipkart partnered with Axis Bank, one of the largest private sector banks, to facilitate personal loans and introduced personal loan service that offers highly competitive loan options, granting access to amounts as high as â‐š¹5 lakhs, allowing customers flexible repayment cycles ranging from 6 to 36 months.

On November 11, 2022, Wells Fargo launched flex loan to give customers more options. Flex loan is a digital-only, small-dollar loan that provides millions of eligible customers convenient and affordable access to funds when they need it most. The flex loan is available in select markets and is expected to be available globally of online payday loans industry.

On January 11, 2022, OneUnited Bank launched CashPlease, a small dollar, short term loan program to help customers better manage their money. It provides online facility to avoid predatory online payday loans and overdraft penalties.

Top Impacting Factors

Growing awareness about online payday loans among youth population

Online payday loans are gaining popularity among youth as young people today are experiencing more financial instability than any other generation. In addition, online payday loans market offers a simple and quick application process. With just a few clicks, borrowers can fill out an application form and receive approval within minutes. This streamlined process caters to the preference of the youth population for efficient solutions to their financial needs. The ease of application makes online payday loans an attractive option for those seeking immediate access to funds. payday lenders have started focusing on the young population with attractive digital advertisements.

Moreover, according to reports from Citizens Advice, up to 4 in 10 young adults use an online payday loan at some stage or another. In addition, with rise in the cost-of-living, Moreover, growing awareness about online payday loans, through online advertising, social media, and financial education initiatives, has contributed to their popularity among the youth population. While many young individuals may not fully understand the risks associated with payday loans, they are attracted to the apparent ease and speed of accessing funds. Increased awareness about these loans has led to a growing acceptance and utilization among younger individuals facing short-term financial challenges. These are the major factors driving the growth of the online payday loans market.

Rise in number of payday lenders

Payday lenders are gaining attraction, and many lenders are following them and entering the business as it is easy to enter. In addition, as many payday lenders offer triple-digit balloon payment loans, they are expanding their products to offer installment loans for shorter term, which drives the growth of the online payday loans market. Furthermore, various regulations supporting payday lenders are willing to enter during the pandemic situations to provide loans to the financially unstable people, which propels the growth of the online payday loans market. For instance, the Consumer Financial Protection Bureau (CFPB) under President Donald Trump, has weakened the consumer protection the applies to protect people who are not able to pay loans from taking any type of loan.

However, with the removal of the bill, payday lenders are free to target anybody with high-interest loans and indulge them in further deeper loans, which is increasing the growth of online payday loans. Furthermore, with rise in the number of competitors, the loans are becoming more diverse and more affordable but still expensive as compared to any other type of loan, which is expected to drive the growth of the online payday loans market in the upcoming years.

Report Coverage & Deliverables

Type Insights

Based on type the online payday loans market is segmented into storefront payday loans and online payday loans. The storefront payday loans segment held the maximum revenue share in 2021 with a share of 53.7% and is expected to register a CAGR of 1.6% during the forecast period. The growth of the segment can be attributed to the presence of numerous payday lending stores. Moreover, a payday loan is likely to get approval in lesser time when a borrower visits in-store compared to an online payday loan application.

Marital Status Insights

Based on marital status, the online payday loans market is segmented into married and single. The single segment accounted for the largest revenue share in 2021 and is expected to develop by the highest CAGR of 4.0% during the forecast period. The growth of this segment can be attributed to a single source of income for singles compared to the married segment, which is likely to have more than one source of income if both members are working.

Customer Age Insights

Based on customer age, the online payday loans sector is segmented into less than 21, 21-30, 31-40, 41-50, and more than 50. The 31-40 segments accounted for the largest revenue of 1,356.3 $ million in 2021 and are expected to expand at a CAGR during the forecast period. The online payday loans market growth in this segment is attributed to a greater number of financial commitments handled by the customers in this age group.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the online payday loans market analysis from 2023 to 2032 to identify the prevailing online payday loans market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the online payday loans market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global online payday loans market forecast.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the online payday loans market outlook players.

The report includes the analysis of the regional as well as global online payday loans market trends, key players, market segments, application areas, and market growth strategies.

Online Payday Loans Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2032 |

| Report Pages | 213 |

| By Type |

|

| By Marital Status |

|

| By Customer Age Outlook |

|

| By Region |

|

| Key Market Players | advance america, Cash USA, Cash Net USA, check into cash, Clear View Loans, Personal Loans, Speedy Cash Holdings, Inc., Bad Credit Loans, ace cash express, Money Mutual |

Analyst Review

Adoption of online payday loan has increased over the years as online payday loans are providing cash to people in need for money at high interest rate that should be returned in 1-2 weeks or on the date of paycheck of the borrower. Furthermore, according to a survey in 2019, it was found that the majority of the students with education loans have taken online payday loans at least once to repay the education loan, which is enhancing the growth of the market. Moreover, rise in adoption of advance technology such as AI, business intelligence among the payday lenders to automate the application process and target more customer who are most likely to take online payday loans is providing lucrative opportunity for the market.

Key providers of global online payday loan market such as CashNetUSA, Lending Stream, Silver Cloud Financial, Inc., and TMG Loan Processing account for a significant share in the market. In addition, 3 out of 4 online payday loans go to borrowers who take out 10 or more loans per year as a large part of the online payday loan economy can be predatory, targeting underbanked or low-income individuals with extremely high-interest rates. As a result, borrowers often fall into a debt trap, which means that they keep having to borrow repeatedly to pay back what they owe. Moreover, the COVID-19 pandemic had a negative impact on the market. In 2020, many people lost their jobs as the world economy slowed down. The general requirement for the market is having a stable source of income, and the borrowers need to provide proof of income to the payday lenders while applying for the loan. Hence, many people became ineligible to apply for a payday loan.

Furthermore, even though online payday loan is said to be emergency, but majority of the borrowers are using it for daily uses and not for emergency use. For instance, in April 2021, GAIN Credit announced the establishment of Synapi, a SaaS (Software as a Service) business that provides companies with the technology and insights for extending credit to their clients. The client businesses are expected to include merchants offering finance for their clients and lenders that want to efficiently serve their customers while maintaining regulatory compliance.

The global online payday loans market was valued at $8.4 billion in 2023 and is projected to reach $18.1 billion by 2032, growing at a CAGR of 9.1% from 2024 to 2032.

Online payday loans are short-term, unsecured loans provided through digital platforms, designed to offer immediate financial assistance to individuals needing quick cash to cover unexpected expenses or bridge gaps between paychecks.

Key players in the online payday loans market include prominent financial institutions and specialized lenders offering digital payday loan services.

In 2023, North America accounted for the largest share of the online payday loans market, generating the highest revenue.

Factors driving the online payday loans market include growing awareness among the youth population, fast loan approval processes, no restrictions on usage, and the presence of numerous payday lenders.

Challenges in the online payday loans market encompass high-interest rates and the potential negative impact on borrowers' credit scores.

Loading Table Of Content...

Loading Research Methodology...